About good news from Iceland, the next act of Greek drama, Spanish ghost city, Presidential poetry and tough love in Europe.

We have good news for you.

Iceland is not junk anymore. Iceland is a country whose credit rating, unlike in the rest of Europe, started to rise. Why is it important? Iceland has done what European insolvent countries and monetary union still resists doing. After the crisis, which mainstream economists and governors didn‘t see coming, it restructured its debt and distributed loses where they originated and where they belong. Also in Iceland politicians wanted to try out „European“, namely bank-friendly model, in which thanks to money paid by taxpayers in the name of „solidarity“ the banks and its creditors are protected.

But Icelanders decided that they won’t pay 13 000 euro per capita to greedy foreign lenders because of stupid decisions of their commercial banks. They made their stand very clear throwing stones at the Parliament and breaking out the torches. The law was changed, some bankers were charged, a few officials went to prison and Icelandic banks wrote off part of the debt of the citizens.

Politicians under pressure finally did the right thing. These are advantages of democracy in small communities, where people and their politicians live close to each other. If you do wrong to your fellows, it can uncomfortably get back to you in a pub over the weekend. Even though now they are not very popular among their European creditors, they will survive as majority of Icelanders doesn’t want to join the EU anyway. Obviously it’s not easy for Icelanders either. After such huge monetary illusion, which was created in Iceland there must come harsh awakening and price for the crisis was paid also by Icelanders themselves (exchange rate of Icelandic kronur decreased by 50% since the year 2007). But unlike in Europe there are already positive trends in this economy.

„If there wasn’t euro, we wouldn’t see today in Athens protests with flags of the EU in the form of swastika. Why we won’t simply say it? Euro became a threat to European integration,“ said Hand-Olaf Henkel, former President of the Federation of German Employers (DBI).

We moved to another act of Greek drama. Ministers of Finance of the eurozone adopted the second aid package. Greece will give up a part of its sovereignty for a couple of years; it will be guarded by Troika. Part of the „aid“ devoted to paying off the debt will go straight to escrow account controlled by Troika in the next quarter. And now shock – even according to very optimistic assumptions of the worst case scenario (GDP decline by -1% in 2013) it seems that Greece will reach the debt at the 159% of GDP level in 2020 (after reaching the debt peak of 178% of GDP in 2015). To set expectations as to how accurate Troika’s estimations are, IMF’s forecast concerning development of Greek economy from May 2010 can be found here (for example unemployment was estimated at the level 14.6% in 2011 and in reality it reached 20.9%). Even at extremely low subsidized interest with time as it seems Greece will be insolvent.

And another thing – any new debt will be subordinate to the existing one. Not very motivating setup for potential investors of the future emissions. Planned nominal haircut adds up to 53.5%. Costs of this package reach 170 bln. euro in the next 3 years with Greek GDP of 220 bln. euro. Most of the rescue package resources will go to creditors, not to Greeks or their economy.

Slovak attitude to the second package is amusing. It was approved by the Prime Minister, who came to power thanks to tough „no“ against the first loan for Greece. After 2 years, which proved these arguments true, similarly relevant arguments are ignored. Masters of populism (main opposition party) will keep their mouths shut.

Europe wants to try out for the first time the „tough love” approach. On Hungarians. They are supposed to be the first Union’s member country which will be punished for not adhering to rules of the macroeconomic stability. For exceeding the limit of deficit at the level of 3% GDP they will pay with 500 mln. of euro from the European Funds, which were supposed to flow to this country in the year 2013. Let’s see if Spanish will also get a rap on the knuckles for actively blurring the image of overall deficit with the regional assistance. When fining will really start, in Europe it may soon look like this:

When it comes to Spain it would be a pity not to mention problems there, which are numerous. Not only China, but also Spain has its own ghost cities. Bubble or a sudden lack of demand for houses? Fiat money out of nothing allows not only extravagant politicians create huge deficits, but also disturb allocation of capital in the economy. ‘Hazardous Times for Monetary Policy: What Do Twenty-Three Million Bank Loans Say about the Effects of Monetary Policy on Credit Risk-Taking?‘ is an article using Spanish loan register data since the year 1984, to describe as decreasing short-term interest rates leads undercapitalized banks to expansion and prolonging loans for risky companies and granting them to new, risky applicants. Austrian business cycle theory in today’s practice.

Spanish real estate or American mortgage backed securities are allegedly toxic assets. But there is no such thing as toxic assets, there are only toxic prices. With the right price, market will clear. But the decline in prices is being fought by Spanish banks taking over failed developer’s projects and hiding them from liquidation on their balance sheets.

Not even 4 months after the EU’s summit in October, when hype about the increase in the effective capacity of EFSF to 1,5 trillion euro using leverage insurance was created, European Sovereign Bond Protection Facility (ESBPF) was established. It will issue insurance certificates for the new emission of state bonds at the request of the member of the monetary union. Certificate will be separately tradable and its holder will be protected for the first 20-30% of the haircut’s on principal of the bonds. We will see if and how it will be used.

ECB is allegedly planning to lower the monetary’s drug doses to the market. Obviously not right away. Later. After another three-year unlimited loan tender (LTRO) will be granted to commercial banks next week (29.2.). According to the last version of the agreement on the permanent form of EFSF – European Stability Mechanism should have a banking license. Not only German MPs are concerned that ESM with the help of ECB’s credits might become self serve buffet for states with serious inflationary consequences.

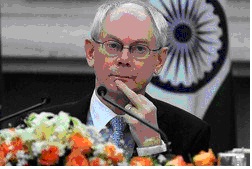

Do you know who this gentleman is?

Your reelected President. Rumor has it that Herman Van Rompuy will be appointed as the „European President“ at the next summit at the beginning of March and will enjoy second 2,5-year term. At least there will be more poems in politics.

Have a poetic weekend!

Juraj Karpiš