Why not to believe door-to-door sellers, central bankers; which European country is the closest to a default,how Italians save money on food to sendpayments to the investment bank Morgan Stanley thanks to their clever politicians, and finally about really clean money.By the way, do you have a chicken at home already?

Mario Draghi, president of ECB, told the German newspaper Bild that when it comes to the European debt crisis, the worst part is already behind us.

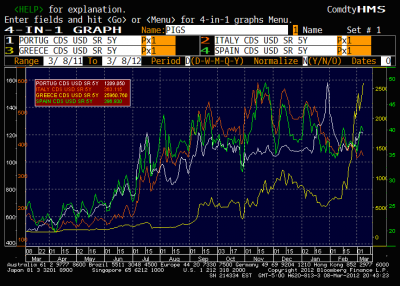

No, for now leave the champaigne in the fridge and cancel your orders to buy Italian bonds. Governors of central banks cannot be trusted. Their mandatory optimism at any cost is just another monetary policy instrument. For example, eight months ago, Jean Claude Trichet, governor of ECB at that time, claimed that betting on Greek default is a sure way to lose your money. If you had acted contrary to this recommendation and had bought some Credit Default Swaps for the Greek debt, you would have earned 1000% (golden line in the diagram).

Obviously, there are still difficult times ahead for Europe. Dutch Minister of Finance doesn’t rule out further restructuring of debt in the European future. Portugal public deficit in the first two months is three times higher than a year ago, and the biggest trade union organized a general strike on last Thursday. The International Monetary Fund issued a warning concerning state of public finances in Belgium, which says that “the vulnerability of Belgium’s sovereign debt to market pressures makes credible medium-term fiscal consolidation a priority.” Greek future will probably bring further default.

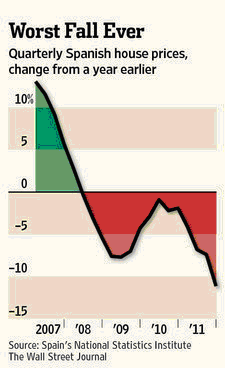

There is another big European economy on the verge of serious problems – Spain. This country has never been so close to default, says Willem Buiter, Citigroup Inc. chief economist. Spain is not able to meet the EU fiscal goals, and according to Spanish Confederation of Employers’ Organizations (CEOE), deficit will reach 6.1% instead of the recently revised target of 5.3%. Spanish unemployment rate reached 23% and house prices tumble –they fell yearly by 11.2% in the last quarter of 2011. Popped bubble in the real estate sector will sooner or later reveal insolvency of Spanish banks, which hold EUR 400 bln of the loans linked to the real estate sector (40% of GDP). Total debt (both public and private sector) of Spain reached 363% of GDP in 2011. Unions are planning a general strike against labour reform for March 29. It will be only the fifth general strike since the end of Franco’s regime in 1975.

Reelected Slovak Prime Minister Robert Fico supported the changes to the Fiscal Compact suggested by the socialist French presidential candidate Francois Hollande. “Fiscal consolidation based solely on cuts lead to higher inflation, higher unemployment, it’s not a good way. Hollande’s opinions are very close to our opinions.“ Fico proved that Slovakia will behave according to „the Union’s rules of solidarity“ from now on. So we won’t protest against the nonsense of sending money to insolvent richer countries anymore?

Italy, which has been saved also by our central bank (ECB), paid the investment bank Morgan Stanley $3.4 billion for unsuccessful business with derivates on the Italian debt. This sum constitutes around 50% out of what Italy wants to gain by increasing value added tax as a part of the second consolidation package. That is not all; the sum paid to Morgan Stanley is only 11% of the whole loss that will affect Italy in the future as a result of its derivative contracts. According to a study by the bank Intesa Sanpaolo, consumption of food, beverages and tobacco in Italy in 2011 plummeted to the level from 30 years ago.

EFSF issued new 5-year bonds for four billion euro. It followed the Monday issue of 20-year bonds worth 1.5 billion euro.

American Treasury Secratary Timothey Geithner warns Europe and the indebted countries against radical cuts in their public expenditures, which could jeopardize economic growth. He apparently forgot that not everyone can use the „exorbitant privilege“ to finance its „Greek“ deficits with freshly printed dollars without people sending the currency to hyperinflationary hell. Some simply have no other choice but to cut down on their spending in a way that they match the income.

Argentinian Senate approved reform of the central bank and enabled authorities to access the monetary reserves. They will be used to support economic growth and to finance public debt.

Belarus wants to solve the problems with high inflation by issuing two-hundred thousand value note. American currency is not alright either. As there is not enough money from the state-monopolized production, it might happen that the market will start looking for alternative currency. In Washington, while looking for drug dealers, police found apart from expected packets of cocaine also huge amounts of liquid detergent Tide. Dealers accepted it, or even preferred it as a payment for their supplies. At the same time, exactly this product was repeatedly stolen from many shops, so police figured out that it functions as money in illegal transactions.

Why did the market choose Tide to serve as money? Tide is easily identifiable (strong colours), can be stored for a long time, easily divisible, relatively valuable (20 dollars per bottle), its supply is limited, it is widely needed, since we all need to do the laundry, and therefore very liquid. That’s why it keeps its value better than dollar. The concept of money laundering gains a new dimension.

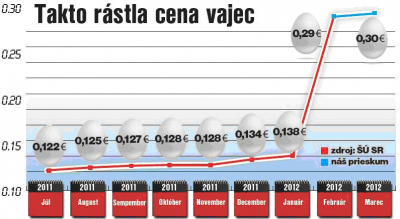

Those of you who go for shopping regularly have probably noticed that this year a European directive banning keeping of laying hens in cages came into force. Egg prices reached record-high levels, which created a spree of amateur breeders in Slovakia.

EU prepared similar course of action when it comes to breeding pigs. So quickly fill your freezer, buy a few pigs to put them in the backyard and cautiously follow what other surprises the EU will bring to the austerity-striken citizens.

If you want to save, I recommend a trip to space and back for 400 seconds and completely for free.

http://www.youtube.com/watch?feature=player_embedded&v=2aCOyOvOw5c

Have a stunning weekend!

Juraj Karpiš