Two years have passed since Euromaidan won in Ukraine. We try to look at what changed over the last two years. We discuss macroeconomic situation, fiscal issues, financial sector, and trade. We also outline major reforms conducted over this period and outline shortly future reforms agenda. The article concludes with the economic outlook for 2016-2017.

Economic developments in 2014-2015: Decline in economic activity

Years 2014 and 2015 were the among most difficult for Ukraine since 1995. The country experienced economic crisis, military conflict in the East and the annexation of Crimea by Russia. Crisis deepened through 2014 and in the first quarter of 2015 primarily due to the escalation of the war in the East. Due to balance of payment problems and deep recession the Government asked for the IMF assistance. As a result, the Government rapidly negotiated Stand-by Arrangement in 2014. In 2015 it was substituted by the Extended Fund Facility Program when need for more prolonged assistance program became obvious. Fragile macroeconomic stability was reached in the mid-2015.

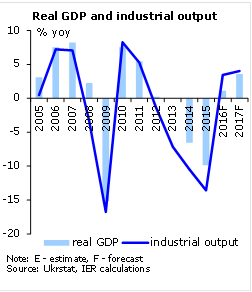

The war in 2014 and 2015 did not only resulted in stoppage of operation by many companies in the occupied territory in the East (many companies there either terminated their operation or stopped reporting to the Ukrstat) or at the front-line, but also disrupted production for many companies in other regions of Ukraine due to logistic problems and cessation of supplies. Coal-fired electricity plants lost nearby and cheap coal supplies and had to replace it with coal imported from Russia or South Africa. In case of steel producers, a number of plants were in Eastern Donbas, while others had faced disrupted railway supplies. The largest coking plant in the country is situated on the frontline. Significant part of chemical industry was also in Eastern Donbas, while remaining chemical plants had difficulty securing gas supplies due to long dispute between Ukrainian Naftogaz and Russian Gasprom. Terms of trade were also unfavourable: Ukrainian companies faced weak external demand and declining commodity prices. In particular, real exports of goods and services declined by14.2% in 2014 and 16.9% in 2015. At the same time, export prices declined by over 22% between 2013 and 2015 with even higher drops in steel and grain prices. Overall, between 2013 and 2015 real gross value added (GVA) decline by 27.5% in extractive industry and by 21.1% in manufacturing.

The war in 2014 and 2015 did not only resulted in stoppage of operation by many companies in the occupied territory in the East (many companies there either terminated their operation or stopped reporting to the Ukrstat) or at the front-line, but also disrupted production for many companies in other regions of Ukraine due to logistic problems and cessation of supplies. Coal-fired electricity plants lost nearby and cheap coal supplies and had to replace it with coal imported from Russia or South Africa. In case of steel producers, a number of plants were in Eastern Donbas, while others had faced disrupted railway supplies. The largest coking plant in the country is situated on the frontline. Significant part of chemical industry was also in Eastern Donbas, while remaining chemical plants had difficulty securing gas supplies due to long dispute between Ukrainian Naftogaz and Russian Gasprom. Terms of trade were also unfavourable: Ukrainian companies faced weak external demand and declining commodity prices. In particular, real exports of goods and services declined by14.2% in 2014 and 16.9% in 2015. At the same time, export prices declined by over 22% between 2013 and 2015 with even higher drops in steel and grain prices. Overall, between 2013 and 2015 real gross value added (GVA) decline by 27.5% in extractive industry and by 21.1% in manufacturing.

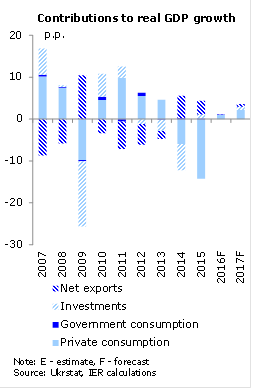

High economic uncertainty, low fiscal capital outlays, restricted bank lending, and bad financial results of companies caused drop in gross fixed capital formation (GFCF) by 31.1% from already low levels of 2013. As a result, capital investment barely replenished losses of capital stock due to wear and tear (fixed capital consumption was estimated by the Ukrstat at 96% of GFCF in 2015) as companies likely invested in most urgent maintenance, repair and modernisation projects. Changes in management of state companies and increase in energy tariffs allowed investments in energy and railway infrastructure. Demand for housing was supported by tight housing market and increased intra-country migration. As a result, investment in residential housing remained at 2013 levels. Investment in commercial property construction fell dramatically. Real GVA in construction dropped by 29.7% during last two years.

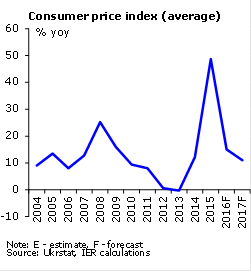

Real private final consumption in 2015 was by 26.8% lower than in 2013. Such drop was reflected in the decline of real GVA in trade (by 28.4% during this period). In part this reflected collapse in demand in Donbas. Share of retail sales in Donetsk and Lugansk oblasts reduced to 4% in 2015 from 15% in 2013. Besides, fiscal consolidation relied on slower than inflation increases of social standards (including minimum wage and minimum pension) as well as restricted increases in public wages. Large slack in labour market led to small nominal increases of wages and cut in employment (unemployment rate increased from 7.3% in 2013 to 9.3% in 2014). Bank lending to households was very restricted while sums due on foreign currency loans soared. Households smoothed their consumption by holdings of cash foreign currency and spending other savings. Runaway inflation in absence of strong indexing mechanisms also reduced purchasing power of households. In particular, consumer inflation was 48.7% on average in 2015, which was the highest level since 1996. Inflation was explained by sharp hryvnia depreciation in the end of 2014 and first half of 2015. Price of foreign exchange as expressed by NEER (trade-weighted average of exchange rates of hryvnia vs. currencies of main trading partners) increased by 98% over 18 months from January 2014 to June 2015. In addition, the Government sharply increased prices for natural gas, electricity and other utilities (in effort to replace blanket energy subsidies with more targeted ones). As a result, price index for housing and utilities increased by 2.6 times in 2014 and 2015.

Real private final consumption in 2015 was by 26.8% lower than in 2013. Such drop was reflected in the decline of real GVA in trade (by 28.4% during this period). In part this reflected collapse in demand in Donbas. Share of retail sales in Donetsk and Lugansk oblasts reduced to 4% in 2015 from 15% in 2013. Besides, fiscal consolidation relied on slower than inflation increases of social standards (including minimum wage and minimum pension) as well as restricted increases in public wages. Large slack in labour market led to small nominal increases of wages and cut in employment (unemployment rate increased from 7.3% in 2013 to 9.3% in 2014). Bank lending to households was very restricted while sums due on foreign currency loans soared. Households smoothed their consumption by holdings of cash foreign currency and spending other savings. Runaway inflation in absence of strong indexing mechanisms also reduced purchasing power of households. In particular, consumer inflation was 48.7% on average in 2015, which was the highest level since 1996. Inflation was explained by sharp hryvnia depreciation in the end of 2014 and first half of 2015. Price of foreign exchange as expressed by NEER (trade-weighted average of exchange rates of hryvnia vs. currencies of main trading partners) increased by 98% over 18 months from January 2014 to June 2015. In addition, the Government sharply increased prices for natural gas, electricity and other utilities (in effort to replace blanket energy subsidies with more targeted ones). As a result, price index for housing and utilities increased by 2.6 times in 2014 and 2015.

Drop in domestic demand and imports substitution dramatically reduced real imports (by 39.2%). In addition, lower energy subsidies led to much lower natural gas imports, Ukraine was also able to diversify gas supplies and negotiate for better prices: while in 2013 more than 90% of all imported gas was purchased from Russia, its share dropped below 40% in 2015.

Drop in domestic demand and imports substitution dramatically reduced real imports (by 39.2%). In addition, lower energy subsidies led to much lower natural gas imports, Ukraine was also able to diversify gas supplies and negotiate for better prices: while in 2013 more than 90% of all imported gas was purchased from Russia, its share dropped below 40% in 2015.

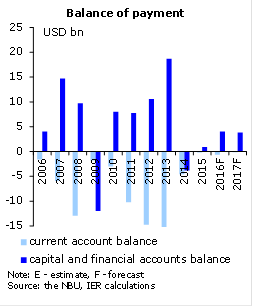

As nominal exports declined more than nominal imports, merchandise trade deficit narrowed from 10.9% of GDP in 2013 to 3.5% of GDP in 2015. Income, transfers and services trade balance improved slightly in relation to GDP. As a result, current account deficit dropped from 9.1% of GDP to 0.2% of GDP, respectively. At the same time, in 2014 the financial account surplus shifted from surplus at 10.2% of GDP to deficit of 2.8% of GDP as real sector was not able to refinance its debt, while net purchases of cash foreign currencies remained high and net FDI inflow was negligible. Public sector borrowings supported financial account balance. Financial account turned to small surplus in 2015 (at 1.0% of GDP) due to public sector borrowings. At the same time, net FDI inflow remained low and was directed for the recapitalisation of banks by parent companies.

Sharp decline in export revenues, very restricted access to the international capital markets for real and public sectors at the background of high economic and political uncertainty resulted in sharp hryvnia depreciation: from UAH 7.99 per USD in the end of 2013 to UAH 24.0 per USD in the end of 2015. The NBU was not very flexible in intervening the interbank exchange rate market due to low international reserves. They collapsed from USD 20.4 bn in December 2013 to USD 5.6 bn in February 2015 as they were used to cover government debt repayments and imported gas purchases. Then, though, they increased to USD 13.3 bn as of December 2015 as balance of payments improved, public external debt was restructured and the IMF and other donors increased assistance to the country. The NBU also moved from selling foreign currency to slow hryvnia depreciation to two-sided interventions to smooth volatility and replenish reserves.

The debt sustainability issue became one of the prior concerns of the Government and was reflected in the IMF program. As large share of state debt was denominated in USD and the Government also received new IMF loans, the share of state debt in GDP increased sharply from 39% in 2013 to near 80% in 2015. Large part of sovereign debt was maturing in the last four months of 2015 and was to mature in 2016-2017, which the Government would likely have been unable to repay. As a result, the Government negotiated the sovereign debt restructuring with debt holders. The agreed in September 2015 debt restructuring envisaged a 20%-haircut on the principal (near USD 3 bn), the replacement of old bonds with new ones, including new Eurobonds and GDP-linked warrants (Value Recovery Instrument), which provide for payments tied on real GDP growth. Principal payments (USD 8.5 bn) were shifted from 2015-2023 to 2019-2027. Overall, the Government reduced financing needs for the next three years by USD 15.2 bn, which corresponds to the IMF Program. Additionally, there was agreed the re-profiling of debts of the state-owned banks (Oshchadbank and Ukreximbank), railway operator Ukrzaliznytsia and local government debt of Kyiv, which resulted in postponement of payments at USD 2.8 bn.

The debt sustainability issue became one of the prior concerns of the Government and was reflected in the IMF program. As large share of state debt was denominated in USD and the Government also received new IMF loans, the share of state debt in GDP increased sharply from 39% in 2013 to near 80% in 2015. Large part of sovereign debt was maturing in the last four months of 2015 and was to mature in 2016-2017, which the Government would likely have been unable to repay. As a result, the Government negotiated the sovereign debt restructuring with debt holders. The agreed in September 2015 debt restructuring envisaged a 20%-haircut on the principal (near USD 3 bn), the replacement of old bonds with new ones, including new Eurobonds and GDP-linked warrants (Value Recovery Instrument), which provide for payments tied on real GDP growth. Principal payments (USD 8.5 bn) were shifted from 2015-2023 to 2019-2027. Overall, the Government reduced financing needs for the next three years by USD 15.2 bn, which corresponds to the IMF Program. Additionally, there was agreed the re-profiling of debts of the state-owned banks (Oshchadbank and Ukreximbank), railway operator Ukrzaliznytsia and local government debt of Kyiv, which resulted in postponement of payments at USD 2.8 bn.

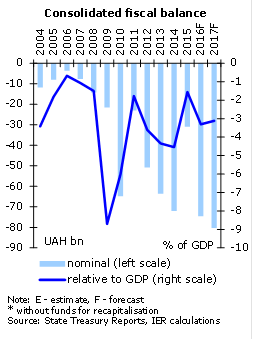

Fiscal consolidation: Much needed belt- tightening

Between 2005 and 2013 public spending on wages, pensions and welfare payments grew significantly faster than fiscal revenues leading to growing fiscal imbalances and public debt. As a result, in 2014 the Government needed to conduct fiscal consolidation at a time of crisis as debt sustainability was one of the conditions for approval of new SBA by the IMF Executive Board. In particular, in the end of March 2014 the Government reduced financing of most programs including social spending and capital outlays. However, defence spendings were raised. Planned increase in subsistence minimum and related wage and pension increases were cancelled, while some in-kind privileges became means tested and some social benefits were reduced. On the revenue side, the Government increased a number of taxes, including excise duty and rent payments. Since April 2014 the 0.5% duty on purchase of cash and non-cash foreign currency earmarked to the Pension Fund (with the rate of 0.5%) was introduced. Moreover, the Government increased progressivity of PIT by raising PIT rates for higher income and raised taxation of passive income. Planned reduction of VAT and EPT rates planned for2015 was cancelled.

Between 2005 and 2013 public spending on wages, pensions and welfare payments grew significantly faster than fiscal revenues leading to growing fiscal imbalances and public debt. As a result, in 2014 the Government needed to conduct fiscal consolidation at a time of crisis as debt sustainability was one of the conditions for approval of new SBA by the IMF Executive Board. In particular, in the end of March 2014 the Government reduced financing of most programs including social spending and capital outlays. However, defence spendings were raised. Planned increase in subsistence minimum and related wage and pension increases were cancelled, while some in-kind privileges became means tested and some social benefits were reduced. On the revenue side, the Government increased a number of taxes, including excise duty and rent payments. Since April 2014 the 0.5% duty on purchase of cash and non-cash foreign currency earmarked to the Pension Fund (with the rate of 0.5%) was introduced. Moreover, the Government increased progressivity of PIT by raising PIT rates for higher income and raised taxation of passive income. Planned reduction of VAT and EPT rates planned for2015 was cancelled.

Due to higher than expected loss of revenues from economic crisis and the need to increase security spending Government pushed another round of tax increases and spending cutbacks through the Parliament in July 2014. 1.5% “military” surcharge to the PIT was introduced and interest on deposits was taxed deposit interest at 15 rate. On expenditure side, non-security spending was cut to compensate for increased financing of security and defence items. In particular funding for a number of central executive bodies was cut as audits, inspections and other control measures by most state bodies without prior authorization by the Government were prohibited. The Government also cancelled premiums and bonuses paid to people’s deputies, ministers and heads of other state bodies.

In 2015 the Government made efforts to keep central fiscal deficit under control. In particular, it preserved a military surcharge to the PIT, introduced real-time VAT accounting, increased excise rates, and later (In February) introduced 5-10% of import duty surcharge. The Government also tried to keep spending under control. One of the key changes was sharp reduction of the subsidy to the Naftogaz due to rapid increase in tariffs for gas (for population and heating generating companies). At the same time, the spending on housing and utility subsidies of population rapidly increased as income grew much slower than energy tariffs, while eligibility criteria were eased substantially (overall, these subsidies help to pay for utilities taking into account rapid tariffs increase, but do not create stimulus for energy savings). Another direction for increased spending was defence due to military conflict in the East of Ukraine. Overall, in 2015 fiscal revenues were fully executed for the first time in many years. Revenues were supported by higher than officially expected hryvnia depreciation and inflation. In particular, higher inflation resulted in larger VAT and excise rate revenues. PIT collections increased as wages were revised in response to inflation. Fiscal deficit turned to be lower than planned due to lower than planned borrowing from official creditors and due to cancelled privatisation. Good revenue flows also contributed to lower deficit.

Indeed, record government funds accumulated at the Single Treasury Account allowed the Government to increase the transfer to the Pension Fund to pay pensions for January 2016. This was necessary taking into account the most substantial step approved by the Government in the end of 2015, namely the reduction of the Single Social Contribution (SSC) from effective rate of 41% to 22%. Such step is officially expected to reduce massive practice in informal wage payments. Overall, reduction in the SSC was the most significant change in tax system in 2016. The planned and discussed comprehensive tax reform, which would ensure higher fairness and equity of the tax system, was not approved as the Government and the Parliament were not able to compromise on the main provisions of tax reform. Still, in 2016 the Government reduced support of agricultural companies by narrowing the application of the special VAT scheme for agricultural companies, that previously had a right to keep accrued VAT at their own accounts and use respective funds for production purposes.

Banking sector market reform: Towards sound banking

Ukraine’s banking sector went through two crisis over the last 10 years: in 2008-2009 and 2014-2015. Relatively few banks failed in 2008 and 2009 due to generous loans from the central bank (NBU), while few larger banks were taken over by the state. Due to lax enforcement banks were slow in cleaning up balance sheets from problem loans and, as result, were de facto under-capitalized, while manipulating rules to avoid forming full provisions for losses. In addition, banking sector maintained high exposure to foreign currency loans that led to high losses in 2009 crisis.

On the other plane, 180 banks were registered in Ukraine and many smaller and some of the larger banks acted not as traditional banks, but rather as treasury departments for affiliated corporate groups or plainly used their banking license to work around legal limits on cash operations, capital controls and tax rules. This led to very low risk diversification in a number of banks.

As a result, Ukrainian banking sector was very vulnerable to the new crisis and over 60 banks representing over a quarter of banking system assets failed in 2014 and 2015. Remaining banks were required to disclose full amount of the losses from bad loans, adopt transparent ownership structure, and reduce exposure to related parties to permitted limits over the next several years. Now, slightly over 100 banks remain operational and most remaining banks disclosed their affiliated parties and reported related party transactions. The key challenge is to gradually unwind loans to related parties and regaining capital sufficient to remain operational. Most foreign–owned banks were recapitalised by their owners and are expected to receive capital injections this year. It is more challenging for Ukrainian owners to raise necessary funding.

On the bright side, largest banks responsible for over 90% of remaining bank assets seem stable, while outflow of bank deposits slowed and even reversed over the last months. If reforms will go to schedule banking sector in 2017 may again be useful for economic growth.

Reform agenda: Large progress but still much to be done

The Government and the Parliament have a long list of reforms to work on in many spheres. A lot of steps were conducted as part of agreed conditionality in return of loans r from the IMF and other donors.

Public procurement. Public procurement reforms were among the more successful. In April 2014, the Parliament approved a new State Procurement Law with key provisions harmonized with the EU rules. The Law extended the list of procuring entities to be covered by this regulation, reduced list of exemptions and narrowed grounds for non-competitive procedures. In 2015, the Government has launched the pilot project of e-procurements using online auction platform ProZorro. The budget saving are estimated at near UAH 0.5 bn in 2015 (or near 20% of funds spent for procurement through ProZorro).

In the end of December 2015 the Parliament approved another revision the Public Procurement Law. The Law will become effective since April 1, 2016. Starting August 1, 2016 public establishments and natural monopolies will have to make procurements through an electronic system run by a specialized government agency (with certain exceptions). New public procurement procedures are expected to result in higher efficiency of public spending and lower corruption.

Moreover, Ukraine joined the WTO’s Government Procurement Agreement (GPA), which means mutual opening of access to public procurements. The decision was taken by the WTO in November 2015, and the Verkhovna Rada ratified the agreement in March 2016.

In 2015, the Ministry of Health transferred medicine procurements to three international organizations: UNICEF, UNDP and Crown Agents. International organisations are believed to ensure transparent medicine procurement at fair prices with low exposure to corruption, while traditionally medicine procurement were known for high level of prevailing corruption.

State aid. The Parliament in 2014 finally approved the State Aid Law that defines procedures for provision of state aid to avoid damage to competition and inefficient state spending. The Law is to aimed to end the situation, when state aid is often granted to favoured companies in an arbitrary manner. The Antimonopoly Committee is to become responsible for compliance with EU-imposed rules on provision of the state aid and to screen all regulations and draft laws that are intended to provide some benefits to companies or sectors of economy for their effect on competition. Transition to new rules will be gradual and it will be fully implemented only after transition period (in 2018). Currently, efforts to reduce two key forms of state aid, i.e. agricultural and mining subsidies, are underway, while most of sectoral tax privileges were cancelled.

Decentralisation. The decentralisation measures were approved in 2014-2015 to stimulate business development in Ukraine. The Government reduced the number of licenses and permissions by 7.2%. The business registration procedure was shortened to two days. At the same time, the functions of permission centres were shifted to Centres of administrative services, which reduced administrative costs for companies.

The Ministry of Economic Development and Trade has already prepared a list of 177 regulatory restrictions, which are proposed to be cancelled in the nearest future. This is expected to improve business climate and increase economic activity.

Technical regulation reform. Ukraine had significant progress in reform of technical regulation. In 2015, 15733 old technical standards (so-called GOST, which were inherited from the USSR) were finally cancelled. At the same time, 47 new technical regulations were approved on the basis of the EU norms. New regulations set key safety requirements to the good, while allowing the producer to choose the means of implementing them.

At the next stage of the reform, the Agreements on Conformity Assessment and Acceptance of Industrial Goods (ACAA) is expected to be signed between the EU and Ukraine in the near future. This Agreement would facilitate the entrance of Ukrainian companies to the EU market. Besides, the Government will continue introducing technical regulation on the base of the EU acquis as well as establish the system of market supervision.

Anti-corruption measures. Incidence of corruption is significant in Ukraine, while perception of corruption is even higher. This, increases costs for business operation and reduces the transparency, fairness and equity of the business environment. High perception of corruption adds one more reason for external investors to stay away from Ukraine. According to the world Corruption Perceptions Index (CPI) 2015 Ukraine gained 1 additional point and was ranked 130 out of 168 positions (in 2014 it was 142 out of 175 positions). The ranking is expected to slightly improve in 2016 as in 2015 and in the beginning of 2016 Ukraine made a significant progress in implementing measures aimed at reducing corruption terrorism. So far, the focus was on creating new institutions to fight corruption that are supposed to be shielded from political influence. In particular, Ukrainian authorities have already established the National Anti-Corruption Bureau, the Specialized Anti-corruption Prosecutor’s office, and the National Agency for Prevention of Corruption. As these bodies started to work only recently, it is too early to evaluate their effectiveness. Still, a number of high-profile cases were opened and a number of high-level state officials were arrested. So far there are few convictions as court cases take long to finish.

The reform of the Ministry of Internal Affairs was also initiated. In particular, old “militia” was renamed as the National Police and substantial part of police officers were recruited and trained from scratch. This reform was recognised by many Ukrainians as the biggest reform success in 2014-2015.

Trade policy: Departure from Russia to other world

Trade conditions and trade structure have been changing in Ukraine over last two years. The provisional application of the DCFTA between the EU and Ukraine started since January 1, 2016, while autonomous trade measures were applied by the EU already in May 2014. Russia responded with trade tensions, which in 2014-2015 took form of import restrictions, but in 2016 were substituted by suspension of free trade under CIS FTA, import bans and transit restrictions.

Moving towards the EU. Autonomous trade measures (ATMs), introduced by the EU in May 2014, supported exports in the first months after introduction, but since autumn 2014 exports to the EU started to decrease. Overall, nominal increased by only 1.5% in 2014 and dropped by 23.4% in 2015. Ukraine was not able to fully benefit from advantages of ATMs as some goods did not comply with the EU food safety standards. Low demand, insufficient production or orientation on other markets for some goods were other reasons for lower exports. As a result, Ukraine was unable to utilize fully duty-free access under tariff-rate quotas (Ukraine fully utilized 6 TRQs out of 36 in 2014, 9 TRQs in 2015, and partially used 12 quotas in both years). At the same time, changes in technologies and standards by some Ukrainian producers open for them access to the EU market (e.g. this relates to exports of poultry, eggs and dairy products). As since January 1, 2016, provisional application of the DCFTA started, we expect increase in both exports and imports. IER calculations show that in long-term DCFTA could allow Ukraine to increase exports by 9.9% and imports by 9.2% in real terms; however, these gains might shrink to 2.3% and 2.2%, respectively, if Russia continues application of MFN in the trade with Ukraine.

Departure from Russia. Ukraine contracted exposure to the Russian market mainly due to trade tensions and political pressure by Russia. Export restrictions by Ukraine (for military and double-purpose goods) and voluntary reorientation by producers also contributed to lower trade. Since January 1, Russia suspended free trade with Ukraine under CIS FTA and imposed partial import ban on agri-food goods from Ukraine. Ukraine reacted with mirror measures but extended ban by locomotives and railway equipment. This trade war is expected to result in lost USD 0.6 bn of exports (0.7% GDP) and USD 0.5 bn of imports (0.6% GDP) and negatively affect Ukraine’s trade balance (estimates made by the IER and the German Advisory Group). Since January 1, 2016, Russia also introduced new rules for the transit of Ukrainian goods to Kazakhstan through its territory. It suggested that Ukraine should ship its goods to Kazakhstan through Belarus, the trucks and wagons should be equipped with GLONASS seals, all the trucks should move with convoys. This implies longer distance and time, higher cost of transportation, and higher political risks. Ukraine alternatively tested New Silk Road route through Black sea, Georgia, Azerbaijan, Caspian Sea to Kazakhstan and the border of China, but it is not operating yet due to higher cost comparing to Belarusian route, as well as exposure to weather conditions at the sea.

Other important steps. On July, 14, 2015, Ukraine and Canada completed negotiations on free trade area, which is expected to be ready for implementation in the fall of 2016 and in perspective will open the Canadian market for 98% of Ukrainian exports. Ukraine also intensified talks with Israel and Turkey on free trade area and considers a possibility to sign the FTA with North African countries, which are one of the main consumers of Ukrainian agricultural goods. There are also intentions to join Regional convention on rules of origin Pan-Euro-Med, which allow 42 member-counties (EU, EFTA, Turkey, Montenegro, Israel, North Africa etc.) to apply principle of diagonal cumulation for identifying the country of origin. Ukrainian producers also received a possibility to export dairy products not only to the EU, but also to China, and sell beef, sheep and poultry meat to the United Arab Emirates (UAE). After Kazakhstan joined the WTO, Ukrainian dairy and meat producers renewed access to the Kazakhstan market. Finally, the Government continues to work on deregulation of export-imports operation, which would reduce cost and time of crossing the border.

Economic outlook for 2016-2017: Long road to recovery

Bounce in 2016. Real GDP in 2016 is expected to increase by 1.1% in 2016. We assume that the Government will continue reform program agreed with official donors, including the IMF, and loans will continue. In particular, the Government will continue anti-corruption measures, reduce tax avoidance (levelling playing field for business), increase efficiency and transparency of fiscal spending. The deregulation is likely to be continued, which would help to moderately improve investment climate. Moreover, the Government will be able to restart privatisation process.

Domestic demand will bounce back slightly as wages will recover some of the purchasing power lost in 2015 and companies will finance overdue investment projects. Banking sector will be more stable and will not be a drag on consumption and investment demand. We expect that real gross value added will back slightly in most sectors of the economy, with notable exception of agriculture (due to lower area seeded and decrease in yields after several years of high harvests).

Real exports is projected to remain stable as loss of remnants of Russian market is expected to be offset with slightly higher exports to the EU and other countries. This will be supported by the continued access to the EU market as part of Association Agreement and recent successes in reduction of phytosanitary barriers for Ukrainian food exports. Increasing number of Ukrainian food exporters were authorized to supply their products to a number of external markets.

Recovery in 2017. We forecast real GDP growth in 2017 at 3.6% due to higher domestic and external demand. In response to more stable situation in the Eastern Ukraine and macroeconomic stabilization, the confidence of consumers and producers is expected to recover to a degree. At the same time, more stable financial sector will again start to contribute to more efficient use of savings in the economy.

Thus, we expect that investments will continue to grow in 2017 due to recovery of economic activity, improved financial situation of companies, and higher bank lending. However, wage growth will be limited by attempts of companies to increase financing primarily for investments. The Government is not likely to increase substantially gross wage bill in public sectors.

In response to moderate bounce back in global demand for commodities real exports will increase more than real imports. At the same time, Ukraine will not increase energy imports. Still, hryvnia will somewhat depreciate as the NBU policy focus will be shifted to inflation targeting.

The Government is projected to continue reforms, which would mean further support of international donors. Some of the assistance will be allocated to financing of infrastructural projects.

High risks. At the same time, there are significant risks of the forecast. One of the risks is the escalation of war in the East of the country. However, recently political risk became significant. Ukraine is likely to receive new Government in the nearest future. Meanwhile, the IMF delayed the provision of the third tranche under the EFF (which was initially scheduled for end of 2015) significantly. If political instability continues cooperation with donors will suffer leading to higher volatility of the exchange rate and possibly high and persistent inflation.

To sum up…

In 2014 and 2015 Ukraine faced the biggest challenges over years of independence. First, the regime of President Yanukovych was toppled by “Euromaidan” protests in Kyiv’s central square. However, the victory of the Euromaidan was soon dimmed by lightning takeover of Crimea by Russia and military conflict in the East of the country. Most of the Eastern Donbas is controlled by separatists with Russian military aid and the conflict seems to be a lasting one. War in the East undermined Ukrainian economy as it led to loss of large part of export revenues leading to large-scale depreciation of the national currency and undermining macroeconomic stability. Economic activity in Donbas was severely disrupted, while companies in other regions faced logistic problems due to broken supply chains. Russia that was previously one of the largest trading partner of Ukraine increasingly restricted Ukrainian exports, which resulted in sharp decline in trade between two countries. To top it off weak external demand for key Ukrainian exports and declining world commodity prices further hammered Ukrainian exports. As a result, exports dropped by about 45% in dollar terms in 2015 from its peak in 2012, inflation exceeded 40% in 2015. About quarter of banking sector was liquidated due to financial crisis and contraction of domestic demand added to drop in economic activity. Overall, real GDP in 2015 was by 15.5% lower than in 2013. However, GDP outside troubled Donetsk and Lugansk oblasts declined more moderately, i.e. by estimated 8-8.5% over 2 years.

At the same time, difficult economic situation created an opening for long-delayed reforms. Reform agenda was formed as part of negotiations to ensure assistance of the IMF and other official donors, primarily the EU. Besides, the Association Agreement between Ukraine and the EU contains commitments to harmonize a significant part of Ukrainian legislation to EU rules. Full application of the Association Agreement including trade provisions started in in 2016. The Government was able to improve fiscal situation, reduce energy subsidies and reduce administrative burden on business. However, many reforms are still to be implemented, which required the Government to continue reform efforts.

The article was originally published on http://www.russkiivopros.com/?pag=one&id=657&kat=5&csl=75 Isuue 1, 2016