In recent months, the topic of budget deficits has taken center stage in heated debates among economists and politicians, garnering significant attention in the media. In April, the caretaker government proposed a budget with a notable deficit of 6.1% of GDP (on an accrual basis) for 2023. In June, Finance Minister Asen Vasilev proposed a new budget with a negative balance of 3%, which is right at the limit for fiscal stability as set in the Maastricht criteria of the European Commission (EC).

It is intriguing to observe the situation in countries with similar economic characteristics to Bulgaria, such as Lithuania, Latvia, and Estonia. These countries apply comparable macroeconomic policies, underwent influence from socialist regimes, and, like Bulgaria, have experienced high rates of emigration. [1][2] Given Bulgaria’s intention to enter the eurozone by January 1, 2025, it is useful to look at their results, as they also had a fixed exchange rate and successfully transitioned to adopting the Euro.

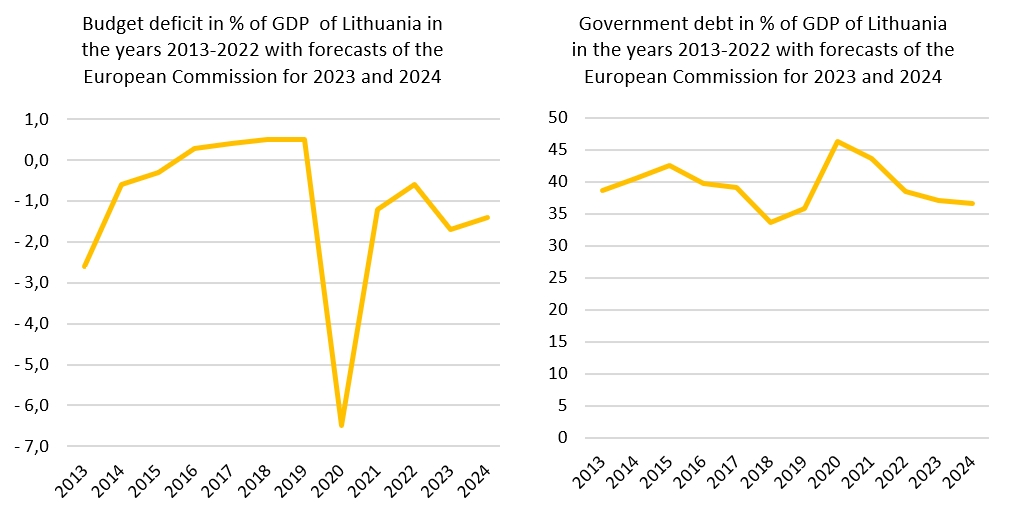

Lithuania is the country that performs best in terms of fiscal indicators among the rest of the Baltic countries. Both its Ministry of Finance and the European Commission predict that it will remain in the framework for fiscal stability in the coming years. In 2022, its deficit is projected to reach 0.6 % of GDP, but it is expected to increase to 1.7% in 2023 according to the EC’s forecast and to 2.2% according to the Lithuanian Ministry of Finance forecasts. This is due to rising costs for measures supporting intermediate consumption, social payments such as pensions, gross capital formation, and a decrease in tax revenues. Debt is projected to remain in the 36-38% of GDP range in 2023 and 2024.

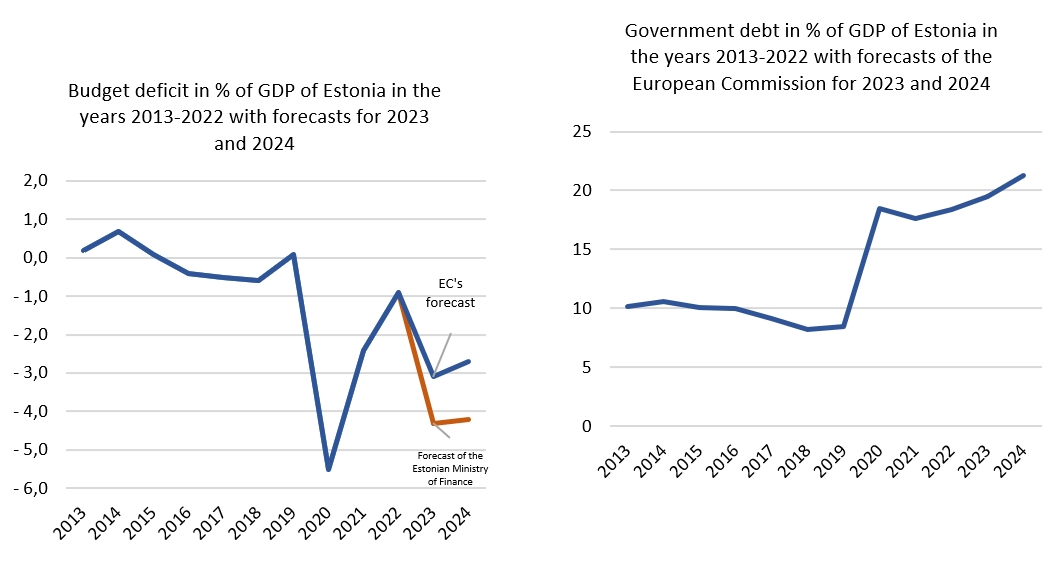

In Estonia’s case, the forecasts of the European Commission and the Estonian Ministry of Finance differ significantly in terms of both deficit and debt. The EC predicts Estonia will deviate from the fiscal framework with a deficit of 3.1% of GDP in 2023, returning to it with a deficit of 2.7% of GDP in 2024.

The Estonian Ministry of Finance, on the other hand, has set in its Stability Programme to reach a deficit of 4.3% of GDP in 2023 and 4.2% of GDP in 2024. The difference comes from Estonia projecting higher costs for workers’ compensation, social payments, and gross capital formation compared to the EC’s projections. The high deficit is attributed to Estonia’s plans for increased pensions, civil servants’ salaries, child allowances, along with elevated spending in defense, education, and national security. In terms of the debt indicator, Estonia remains the leader in the EU with 19.5% debt to GDP in 2023 and 21.3% in 2024 according to the EC’s forecast.

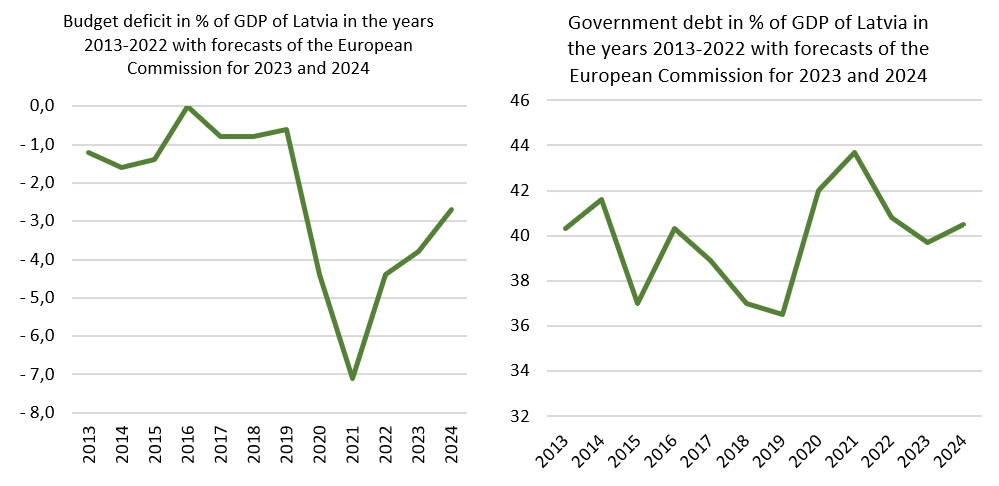

Latvia is the only country expected to reduce its deficit in 2023, going from 4.4% of GDP in 2022 to 3.8% in 2023 and 2.7% in 2024 according to the EC’s forecast and to 4% of GDP in 2023 and 2.5% in 2024 according to the Latvia’s Stability Programme. Latvia plans mainly to increase tax revenues and reduce its expenses for measures related to the COVID-19 crisis and to easing the inflation due to the geopolitical events in 2022.

It is important to mention that Latvia envisages to spend more on salaries for the public administration and health workers, as well as on incentivising research and investments in defence and internal security, which will be offset by the above-mentioned reduced expenditure. Latvia meets the Maastricht criteria with a projected debt of 39.7% of GDP in 2023 and 40.5% in 2024 according to the EC.

In conclusion, while different countries exhibit varying fiscal indicators, they follow a similar trajectory: an increased deficit in 2023, expected to stabilize from 2024 onward. This analysis gives us hope that Bulgaria will follow a similar path of stabilization upon entering the eurozone.

[1] Economic and Social Council. (2022). Impact of Bulgaria’s accession in the Eurozone on economic development, inflation and incomes in the country. https://esc.bg/wp-content/uploads/2022/07/ESC_4_018_2022.pdf

[2] The analysis is based on the spring 2023 economic forecast published by the European Commission.

Written by Nikol Valkanova

Continue exploring:

Recovery Plan And Resilience Is Faltering in Bulgaria, And With It, The Reforms