One of the major barriers which prevent the labour market from demanding more workforce (thus lowering the unemployment) is the high level of compulsory social contributions. This is the case especially in Slovakia where both the employer and the employee have to pay contributions from the first euro which the employee earns. Slovakia ranked amongst top 9 OECD countries with the highest rate of social contributions in 2011 and the recent increases of the base for contributions will move us even closer to the ‘top’.

The blame for the low wages is often connected with the unwillingness of the employers to provide a higher salary. But the reality is often different. Companies operating in the regions with high unemployment are often the one and only choice for the low-skilled workers to find a job. Even though the wages are much lower in Slovakia than in Western Europe, in general, we have to point out that there is a big difference between the net wage and gross wage. The Slovak government takes away 36% of labour costs in the form of social contributions even of the employees earning the minimum wage.

Since the government cannot raise the added value of an employee in the eyes of an employer, it cannot raise his salary either. The only way for the government to achieve raising the net wages is to lower the burden it imposes on the labour. Unlike productivity and capital equipment of the private sector, tax burden is 100% under the control of the state.

INESS Policy Note

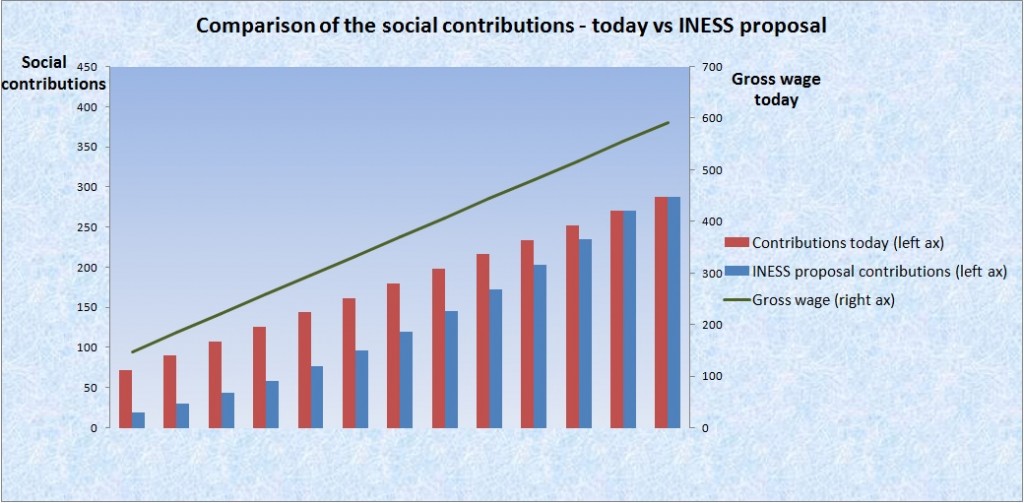

In the line of this argument, INESS published a proposal which would make the contributions base rise gradually. This contribution relief would affect the low-income individuals by lowering their social contribution burden. The lower the income, the bigger the relief.

As we can see in the graph, a person earning a minimum wage in Slovakia (327 € per month in 2012) has to pay 159 € in the form of social contributions (employer’s share included). This is a huge amount which makes employing the low-skilled workforce so much more expensive. Assuming the labour costs remain the same, INESS proposal would cut the social contributions by 65 €.

In reality, contribution relief might be divided for the benefit of both, the employee and an employer. This would extend the relief because remember – the lower the labour costs, the bigger the relief. If an employer cuts his costs for a minimum wage employee by 38 € under INESS proposal, the employee’s salary would still be 38 € higher than today. His net wage would effectively rise by more than 13%.

This proposal, with the combination of abolishing the minimum wage law, could create tens of thousands of new jobs in Slovakia. Employing low-skilled workers would be cheaper and their salaries higher. 700,000 people would benefit from the contribution relief which is one-third of the Slovak workforce.

Lower tax revenues (caused by lowering the social contribution rates) would be offset by positive effects – higher employment and contraction of the black labour market. The government can also stop providing tax cuts for the selective industries based on their lobbying as this proposal would represent a tax cut for all the industries in the economy.

Especially, a state with a socially-oriented philosophy should consider this opportunity. It can start with abolishing the minimum wage law, which can be done immediately. This action would help thousands of low-skilled citizens who have a hard time finding a job in the economy with 14% unemployment rate. In the long-term, the most social action the state can provide is to give people a chance to live a dignified life based on their own income without a dependency on the state or society.