Ukraine’s manufacturing sector suffers war losses, but most industries keep optimism about the future. However, manufacturers that secure the basic human needs (food, clothing, and shoes) demonstrate the best production and recovery results. These are the main findings of the 3rd monthly enterprise survey conducted by the Institute for Economic Research and Policy Consulting (IER) in July 2022.

Russia ‘s full-scale invasion of Ukraine highlighted the weak points of the Ukraine’s economy. In the recent years, Ukraine’s manufacturing sector predominantly demonstrated stagnation. Consequently, manufacturing is expected to decline by 42.6% due to the war, much higher than decline of Ukraine’s GDP – 31% (according to the IER assessment).

At the same time, IER survey results demonstrate that selected industries have higher level of wartime resilience.

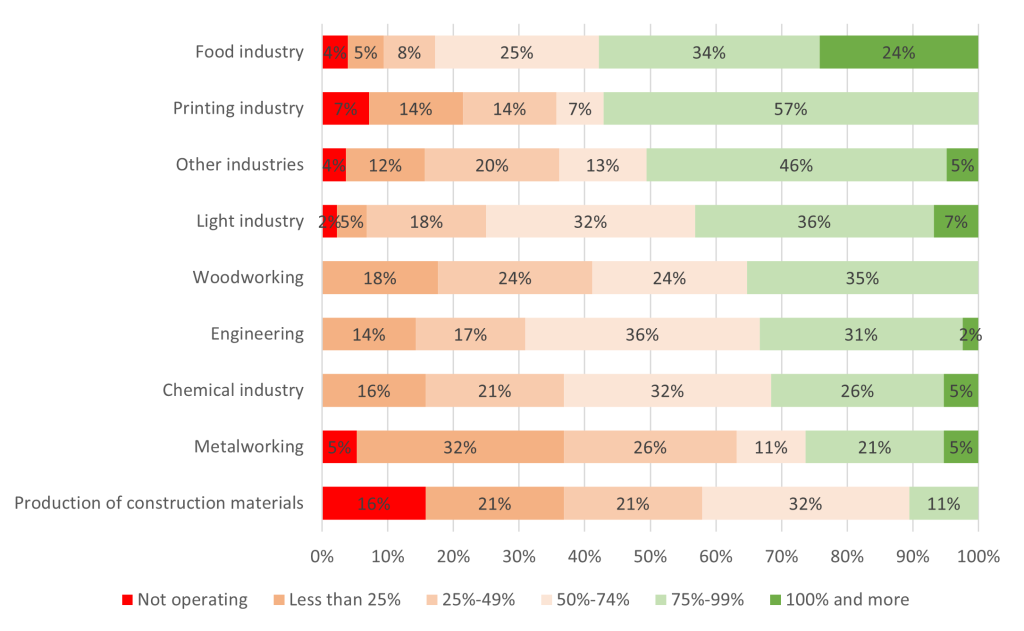

Industries that secure the basic human needs (food, clothing, and shoes) are more likely to keep and / or recover production level. As of July 2022, in the food industry 24% of enterprises operated at full capacity or more in comparison with the prewar period. In the light industry, the same figure is only 7%. However, respective results are less optimistic in other industries due to poor resilience.

Source: Monthly Enterprises Survey “Ukrainian Business in Wartime”. Institute for Economic Research and Policy Consulting, 2022

Source: Monthly Enterprises Survey “Ukrainian Business in Wartime”. Institute for Economic Research and Policy Consulting, 2022

The survey recorded critical decline of production in production of construction materials, metalworking, chemical industry, and engineering. For example, 16% of enterprises manufacturing construction materials do not operate. In metalworking, 63% of enterprises reduced production by more than a half.

Even in the woodworking industry, which is mainly concentrated in the west and north of the country, only 35% of enterprises operate at almost full capacity. The survey confirms immediate negative impact of the war due to disrupted supply chains, blocked export routes, and low demand.

Negative Current Assessments, Optimistic Expectations

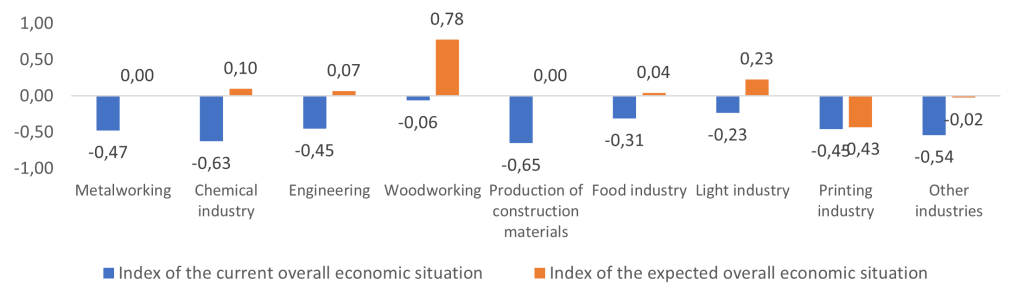

The leadership of certain industries is reflected in assessments of overall economic environment and business activity. Assessment of business environment remains negative (balance index -0.37 in July). This means that negative assessments of the overall economic situation significantly outweigh positive ones (45.5% versus 8.5%).

Assessments remain negative in all manufacturing industries. However, the most optimistic results are in food industry (-0.31), light industry (-0.23), and woodworking (-0.06).

Source: Monthly Enterprises Survey “Ukrainian Business in Wartime”. Institute for Economic Research and Policy Consulting, 2022

Source: Monthly Enterprises Survey “Ukrainian Business in Wartime”. Institute for Economic Research and Policy Consulting, 2022

Most industries have positive assessments of future changes in the overall economic environment (balance index +0.09 in July). Optimism prevails in the light (+0.23) and woodworking (+0.78) industries. At the same time, in the food industry the balance index of expected changes is only +0.04, possibly reflecting uncertainty about autumn sowing season in agriculture and access to global markets.

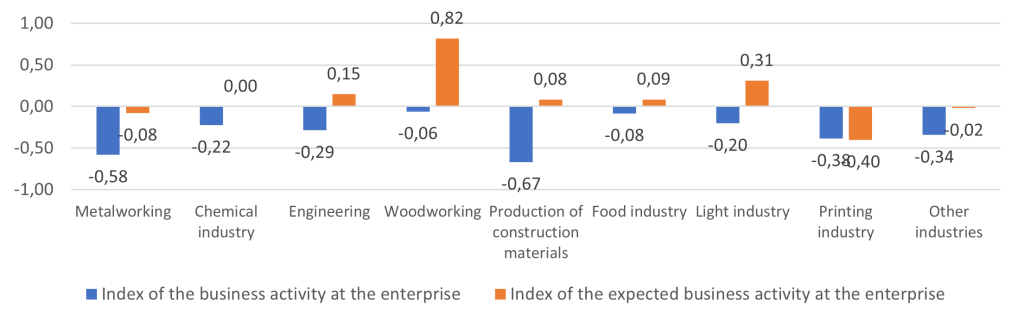

Similar results are observed regarding business activity at enterprises. Assessment of current situation is negative for all industries, yet enterprises in the food and light industries are less pessimistic (-0.08 and -0.20 respectively). On the other hand, expectations regarding business activity are again very cautious in the food industry (+0.09). The best expectations are in woodworking (+0.82), and in the light industry – (+0.31).

Source: Monthly Enterprises Survey “Ukrainian Business in Wartime”. Institute for Economic Research and Policy Consulting, 2022

Source: Monthly Enterprises Survey “Ukrainian Business in Wartime”. Institute for Economic Research and Policy Consulting, 2022

Food and Light Industries Keep the Best Production and Sales Results

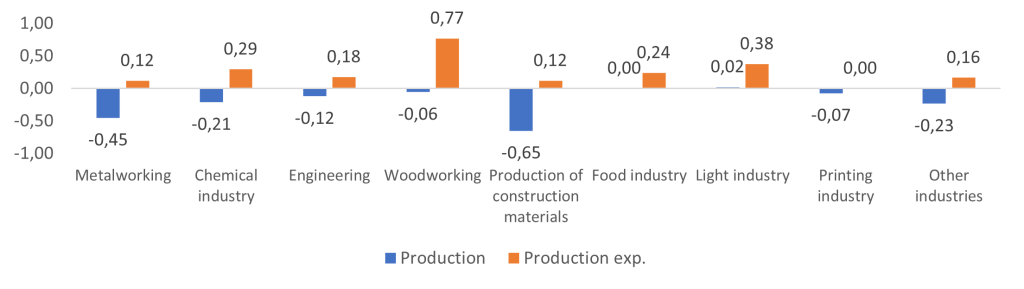

In July, only two industries did not have negative balance index of changes in production – food (0.00) and light industry (+0.02), while average result was -0.12. The lowest results are in production of construction materials (-0.65) and metalworking (-0.45).

Production expectations for the next three months are predominantly optimistic in all industries. The highest results are for food (+0.24), light (+0.38), and woodworking (+0.77) industries.

Source: Monthly Enterprises Survey “Ukrainian Business In Wartime”. Institute for Economic Research and Policy Consulting, 2022

Source: Monthly Enterprises Survey “Ukrainian Business In Wartime”. Institute for Economic Research and Policy Consulting, 2022

Similar to production, sales decline is all industries (sales change index -0.16 in July). The best results are recorded in the light industry (+0.04), woodworking (0.00), and food industry (-0.03). At the same time, expectations for changes of sales are also positive in all industries.

The highest level of optimism was recorded in light industry (+0.38) and woodworking (+0.69). However, the food industry has only +0.23, at the level of the average result.

Export Activities Are Recovering, Export Volumes Continue to Fall

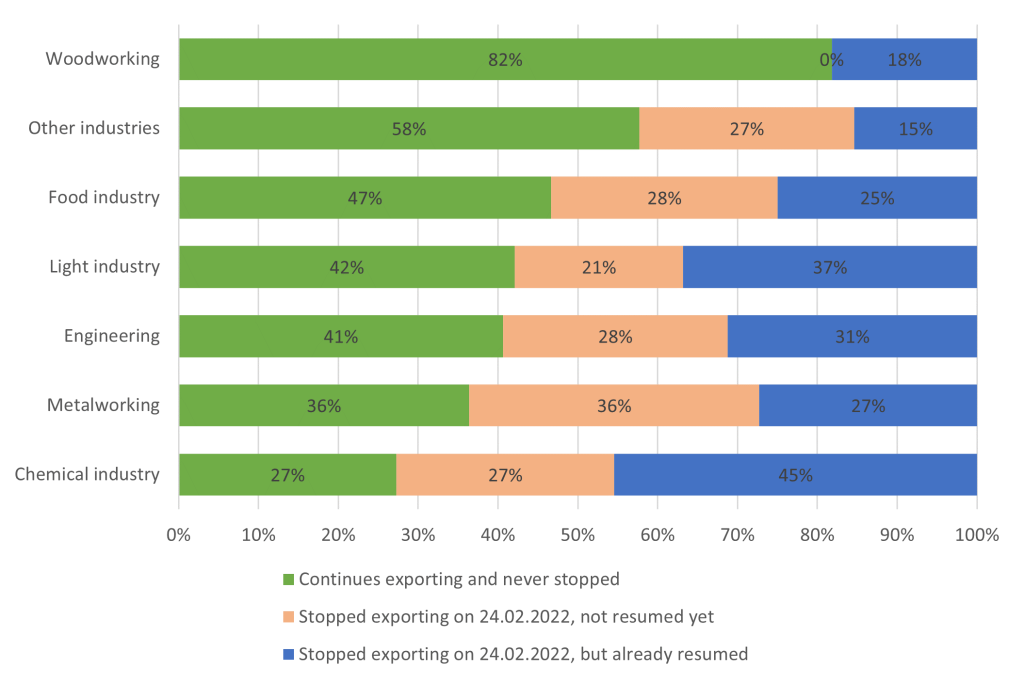

The war has had a disproportionate impact on the exports in different industries. The best situation is recorded in the woodworking, as 82% of respondents have never not stopped exporting after start of the war. This can be explained by geographical distribution of the industry again. The food production has also coped with war impact better than other sectors, as 47% of enterprises did not stop exporting.

At the same time, the smallest shares of enterprises that did not stop exporting are spotted in the chemical industry (27%), metalworking (36%), and engineering (41%).

Source: Monthly survey of enterprises “Ukrainian business during the war”. Institute of Economic Research and Policy Consulting, 2022

Source: Monthly survey of enterprises “Ukrainian business during the war”. Institute of Economic Research and Policy Consulting, 2022

Despite recovery of export activities, all manufacturing industries have experienced decline of export volumes. The situation is alarming in the production of construction materials (-0.86). At the same time, a significant downward trend is recorded in the light (-0.14), food (-0.25), and woodworking (-0.25) industries. Expectations regarding recovery of exports remain positive.

However, the lowest balance index was recorded in the food industry (+0.07). This raises additional concerns regarding uncertainty in the agri-food sector.

About the Survey

The Institute for Economic Research and Policy Consulting conducts a monthly enterprise survey using the Business Tendency Survey approach to quickly collect information on the current economic state at the enterprise level.

The methodology was developed to assess the situation from the “basic level”, on the judgments and expectations of the main economic agents – entrepreneurs and enterprise managers. Field phase of the 3rd monthly survey took place from July 4 to July 14, 2022.

The article was prepared within the project “For Fair and Transparent Customs”, financed by the European Union and co-financed by the International Renaissance Foundation and Atlas Network.

Continue exploring:

In Claws of Kremlin Bear. Hungary’s Russian Dependence Illness

Georgia’s Trade Dependence on Russia Is Political, Not Economic