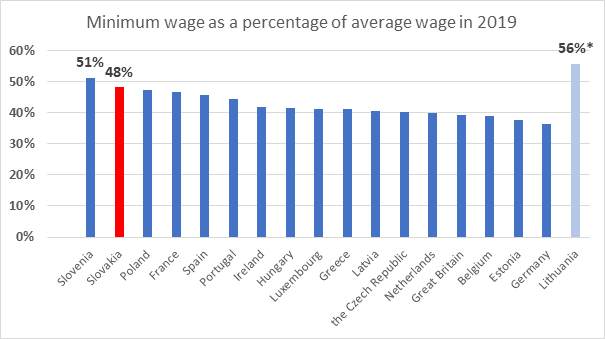

In Slovakia, the minimum wage has become a political evergreen of every autumn. However, its growth has been rapidly increasing in recent years. Moreover, the former Slovak prime minister has proposed a new law, which will set the minimum wage at 60% of an average wage of the previous year (effectively t+2).

This development is dangerous for a country with deep regional differences. Not to mention a slowdown of economic growth both in the EU and in Slovakia.

Note: Lithuania has reformed income taxes and contributions. They abolished „gross wage“ and all taxes and contributions are paid by employees. This reform led to a minimum wage increase by 38%. In reality, the net minimum wage increased by 7.5%.

Note: Lithuania has reformed income taxes and contributions. They abolished „gross wage“ and all taxes and contributions are paid by employees. This reform led to a minimum wage increase by 38%. In reality, the net minimum wage increased by 7.5%.

Source: Eurostat, EC, OECD

Due to the abovementioned reasons, INESS published two publications which address minimum wage in detail, and provide a complete overview of:

-

The impact of the minimum wage in Slovakia specifically;

-

Academic literature, which is dealing with the influence of minimum wage on employment.

The first publication entitled Triple Impact of Minimum Wage analyzes its social impact.

Regional Differences and Low-Skilled Workers

Even though the Slovak economy is doing alright as a whole, it does not necessarily mean that it applies to all regions. We still have districts with 15% unemployment rate, where tenths of unemployed people wait for a one job vacancy.

Slovakia has been struggling with the issue of long-term unemployment for a long time. In the Prešov or Košice regions, 9 out of 10 of unemployed people belong to disadvantaged groups.

Minimum Wage Is Not Only about Minimum Wage

Furthermore, the minimum wage is linked to 42 laws, which subsequently manifest its influence on the whole economy.

Increased bonuses for working during the night and weekend could serve as an example. This is how politically driven increasing minimum wage increases the labor costs of entrepreneurs abruptly and unpredictably.

Minimum Wage in Public Sector

Finally, increasing the minimum wage also influences the expenditure of the public sector, where almost 30,000 employees receive it. Therefore, increasing minimum wage raises public expenditure and also tax burden.

It is estimated that in the upcoming year, this will mean an additional expenditure of approximately 32 million euros.

For these three reasons, we suggest taming the political race in increasing of minimum wage and linking its growth to the growth of work productivity. Besides, the minimum wage is already high and this needs to be dealt with. What we suggest is to do it through a deductible item from social contributions.

Further Analysis

The second publication entitled What We Do (Not) Know about the Minimum Wage is focused on academic literature.

Surely, you must have taken notice of claims of some politicians or trade-unionists that it has been proven that increasing of minimum wage does not have a negative impact on employment. This is far from the truth. There are multiple studies, which warn against the negative impacts of this tool.

We go into the depth of the famous study of economists Card and Krueger from New Jersey, where they prove that increasing the minimum wage increased employment.

On top of this, we will also look into the recent significant increase of minimum wage in Seattle, which had been analysed by two teams of economists and they have reached two differing conclusions.