Since 2014, Ukraine’s exporters are feeling impact of armed conflict in the Eastern Ukraine and receive less and less dollars for their products due to plummeting prices for steel, wheat and many other commodities. Since the very beginning of 2016, exporters face additional obstacles for sale of goods to Russian purchasers. At the same time, Ukrainian importers received some relief. On January 1, 2016, provisional application of the Deep and Comprehensive Free Trade Area (DCFTA) with the EU started, which lowers duties on the EU goods. Import duty surcharge (at 5-10%) was cancelled.1 The presented article is an attempt to analyse impact of these events on international trade.

Effective from January 1, 2016, the Russian Federation suspended duty-free access for Ukrainian goods until further notice and introduced most favoured nation (MFN) duties. Import ban on Ukrainian agricultural and food products (mirroring import ban introduced for EU goods) was introduced from January 1, 2016, at least to August 7, 2016. Russia claimed that trade restrictions were made in response to provisional application of the DCFTA between Ukraine and the EU. The excuse was that EU producers will circumvent Russian duties and import restrictions on EU goods by exporting through Ukraine.

On New Year’s day Russia also drastically changed rules for transit of Ukrainian goods to Kazakhstan. Now automotive and railway transit of Ukrainian goods to Kazakhstan is allowed only with the entry through the territory of Belarus. All the containers should be equipped with seals with GLONASS tracking devices issued at the Russia-Belarus border. The transit should be made through 2 checkpoints (1 railway and 1 automotive) at the Russia-Belarus border and 3 checkpoints at the Russia-Kazakhstan border (1 railway and 2 automotive).

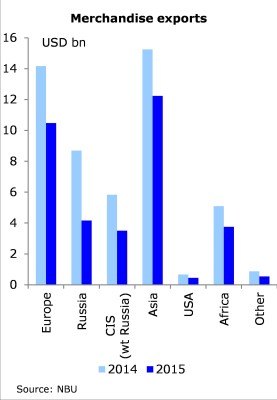

According to the recent estimates of the IER and German Advisory Group, cancellation of the FTA and import ban by Russia could potentially reduce Ukraine’s exports to Russia by USD 0.6 bn or 13% of 2015 exports. The impact of restricted transit on exports remains an open question, as higher cost, longer duration and limited capacity of alternative routes could significantly reduce Ukraine’s exports to Kazakhstan, Central Asia and China.

Ukraine responded to new Russian policies with mirror measures on Russian exports. It introduced MFN tariff rates for Russian goods from January 2, 2016, to December 31, 2016, with the provision that the FTA duties will be restored if Russia cancels application of MFN duties. Moreover, the Cabinet of Ministers of Ukraine introduced import ban on selected agricultural and foods products, as well as locomotives and railway equipment.2 Import ban is applied since January 10, 2016, to August 5, 2016, or until Russia allows Ukrainian goods at its market. On January 20, the list of banned Russian goods was expanded. Ukraine did not block transit of the Russian goods justifying it by adherence to WTO rules. However, the number of checkpoints, where transit of banned by Ukraine Russian goods can cross the border, was decreased.

To deal with the problem of restricted transit through Russia to Kazakhstan, Ukraine launched the new route through the Black Sea, Georgia, Caspian Sea and Azerbaijan. It is unclear how this alternative route will develop given almost twice higher cost and long turnaround times, dependence on weather conditions as well as limited capacity. Ukraine also used WTO dispute resolution framework for import ban and transit restrictions by Russia.

In 2016, Ukraine and the EU started provisional implementation of Deep and Comprehensive Free Trade Area (DCFTA). Whereas Ukraine just opened its market for the European goods, the EU unilaterally opened its market for Ukrainian goods under conditions similar to the DCFTA since April 23, 2014 (as autonomous preferences). Since 2014, 94.7% of industrial exports and 83.4% of food exports had duty-free access to the EU market, whereas 15.9% of exports could be traded duty-free within tariff-rate quotas. Thus Ukrainian producers already experience positive effects from the implementation of the Association Agreement between Ukraine and the EU.

In 2016, Ukraine and the EU started provisional implementation of Deep and Comprehensive Free Trade Area (DCFTA). Whereas Ukraine just opened its market for the European goods, the EU unilaterally opened its market for Ukrainian goods under conditions similar to the DCFTA since April 23, 2014 (as autonomous preferences). Since 2014, 94.7% of industrial exports and 83.4% of food exports had duty-free access to the EU market, whereas 15.9% of exports could be traded duty-free within tariff-rate quotas. Thus Ukrainian producers already experience positive effects from the implementation of the Association Agreement between Ukraine and the EU.

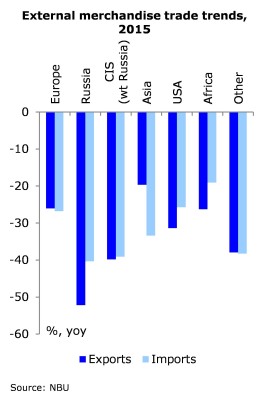

During the first months of application of autonomous trade preferences (ATP), Ukraine’s exports to the EU increased sharply (growth rate varied from 31.6% yoy in May 2014 to 9.4% yoy in August 2014). However, downward pressure of arm conflict and lower prices on exports magnified since the second half of 2014. As a result, Ukraine’s exports to the EU started to contract. Overall, between May and December 2014, exports to the EU dropped by 2.6% yoy, while exports to Russia and other countries declined by 39.5% yoy and 15.3%, respectively.

Termination of production in the East of Ukraine, broken logistic chains and lower world commodities prices resulted in decline in Ukraine’s exports in 2015. However, likely due to the positive impact of the ATPs exports to the EU declined less than exports to other countries (by 27.2% as compared to 31.8%). The difference of 4.6 p.p. is in line with our early evaluation of potential effect of the DCFTA on Ukraine’s export to the EU (additional 4.5% to the exports to the EU in the first year of application comparing to status quo, later gradually increase to 5.1%).3 We expect that when the downward pressure of general factors impacting trade weakens, Ukraine will be able to expand its exports to the EU.

In 2015, Ukraine also improved utilization of tariff-rate quotas (TRQ): 9 out of 36 TRQs were fully utilized as compared to 6 TRQs in 2014. In future, when Ukraine completes the harmonization of technical regulation and sanitary and phytosanitary measures, we expect that the potential of TRQs will be used more.

Initial impact of introduction of the DCFTA on imports will be limited as Ukraine opens its market gradually (additional 2.3% to the imports from the EU in the first year of application is expected comparing to status quo, later imports will gradually increase by 4.8%). Weak demand for imports will also limit the effects of the DCFTA at the early stages of application.

Since January 1, 2016, Ukraine also completed application of temporary import surcharge of 5-10% under Article XII of GATT, which was aimed on improving balance of payments. This would positively contribute to imports in 2016. According to the Institute for Economic Research and Policy Consulting (IER) estimates, this measure added 5.5 p.p. to imports drop in 2015.

To take into account new external trade realities Ukrainian government intensified policies that are expected to facilitate entrance of Ukrainian producers to other markets. In particular, Ukraine continued to harmonize its horizontal and sectoral legislation as well as technical regulations with the EU directives and regulations. This is expected to not only allow Ukrainian companies to receive access to the EU market, but also ease access to other countries. In particular, changed technical regulations have already allowed Ukrainian dairy producers to enter the markets of the EU and China. After Kazakhstan joined the WTO, Ukrainian dairy and meat producers renewed access to the Kazakhstan market. Another positive factor was lower antidumping duty by the EU on Ukrainian steel ropes and cables. Also, after investigation, Turkey decided not to impose antidumping measures on Ukrainian hot metal rolls.

To take into account new external trade realities Ukrainian government intensified policies that are expected to facilitate entrance of Ukrainian producers to other markets. In particular, Ukraine continued to harmonize its horizontal and sectoral legislation as well as technical regulations with the EU directives and regulations. This is expected to not only allow Ukrainian companies to receive access to the EU market, but also ease access to other countries. In particular, changed technical regulations have already allowed Ukrainian dairy producers to enter the markets of the EU and China. After Kazakhstan joined the WTO, Ukrainian dairy and meat producers renewed access to the Kazakhstan market. Another positive factor was lower antidumping duty by the EU on Ukrainian steel ropes and cables. Also, after investigation, Turkey decided not to impose antidumping measures on Ukrainian hot metal rolls.

Besides, Ukraine continues negotiations with other countries on establishment of free trade areas and conclusion of international treaties. On July 14, 2015, Ukraine and Canada completed negotiations on free trade area, which is expected to be ready for implementation in the fall of 2016. This FTA will open Canadian market for 98% of Ukrainian goods with producers of food, clothes, metals and minerals to benefit the most. Ukraine also intensified talks with Israel and Turkey on free trade areas. Ukraine considers currently a possibility to sign the FTA with North African countries, which are one of the main consumers of Ukrainian agricultural goods.

Another trade facilitation effect could be obtained from the implementation of international trade-related treaties. In 2015, Ukraine ratified the WTO Trade Facilitation Agreement, which will allow reducing cost of trading externally. External trade is expected also to benefit from deregulation of export-import operations approved by the Ministry of Economic Development and Trade. Also in 2015, Ukraine joined WTO Government Procurement Agreement, which opens access for Ukrainian companies to government procurements of WTO members. There are also intentions to join Regional convention on rules of origin Pan-Euro-Med, which allow 42 member-counties (EU, EFTA, Turkey, Montenegro, Israel, North Africa etc.) to apply principle of diagonal cumulation for identifying the country of origin.

To sum up, Ukrainian government has finally intensified policies aimed at trade facilitation. In particular, Ukrainian companies received better access to other markets due to technical regulation reform as well as establishment of FTA, primarily with the EU. Besides, as Russia has restricted access for Ukrainian goods, Ukraine has to look for new markets for the lost exports and new alternatives for transit.

1 5-10% of imports surcharge was introduced in February 2015.

2 The Decree of the Cabinet of Ministers of Ukraine №1147, from 30 December 2015

3 http://www.ier.com.ua/files//Projects/Ryzhenkov_Partial%20equilibrium_2014-11-27.pdf

The article was published on February 11, 2016 as a Highlight of the Month in the Issue #2 (184) of Monthly Economic Monitor of Ukraine (http://www.ier.com.ua/en/publications/regular_products/monthly_economic_monitoring?pid=5182)