Oil is world’s number one energy source and it is also a complementary good for utterly everything that we can buy. This is the reason why an oil price increase could be reflected in rising prices of all goods.

It is intriguing to observe the level of oil taxation in each European country owing to the mutual tax competition in the field of transportation. Large fuel tanks make crossing the territory of many countries without refuelling possible. It is common knowledge that citizens from border areas often refuel in a neighbouring country in cases when it is convenient. So, a tax burden is a very important thing to analyse.

Governments very rarely decrease oil excise duties. In EU27, or more precisely, in EU28 countries, for example, diesel fuel excise duties have increased nine times this year, whereas they have decreased only six times. This is highly surprising, considering that typical government proclamations (at least in the Czech Republic) highlight preserving low prices of basic goods.

The following tables represent recent total diesel fuel taxation and total gasoline fuel taxation expressed in EUR/1000 L.

|

Diesel fuel |

Gasoline |

|||||

|

Country |

EUR/1000 L |

Country |

EUR/1000 L |

|||

|

1. |

United Kingdom |

63359 |

1. |

Ireland |

718.04 |

|

|

2. |

Italy |

669.26 |

2. |

Slovakia |

881.55 |

|

|

3. |

Sweden |

550.71 |

3. |

Spain |

582.85 |

|

|

4. |

Ireland |

592.65 |

4. |

Netherlands |

709.11 |

|

|

5. |

Finland |

622.45 |

5. |

Italy |

641.00 |

|

|

6. |

Denmark |

629.65 |

6. |

Hungary |

696.91 |

|

|

7. |

Germany |

706.72 |

7. |

Latvia |

919.46 |

|

|

8. |

Netherlands |

614.75 |

8. |

Malta |

637.94 |

|

|

9. |

Slovenia |

754.28 |

9. |

Austria |

933.76 |

|

|

10. |

Hungary |

657.80 |

10. |

Romania |

858.11 |

|

|

11. |

Belgium |

698.72 |

11. |

Denmark |

905.81 |

|

|

12. |

France |

599.89 |

12. |

Czech Republic |

990.89 |

|

|

13. |

Austria |

674.98 |

13. |

United Kingdom |

693.46 |

|

|

14. |

Slovakia |

777.50 |

14. |

Sweden |

899.18 |

|

|

15. |

Czech Republic |

916.17 |

15. |

Bulgaria |

1039.,63 |

|

|

16. |

Portugal |

572.84 |

16. |

Poland |

659.19 |

|

|

17. |

Cyprus |

556.26 |

17. |

Greece |

668.27 |

|

|

18. |

Estonia |

492.97 |

18. |

Belgium |

630.98 |

|

|

19. |

Malta |

609.86 |

19. |

Cyprus |

707.52 |

|

|

20. |

Spain |

692.64 |

20. |

Croatia |

1048.38 |

|

|

21. |

Greece |

586.52 |

21. |

France |

634.76 |

|

|

22. |

Croatia |

625.20 |

22. |

Slovenia |

872.68 |

|

|

23. |

Romania |

590.66 |

23. |

Estonia |

605.80 |

|

|

24. |

Poland |

633.22 |

24. |

Lithuania |

810.17 |

|

|

25. |

Latvia |

691.01 |

25. |

Germany |

812.57 |

|

|

26. |

Lithuania |

604.98 |

26. |

Portugal |

708.23 |

|

|

27. |

Bulgaria |

871.86 |

27. |

Finland |

954.85 |

|

|

28. |

Luxembourg |

979.76 |

28. |

Luxembourg |

964.34 |

|

European Commission

Analysing the data presented, we can see that the highest total taxation on diesel fuel is in the UK (633.59 EUR/1000 L), which is followed by Italy (668.26 EUR/1000 L). The third place in the ranking of EU27 countries with the highest total taxation belongs to Sweden (550.71 EUR/1000 L).

The highest excise duty on gasoline is in Ireland (718.04 EUR/1000 L). The second place belongs to Slovakia (881.55 EUR/1000 L), which is followed by Spain (582.85 EUR/1000 L).

Victory isn’t always positive. In the case of EU27 ranking of the countries with the highest taxation of fuels, it is even beneficial to stick with the losers. It is probable that the losers will be far better rewarded not only by collecting higher tax revenue, but also by preserving their greatest political virtue – the respect for the private property of the citizens.

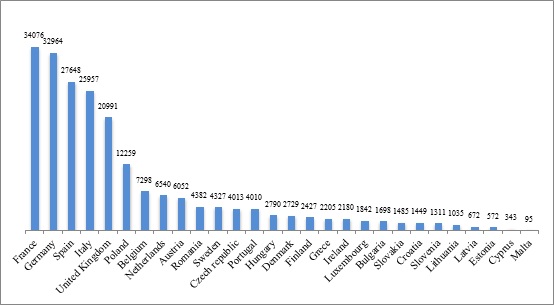

The following chart represents total consumption of diesel fuel in each of the EU28 countries expressed in 1,000,000 kilograms (=kt). The latest available data on fuel consumption is unfortunately two years old. As you can see, the highest consumption was in France (34,076 kt), which was followed by Germany (32,964 kt) and the third place belonged to Spain (27,648 kt).

European Commission

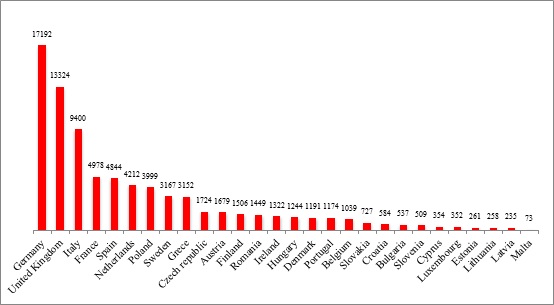

The next chart shows consumption of gasoline in the EU28 countries in 2011. Analysing the data presented, we can see that the highest consumption of gasoline is in Germany (17,192 kt). The second place belongs to the United Kingdom (13,324 kt) which is followed by Italy (9,400 kt).

European Commission

No comments

Be the first one to leave a comment.