Will a knight from the executive board of ECB buy problematic bonds for his private portfolio as well? Are the „fiscal pact“ and ESM unconstitutional? Do you know that through the European funds you are also contributing for the early retirement of the boss of the company which was bought by Facebook for a billion dollars.

It seems that the period of peace brought about by the massive intervention of ECB is coming to an end. The radical Spanish austerity package, mentioned in last week’s issue, didn’t save the market, and a bond auction at lower end of the target range followed (instead of the planned EUR 3.5 billion they sold EUR 2.6 billion worth of bonds). It didn’t help when the dragon was eating its own tail (insolvent Spanish banks were buying bonds of insolvent Spain with money from ECB) and the interest rate of the Spanish government bonds reached 6%. On the other hand, Germany issued bonds with historically low interest rates.

European officialls are sick of it. They expected the trillion of new EUR issued in LTRO in December and February to buy them a longer holiday from the crisis problems. Germany „regrets that the markets have not yet fully recognised these enormous reform efforts“. People who risk their own money buying the bonds have very different idea about what „enormous reform efforts“ mean than officials paid paid by tax money. Member of the ECB executive board Benoit Coeure is also disappointed by the markets: “What is happening at the moment in the market does not reflect the fundamentals.“ As a honoured knight and a holder of the National defence medal he is ready to intervene. “We have an instrument for intervention, the SMP, which has not been used recently, but which exists.” he pointed out. Who knows if he intends to use also his own money to buy problematic bonds to support this fight..

There are interesting questions arising from the continuing eurocrisis for central planners in Frankfurt (the seat of ECB) who believe in their ability to set the interest rates better than the market does. In Greece and Spain there is depression with unemployment reaching over 20%, and property prices are falling down faster than North Korean missiles. On the other hand in Germany, the unemployment rate has fallen down to record low level, salaries are increasing at the fastest pace in the last two decades and property prices started growing dynamically. What is the correct interest rate in such a monetary union?

„The euro may not make it even to the end of this decade,“ says economist Ken Rogoff. Investor George Soros is not optimistic about the situation either and he warns that „The fundamental problems have not been resolved yet; indeed, the gap between the creditor and debtor countries continues to widen. The crisis has entered what may be a less volatile, but a more lethal phase.”

After Iran put a halt to supplying Greece with oil, it did the same towards Spain, whose oil import from this country amounts to 12%. Anything that can go wrong, will…..

The former German Minister of Justice Herta Däubler-Gmelin announced that she would report to the German constitutional court the „fiscal compact“ agreement and the agreement on setting up the European Stabilization Mechanism. According to her, these agreements are not sufficiently democratic and cross the line in transfer of power away from the national parliaments.

Former Greek Minister of Defence Akis Tsochatzopoulos was arrested in Athens and accused of money laundering. He took bribes of around EUR 8 billion, which were supposed to ensure purchase of German submarines in the year 2000 for EUR 2.5 billion.

„It took 30 years of frivolous public spending to bring the country to a debt-to-GDP ratio of 120%. Two years of severe austerity brought debt to 168% of GDP. Obviously the medicine didn’t work… And what democracy can sustain so great a shock with such poor results?“ “ asks Antonis Samaras, the president of Greek centre-right party New Democracy, in his commentary in Wall Street Journal. These are the results of the dubious efforts to protect the creditors of Greece by pretended false solidarity with the Greek people, when the inability to pay off the debt leads to even bigger debt.

Greeks discovered 57 bags full of Nazi Reich marks of total nominal value reaching 14.3 million of marks in the basement of the central Bank of Greece. Germans didn’t manage to take them while retreating during the World War II. Will Germany accept this notes at inflation adjusted value as a repayment of the Greek debts? Probably not, they allegedly have only historical value. But at least the employment rate increased in Greece. The Greek Ministry of Finance appointed commission of 6 members to decide what to do with the money.

This week Facebook bought a two-year-old company Instagram, which developed photo-sharing software, for incredible amount of $1 billion. The company has 13 full-time employees. They together with the investors became fabulously rich, when just the account of the Instagram‘s director (CEO) gained $400 million. And then you read that the European Commission approved a grant for the same Facebook from the funds for the regional development amounting EUR 12 million to pay for the construction of enormous server rooms in northern Sweden. You taxes also helped to assist this huge American company with the market capitalization of around $ 100 billion in its investment projects in one of the richest European countries. Well, at least the EU ensures we are safe at the hairdressers‘.

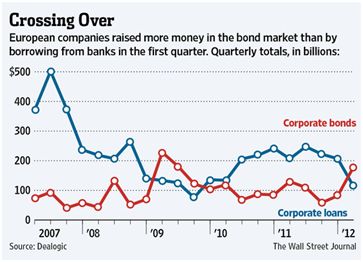

Quick report on the state of the European banking sector: European companies borrow on the bond markets more than what is the value of the corporate credit in the banking system. For Europe, where the corporate sector has traditionally been based on direct bank financing, it is a highly unusual situation.

According to the Bloomberg, world banks would need further EUR 486 billion in equity to ensure implementation of new Basel law (Basel III).

After Italy, also Spain banned transactions in cash over EUR 2.5 thousands to prevent tax evasion and introduced the obligation to report to the authorities existence of foreign accounts. It is a sign of times to come. Get ready.

IKEA is planning to design, build and develop own neighbourhood sized 11 hectares in East London. Finally! Some competition for local authorities is surely not a bad thing. We’ll see how the experiment will work. Indian equivalent of a „private“ city, ruled by the market, works perfectly.

Speaking of governments – communists from North Korea fired a missile which was supposed to place a „satellite“ in the space. A minute after the start the missile exploded and broke into 20 pieces, which fell down to the sea off the West coast of South Korea. I don’t know if it surprised anyone, especially if the operators trained on this kind of technology (a tractor simulator for North Korean students). Moreover, it is difficult to focus, when you are hungry. I already feel sorry for them. There is still a lot of place in the communist concentration camps and after this public disgrace, a couple more people will be added to around 200 000 prisoners that are already there (this is a very sad article by a man who was born in such camp, I recommend you read all of it). Only if the rocket wasn’t shot down by American Patriot missile.

Korean students). Moreover, it is difficult to focus, when you are hungry. I already feel sorry for them. There is still a lot of place in the communist concentration camps and after this public disgrace, a couple more people will be added to around 200 000 prisoners that are already there (this is a very sad article by a man who was born in such camp, I recommend you read all of it). Only if the rocket wasn’t shot down by American Patriot missile.

And now (poor) attempt to balance my writing. Even capitalists don’t always succeed in everything. Especially when they „teach democracy“ the God’s children on the other side of the globe in Afghanistan (nobody died nor was hurt while making this video).

http://www.youtube.com/watch?v=yN54bKvKFzY&feature=related

Have a weekend without any accidents (or Patriots)

Juraj Karpiš

8 Comments

So much info in so few words. Tostloy could learn a lot.