Why the zombie banks aren’t stressed by stress testing, about Austrian Japanese, and about how difficult life the Spanish banks and especially Spanish bankers have. And that Trichet, even though he uses bad economic theories and non- functioning economic models, doesn’t regret anything.

When it comes to solving the crisis in Europe, many people use the example of the USA, where central bank during the crisis provided the whole financial sector with guarantees, which apparently resulted in the local banks being sound and safe today.

This was supposed to be proved by the recent stress test. Out of 19 tested banks only 4 failed the test, which was supposed to simulate the crisis mechanism that surprised the financial system in 2008. Are the American banks fine then? No. This test was a comedy and a PR exercise, in the same way the European versions (remember? Dexia as the most adequately capitalized bank?). American banks keep their heads above the water only because they don’t have to price their assets at market prices and therefore they have them in their books at unrealistic inflated prices. For example, the stress test was passed by a zombie bank, which was unable to pay back aid from TARP and in its financial statements‘ footnotes it can be read that the real value of its assets tumbled by more than what its equity is worth.

The truth is, however, that American banks are sounder than European ones. Loans provided by American banks are mostly covered by deposits. The loan to deposit ratio is 78% in the USA. In Europe it reaches 110%, in Spain 145%. The resulting gap that has to be financed by the European banks on the interbank lending market is estimated at the level of EUR 1,3 trillion.J

The governor of the American FED admitted possibility of the third round of quantitative easing. At the conference of organized by FED in Washington, the Bank of Japan Governor Masaki Shirakawa warned against consequences of extremely low interest rates. „If low interest rates induce investment projects that are profitable only at such low interest-rate levels, this could have an adverse impact on productivity and growth potential of the economy by making resource allocation inefficient“. Exactly the same is said by the Austrian business cycle theory. It might come as a surprise that this theory is used in reasoning by a central banker. Also the former ECB governor Jean Claude Trichet warns against the consequences of purchasing state bond by the central banks. He knows what he is talking about, after all he is the father of those purchases in Europe. At the same time, Trichet doesn’t regret anything what happened during his career. His only disappointment is the failure of contemporary macroeconomic models. He should have read more „Austrians“, as his former Japanese collegue did.

The two rounds of unlimited three-year loans granted by ECB to commercial banks are supposed to „grease the flow of credit to households and businesses“. The data from February indicate stagnating volume of loans granted to households and decline in the volume of loans granted to non-financial firms. On the other hand, money flow into sovereign debts is doing well. Italian and Spanish banks purchased government bonds in record volumes (EUR 23 billion and 16 billion respectively) in February. By the way, did you know that the amount of financing from ECB in some of the Spanish banks exceeds 10% of their loan portfolio’s volume? And that Spanish luxurious prostitutes refuse to serve the bankers in protest?

When it comes to effects of monetary policy, the price level has to be mentioned as well. European households will spend 11% of their income on the energy and personal transport this year. It is twice as much as the historical average (6-7%).

There was a general strike in Spain a couple of days ago. 9 people were injured, 58 arrested.

The fear of a strike, in this case of truck drivers, is present also in the Great Britain. At first, politicians prudently advised people to supply themselves with fuel before the Easter strike – and then the police tried to solve the panic purchases and roads stuck with rows of cars in front of gas stations by closing them until the situation calms down. Hilarious.

Spanish interest rate rose and is close to the 5.5% level. Mario Monti, Italian (!) Prime Minister put to power by the European technocrats, warns of a threatening fiscal catastrophe, which could exhaust the capacity of existing and planned aid mechanisms. He calls for increasing the agreed capacity of ESM (EUR 500 billion) in the future. Is he afraid that after aiding Spain there won’t be enough tokens left for Italy?

He’s not alone. Also the group of G20 countries pushes for increasing the rescue fund capacity and suggests replenishing resources of the International Monetary Fund necessary for participation in the aid programmes. Last week also the OECD joined the motion, it wants ESM to have minimal capacity a trillion EUR. France is in favour and nearly all the other EU member states are. But Germany, which guards the European cashbox, is against. Both increasing either the transferred part of the capacity from the disappearing EFSF (theoretically, there are still EUR 240 billion unused out of the total guarantee of EUR 440 billion) or directly increasing the capacity of ESM will have to be approved by the German parliament, which has recently set the maximum of the German share at EUR 211 billion. Now it seems that despite the initial German refusal, some form of its share increase will be sooner or later agreed. According to the latest information, there is a possibility of agreement on ESM at the level of EUR 800 billion.

Poland’s central bank chief Marek Belka suggests that Greece should temporarily create a new currency to be used especially for payments within the public sector. Depreciation of this currency would decrease the real value of debts and expenses of the Greek state, without depriving the private sector of its purchasing power. A reasonable idea of parallel currencies was already presented at the beginning of the year 2011.

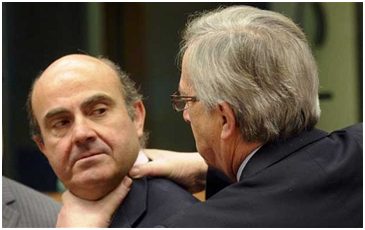

Nothing should be left to chance. The EU will help reaching the right outcome of the Irish referendum on the fiscal compact by forgiving the March payback of the Irish debt. Retiring Mr. Euro Claude Juncker doesn’t see any problem here. At the moment, he is going after the Spaniards’ neck, since they don’t fulfill the Brussel’s targets.

American President Barrack Obama chose a new candidate for the chief of the World Bank Jim Yong Kim. Apart from the fact that this gentleman thinks that „neoliberal“ policies didn’t help a quarter of people living in poverty (really?), big companies‘ profits worsen life of millions of people and that there are positive examples of giving priority to human rights over economic growth in Cuba, he also has other skills (he appears on the stage in the second minute), which he might use when leading this centralist organization:

http://www.youtube.com/watch?v=4lHKJEp5e-8

Have a weekend of your life!

Juraj Karpiš

No comments

Be the first one to leave a comment.