Back in late 2012, the European Commission put forward the notion of reindustrializing Europe. The main goal of that policy is to increase the industrial sector’s share in the European economy from 15.6% in 2012 to 20% in 2020. The target itself is easy to remember and is unlikely to be misquoted by European bureaucrats. As a Deutsche Bank analysis published at the very end of 2013 showed, it is just as unlikely to be reached in the foreseeable future.

Deutsche Bank’s report, entitled “Europe’s reindustrialization: The gulf between aspiration and reality”, outlines two main issues:

- many other sectors of the European economy have a larger growth potential than industrial sectors, which makes increasing industry’s relative share of GDP unlikely;

- many of Europe’s manufacturing industries (such as auto manufacturing) suffer from overcapacity and their consolidation is likely to continue throughout the next several years.

Where does Europe’s industry stand?

Although much of the decreasing significance of European industry can be accredited to faster growth in the service sector, in some countries it is the loss of competitiveness that drives the process. While Germany and the Scandinavian countries remain highly competitive, countries such as France, Italy, Spain and others lag behind. This is not only as far as price competitiveness is concerned, but also with regard to factors such as institutional capacity, financial markets and labour market development. The number of people employed in EU manufacturing has decreased by 17.6% in the years between 2000 and 2012, but nearly half of the decline is registered in the years before the crisis.

Deutsche Bank’s report outlines another important aspect of Europe’s reindustrialization. German companies that in 2012 maintained production capacity of their own abroad, continue at 82% of their production within the EU (61% in Germany and 21% in other countries). This implies that a significant increase in the industrial sector’s share of the European economy through re-shoring production capacity from non-EU countries is virtually impossible.

The European Commission remains ignorant of one more controversy – the combination of “green policies” and striving for quick reindustrialization. Environmentally friendly policies have an irrefutably negative effect on energy prices which generate competitiveness issues for many industrial sectors at least in the medium term. It should be noted that industrial powerhouses, such as China and the US, are far less enthusiastic in their pursuit of a “greener” future. Such policies risk not only driving manufacturing away from the continent, but also limiting potential profits, and thus discourage future investment.

The past and the future of manufacturing

The economic recovery (and future sustainability) of the European economy does not depend on the expansion of the industrial sector, despite the growing popularity of this notion among policy makers and the public alike. One of the main reasons for that perception is that Germany is one of the countries which seem to have gone through the economic crisis relatively unharmed. Despite that – even in Germany – the share of manufacturing as part of GDP has declined – from 26.5% in 1995 to 21.3% in 2012. What is more important is that Germany is the only European country in which value added by the industry in 2012 was higher than it was in 2000. All other countries registered declines. It is curious to note that both the EU commission and Deutsche bank seem reluctant to point out the significance of the currency union in this process – an artificial rise in the standard of living (coupled with a drop in labour productivity) in many of the periphery countries after their adoption of the Euro.

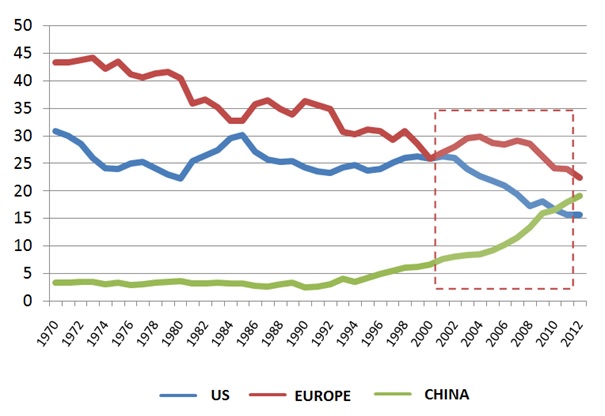

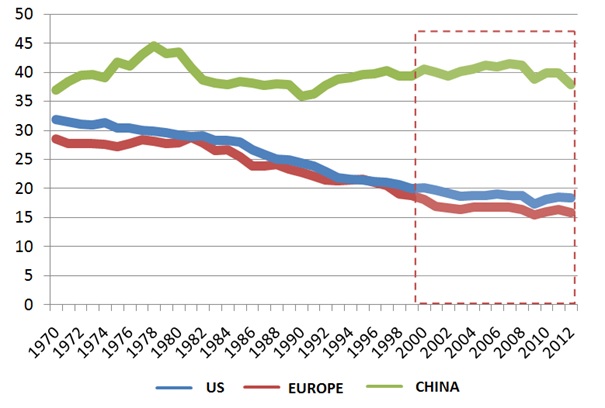

The Commission’s ideas for “reindustrialization” were presented and supported with figures and data. We present here two of the figures it used, but we’ve modified them to include longer periods of time. The reason is that willingly or not, the time frame used by the Commission only includes the period after 2000 (marked by the red square on each of the charts).

Figure 1: Share of global industrial output (%)

Source: UN

Figure 2: Manufacturing as % of GDP (%)

Source: UN

This does not imply that all efforts to attract investment in industrial sectors should be abandoned. It also doesn’t imply that EU manufacturing cannot be profitable in years to come – to the contrary. The question is whether it is the job of policy makers in Brussels and elsewhere to try and reverse a natural economic transition that has taken part for the better part of 4 decades.

In other words – the danger lies in committing valuable state resources to achieving targets that are arguably unachievable. Also, with major policy positions such as this there is always the risk that decision makers might ignore realities on the ground. Because when an investor starts a manufacturing business with the aim of generating profits, he does so at his own risk and with his own money. When the government builds a factory, it usually does so with the goal of securing political dividends at the tax-payer’s expense.

No comments

Be the first one to leave a comment.