On July 3, the Institute for Мarket Еconomics (IME) presented its analysis on the condition of “Bulgarian Posts” in the context of liberalization of postal services in the EU and Bulgaria. The round table took place at the “Sofia” hall of Grand Hotel “Sofia”. Amongst the participants there were representatives of:

The Ministry of Economy, Energy and Tourism (MEET); Ministry of Transport, Information Technologies and Communications (MTITC); “Bulgarian Posts”; the Communications Regulation Commission (CRC) and syndicates.

- The complete analysis of IME is available here.

- IME’s presentation made at the round table is available here.

Summary of the analysis

From January 1, 2011 the postal sector in Bulgaria is completely liberalized.

- In the period between 2006 and 2011 “Bulgarian Posts” PLC provided around 96% of the services that fell within the scope of the universal postal service (UPS).

- Most of the private postal operators chose to provide non-universal postal services (NPS), thus increasing their market share faster.

- With the penetration of electronic services in Bulgaria the market share of the national operator shrank, paralleled by a decline of its UPS revenues.

- The obligation of Bulgarian Post to ensure the provision of UPS throughout the entire territory of the country hindered the optimization of the company’s structure and activities.

„Bulgarian Posts”

„Bulgarian Posts” is the universal postal service provider on the territory of Bulgaria.

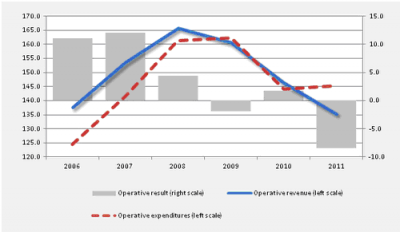

The company managed to remain profitable during four of the last six years. Between 2006 and 2008 the company increased its revenues by more than 20% – from 137 million lv. to 165.7 million lv, mainly due to favorable macroeconomic conditions, combined with its legally protected monopoly in the so-called reserved services and a relatively broad coverage of the UPS. Nevertheless, the market share of the company shrank significantly.

Market share of “Bulgarian Posts” as a % of total postal sector revenues (2004-2010)

Source: Annual reports of CRС – Analysis of the market of communication services

In a free postal market environment “Bulgarian posts” PLC continues to be the company retaining the biggest, although shrinking, market share in the sector of the postal services.

At the same time, during 2011 operational revenues fell for a third year in a row, reaching their levels from 2006.

Total expenses, in turn, are about 20 million lv. higher in 2011 in comparison to 6 years earlier, mainly due to a significant increase in the payroll during the years preceeding 2010. This rise was observed despite the gradual downsizing of the company’s staff. During the first year after the liberalization of postal services (2011) “Bulgarian posts” PLC reported a net loss of 9.2 million lv.

Financial Result from the Operational Activities of “Bulgarian Posts” (2006-2011), million lv.

Source: Financial statements of Bulgarian Posts, 2006-2011

Main Findings of the Analysis regarding the Development of “Bulgaria Posts”

- The restructuring of the postal network is sluggish and ineffective.

- The gradual lay-off of employees and the negotiated program for voluntary departure of employees, started in 2012 show that the need for staff optimization and restructuring of the company is well realized by both the company’s management and its labour unions.

- The current collective labor contract (CLC), however, contains a number of prescriptions, which make it difficult for the management to reduce the number or the working hours of its employees.

- Further optimization of expenses should be focused on the number of postal stations and a change in the way its services are being provided, making the company more effective.

- The sell-off of non-operational assets, that further strain the budget of the company, should continue.

- The deterioration of the financial results of the company has its own direct effect on the bond liabilities of the company. In order to evade losses, arising from the failure to comply with signed agreements, more realistic projections should be set. These projections should take into account the company’s falling revenues from the UPS, rising competition and shrinking market share.

- A potential privatisation of a stake at Bulgarian Posts may help attract new capital and reform capacity.

Universal postal service (UPS)

In recent years the debate on the exact scope of the standard UPS has been revived. There are a number of possibilities in regard to alternative solutions:

- Decreasing the minimum required time for delivery or the number of days in which the universal service is guaranteed;

- Taking certain products out of the scope of the service;

- Lowering the requirements for minimum geographical coverage, i.e. the number of postal stations in relation to territory.

Finding the balance between guaranteeing a certain number of services and the company’s profitability will become more and more difficult in the years to come, because of diminishing demand for the UPS services due to the emergence of viable alternatives, as well as increasing competition in the sector.

For questions: Mr. Yavor Alexiev, economist, 02/952 62 66, 952 35 03,

UPS includes one collection and one delivery to every address in the EU 5 days in a week and is provided by specifically assigned operators. The scope of UPS consists of services such as corresponding parcels weighing up to 2kg, parcels up to 10kg and other packages, in a way that guarantees affordable prices and equal quality to all customers. The rest of the postal services are included in the non-universal postal services (NPS). NPS’ prices and services are determined by the market in correspondence to customer demand, competition, speed and quality of the service.

No comments

Be the first one to leave a comment.