France makes promises and Commission is happy. Will Spain get gifts during the weekend? Be careful about your language, there is always somebody listening. Is euro a dogma? Will it rain dollars or are we facing a dry summer? Silvio is joking again.

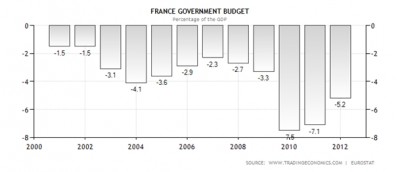

In a detailed analysis of French public finances, the European Commission expressed concern if the country will be able to fulfill the deficit target 3% of GDP in the year 2013 and it warned against the „significant imbalance“ in economy, decrease of competitiveness and exports. French Minister of Finance Pierre Moscovici didn’t hesitate for a moment and he assured the Commission on Monday that France will fulfill consolidation objectives and will balance its budget until the year 2017. By the way, that didn’t happen even once in the last 34 years. However, the Socialists plan to achieve this during the biggest financial crisis since the World War II, despite French banks having majority of money in problematic peripheral PIIGS countries. The three biggest banks‘ assets amount to 240% of French GDP, and all the French banks are around four times bigger than the French GDP. When they will have to be saved (the question is not if, but when), it won’t take only a couple percent of GDP.

It is clear why this analysis of France looks so bad, it is based on the plans of the „bad“ former right-wing government. But be careful, this country will not only reach planned deficit, but according to Moscovici, it will also reach it without introducing any austerity measures“!

The way it will be done was reflected by the first step of the recently elected socialist President Francois Hollande. Last week he announced that he would cancel his predecessor’s pension reform and lower the retirement age from 62 to 60 years. It will cost billions of euros annually, but according to the government, France can afford it thanks to the adequate increase in social contributions. Everything is inside out.

The way it will be done was reflected by the first step of the recently elected socialist President Francois Hollande. Last week he announced that he would cancel his predecessor’s pension reform and lower the retirement age from 62 to 60 years. It will cost billions of euros annually, but according to the government, France can afford it thanks to the adequate increase in social contributions. Everything is inside out.

Ministers of Finance from the G7 countries and their central bankers met. Nothing specific came out of this meeting. Apart from the conclusion that they will be cooperating in order to solve the euro crisis. Which was clear already from the fact that they met.

We live in a world full of uncertainties. „Spanish government is not interested and does not want to use aid packages from the EU or from the other institutions“ said Spanish Prime Minister two weeks ago. This week he they already ask for spare change. „The amount needed by Spain’s banking system isn’t very high, nor excessive. What matters is the procedure to provide such an amount – and that’s why it is important that European institutions open up and proceed with this. That’s why it is important that European institutions open up and proceed with this…and support banking union, said Minister of Finance Cristobal Montoro in an interview for the Spanish radio. What that premium says is that markets are not open to Spain. Last Thursday Spain managed to sell 3 and 5-year-old bonds of EUR 2 billion value. At high price – interest rates over 6%.

Despite denying this option until the very last moment, Spanish government asked eurozone for help and will receive around 100 billion to recapitalize its banking system. Whether the money will come from EFSF or ESM is unknown so far.

After S&P also Fitch lowered the rating of Spain (to BBB with negative outlook). There is only downgrade from Moody’s left and ECB will apply 5% discount on bonds’ value when accepting them as a collateral, which will further make refinancing operations more expensive for Spain. Agency Moody’s lowered the ratings of Austrian and German banks because of increasing risk a further deepening of the crisis and slowdown of the economy poses on their assets.

But bad news should be spread carefully and especially quietly. According to the Slovak Minister of Finance Peter Kazimir, spreading bad  news negatively influences Slovak retail sales.

news negatively influences Slovak retail sales.

Cyprus has admitted that there is a possibility it will need EU bailout due to the impact of the Greek problems. EU agreed that individual member states can „in urgent cases of threats to internal security“ close their borders (and control passports) for up to 30 days. An arrest warrant was issued for spokesman of the neonazi party Golden Dawn Ilias Kasidiaris, who in TV poured water on the MP Rene Dourou from Syriza and then punched Communist MP Lian Kanelli in the face. Your „Tax Euros At Work“.

„We made mistakes“ says one of the eurozone’s fathers, Niels Thygesen, former member of the Delors Commission, that came up with the idea of creating European monetary union in the year 1988. „We probably overestimated positive effects of single currency market on economies. In this idea there was obvious naivety.“ „Politicians depend on this fantastic project (euro), let it be as it is, as if it was dogma. And this will bring Europe immense worries.“ says well-known financier Felix Zulauf. „Euro is not an integration project, on the contrary, it divides Europe.“

Change of the Lisbon treaty, which enables setting up a permanent form of bailout – European Stabilization Mechanism (ESM) – was passed in the Czech parliament. But the attention of the Czech public opinion was drawn to totally different parliamentary theatre.

http://www.youtube.com/watch?v=ODeZ2TH-rcA

So, you speculators (since the council of the central bank wisemen is the most  important factor in determining prices of assets, we are all speculators), are you stressed? Will there be QE3 or not? The next meeting of the American central bank (FED) is coming up. It will take place a couple of days after the apparently historic Greek elections. There is deterioration of the economic indicators in the US with the major disappointment focusing at the actual numbers of the labour market, which creates space for a further monetary intervention. Speculations about QE3 are reaching their peak and interpreters of words, gestures and mimicry of the council of the wiser (central bankers) have a lot of work. A lot of money is at the stake. Morgan Stanley gives QE3 56% probability (yes, I am also laughing at the 6% detail). It remains to be seen how it will work out. Yields on 10-year-old American bonds are already today, without QE3, thanks to the European horror, at the lowest level since the year 1942 (under 1.5%).

important factor in determining prices of assets, we are all speculators), are you stressed? Will there be QE3 or not? The next meeting of the American central bank (FED) is coming up. It will take place a couple of days after the apparently historic Greek elections. There is deterioration of the economic indicators in the US with the major disappointment focusing at the actual numbers of the labour market, which creates space for a further monetary intervention. Speculations about QE3 are reaching their peak and interpreters of words, gestures and mimicry of the council of the wiser (central bankers) have a lot of work. A lot of money is at the stake. Morgan Stanley gives QE3 56% probability (yes, I am also laughing at the 6% detail). It remains to be seen how it will work out. Yields on 10-year-old American bonds are already today, without QE3, thanks to the European horror, at the lowest level since the year 1942 (under 1.5%).

ECB didn’t lower the interest rates at the last meeting. Even though the President of IMF Christina Lagarde asked for it. „Growth can be spurred by monetary policy, such as the LTRO. It is also evident that there is room for another interest rate cut,” she said before the council’s meeting. „ I don’t think it would be right for monetary policy to fill other institutions’ lack of action.” said the president of ECB Mario Draghi at the press conference. Apart from that he warned that in order to recapitalize banks directly through ESM, the Lisbon Treaty would have to be changed.

Silvio Berlusconi, 76-year-old man with a face of 50-year-old actor, libido of a thirty-year-old man and behavior of a teenager, contributed with his suggestion to discussion how to solve the eurocrisis. Bon vivant, king of sexual jokes, refreshment of dull European political stage and replaced (is it possible that it was for this?) Italian ex-Prime Minister spoke from the political exile. He has a plan how to save Europe and above all Italy. It is devilishly simple: „Let’s print euros on our own!“ If Germany isn’t fine with it, it can leave the eurozone! After all, Italians are used to three-digit price of ice-cream.

http://www.youtube.com/watch?v=O5B3r7Py2h4

It seems that there won’t be European rating agency. Unlike the weekend. which will be coming.

Enjoy it!

Juraj Karpiš

No comments

Be the first one to leave a comment.