Mateusz Morawiecki, during the recent press conference “Stable public finances in unstable times”, bragged that under the rule of PiS’ government “the [public] debt in relation to GDP will fall” and it will be the case “despite gigantic expenses during the pandemic, despite huge expenses on the anti-inflation shield.” He stressed that “there are no catches here, there are no special operations.”

However, it should be remembered that although debt in relation to gross domestic product is actually falling, it is due to double-digit inflation. When calculating the ratio of public debt to GDP, nominal GDP is taken into account, which in conditions of high inflation may grow even when in real terms we are becoming poorer.

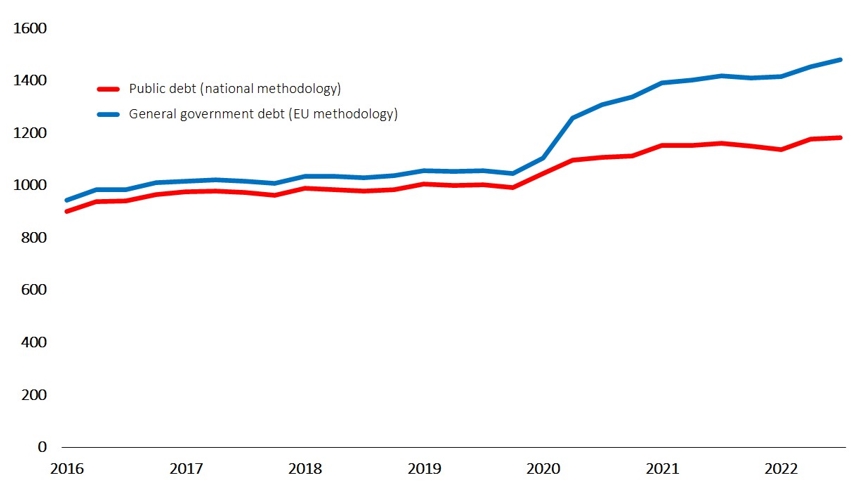

To begin with, let us remind that when it comes to “huge expenses during the pandemic” and “huge expenses on the anti-inflation shield“, this funds originated in debt. As a result, Polish public debt calculated in line with the EU methodology, from the beginning of 2020 to the end of the third quarter of 2022 increased by as much as 433.3 billion zł (41%), that is by over 11,000 zł per person (Chart 1).

Chart 1. Polish public debt according to national and EU methodology

In 2020 alone, the public debt in relation to GDP also increased sharply – from 45.7% to 57.2%. It started to decline only in the following years. However, it is worth to recall here that the ratio of public debt to GDP is calculated on the basis of the nominal amount of public debt and, what is extremely important, nominal GDP. In conditions of fast-growing prices, the economy can grow nominally even when in real terms – that is after cleaning GDP from the impact of inflation – it shrinks.

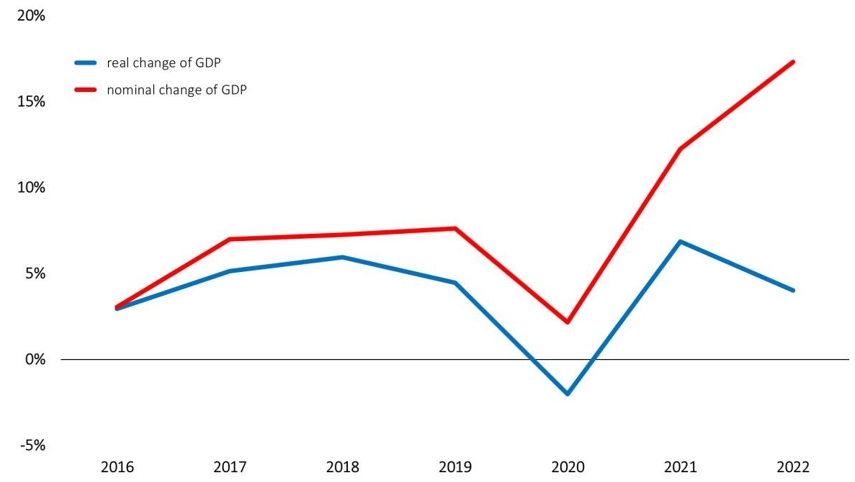

In 2021, the average annual inflation in Poland amounted to 5.1%, and in 2022 it reached the level of 14.4%. As a result, while real growth slowed abruptly last year, nominal growth accelerated, with the difference between nominal and real GDP change exceeding 13 percentage points (Chart 2). Also, during this year, according to forecasts, we will have to deal with a huge difference between real and nominal growth. The European Commission predicts that in real terms, growth will slow down to 0.7%, while in nominal terms it will be double-digit – 11%.

Chart 2. Nominal and real change in Polish GDP

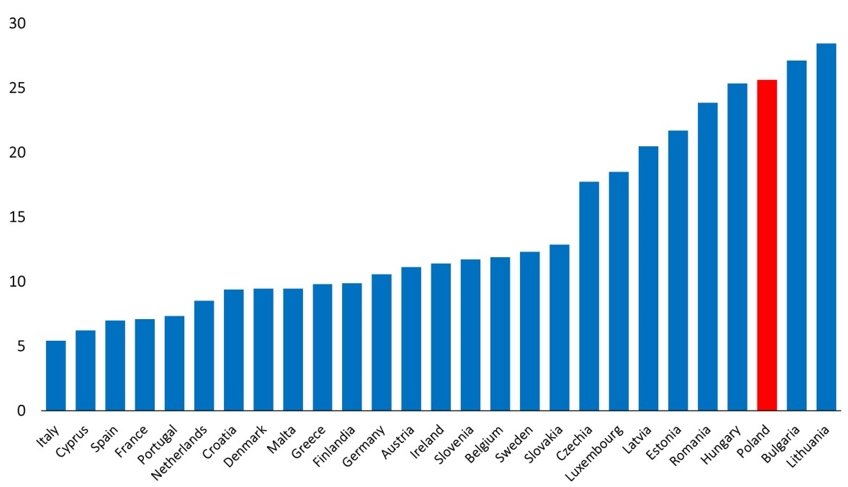

It should be noted that in Poland the difference between the nominal and real change in GDP is very high compared to the European Union. In real terms, the Polish economy has grown by 8.9% since 2019, while nominal growth has reached 34.5%. Thus, the difference amounted to as much as 25.6 percentage points. Only in two EU countries – Lithuania and Bulgaria – this difference was higher in the analyzed period (Chart 3).

Chart 3. Difference between nominal and real cumulative change in GDP in 2019-2022

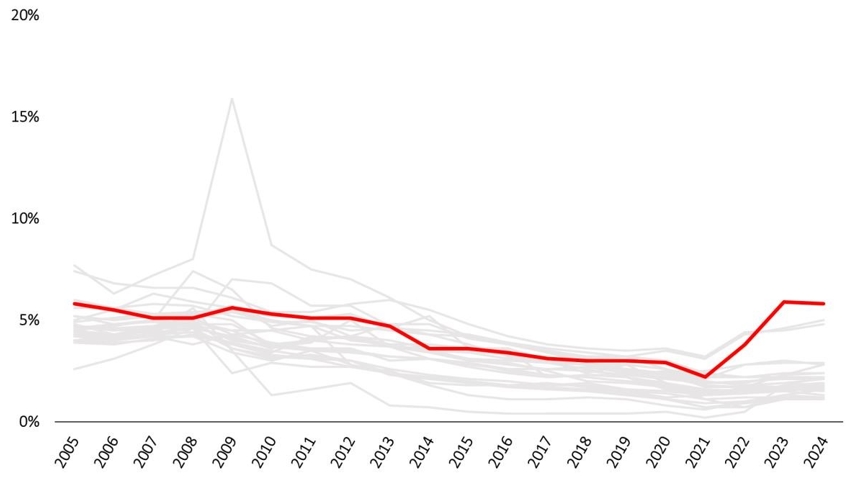

The public debt-to-GDP ratio is a useful measure when, in times of low inflation, one wants to compare the debt of countries taking into account the size of their economies. However, it should not be presented in isolation from other economic indicators, including, for example, government bond yields. Currently, the five-year yield on Polish treasury bonds is around 6%, and in the last six months it even approached 9%.

Due to the enduring deficit of the public finance sector and the need to roll over the bonds maturing this year (issuing new debt to pay off the old one), the Polish state, as estimated by the economists of the Crédit Agricole bank, will have to incur liabilities worth 422 billion zł this year (12.5% of GDP) . This debt will be significantly more expensive than the debt issued in 2021. As a result, according to the European Commission’s forecast, in 2023 and 2024 Poland will pay the highest interest on public debt among all EU countries – 5.9% and 5.8%, respectively (Chart 4).

Chart 4. Public debt servicing costs as % of public debt in the previous year. Poland compared to other EU countries.

The decrease in public debt in relation to GDP resulting from a real growth with low inflation is a positive phenomenon and proves the strength of the economy and public finances. Currently, however, “growing out of debt” in Poland is taking place thanks to inflation-driven nominal growth. The costs of this are borne by households, in which savings are rapidly losing their purchasing power.

Inflationary “debt outgrowing” proves not to the strength of the economy, which is currently slowing down sharply, but its weakness.

Written by Marcin Zieliński & Bartłomiej Jabrzyk