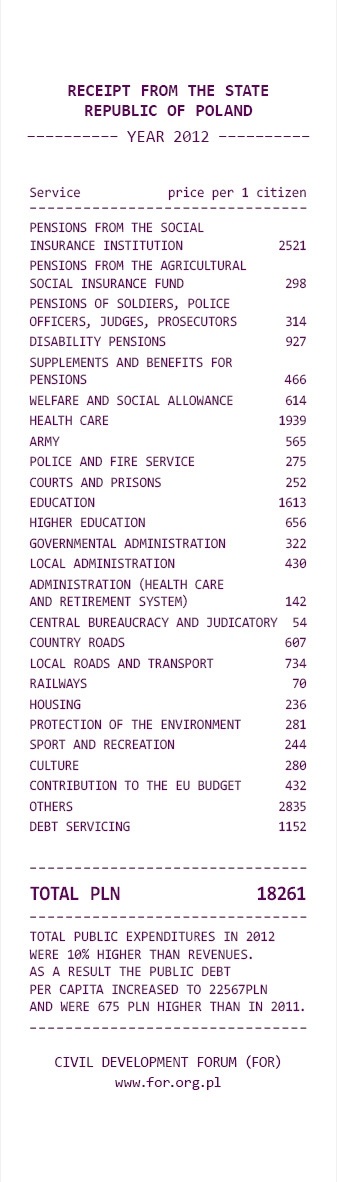

The end of April is the time of the income tax settlement in Poland. The Civil Development Forum took it as a good opportunity to show Poles how much money the Polish state spends and what it is spent on. It is definitely not a small amount; in 2012 alone the expenditure of the state oscillated around 680 billion PLN, and speaking more lucidly, 18,261 PLN per person. The second issue of the Receipt from the state, prepared by the Civil Development Forum, shows how this amount was spent.

It is always important to keep in mind that public expenditure comprises not only governmental expenses, but also those of local authorities, self-governments, National Healthcare Found (NFZ), public retirement funds and other public institutions.

By the end of April, some public institutions still had not published their detailed financial reports for the year 2012 and, therefore, our calculations should be treated as approximate. They are designed to present the scale of particular expenditure per capita. The idea of the Receipt from the state was invented in Slovakia, where it is the flagship project of the INESS think-tank. (In Poland similar calculations are carried out also by the Globalization Institute).

According to initial calculations, the Receipt in 2012 was 436 PLN (2.5%) higher than in the year 2011. However, taking into consideration the high inflation rate (3.7%), it can be stated that the Receipt diminished. What is more, if we take into account the economic growth (4.3%), we will see that the real level of public spending went down from 43.6% to 42.8% of the GDP. Such developments should be welcomed, because excessive public spending is harmful to the economy. Despite the decline, we cannot forget that the level of 42.8% of the GDP is still quite high, given the level of Poland’s development.

Despite the common belief, the highest spending is not connected with the administration, but with the retirement system. In the year 2011, every Polish citizen spent on average 3,111 PLN on pensions, including 2,521 PLN on the Social Insurance Institution (general system), 298 PLN on the Agricultural Social Insurance Fund, and 314 PLN on the pensions of judges, prosecutors, policemen and soldiers. A further 1,393 PLN was spent on various supplements, benefits and early retirement. The spending on pensions and early pensions constituted one fourth of the whole public expenditure in 2012. The negative impact of this part of expenditure could be alleviated by important reforms such as the raising of the retirement age. In addition, the system of disability pensions remains unadjusted to the general retirement system, creating incentives to seek disability pension rather than old-age pension.

The spending on the health care in 2012 reached the total amount of 1,939 PLN per person. It is, however, disputable whether Poles will receive good quality for such an amount. 607 PLN was invested in highways and expressways, and local authorities spent a further 734 PLN on the local transport and roads. In this group of spending, the decline in comparison with the year 2012 was very noticeable (129 PLN less per person and 5 billion PLN in total).

The public administration is responsible for only 5% of the national spending. It seems that it is the efficiency and the work ethic that should be improved, rather than the general cost. If every second a civil servant were made redundant, it would lead only to a 2.5% decrease in the total expenditure. Therefore, we should not trust politicians who propose to reduce public administration in lieu of other reforms, because the potential benefit from such an action would be too small to resolve the most important problems of the Polish public finances.

There are other, less significant, positions on our receipt: social benefits (614 PLN), environment protection (281 PLN), sport and recreation (244PLN), culture (280 PLN) and housing (236 PLN). The Common Agricultural Policy of the European Union is also very costly and it seems to be counterproductive – it does not create any incentives for the development and restructuring of the agriculture. Polish contribution to the EU budget amounts to 432 PLN per person. Poland spends money also in numerous different fields (such as trade, modern technologies, science, tourism). The total of those “small” expenses is quite significant – 2,835 PLN.

Poland spends annually 1,152 PLN on the public debt servicing – more than on roads or higher education (656 PLN). Governmental expenditure still exceeds the income, leading to an increase in the public debt by 675 PLN per capita, to the total of 22,567 PLN (Polish methodology). According to the methodology used by the EU Commission (ESA95), the increase of the debt was even higher and reached 23,810 PLN per person.

Public spending is financed from our taxes. Therefore, we have to be aware of the requests for tax cuts, or the increase in spending (health care, highways, education etc.) has to be connected with indication of the financial sources necessary to cover it. We have to take into consideration whether we will cover it with a debt or by cutting other expenses.

Prepared by:

Aleksander Łaszek, Dominika Pawłowska,