Is Germany pro-growth? Spaniards learned the trick. Many meetings in Cyprus. Irish celebration.

Good news! We have new rules for the rules on the rules! The European Parliament approved another set amending the existing rules, this time under the name Two-Pack. It follows the Six-Pack, which is in turn an extension of the Stability and Growth Pact. Two-Pack comes up with two novelties. One of them is an obligation to present the national budget for inspection to the Commission which will assess whether it likes it or not. The European Parliament amended the Commission proposal by including the “growth” measures. In other words, it will be even easier than before to get an exception.

Take Portugal for example. Originally, Portugal was supposed to reach the deficit of 3% this year but has been granted a deferral until 2014. The end of this year is still a long way off and guess what? Portugal is already requesting further extension to 2015. It’s been almost approved although Germans keep muttering something about them not being able to imagine such a thing. On the other hand, they can imagine their own budget balanced by 2015 – more and more clearly every day. In 2014, they will cut the federal budget by 5 billion euros, reducing the whole budget not only in relative terms (to GDP), but also in absolute terms. Although most of Europe accuses Germany of not being “pro-growth”, it is one of the last EU countries which still somehow keeps growing and maintains its unemployment stable.

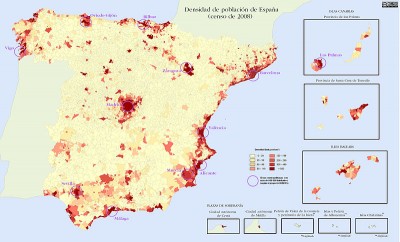

Some others are not as lucky. Spain’s unemployed has reached 5 million for the first time in history. El Pais newspaper accused the government of reaching the “great” last year’s deficit of 6.7% of GDP thanks to a magic trick, when they moved all the tax refunds from December to January. The refunds mysteriously jumped by 82% in January. Without the refunds trickery, the deficit would be 7.2% of GDP.

The French have already officially waived their promises about the deficit. This year barely started, however, they have already revised the 3% deficit target for 2013 up to 3.7%. In addition, it became clear that they will pay nearly € 10 billion to the Commission in various penalties within the next three years.

The new Italian Government, if there soon will be any at all, won’t have an easy job. To make it very clear to everybody, Fitch lowered Italian rating down one notch to BBB +. Italian bond prices are almost the same as the Spanish ones, although both countries are far from the lows of last summer.

Greek merchants are fighting with the crisis as best they can. Pharmacists are facing huge payables for drugs to the state so they started a whole new kind of business. They sell the drugs to dealers who then sell them abroad at higher prices, exacerbating the shortage in Greece.

[Note: Original Fiat Euro article was published on Thursday, 14th of March 2013, before the subsequent spotlight news.] Cyprus is an endless topic. It is clear that it will receive aid, but the Troika has been arguing about it for more than half a year. Most recent rumours say that they will agree on Friday. There is a general opinion that Cyprus should contribute its own bit by raising taxes on corporate income, introducing new taxes, more privatization, or mild milking of Russian oligarchs’ accounts. Cyprus likes none of these but is willing to negotiate a deal. On the top of that, they also put the blame on the Greeks – they say that Greeks are the ones responsible for the crisis in Cyprus, so they should take the courtesy and send at least two billion euros of the aid they received.

The Irish can celebrate. Last week, for the first time since the beginning of the crisis, they sold 10-year bonds on the market. The demand was high, and the resulting 4.15% interest favourable. The country lacks only 1.5 billion euros to have funding secured until the end of 2014 – provided that they will also receive all our money from all the rescue programs. But it will take a while until one “I” will be taken out of the PIIGS acronym. The banking system is far from healed. The Minister of Finance, Noonan, is trying to ease the strict rules of repossessions for the banks, or, allegedly, there is a real threat of collapse of the mortgage market .

As the Irish are going out of the dirt slowly, their neighbour and partial savior, Britain, is falling into it. UK banks have around £30 billion of hidden losses. Another bailout would be a huge load for Britain’s budget, which currently runs Greek-style deficits.

Let’s return to the Continent. European Court of Auditors is an institution that much of the rest of euro-bureaucracy is not too keen about. In its reports, the Court regularly publishes unflattering results of inefficiency and lack of transparency in Brussels policies. Last time it figured out that the expenditures of the European Social Fund to support employment of the elderly have immeasurable effects. Most Member States drawing resources from this Fund did not even bother to introduce any measurable criteria.

This time it was the ECB chief, Mario Draghi, who delivered funny news to Fiat Euro. A journalist asked him at a press conference if he could explain how the OMT program, a program of bond purchases of troubled countries, will work. This is currently the largest calibre weapon to fight the euro-crisis and potentially can be used to buy hundreds of billions of debt, but no one knows how it actually works. Draghi first looked surprised: “I am not sure I understand your question.” But immediately he understood that the journalist was interested in specific rules on paper, not snippets of information from press conferences. “If you are referring to the legal documentation, that is a different matter. We are still working on it. ”

Advice of the week – if you invent a multi-billion dollar plan to save the world, try to outline all the rules on paper now, rather than a year after …

(Translated by Jakub Pivoluska)