Some respected economists identified the issue of consolidation in Slovakpublic budget already in 2022 as a third-order problem. From an analytical point of view, he is, of course, right. A one-year deficit of 10% of GDP is nothing compared to a permanent two to five per cent deficit in the pension system with a declining workforce. Not lifting the cap that fixes the retirement age in Slovakia may mean the collapse of the public finances as a whole, while a one-year deficit can be corrected by the first responsible government.

But this view ignores the political reality of Slovakia. The recently approved Stability Programme describes the past ten years very accurately:

“Debt consolidation in the previous decade was not sufficient. Since the peak in 2013, debt has only been reduced by about a quarter of the post-crisis increase by 2019.This is mainly because a surplus economy has not been achieved even with solid economic growth.”

However, the ministry officials did not add important sentence. Debt has not fallen despite tax-and-tax revenues rising from a pre-crisis 29% to an average of 34%of GDP in recent years. In short, even a substantial increase in tax revenues has failed to keep pace with spending.

Most economists reduce the story to the need to impose so-called spending caps. One cannot disagree with these limits, but we must not succumb to the recurring fallacy. It is not enough to transpose the existing rules on spending limits from another country to Slovakia.

It would also be necessary to transfer the political culture, and everywhere in the world, it turns out that the Scandinavian one in particular somehow only works in countres where it is always cold and people trust contracts more than they trust their relatives.

In 2019, the Slovak parliament approved a budget for 2020 with uncovered expenditure of more than one billion euros. The following year, the new parliament, already facing a record deficit, approved several new social benefits that none of the experts had proposed. Pregnancy benefits, an increase in the Christmas pension allowance or the constitutionally guaranteed introduction of a parental bonus.

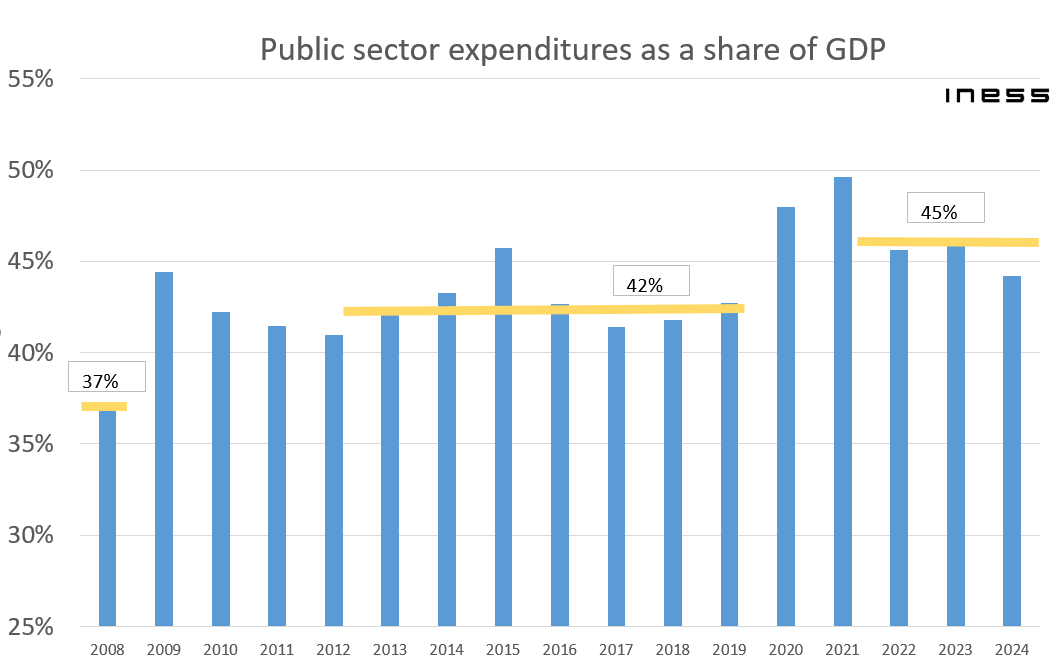

In Slovakia, we are extremely close to populism in spending. On the contrary, what ‘we’ are not good at is getting spending back on track. While in 2008, state spending was still at 37% of GDP, the crisis shot it up and it has never gone back down. But of course, we got a bunch of promises about how spending would be ‘normalised’.

In 2015, the government projected 2017 spending at 34.9% of GDP; the reality was 41.4%. In 2017, the government projected 2019 spending at 37.6%; the reality was 42.7%. Consolidation of spending (reducing it relative to GDP from pre-crisis levels) never occurred. Meanwhile, spending increases did not mean investment in the future, but mainly inefficient consumption.

It must now be clear to everyone why the current high deficit is a problem. It is not about its effect on the debt in the long term, but about the fact that it is increasing the overall level of spending for which we are not getting an adequate return. Unfortunately, the government, with the support of some economists, has also approved a comfortable budget year without cuts for 2022.

Of course, nobody expects cuts before the election, and at the same time we see that there is a ‘competition’ within the coalition to see whether the parental bonus will be more expensive than the increased child benefit.

High deficits tapped off without any discussion are very likely to take us from 43 to 45% of GDP in expenditure at the end of this term, quite unnecessarily, given that we are supposed to be getting one to two per cent of GDP a year from the Recovery Plan for investment. Such populist spending increases must be annoying even to fans of a strong state.

And how does this relate to debt sustainability? You need to raise taxes to finance high spending. You can do it, for example, by raising the VAT rate from 20 to 30% or the personal income tax to 31% (!). And we are only addressing the current deficit, not debt sustainability. For this we need to generate budget surpluses.

The government cannot generate these by austerity, just look at the implementation report of savings. Only ten per cent of the savings identified by state administration has been tapped, yet these have been calculated with a view ensuring that the ministries under scrutiny do not fall into depression. Temporarily, the state can freeze some spending, but the focus of consolidation will once again be on tax increases.

There is still a lack of wealth in Slovakia that would offer an “easy” tax target. We do not have Nordic gas, oil, wind or sea, but instead hundreds of thousands of long-term unemployed people. However, increasing spending is not directed at tapping this human potential and the growth of the tax burden makes it much more difficult.

The high deficit this year and next year is also a major problem for long-term sustainability and should, therefore, be an important part of the discussions. It does not matter whether you raise taxes at 30% or 40% for the sake of sustainability.

At higher burdens, additional taxes are ‘harder’ to collect and the negative effects of high taxes on economic growth are more pronounced. Moreover, in a situation where we know that we will not get higher quality public spending for a higher price, but more influence of politicians on our lives and fewer resources for our own needs.