Automotive industry plays one of the most important roles in economies of the Visegrad Group countries. The sector became the regional leader in export and a reason for close ties among countries. Hyundai Kia in the Czech Republic and Slovakia is a textbook example of how one company ignores artificial national borders. Thanks to automotive industry, all V4 countries profit from a business relationship with Germany, the productive hegemon in the EU. Hundreds of thousands of usually above-average paid employees are only one of the significant benefits for the economies. Let’s mention also transfer of know-how, improvements in business culture, modern technologies, among others.

Nevertheless, the notable presence of the automotive industry did not come for free. Governments heavily subsidized them. We could talk about the stimuli competition (some even use the term “stimuli bribe”), in which the investors were choosing from the subsidy packages offered by V4 governments. For example, Slovakia paid over EUR 400 mln in direct state aid to attract KIA and PSA (Peugeot Citroen). We can easily compare it to the annual EUR 2.7 bln revenue from corporate income tax.

Nevertheless, the notable presence of the automotive industry did not come for free. Governments heavily subsidized them. We could talk about the stimuli competition (some even use the term “stimuli bribe”), in which the investors were choosing from the subsidy packages offered by V4 governments. For example, Slovakia paid over EUR 400 mln in direct state aid to attract KIA and PSA (Peugeot Citroen). We can easily compare it to the annual EUR 2.7 bln revenue from corporate income tax.

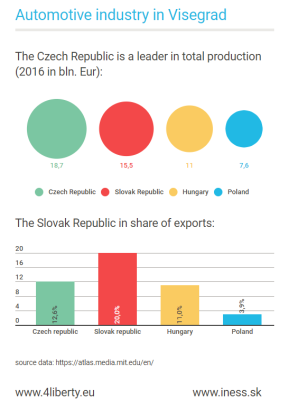

Large projects are especially attractive, as they have a high priority on PR lists of every government. The small country gave a seat to three large producers, and Slovakia finally took the lead at least in one global ranking (production of cars per capita).

But that’s not the end of the automotive story in Slovakia. Jaguar Land Rover was cruising around the region and searching for a location with cheap, but qualified labor. The Slovak government could not resist and won the bidding competition. But wait, there is an EU limit set for maximum state aid ratio of 9% of the investment, so you may ask, how there can be any competition for investors among these neighbors? The definition of investment covers buildings and technologies. The Slovak government included in its package also the construction of a whole business park, road connections, and land purchase. Based on publicly available contracts, the total bill will exceed EUR 0.5 bln (total JLR investment is app. EUR 1.4 bln). Slovakia will take the regional lead not only in the share of automotive export but also in total value exported. But is it worth it?

Source data on exports: https://atlas.media.mit.edu/en/