Ukrainian SMEs Want Deregulation and Friendlier Tax Authorities

BY

Iryna Fedets AND The Institute for Economic Research and Policy Consulting - Kyiv / October 16, 2016

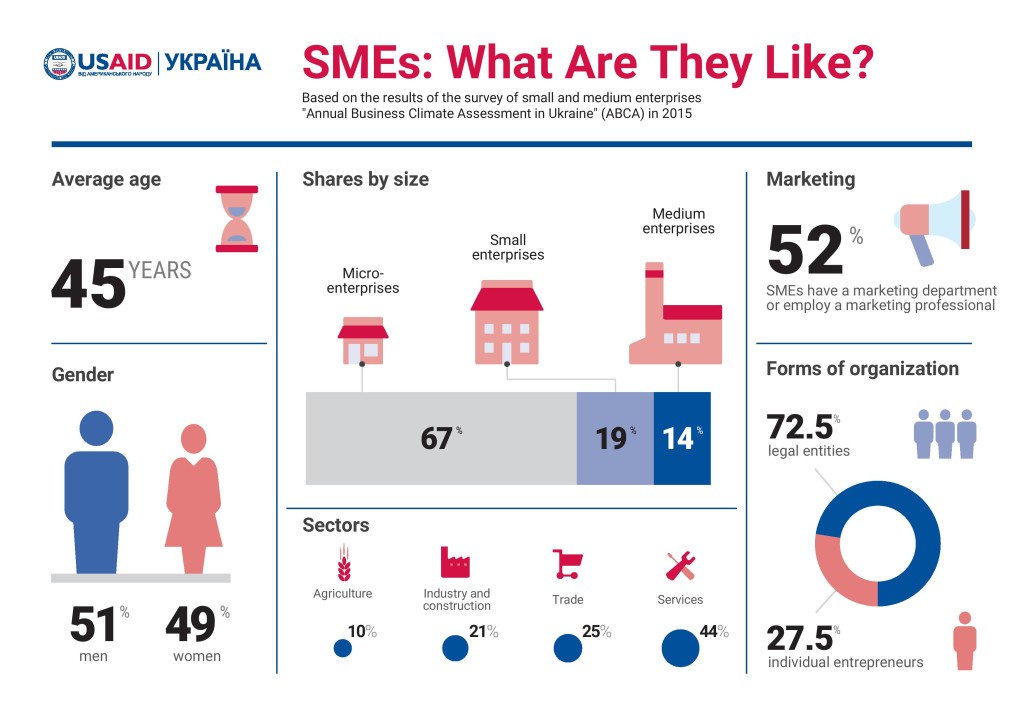

In late 2015 – early 2016, when the ABCA survey was conducted, Ukrainian small and medium businesses mostly assessed business climate in the country as neutral or negative. Only 6% of the polled SMEs believed that business climate was favorable.