What we have is that most of the taxpayers in Georgia do not know that they pay taxes.

- Value-added tax is hidden in the price of the goods or services we buy. For example, if we consume electricity, the value-added tax is a little more than 15% of the price. It can be said that VAT is paid by the final consumer, but technically it is transferred by the business to the state budget through the accounts of the State Treasury.

- Excise tax is also hidden in the price and is a higher cost than VAT for the corresponding goods. For example, the excise tax is more than half of the price of cigarettes. It is also included in the price of alcohol and petroleum products.

- Income tax – 20% of the salary – is paid (withheld and transferred to the State Treasury, Budget) by the employer, and in most cases, the hired workers do not know if or how much they are paying. So are mandatory pension contributions, which are actually state taxes as well.

- Profit tax (15%) is paid by the businesses, although it is also included in the final price of the goods sold.

- The business property tax is also paid by the business, although it is ultimately reflected in the price of the goods sold, it is only a cost to the consumer.

- Any customs duties and taxes are also included in the price of the goods and are paid by the customer at the time of purchase.

For these taxes (these are the only taxes in Georgia), the business is basically a remittance institution, in the end, everything is borne by the consumer.

Accordingly, state taxes are included in the price of any goods and services. In some cases, like cigarettes, the taxes total more than half the price of the item, although in others it is closer to 20%. On average, in Georgia, the sum of taxes in the price, that is, the tax burden, is about 30%.

Why Is This Important?

The tax burden directly determines how many resources remain in the hands of businesses and how much goes to the state budget. However, it also has some influence on the price level. The size of the tax burden affects the speed of economic development – the more money a business has in possession, the more development and expansion opportunities it has, the more materials it buys, the more money it invests in the purchase of new equipment and devices; it tries to raise wages and hire new people. On the other hand, in this case, the government will have less money for its activities.

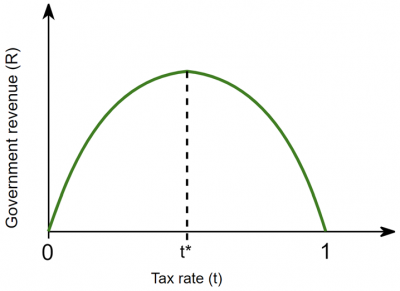

And vice versa – the less money a business has, the less it can develop and expand, although in the short term, the government may have more money. In fact, high taxes reduce the budget revenues in the long run, because business turnovers (and thus the ability to invest) acquire more resources, pay more wages, employ more new people, and create more products, and therefore are inexorably reduced (See below – the Laffer curve).

Important negative consequences that high taxes can have include tax evasion, concealment of taxable operations and goods, falsification of documents, extra-legal activities, restriction or suspension of business, and transfer of the business to another place. The American economist Arthur Laffer showed this problem with the curve – with the increase in the tax rate, the income also increases until it reaches the optimal value for the government – the maximum income. A further increase in the rate will lead to a decrease in revenues and, eventually, to bankruptcy – if the business decides to stop (it is not worth it anymore) or move to extra-legal space.

Laffer Curve, chart from: Laffer curve – Wikipedia [1]

The impact of punishment should also be included in this logic. The taxpayer tries to avoid the illegal act so as not to be punished. When the tax rate is low, the taxpayer prefers to pay. However, when taxes increase, the taxpayer weighs the risk of penalties and decides whether it is worth paying the tax or hiding it. The higher the tax and the greater the loss from the payer’s labor, the more willing they are to avoid it. Otherwise, if such a person considers breaking the law to be unacceptable, then their motivation to create and earn more and pay more will decrease.

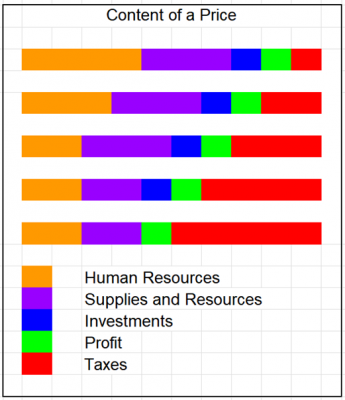

In addition to this, here is a visual I created (first time appeared in my publication with Tax Foundation – Tax Reforms in Georgia 2004-2012[2]). It presents what happens if the tax share of the price of goods increases (assuming that the national/central bank is not printing too much money and inflation is low and stable):

The graph shows that as a result of an increase in tax rates/burden (red), under the condition of a stable price level (buyers do not have extra money), businesses are forced to reduce other components of the price. It may reduce profits to a complete stop but in order to maintain the volume of activity and production, it will first try to reduce human resource costs (yellow), then start economizing consumption of supplies and materials (purple), and finally, in addition, it will refuse to invest (blue), for example, in innovation, technologies, and machines.

All this will eventually lead to a decrease in the volume of production and a slowdown of the economy. Moreover, economic agents will probably stop and will move to the extra-legal space (which will also limit their ability to expand and compete for resources). High taxes reduce the price competitiveness of local goods and services. Fighting foreign goods with customs duties will not bring good results: extra-legal imports will increase, local products will become more expensive with fewer competitors, and partner countries will also impose high taxes on our products.

As mentioned above, the average tax burden in Georgia is about 30%, or on average 30 tetri (₾0.30) of state taxes in the price of 1 GEL of products. This can be good for a developed nation that does not need the same speed of growth as a developing one, like Georgia, needs. Georgian Right-wing liberals prioritize development and growth, which is especially important for a poor country. Those of other ideologies may prefer that the government have more resources to do more things, but as Margaret Thatcher correctly emphasized, “Pennies do not come from heaven. They have to be earned here on earth.”

The issue of the tax burden can only be considered as an issue of economic policy – in addition to growth, it also affects, for example, employment. The higher the wage tax, the more difficult it is to pay, and often businesses resort to illegal employment (for example, the majority of Georgians are illegally employed in the US) or hire fewer people, including young people.

Tax Payment And Politics

The tax burden also affects the democratic process. High burdens often lead to a search for solutions, including lobbying for certain privileges and benefits and corruption to avoid tax payments. In a democracy, a majority of voters may support a tax increase while others are unable and unwilling to pay much, if at all because they are unhappy with the results of the spending. The voters who operate illegally and evade payment mostly prefer to refrain from political activities.

The fact that most taxpayers are unaware of the tax the government pays also has a painful effect on democracy. They are under the illusion that taxes are primarily paid by others, mainly the rich. The rich pay the highest taxes in Georgia, often subsidizing certain public services (such as universal health care) instead of others. However, low-income families also pay a lot, for example, excise tax on cigarettes, alcohol, gasoline, VAT on all these and all other cases. Unfortunately, they mostly do not know about it, and if some of them receive government assistance, they think they should just be grateful.

Tax rate increases are often unpopular, but spending money from the budget is still attractive. This causes government revenues to lag behind expenditures – a deficit. Instead of raising unpopular taxes, the government is taking two possible paths:

- Borrowing inside or outside the country;

- The release of additional money into circulation – which leads to inflation and the reallocation of people’s resources to the side of the government’s redistributive welfare programs.

The additional costs caused by such approaches will ultimately fall on taxpayers, both today and especially tomorrow, whose economic opportunities will be limited. Accordingly, the constitutional limitation of tax increases and the introduction of new taxes, as established in Georgia in 2011, makes the political process more disciplined.

The fact that the population pays the taxes (directly or indirectly) is clearly confirmed by the laws on the state budget. For example, according to the law of 2024, the tax revenues of the budget are planned in the amount of 19,115,000,000 GEL (100%). of them:

- Income tax (which is a tax of natural persons) – 6,345,066,000 GEL (33.19 %);

- VAT[3] – 7,388,334,000 GEL (38.65%);

- Excise duty – 2,375,000,000 GEL (12.42%);

- Import tax – 150,000,000 GEL (0.78%);

- Profit tax – 2,690,000,000 GEL (14.07%);

- Other taxes (property tax) – 166,600,000 GEL (0.87%).

Let’s count (except for the profit tax) – almost 86% of the state budget is filled directly by the population. As for the profit tax, we mentioned above that it is one of the constituent elements of business pricing and, therefore, it is clear that the buyer (that is, the population in the end) pays for it.

These data do not include the state fees (which are also mandatory payments) and the mandatory contributions paid to the pension fund, the amount of which is about 5.5 billion GEL for 7 years, that is, on average, about 800 million GEL per year.

This does not exclude the fact that these taxes also affect business incentives and actions. In some cases, for example, VAT is neutral – especially if every business pays and the rate is equal. However, if the rate rises or even if sectoral differences emerge, the incentive to avoid or move to a better tax location will increase. If a business finds it expensive to hire workers and the related taxes, it will either start hiring illegally or partially or completely stop its activities.

[1] https://en.wikipedia.org/wiki/Laffer_curve

[2] https://files.taxfoundation.org/20190716191139/Tax-Reforms-in-Georgia-2004-2012.pdf

[3] VAT, excise duty and import tax, according to the definition of the Tax Code, are indirect taxes, which are set as a supplement to the price of delivered (imported) goods and/or services and which are paid by the consumer (importer) with the increased price of this tax when purchasing (importing) goods and/or services. The consumer is the population.

Written by Gia Jandieri and Irakli Shavishvili – co-founders of New Economic School – Georgia, 2001