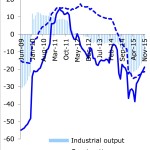

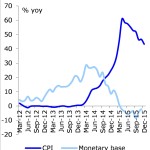

2015 was a year of many wins and losses for Ukraine. In the first half of the year, Ukraine faced a near-perfect storm of escalating military conflict, falling commodity prices and political instability. As a result already low export revenues went even further down and foreign currency reserves dropped to 5 billion dollars. This led to very volatile exchange rate, in February and March. By April hryvnia stabilized after losing about 20% of its value from the beginning of the year. As a result, prices shot up by over 35% between February and May, domestic demand shriveled and industrial output went down. Economy evened out in the second half of 2015. Inflation slowed down sharply. Prices continued to go up but at 10-11% annualized pace. GDP stopped falling but recovery is likely to be very slow.

The National Bank of Ukraine moved to more flexible exchange rate and started to conduct something of a monetary policy. It created the Monetary Policy Committee, started regular policy meetings and began issuing quarterly inflation reports. Tight monetary policy helped to reduce inflation and stabilize exchange rate. However, stability in foreign exchange market is still propped by harsh administrative measures including 75% mandatory sale of export revenues, restrictions on dividends and profit transfers abroad and discretionary scrutiny of all large transactions by the NBU officials. Macroeconomic stability is helped by four-year USD 17.5 bn Extended Fund Facility (EFF) from IMF.

The banking sector is still a mess, but now much fewer zombie banks haunt it. All in all, 45 banks were liquidated over the year accounting for 18% of the banking sector assets in the beginning of 2015. The majority of large remaining banks received capital injections from their shareholders.

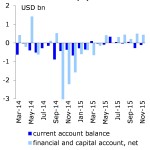

Current account deficit significantly contracted in 2015 because of hryvnia depreciation and introduction of additional 5-10% import surcharge. Financial account improved and was in surplus due to FDI inflow (mainly as recapitalization of foreign-owned banks) and external financing received by the Government sector. As a result, balance of payments had slight surplus.

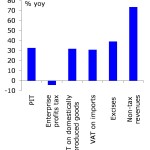

Fiscal balancing act was moderately successful in 2015. High inflation allowed the government to meet social commitments (that were frozen for the most of the year) while energy subsidies were cut sharply. Future debt sustainability is helped by sovereign debt restructuring with debt holders, which was essential for securing fiscal sustainability of the country. The debt restructuring envisaged a 20%-haircut on the principal (near USD 3 bn), replacement of old bonds with new ones, including new Eurobonds and GDP-linked warrants, which imply payments based on real GDP growth. Overall, the Government reduced financing needs for the next three years by USD 15.2 bn.

The Government also started to implement long-delayed and necessary reforms. The progress had been slower than needed but faster than over the last 10-15 years. Deregulation was among the largest successes in government policies last year. Number of licenses, permissions and certificates needed to do business went down. Significant progress was also achieved in public procurement reform. Pilot e-procurement system ProZorro allowed saving up to 20% of planned amounts. Still reform is hampered by low trust from potential government contractors.

Reform of technical regulation was also among successes. Regulation became more compliant with the EU standards and norms than those inherited from the Soviet times. The natural gas market reform was approved. Besides, the Government has finally moved towards ensuring higher efficiency of state-owned companies’ management. Perception of corruption remained strong but a number of high profile cases were prosecuted and independent anti-corruption bureau started functioning in the end of 2015.

However, there was little progress in comprehensive tax reform, pension reform and social assistance system. Only partial amendments were made in the Tax Code, while the comprehensive tax reform is expected to be worked out in the first quarter of 2016. The major change is a decline in single social contribution from the average rate of 41% (ranging from 37 to 49%) to flat rate of 22%, which required a substantially increased transfer to the Pension Fund in 2016. This reduced tax burden on wages but made the PAYG pension system even more dependent on the central fiscal financing than on insurers’ contributions. Overall, long list of reforms is still on the agenda.

In international relations Ukraine strengthened its ties with EU in 2015 despite costs imposed by Russia. Ukraine continued harmonizing its legislation with EU rules as was agreed by the Association Agreement (AA). Ukraine implemented necessary measures envisaged in the visa-liberalization action plan. As a result, the European Commission formally recommended the EU Council to grant visa-free regime for short-time trips of Ukrainians to the EU.

Throughout the year Russia put pressure on Ukraine to postpone the introduction of the Deep and comprehensive free trade area (DCFTA) between Ukraine and the EU. Russia imposed non-tariff barriers on imports from Ukraine in 2015, introduced food embargo and severely restricted transit of Ukrainian goods since 2016. In response Ukraine also imposed restrictions on trade with Russia and forbade flights of all major Russian air carriers over its territory. Still, the AA with the EU was not changed and the DCFTA was introduced as planned since January 1, 2016.

Ukraine reduced its energy dependency on Russia as it imported only 30% of natural gas from Russia, while the rest was purchased from Europe. This allowed to bargain for better price on gas imports.

Finally, we can say that Ukraine’s real GDP in 2016 is expected to grow by 2% as situation becomes more stable and domestic demand may pick up slightly. However, economic development is subject to many risks, including escalation of war and higher political uncertainty.