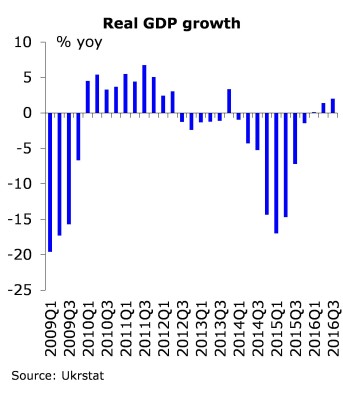

Year 2016 in Ukraine became a year of starting on the economic recovery path. Real GDP growth in 2016 is estimated at 1.4%. It was supported by higher domestic demand. In particular, real private final consumption increased due to higher disposable income primarily attributed to increase in wage income. Investments increased due to higher commercial and residential construction, larger government financing of infrastructural projects as well as the implementation of delayed modernisation projects.

At the same time, real net exports made negative contribution to economic growth due to decline in real exports as Russia imposed ban on imports of many Ukrainian products and restricted transit of Ukrainian goods to other countries through Russia’s territory. Besides, Ukrainian companies suffered losses due to military conflict in the East of the country. Necessity to maintain support by the IMF and other official international donors at the time of difficult economic situation pushed the Government to continue implementation of reforms. The Public Procurement Law was fully implemented, which means that since 2016 all public entities should conduct procurement above certain threshold on the basis of electronic platform ProZorro.

The Government has also moved forward the reform in energy sector imposing the import parity price on gas sold in Ukraine regardless its origin. E-declarations became another important win of the year 2016. The Parliament also approved important laws on the judicial and tax reforms, which are to become wins of 2017, if fully implemented.

War and Political Uncertainty Remained the Main Challenges

The armed conflict with combined Russian-separatist forces in the Eastern Ukraine further hampered economic development of Ukraine and resulted in losses of Ukrainian servicemen. It escalated the most in July and August in the area of the towns of Mariinka and Avdiivka and in December when Ukrainian army was defending Svitlodarsk bulge in Donetsk oblast. Russia failed to fulfil the requirements of the Minsk peace process, including a withdrawal of its troops from Ukrainian territory and a full ceasefire.

Throughout the year high political uncertainty undermined reforms speed. The Cabinet of Ministers changed in 2016 after the resignation of Prime Minister Arseniy Yatseniuk, which was preceded by the resignation of the Minister of Economic Development and Trade Aivaras Abromavičius and two parliamentary factions leaving the government coalition. Volodymyr Groysman, a close ally of President Petro Poroshenko and a former Speaker of the Verkhovna Rada, became a new Prime Minister. At the end of the year, several high officials left their positions, including Head of Odesa Oblast Administration Mikheil Saakashvili and National Police Chief Khatia Dekanoidze. They cited political pressure and lack of support from the Government as reasons for their departure.

The Government was not able to ensure the sufficient implementation of reforms to ensure smooth cooperation with international partners. The third tranche of IMF loan under the EFF was received only in September at a smaller than previously scheduled amount and the installment of the fourth tranche was terminated. Ukraine also did not receive previously scheduled UAH 600 m of macrofinance assistance from the EU due to lack of expected policy steps.

In 2016, Russian occupation of the Autonomous Republic of Crimea continued and led to politically motivated prosecutions and abductions. The Supreme Court of the Russian Federation declared the Mejlis of the Crimean Tatar People an extremist organization. In November 2016, the United Nations human rights committee adopted a resolution that recognizes the AR of Crimea and the city of Sevastopol as temporarily occupied by Russia and condemns the abuses and discrimination against Crimean Tatars, ethnic Ukrainians, and other groups by Russian occupation authorities.

Ukraine Is on the Path of Macroeconomic Stability

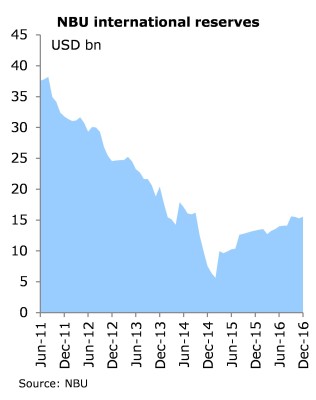

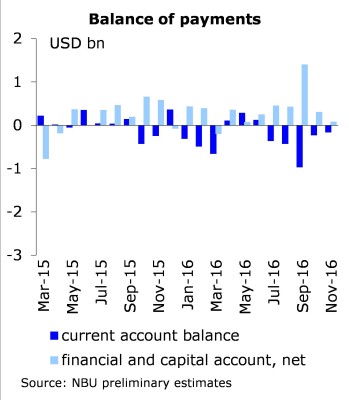

Real GDP in the first three quarters of 2016 increased by 1.3% yoy due to stronger domestic demand. Gross fixed capital accumulation surged by 16.5% yoy likely due to necessity to increase competitiveness after years of under-investments. At the same time, wage income increased as employers compensated for lost purchasing power of wages in 2014-2015. Higher domestic demand drove the growth of imports. Real exports declined by 5.3% yoy as Russia banned imports from Ukraine of many products (primarily food) and demand on other markets remained weak. Growth of nominal imports and further decline in nominal exports resulted in sharp increase of current account balance from USD 0.19 bn in 2015 to USD 3.36 bn in 2016. Still, this deficit was counterweighted by the financial account surplus, which partially smoothed exchange rate volatility. Still, interbank exchange rate weakened from UAH 24 per USD in the beginning of 2016 to UAH 27 per USD in the end of 2016 as demand for foreign currency outpaced supply. International reserves of the National Bank of Ukraine increased by USD 2.2 bn to USD 15.5 bn (which is more than 3 months of imports) due to state foreign currency borrowing and net purchases of foreign currency on the interbank market.

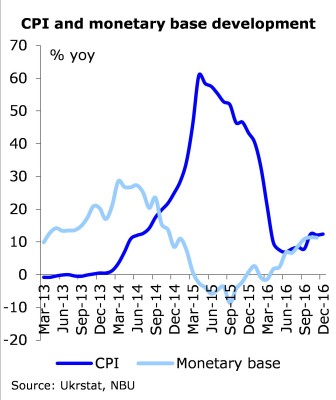

Inflation slowed remarkably to 13.9% on average in 2016 from 48.7% on average in 2015. This reflected moderate increase in demand, weak global commodity prices and lower inflation expectations. Food prices increased by 9% while housing and utility costs surged by 35%. Lower inflation expectations and higher economic stability enabled the NBU to reduce policy rate to 14% p.a. from 22% p.a. between April and October of 2016 and held it steady afterwards. This helped deposit and lending rates to move down as well. Indicative retail deposit rate reduced to 18% p.a. from 21% p.a. for 12-month hryvnia deposits while interest rate on short-term corporate lending fell to 15% p.a. from 20% p.a.

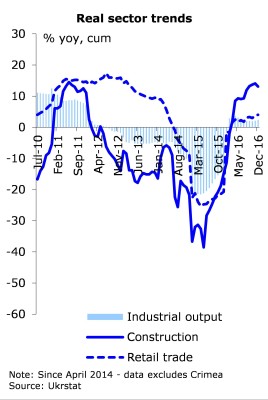

Most sectors improved their performance during the year. Industrial output in 2016 increased by 2.4% due to recovery of manufacturing after rapid decline during previous two years. Metallurgy, food production and pharmaceutical production grew the most. Machine building increased primarily due to higher defence orders. At the same time, extractive industry declined production by 0.3% as the war in the East created logistic problems. Increase in real private final consumption and industrial output resulted in higher real gross value added in trade and transports. Construction surged due to higher financing of all types of construction.

Agricultural production surged by 6.1% due to good harvest of most crops with a record grain harvest. This was explained by both higher yields and larger harvested areas. At the same time, livestock production declined due to weak demand.

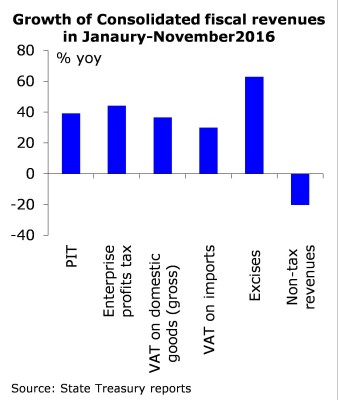

Favorable economic development resulted in encouraging fiscal situation. Consolidated fiscal revenues grew rapidly due to improved tax administration and increased economic indicators. In particular, PIT revenues grew due to higher effective tax rate and bigger wages. Higher rates and consumption contributed to growth of excise collections. Narrowed use of special VAT scheme for agricultural companies, higher consumption and investments resulted in VAT revenues growth. Local fiscal revenues and expenditures increased due decentralization efforts. However, lower than planned consolidated fiscal deficit resulted in underfinanced expenditures. As usually, capital outlays were under-executed more than current expenditures.

Progress in Reforms but Not Sufficient

In 2016, procurement through the public electronic system ProZorro became obligatory for all public institutions and companies, which was officially declared to have resulted on savings. However, other approved changes were de facto not fully implemented. Important changes took place in 2016 in the area of civil service and judicial system. A new law on civil service became effective since May 2016 that de jure makes the process of hiring public servants more transparent. However, salaries of civil servants were not increased to more competitive level, which resulted in inefficient implementation of changes. Amendments to the Constitution on judiciary and a new law on judicial system made the selection of judges more competitive and stripped the Parliament and the President of the right to dismiss judges.

During the year, the Government continued efforts for deregulation and simplifying the tax administration. The Ministry of Economic Development and Trade reported 40% decrease of required permits and 46% decrease of licenses over the period of 2014–2016. The number of administrative services was reduced; some of the most typical ones are available online.

In 2016, the Government continued reforms on the gas market. It created “Magystralni gazoprovody Ukrainy” (MGU, eng. Trunk Gas Pipelines of Ukraine), a new operator of gas pipeline system of Ukraine in the framework of the Naftogaz unbundling process. After unbundling, the Naftogaz will retain only the function of gas trading, while gas storage and transportation will be performed by other companies.

Ukrainian Government set the universal price of gas for households based on import parity and increased the purchasing price for Ukrgazvydobuvannya close to imports price in order to reduce free riding in gas system. Moreover, purchasing prices for coal are set based on wholesale market price in the port of Rotterdam.

In December, the Government pushed through the Parliament several important draft laws overnight, including the State Budget Law for 2017, amendments to the Budget Code and the Tax Code and changes to many other laws. The parameters of the State Budget Law for 2017 are based on rather realistic macroeconomic assumptions, even though there is a downward risk for tax revenues (e.g. VAT and EPT). New provisions of the Budget Code are directed towards increase in decentralisation. Amendments to the Tax Code are primarily directed towards easing of tax administration.

Throughout the year, the NBU continued cleaning of the banking sector. 20 banks were liquidated in 2016 for a number of reasons. Some closed voluntarily, some did not have enough liquidity to function, while other failed to reach required capital or violated money laundering rules. The largest Ukrainian bank Privatbank failed to recapitalize as required but it was bailed out and nationalized by the Government. The latter was the major reason for the increase in state debt in relation to GDP to near 83%, which is a fiscally unsustainable level.

One of the major failures of the year was the lack of political will to restart the privatization. The biggest disappointment in agricultural policy relates to the prolongation of the moratorium on agricultural land sales for another year until 2018, which hampers investment climate in the sector. Ukraine still did not start pension reform and did not take necessary steps to increase the independence of anti-corruption law enforcement agencies and to convict corrupt high-level officials.

Regardless military and economic pressure from Russia, the application of the Deep and Comprehensive Free Trade Area (DCFTA) between Ukraine and the European Union started in January 2016. The efforts of the Ministry of Agrarian Policy and Food ensured the entrance of Ukrainian dairy producers to the EU market. However, this only partially compensated losses from the embargo imposed by Russia for Ukrainian food products.

Throughout the year, Ukraine had been negotiating visa liberalization with the EU. A joint report released in late 2016 by the European External Action Service and the European Commission noted that Ukraine had successfully met all benchmarks under the Visa Liberalization Action Plan. However, in 2016, the European Parliament did not cancel short-term visas for Ukrainians.

Conclusions

To sum up, the Government again appeared to be slow in reforms in 2016. The reached progress was rather fragmented. Year 2017 has started with more challenges on political and economic arena. This is not going to be a year of rest, but could become a year of change for the better.