There is an on-going discussion now in Georgia – why Georgian lari has devalued by 26 percent since November 2014. My opinion on this matter quite differs from opinions of our experts. I think we need either to eliminate lari altogether (we can use US dollar instead, as it is already the most popular currency in Georgia), or we need to adopt such a system in which fiscal and monetary disciplines will automatically work (Currency Board). The outcome will be no inflation, no devaluation and no deficits.

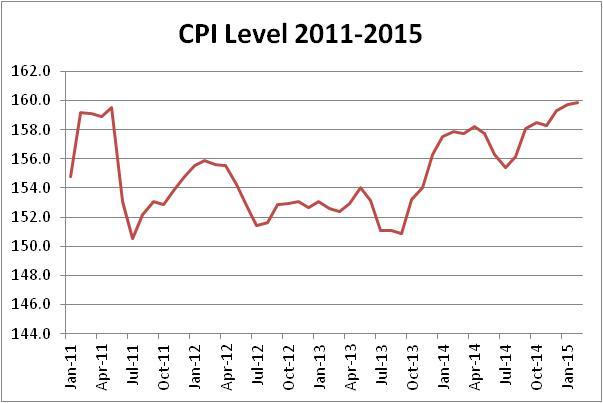

I don’t believe that we need central banking, monetary policy or our national monetary unit. Without this, we can’t avoid two essential problems – politicization of the monetary politics and also its competitiveness. But by saying this I do not wish to imply that in this particular case of devaluation of the lari the central banking system was the major problem. Quite the opposite, the leadership of the National Bank, knowing about the possibility of politicization of the issue (and remembering the 2011 high inflation), has been trying to be most careful not to make mistakes and take all the blames. Because of this, in some months of 2014 we experienced even decline of price level, which has remained stable during all 2011-2014 years (see the chart, CPI, 2005 = 100, National Statistics Office of Georgia – Geostat):

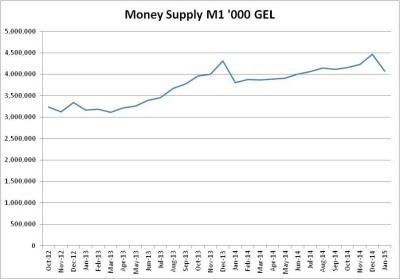

According to the National Bank (NBG) statistics, the volume of money M1 controlled by it has been growing in parallel to economic growth. The next chart shows M1 dynamics during 2012-2014 (NBG statistics):

It is visible that in December the NBG, as always, increases the money in circulation to meet the New Year temporary demand but it decreases back in the following January.

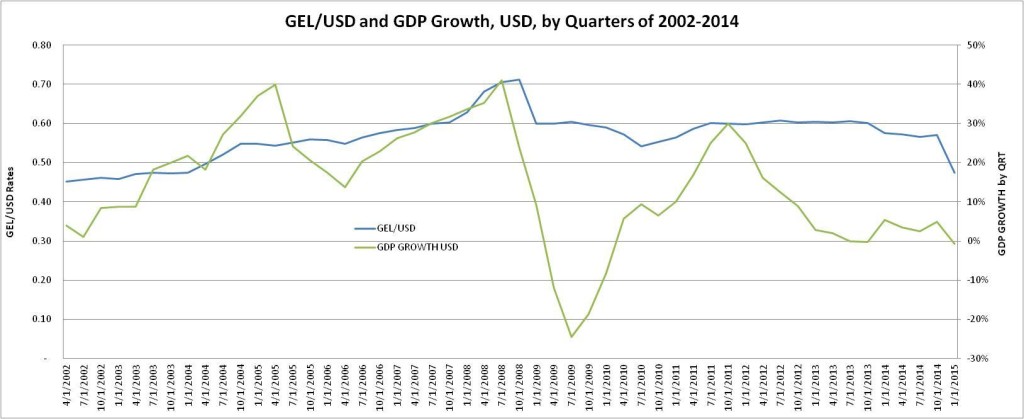

There are a few more interesting facts. For instance, it is crucial to consider the rate of the lari to US dollar during the last decade. We can see from the next chart that the lari was always improving in the periods when the economic growth was higher than 6 percent, stable in the range of 5-6 percent and declining when the growth was lower than 5 percent. This clearly shows that strength of lari, if it freely floats in the market, is dependent on the soundness of the economy (in our case – if the growth is higher or lower than 6 percent). The latter is itself dependent on the economic policy of Georgia, on how easy it is to embark on an economic activity in the country (or how wealthy is a country in terms of natural resources, but in some cases this does not help anyway – let’s look at Azerbaijan, its currency devalued even more). If an economy is free, it is more likely to attract investors, and if we also convince them that this is a sustainable policy, they will come and invest. So what happened now to the lari is a reflection of the sharp decline of the economic growth from 9-10 percent first to 5-6 percent and then to 3-4 percent. Two percent of growth, now promised, is also politically dangerous; I assume our enemy will not miss this opportunity for mudding the water. (Chart: GEL/USD rates and GDP Growth, 2002-2014, Geostat and NBG):

The strength of the lari can be also supported by big international projects, the success of which is dependent on many different aspects of governmental activities, including trust that is in itself tied to the degrees of management, efficiency, transparency and politicization. All these we experienced and they are undoubtedly the weaknesses of the current government.

It is a clear deception when someone says that instability of the lari can be explained by the problems in the region (including the fall of euro in the last quarters). Even in our experience, we can find good arguments against this thesis. But I think that even more unprofessional is blaming our neighbours for the fall of the lari. Their currencies have also depreciated (and due to other, different reasons). Consequently, when we were losing while exporting, at the same time we were gaining while importing (or vice-versa). Apart from the regional trade partners, we should not expect to have damaging trends from the trade with the Eurozone states – euro declined slightly more than the lari towards the US dollar and Georgia has negative trade balance with the Eurozone nations.

As an example, now it is again worth to buy second-hand cars in Germany

as they became cheaper in the US dollar equivalent – in Georgia they are valued in this currency anyway.

It was also obvious that drop of the oil prices during the last two quarters made a huge economizing effect for the economy and the life of the individuals.

Let’s consider other reasons, specifically what and when could shake the purchasing power of lari. It is obvious that the fiscal discipline is important but not sufficient for solving this kind of crisis – we had a fiscal deficit during all the years of the successful reforms but this didn’t hinder strengthening of the lari and economic growth. Deficit is a political fraud – more expenditures than existing resources. If we didn’t have the deficit during the reform years, we could have easily had a double digit growth during that period. One thing is clear – you can have deficit but simultaneously quality economic policy, growth and a strengthening currency.

One of the major reasons for economic growth is easiness in attracting resources and in using them. It is necessary for a state like Georgia in its current political conditions to maintain the most liberal (free) approaches in the economy. You can justify this even theoretically, but there are two real life proofs as well:

1. Where is it better to invest, in Bulgaria or Georgia, if they both have similar economic systems? Obviously, in Bulgaria – its territory is not occupied; there are no military conflicts in the region; it has open borders with the biggest economic system – EU; it is a member of NATO, etc.

2. Slovenia, the richest post-communist state borders Italy and Austria, nations which are its competitors (that’s why ordinary Slovenians wake up at 7AM), its investors (why should one go invest somewhere far away?) as well as informal business mentors (it takes only a 20 minute drive to some neighbouring Italian village to see how do they bake bread). Georgia, unfortunately, doesn’t have such experienced, competitive and rich neighbours.

Much less impact could have methods of budgetary expenditures – sooner or later these resources will appear in the market in some or other form and the financial sector understands this and is willing to wait. Yes, it may cause some kind of fluctuation but in a short-run and it would be far less serious. Another thing is that the decrease in government expenses accelerates economic processes, even though – only in parallel to other economic freedoms.

Nonetheless, part of our problems is not in any way dependent on us at all and as a result we can’t change much. In these circumstances, it becomes obvious that we need to think of advantages which could ensure acceleration despite of the abovementioned regional brakes. What could serve as such advantages? Free trade with the EU and the US? Maybe, but it is very unlikely for us to use this “advantage” now, if anything, we’ll maybe use it later.

At the same time, it’s very apparent that despite of the success of our Easter-European friends – frequently due to the EU funds – some of them still deal with heavy financial difficulties (this applies, for instance, to Slovenia, Hungary, Croatia and Slovakia) and a continuous growth face only those which have chosen the way of economic liberalism and pragmatism (for instance Estonia and Lithuania). The bottom line is therefore, you can’t truly rely (solely) on the finances.

Therefore, in my opinion it is more accurate to state that the decline of the lari was caused by rejection of the economic policy of liberal economic reforms of most successful years of 2004-2008. The rejection and reversal after 2012 elections have been sometimes happening by adopting legislation purposefully against investor-employers (labour code amendments) and sometimes by loud statements (frequent statements about a necessity to regulate one or another sphere of economic activities).

One especially big mistake was, in my belief, the existing illusion connected with the reopening of the Russian agrarian market and orientation towards this unstable, politicized, corrupted and bureaucratized economic space, leadership of which is proud of occupation and annexation of Georgia’s territories. If Georgian products are more competitive, then the European market is much bigger and wealthier. But coming back to the Russian market decision, it is once again a promise of making our state a political hostage of Russia but not its revenues.

Also, as a minimum, it was not a good idea to waste so many financial resources in the agrarian sphere. If we recognize that these projects haven’t produced real outcomes, it will become obvious, that the spent resources are lost in other spheres where they could have been used much more efficiently and result in creating employment for several thousands of people.

It seems that some politicians still believe that it is possible to design and pack up the incorrect policies and rhetoric in a pleasant way so that investors and international partners will not notice anything. However, they have already heard many of the statements of the government that, for what it’s worth, were directed at restoring justice and that it would not harm the investors in any way but at the same time they also heard about the strange policies they promoted. One official asked what went wrong with the amendments of the labour code – after all, nobody was complaining. It seems that the state authorities think that investors would come and knock on their door on their own to report that there was some harm done. Instead, they just left for the countries that might have worse labour laws but have some better other conditions, for instance no Russian tanks standing 40 kilometres from the capital city.

Some of the decisions of the government were indeed not civilized ones. They can deliver as many bad examples as they want but free movement of individuals and resources, labour freedom, investment and freedom of property were the advantages, making our country’s image very positive. It was seen by many people, if we don’t count some marginal leftist forces and the unhappy Kremlin. That’s why representatives of governments of so many states came to learn from our experience, and many Georgians were also invited to share their knowledge in Asia, Africa and even in Europe.

European Union also started with the same ideas and blaming it now that it was restrictive in terms of entering visas and labour market openness, land ownership for foreigners does not seem serious and seems to be a part of the undesired atmosphere that has been established around our country and which is reflected in our economic results.

Limited state liabilities and correct economic policies (which are now being undermined by the initiatives of the government) have given us hope for better opportunities. What is the “correct” economic policy? Maybe it is what you are thinking while reading this article. These are the competitive decisions which return capital back to us. We have to always remember that there are other people who also try to obtain the same resources we sometimes assume to be already safely put aside for us.