On May 1, 1998, privatisation in Slovenia was declared officially over – an occasion marked by the coming into force of a new law. Passed only weeks earlier, it was aptly titled the ‘Act Concluding Ownership Transformation and Privatisation of Legal Entities Owned by the Development Corporation of Slovenia’. Fifteen years later, independent observers still report that the State holds an excessive ownership stake in the Slovene economy. International institutions indeed admonish Slovenia for not having privatised enough, even though a massive privatisation had taken place. In 1990, there were 3,709 ‘socially owned’ companies operating in Slovenia1. Approximately 1,500 were at least partly privatised, the remainder ended in insolvency or liquidation2. By 2010, the State had retained significant shareholdings in 79 companies in 7 industrial sectors3. However, this official figure understates the true involvement of the State with the Slovene economy. It accounts neither for investments held by State-owned enterprises (SOE), nor for collateral on non-performing loans seized by State-owned banks during the recent economic crisis4.

As lately as in April 2013, the OECD complained over the ‘already large state ownership in the economy’. The organisation also noted that ‘privatisation of non-financial corporations supported by the definition of a clear asset management strategy, underpinned by a well-defined distinction between strategic and non-strategic holdings, could attract valuable equity’5. Only a month earlier, an IMF mission to Slovenia had concluded: ‘Misconceived defence of “national interests,” including the reluctance to sell assets to foreigners, burdens the budget and unduly prolongs the corporate and financial sector distress. A prominent privatization could convey a powerful signal to international investors’6.

This article argues that the Slovenian experience with privatisation has been marked by two phenomena. First, the Slovenian State did not exit enough business – there was widespread failure to privatise. Second, the privatisation campaigns that were undertaken suffered from several severe problems – there was widespread privatisation failure. Both phenomena were related even though the precise relationship can be modelled in several ways. For instance behaviourally – privatisation failures could have been common knowledge and were reflected in non-negligible ‘failure expectations’ that inflated the expected costs of privatisation (thereby contributing towards failure to privatise). The article assesses several ways of defining and modelling privatisation failure and the failure to privatise.

A brief chronology of Slovene privatisation

Ironically, the large extent of state ownership in the Slovene economy is an outcome of the privatisation process itself. The latter can be broken down into several stages. Stage 0 refers to the starting point, a socialist economy of the Yugoslav type. Capital was socialised and companies subjected to soft budget constraints, but from the late 1960s onwards, there was no central planning (unlike elsewhere in Eastern Europe). ‘Ownership was deemed to be “social” rather than “state,” on the ostensible grounds that enterprises were managed by workers’ councils rather than through centralized branch ministries’7. Moreover, Slovene companies traded heavily with Western European markets.

In the late 1980s, the reformist (and final) Yugoslav federal government of Ante Marković laid legal groundwork for a spontaneous ‘proto-privatisation’ (often disparagingly referred to as ‘wild privatisation’ by contemporaries). After Independence of 1991, the new Slovene government begun preparing a new legal framework for privatisation but was slowed down by intense political disagreements over privatisation method.

Thus Stage 1 only begun in late 1992, with the passing of privatisation legislation. It enabled the transfer of ‘social capital’ to new private owners but also, more importantly, to the State. State ownership thus arose at the same time as private ownership – previously, all companies had been owned by the notional society. Despite some test cases there were initial delays in privatisation, partly due to legal uncertainty created by on-going revisions of the legislation. Therefore, ‘mass privatisation’ is usually dated from 1995–19998.

Phase 2, the subsequent period of ownership consolidation, is usually referred to as ‘secondary privatisation’. Owners from mass privatization started selling their stock – they were ‘largely transitional owners, playing a role of privatization agents in search of strategic investors’9. Stage 3 was only announced in the aftermath of the financial crisis of 2008–2013, within a framework of fiscal consolidation10.

Any discussion of privatisation failure is prone to three types of pitfalls. The ‘muckraking syndrome’ manifests itself in long catalogues of various crimes and misdeeds. Since it is essentially lacking in theory, it provided few valid policy lessons.

The other extreme is the theoretical high ground, dismissing the whole topic as insignificant because it is already predicted by even the simplest of models. For instance, since it is the government that manages privatisation, privatisation failure can be expected as a simple consequence of all-common government failure. But privatisation itself is a policy designed to prevent government failure. It is therefore useful to understand how the problem ends up corrupting the proposed solution.

The third pitfall is the checklist approach. How does it decide when to call privatisation a failure or a non-failure (or outright success)? The analyst counts the indicators for failure and deduces the number of indicators for non-failure. However, this approach is sensitive to the total number of indicators used and on top of that, national governments are expert at playing such evaluation forms.

A typology of failure

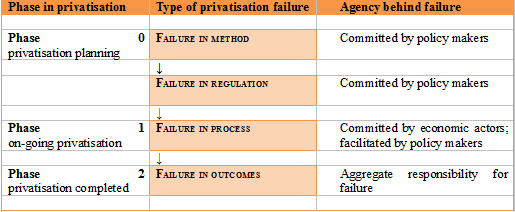

In economic literature, a focus on privatisation outcomes often means that privatisation itself is treated as a black box. But privatisation failure can also be defined independent of outcomes: as failure in privatisation method, failure in regulation and failures in privatisation process. As illustrated in Figure 1, these different types of failure arise at different points in time – before, during, and after privatisation11.

Figure 1: Four types of privatisation failure

In economics, policy failure is typically defined against the outcomes. If a policy (say, privatisation) appears to raise a given set of criteria, it is deemed successful, otherwise it is a failure (strictly speaking, there is also a zone of indeterminacy but it is outside the scope of this argument). From a microeconomic perspective, privatisation failure is measured against performance criteria for individual companies. Despite the predominance of financial variables (e.g. return on capital, value added), equitable considerations are also common (e.g. labour shed or added, firm-level income inequality).

Taking a broader view, privatisation is itself one of the main indicators of success and failure of economic transition. Successful privatisation is behind two of Janos Kornai’s three criteria for accomplished transition12. The first one states that ‘the Communist Party must lose its monopoly power in politics’. But already the next one refers to disposal of State assets: ‘the dominant part of the means of production must be held privately, and the private sector must account for the larger part of the gross domestic product (GDP). This private sector does not have to be created exclusively through privatization: it can become dominant through the entry of more and more new firms.’ The third criterion requires the market to be the dominant coordinator of economic activities, alongside various other mechanisms.

Failure in method

Failure in method means that of the several possible techniques of privatisation, a sub-optimal one was chosen. And there is a lot to choose from; according to a World Bank report, ‘the most commonly used methods of privatisation are: public offering of shares, private sale of shares, new private investment in an SOE, sale of government or SOE assets, reorganisation (or break-up) into component parts, management/employee buyout, and lease and management contract’13.

Unfortunately, most applications of the ‘failure-in-method’ approach rely on further assumptions regarding the optimality of outcome. In consequence, this approach to privatisation failure offers nothing more than a particular hypothesis for explaining general failure in outcome (which has to be demonstrated prior to analysis along some other dimension, i.e. without using data on the privatisation method). Nevertheless, such approaches to evaluating privatisation enjoy a long-standing tradition in economics. For example, Ferguson14 compares four methods (sale to foreign company; auction sale to nationals; voucher sale or give-aways to nationals, also with intermediaries) based on seven criteria (ownership pressures; competitive pressures; entry possible; static efficiency; dynamic efficiency; know-how transfer; and equitable transfer), depending on market power of the privatisation targets.

There is another drawback of tying privatisation method to privatisation outcomes. The method is only one among many factors that can determine the outcome – and these variables need to be controlled for. Zinnes, Eilat et al.15 find ‘that as a result of different initial conditions the economic performance responses of countries to the same policies are different’.

In the case of Slovenia, failure in privatisation method can be observed without recourse to outcome optimality. Failure was inherent in the particular legislative set-up of privatisation. The Ownership Transformation of Companies Act (1992) introduced the following model: 10% of a company’s socially-owned capital was to be transferred to the State-owned pension fund, 10% to the State-owned Compensation fund, and 20% was to be exchanged for privatisation vouchers managed by special investment funds (vouchers were allocated for free according to age; the amounts ranged from 100,000 tolars – for all citizens under the age of 18 – to 400,000 – for citizens over 48). Alternatively, vouchers could be exchanged for shares by citizens acting on their own account, but only within the remaining 40% of capital earmarked for ‘internal distribution,’ i.e. for insiders (workers and management) as well as their close family members16.

Slovene privatisation was therefore set up in a way that increased State holdings. Privatisation transferred the socially-owned capital into private – and into State hands. This was not lost on contemporary observers; the CEO of a major pharmaceutical company was quoted as saying: ‘It is completely clear that privatisation needs to be an acceptable political compromise. […] The political goal was to distribute among citizens a certain amount of property based on the criterion of equity. But let us be completely clear. Now, the fundamental principle of the law is nationalisation, which cannot be efficient in the long run’17.

Failure in regulation

Privatisation can also fail because of internal inconsistency in the legal framework. In Slovenia, these inconsistencies arose because privatisation was based on several foundational acts. The Denationalization Act (1991) provided for the restitution – in kind, in bonds backed by the Compensation fund, or in other State-owned securities18. The Housing Act (1991) enabled the sale of socially-owned apartments to their occupants at heavily discounted prices (citizens living in private accommodation, either as owners-occupants or as tenants, were excluded)19. The Ownership Transformation of Companies Act (1992) created the legal framework for privatising socially-owned enterprises. The National Farm Land and Forest Fund Act (1993) transferred all socially-owned land that had not been claimed by previous owners to the State20.

These acts created competing claims to the same assets even though legislation addressed almost the most egregious examples. If, for instance, an apartment had been confiscated after the Second World War, claims of the initial owners or their heirs took precedence over the tenants. In other cases, precedence was less clear. Companies that had acquired plots of agricultural land found all this property confiscated by the State. They also had to create capital reserves to offset denationalisation claims21.

Failure in process

Failure in process is related to failure in regulation, which is a consequence of incomplete contracting or incompetent drafting. In short, most actors involved in privatisation have to take failure in regulation as a fact of life. Failure in process implies activity – privatisation was carried out against the law. However, even though privatisation process failure involves white-collar crime, Slovene criminal law offers little help to elucidate the concepts. What follows is an argument against using a legalistic definition of failure in process in the case of Slovenia.

The State criminalised mainly the spontaneous proto-privatisation that was based on either Yugoslavia-era laws or on a blatant disregard for law. To quote an official report, ‘from 1990 until the adoption of the [Slovene privatisation legislation] many companies have restructured, recapitalised or reorganized on the basis of the then Federal Enterprises Act and the Traffic and Disposal of Social Capital Act (the so-called “Marković Act”)’22. This self-emergent, covert privatisation was run by company insiders – only to be partially undone by the passing of the Ownership Transformation of Companies Act, which went into force on December 5, 1992. But it took a second amendment Act in June 1993 to criminalise previous privatisations23.

The amended law introduced ten new offences of ‘injury of socially-owned property’ (‘oškodovanje družbenega premoženja’): approving loans and other credit facilities with an annual real interest rate below inflation plus 8% (s. 1 and 2); leasing out premises bellow the regulated rent (s. 3); paying out dividends without making prior capital reserves of at least 6% of socially-owned capital (s. 4); preferred shares issuance (s. 5); cost reimbursement without the necessary proof of payment (s. 6); unjustified or undocumented write-offs (s. 7); unpaid transfers outside the company holding structure if socially-owned capital was thereby reduced (s. 8); taking out loans from employees or employee-owned firms at higher rates than offered by the company’s main bank (s. 9); and ‘all the other cases’ with the interest rate below inflation plus 8% or with socially-owned capital not being revaluated prior to recapitalisations (s. 10).

The list codified in the law was, nevertheless, open-ended: it also mentioned ‘the other cases of socially-owned capital being reduced through privatisation’ (s. 10)24. Sections 1, 2, 3 and 10 thus effectively created an offence against central planning (even though it had been mostly abandoned already under Yugoslav socialist self-management). The law explicitly presumed that any deviation from regulated prices was wealth destroying.

A total of 17 companies (some of them represented by the Slovene Chamber of Commerce) appealed against the new amendments. They were joined by the Ljubljana branch office of the State Accounting Agency (‘Služba družbenega knjigovodstva’, a now defunct socialist-era organisation responsible for tracking financial transactions, auditing and keeping the company register) as well as the Slovene State Council (‘Državni svet’, the unelected upper chamber of parliament representing various interest groups). The constitutional judges, however, stroke down a single provision, the one that declared all unpaid transfers of socially-owned assets between companies illegal25.

A new government body was set up to investigate privatisation-related offences, the Privatisation Audit Agency (‘Agencija Republike Slovenije za revidiranje lastninskega preoblikovanja podjetij’, operating from August 1996 to July 2004). The agency conducted 1,106 audits into privatisation undertaken between January 1, 1990 and December 31, 1992, that is, before the Ownership Transformation of Companies Act was operational. The investigation valued the total damage to socially-owned capital at 86,174 million in 1992 tolars, the Slovene currency at the time (equal to 873 million 1992 US dollars). Investigation was dropped in only 77 cases; 524 firms (60%) ‘voluntarily’ restituted socially-owned capital valued at 52,215 million tolars (529 million 1992 dollars). The agency also had authority to reopen audits as long as privatisation had not been formally concluded (through registration with the court). There were 246 such audits that uncovered additional damages of 8,820 million 2004 tolars (44 million 2004 dollars)26.

Even though some of the privatisation offences were only created in 1993 – and systematically investigated since 1996 – previous investigation had taken place. An official report explains that Slovene authorities ‘began preparing for a period of privatisation at the end of 1989.’ From 1990 to 1992, 58 privatisation-related criminal charges were pressed, most commonly for exceeding the bounds of discretion, signing detrimental contracts, abuse of office and falsification or destruction of business documents. But even the authorities admitted that ‘deviant phenomena in ownership transformation are also due to vague and unclear property laws, which the executives in socially-owned companies abused for a speculative undertaking of privatisation, hoping that a lack of regulations would preclude prosecution. We have also found that the process of privatisation cannot be effectively guided solely by repressive measures, since these measures are meaningful only in specific cases where there is suspicion of criminal activity’27.

The economic performance of the firms involved points to further weakness of the criminal law perspective on privatisation failure. Smith, Cin, and Vodopivec28 analyse data for all the companies operating in Slovenia from 1989–1992 in a period of ‘spontaneous privatization’ (note that this time frame is a year longer than the one used by the Slovene Privatisation Audit Agency when investigating suspicious transactions). They use income statements and balance sheets to determine the degree to which insiders had already privatised the company’s capital (ingeniously, the old Yugoslav accounting standards provided the category of ‘domestic ownership’ – i.e. the amount of capital owned by private citizens as opposed to ‘society’ – as a proxy for employee ownership). In 1989, 24 companies out of a country-wide total of 2,795 exhibited ‘some employee ownership’. This proportion increased from 74/3,709 in 1990, 180/6,538 in 1991 and finally, to 134/9,693 in 199229 – or in percentages, 0.86%, 2.00%, 2.75%, 1.38% (for 1989, 1990, 1991 and 1992, respectively).

The authors find that a percentage point increase in employee ownership was associated with a 1.4% increase in value added (only 208 observations of partly privatised companies are actually used for productivity analysis). All data pooled together, companies that were more likely to privatise also tended to be export-orientated, with higher revenues and profits30.

If Smith, Cin and Vodopivec are correct, then proto-privatisation was associated with efficiency gains. Since one of the stated objectives for system-wide privatisation were already accomplished, the subsequent State-enforced undoing of much of the previous self-emergent privatisation must have been motivated by factors other than economic efficiency, especially since self-emergent privatisation was mostly to be found among a small number of successful companies31.

The public, however, approached the matter with remarkable detachment, often observing that the ‘proverbial Slovene envy’ could have been one of the reasons for the spontaneous privatisation being contested. Jože Mencinger, the former Minister of Economy who had resigned over privatisation disagreements, was quoted saying that ‘The numerous requests for audits of privatisation proceedings are an expression of envy and the desire to redistribute an ever smaller loaf of bread, instead of ensuring it would grow’32.

Once privatisation began in earnest (that is, once it was restarted based on new laws), it was set up in such a manner that it benefited both company insiders and the State itself (hidden behind a veil of special-purpose vehicles and investment funds). Additionally, the renewed privatisation created a lucrative market for legal advice.

Whom to blame?

So far, the discussion has largely avoided the topic of agency (the third column in Figure 2) – who is to blame, the rotten system or the rotten individual. Both levels clearly interact, since any system would be considered rotten if it contained too many rotten agents. Therefore, it might be useful to rephrase the question: How could a system not be rotten even though it employed rotten elements? Ideally, a system should be robust enough to maximise given objectives under given constraints. If the system under consideration is a State which is about to launch a privatisation campaign, its stated long-term objectives can range from GDP growth to the equally abstract utilitarian principle ‘the greatest happiness for the greatest number’. Among the major constraints are, of course, the corrupted elements inside the system.

In an ever-changing world, constraints rarely stay as given. An ideal system would also minimise the obstacles to its objectives, for instance by reducing the incentives and the opportunities for graft, cronyism and corruption among its agents. It is useful to distinguish between temptation and the opportunities for acting out on it. Even if a legislator could squash every single opportunity for corruption existing at a given moment in time, new ones would soon arise since we are living in a world of uncertainty, incomplete contracts and information.

If the state is unwilling or unable to monitor its agents, is the civil society going to perform this role? On the brink of independence, privatisation enjoyed great public support which should have made implementation easier. It hints at what beliefs Slovene economic actors had at the time, i.e. untainted or unconditioned by the tough, rough and messy experience of economic transition.

A survey conducted between May and June 1991 showed that only 14.9% of respondents opposed privatising socially-owned enterprises while a significant 16.8% declared to be without any opinion on the matter. 33.4% advocated a privatisation method that would transfer the ownership of the company to its employees, 18.4% were in favour of selling the enterprises to the highest bidder (‘even if the buyers were foreign’) and 16.6% advocated restitution to original owners if the company in question had existed and been nationalised after the World War II33.

A previous survey conducted in November and December 1990 offered further insight into privatisation preferences held by the Slovene public. 9.6% intended to apply for damages or for restitution in kind for family property confiscated in the 1940s. Another 4.6% had no intention of pursuing the matter while a majority of 80.7% declared to have no claims to such property. As for denationalisation itself, 59.3% were against the restitution of the property seized to foreign owners (especially German or Austrian), while the rest of respondents split almost evenly between the proponents of the policy and the undecided34. It was less a reflection of an underlying Slovene economic nationalism – rather, it reflected fears that the aggregate stock of capital about to become privatised would diminish.

The Slovenes expressed the greatest support for those aspects of privatisation that were most likely to benefit them personally – in other words, when the expected individual pay-off was easily evaluated and accrued already in the short term. Consequently, the privatisation of former socially-owned housing was met with a 63.4% approval rating, tenable and short-term benefits to a majority of citizens35. As for the pace of transition, 54.1% felt ‘things were moving too slow’, 16.3% felt they were going ‘fast enough’ and 16.0% ‘too fast’36.

The economic crisis concentrated Slovene minds on economic topics, albeit not necessarily on privatisation. In a survey conducted in February 1992, only 5.1% of respondents named privatisation as ‘the most pressing problem’ and 6.2% as the ‘second most pressing problem’. Instead, they chose inflation (38.7%), unemployment (35.7%) and social security (14.4%) as the most burning issues of the day37.

Therefore even in crucial early stages of privatisation, there was not enough wide-spread interest for screening and monitoring the process – this opened up opportunities for graft. Unfortunately, the privatisation process was not robust enough to contain this type of privatisation failure.

Note that the system is assumed to be closed – working independent of the forces in its environment and, more importantly, having assigned the role of an active principal. So the system is employing agents in order to fulfil its objectives. A more radical position would hold that the system is itself an agent, serving the interests of ruling elites. The rulers may change, but they pass on the ropes and pulleys they use to rule with – in other words, the State survives in spite of regime change.

Unsurprisingly, the State itself relies on the ‘rogue individual’ explanation. Thereby, it eschews responsibility for having created the incentives for graft in the first place, and for not having closed down opportunities for corruption. For this reason, privatisation-related white-collar crime should not count as an exogenous shock to privatisation. Rather, it is should be considered as endogenous to privatisation – another version of the argument against the legalistic definition of privatisation failure.

So far, the State has been implicitly assumed to be a system set up by a benevolent if incompetent designer – in other words, the State’s responsibility for privatisation failure lies in its oversight and its inactivity. This assumption is habitually relaxed in economics. Frye and Shleifer (1997), for instance, define three basic views (Weberian ‘ideal types’) of how ‘bureaucrats and entrepreneurs interact during transition, as well as more generally’38. Privatisation outcomes can be thus related to the type of State itself; indeed, they can be used as an indicator. The three ‘models of government’ are summarised in Figure 2.

Figure 2: Economic role of the state during transition (Frye and Shleifer 1997)

|

Model |

Legal environment |

Regulatory environment |

|

Invisible-hand |

Government is not above law and uses power to supply minimal public goods. Courts enforce contracts. |

Government follows rules. Regulation is minimal. Little corruption. |

|

Helping-hand |

Government is above law but uses power to help business. State officials enforce contracts. |

Government aggressively regulates to promote some business. Organized corruption. |

|

Grabbing-hand |

Government is above law and uses power to extract rents. The legal system does not work. Mafia replaces state as enforcer. |

Predatory regulations. Disorganized corruption. |

Frye and Shleifer define each model of the State in terms of its legal and regulatory environment. But the chain of causation is by no means clear – is the dire state of the legal system a consequence of the grabbing-hand State or is it the other way round? Or are both influenced by a third, hidden factor?

Towards formalising failure

‘It doesn’t follow that in order to attract foreign capital or to send a “positive signal,” we should rush into selling – below the long-term potential valuation – profitable Slovene businesses and strategic infrastructure companies. Without analysing the broader consequences and without considering the long-term consequences, you just don’t do that.

Successful nations take advantage of foreign capital, but are careful to remain owners to a sufficient extent. This way, they retain a decisive option to influence their own future’39.

Opponents often refer to ‘the State’s heirlooms,’ ‘the national patrimony’ or to its ‘family silver’. These buzzwords imply the speaker is not against privatisation as such, merely against a particular privatisation target (often by evoking the ‘national interest’ and the company’s ‘strategic importance’), or against a particular privatisation timing. But behind ideology and opportunism there lies a valid point: privatisation is indeed irreversible (the State’s ability to renationalised assets at some later time is severely constrained by its membership international organisations) and privatisation is indeed affected by several types of uncertainty (political, macroeconomic or financial).

Politicians and activists who insist on postponing or even cancelling privatisation appear to be intuitively using the ‘options’ concept originating from finance. In order to criticise such positions validly, one should take their authors by their words and assess how they measure up against a framework they themselves are accidentally proposing. What follows is by no means a formal exposition of the underlying theory but a short summary of the main implications for privatisation theory.

Option is a contract that gives its owner the right – but not the obligation – to buy or sell an asset at a future date of his or her choosing40. Similarly, a privatisation program gives the State the opportunity but no obligation to dispose of a company (unless required by international lenders). This optionality is further reflected in persistent rumours that place certain companies among privatisation targets (e.g. Triglav, the leading Slovene insurance company, and Telekom, the former telecommunications monopolist). But the State still has not exercised the option (since it is open-ended, it can be modelled as a perpetual American put option).

This waiting also raised the cost of privatisation – but only if compared to a now-or-never privatisation campaign. Are the talks earnest or is it just a manoeuvre to postpone privatisation, perhaps indefinitely? And why postpone it in any case? Leaving aside ideological arguments about the merits and demerits of privatisation, financial economics has developed methods to determine the optimal timing of privatisation (now, later, or perhaps never). Note that by adding some extra assumptions and complexity, real option models can be calibrated with real-life data to generate valuation ranges for State-owned enterprises and to determine the optimal (i.e. the State’s wealth-maximising) privatisation timing at the level of individual privatisation targets.

A real option framework presumes that Slovene politicians are indeed rationally maximising the state coffers (no assumption is being made about the potential for graft and how it influences the decision to privatise or not). Finally, valuation models churn out fair valuations of the option to privatise, which a rational decision-maker would use in order to decide whether to privatise a given firm (‘to exercise the option’) or keep it.

The decisions he or she actually takes (or postpones) may turn out to be ‘irrational’ in this very limited, model-based sense. Significant deviations from the theoretically-derived ‘rational policy’ point to privatisation failure or even to sheer corruption (keeping the assumption that policy makers are rational). Deviations from these theoretically determined values can be taken as a measure of privatisation failure. Similarly, the failure to privatise can be defined as the failure to exercise the privatisation option at the optimal time.

1Smith, S. C., B.-C. Cin and M. Vodopivec (1997). “Privatization incidence, ownership forms, and firm performance: evidence from Slovenia.” Journal of Comparative Economics 25 (2): 158‒179.

2Simoneti, M., A. Bohm, M. Rojec, J. Damijan and B. Majcen (2001). “Secondary privatization in Slovenia: Evolution of ownership structure and company performance following mass privatization.” CASE Network Reports (46).

3AUKN. (2011). “Strategija upravljanja kapitalskih naložb Republike Slovenije.” Retrieved: December 29, 2014, from http://www.auknrs.si/f/docs/Obvestila_za_javnost/Strategija_upravljanja_november_2011_1.pdf.

4No consolidated list of State holdings exists even in 2013. The complex network of SOE cross-holdings can be illustrated with the ownership structure of Triglav, the largest Slovene insurance company by market share – 34.47% of its shares are controlled by the State Pension Fund, 28.97% by the State-owned Compensation Fund (Slovenska odškodninska družba, SOD, which in late 2013 is being restructured into the Slovene Sovereign Wealth Fund), and 3.06% by NLB (the State-owned bank with the largest market share in the country). The remainder is held by the private sector, mainly by institutional investors. Now Triglav controls, through its wholly-owned investment vehicle Triglav Naložbe, a diversified portfolio of firms, ranging from a 39.07%-stake in Nama, a Ljubljana department store, to 80.10% of Golf Arboretum, a 18-hole golf course (Triglav Group (2013). Annual Report 2012. Ljubljana.). None of such investments by State-controlled holdings appear in the official list of State-owned enterprises (SOD. (2013). “Letno poročilo upravljavca neposrednih kapitalskih naložb RS 2012 [Annual Report by the manager of sovereign investments].” Retrieved December 29, 2014, from http://www.so-druzba.si/files/1371817044LETNOPOROILOZA2012.pdf).

5OECD (2013). OECD Economic Surveys: Slovenia 2013, OECD Publishing, p.65.

6IMF. (2013). “Slovenia 2013 Staff Visit—Concluding Statement of the Mission.” Retrieved December 29, 2014, from http://www.imf.org/external/np/ms/2013/031813d.htm.

7Pleskovič, B. and J. D. Sachs (1994). Political independence and economic reform in Slovenia. The Transition in Eastern Europe. Chicago, University of Chicago Press. 1: 191‒220.

8‘Mass privatization was formally completed at the end of 1998 but has actually remained uncompleted on both the demand and supply sides’ (Simoneti, M., A. Bohm, M. Rojec, J. Damijan and B. Majcen (2001). “Secondary privatization in Slovenia: Evolution of ownership structure and company performance following mass privatization.” CASE Network Reports (46)).

9Simoneti, M., A. Bohm, M. Rojec, J. Damijan and B. Majcen (2001). “Secondary privatization in Slovenia: Evolution of ownership structure and company performance following mass privatization.” CASE Network Reports (46), p.7.

10In May 2013, the Slovene government announced 15 SOE targets for imminent privatisation, in fulfilment of its commitments given to the European Commission in the course of the Excessive Deficit Procedure. The shortlist includes Adria Airways (the national airline), Ljubljana Airport, Telekom Slovenije (the former telecommunications monopoly), NKBM (Slovenia’s second largest bank), Terme Olimia Bazeni (a spa resort), as well as two chemical companies, Helios and Cinkarna Celje. UKOM. (2013). “8. redna seja vlade [press release after the 8th meeting of the government].” Retrieved December 29, 2014, from http://www.vlada.si/fileadmin/dokumenti/si/Sporocila_za_javnost/sevl13-8.doc.

11Introducing Phase 0 and 1 into analysis could also be thought of as the opening up of the ‘black box’ of the privatisation process. It also implies that some types of failure can be identified even while privatisation is on-going, whereas failure in outcomes is only observable after privatisation had been completed, i.e. with a significant time lag.

12Kornai, J. (1999). Reforming the Welfare State in Postsocialist Economies. When is Transition Over? A. N. Brown. Kalamazoo, MI, W.E. Upjohn Institute for Employment Research: 99‒113.

13Vuylsteke, C. (1988). Techniques of Privatization of State-owned Enterprises: Methods and implementation, World Bank, p.8.

14Ferguson, P. R. (1992). “Privatisation options for Eastern Europe: the irrelevance of Western experience.” World Economy 15 (4): 487‒504.

15Zinnes, C., Y. Eilat and J. Sachs (2001). “The gains from privatization in transition economies: Is “change of ownership” enough?” IMF Staff papers: 146‒170.

16[Ownership Transformation of Companies Act] (1992). Zakon o lastninskem preoblikovanju podjetij, Uradni list. 55/1992: 3117.

17Čeh, S. (1993). Kako se privatizirajo podjetja [How companies privitise themselves]. Delo. Ljubljana.

18[Denationalization Act] (1991). Zakon o denacionalizaciji, Uradni list. 27l/1991: 1093.

19[Housing Act] (1991). Stanovanjski zakon, Uradni list. 18/1991: 589.

20[National Farm Land and Forest Fund Act] (1993). Zakon o Skladu kmetijskih zemljišč in gozdov Republike Slovenije, Uradni list. 10/1993: 454.

21Čeh, S. (1993). Kako se privatizirajo podjetja [How companies privitise themselves]. Delo. Ljubljana.

22[Ministry of Interior] (1995). Poročilo o delu na področju lastninskega preoblikovanja podjetij [Report on the work in the field of privatisation of enterprises]. Ljubljana, p.4.

23Therefore, the law acted retroactively. The first Privatisation Act of 1992 merely provided for retrospective audits of a limited number of transactions that resulted in a change of ownership structure. The amended text of 1993, however, not only expanded this list of suspicious business activities but also defined them as ‘injuries of socially-owned property’, as well as introduced legal sanctions.

24[Ownership Transformation of Companies Amendment Act] (1993). Zakon o spremembah in dopolnitvah Zakona o lastninskem preoblikovanju podjetij, Uradni list. 31/1993: 1699.

25Ustavno sodišče (1994). Odločba o razveljavitvi tretjega odstavka 51. člena in o ugotovitvi, da določbe 48. a, 48. b in 48. c člena zakona o lastninskem preoblikovanju podjetij niso v neskladju z ustavo, Uradni list. 32/1994: 2102.

26Žušt, R. and A. Kovač Arh. (2004). “Zadnje poročilo o delu Agencije za revidiranje na dan 31. 7. 2004 [Closing report by the Privatisation Audit Agency].” Retrieved December 29, 2014, from http://www.arlpp.gov.si/porocilo_o_delu_2004.doc.

27[Ministry of Interior] (1995). Poročilo o delu na področju lastninskega preoblikovanja podjetij [Report on the work in the field of privatisation of enterprises]. Ljubljana.

28Smith, S. C., B.-C. Cin and M. Vodopivec (1997). “Privatization incidence, ownership forms, and firm performance: evidence from Slovenia.” Journal of Comparative Economics 25(2): 158‒179.

29Ibid.

30Ibid.

31Was proto-privatisation criminalised in order to cut short (and attempt to reverse) on-going looting, or merely ex-post abuse of power? Further research is needed to uncover conclusive evidence in favour of either hypothesis. Writing during Stage 1 privatisation, the Slovene sociologist Veljko Rus (Rus, V. (1993). “Socialna evalvacija privatizacije [The social evaluation of privatisation].” Teorija in praksa 30(7/8), p. 610) observed: ‘the asserted dominance of external owners (State funds and citizen shareholders) over internal owners (workers and managers) […] was of course entirely politically motivated, since it wanted to take away the property as well as capital from “red” managers and workers, and to transfer it to State funds as well as to citizens, over which greater control could be held by parties of the then ruling coalition’.

32Lekše, M. (1993). Vsi kapitalizmi niso enaki [Interview with Dr Jože Mencinger]. Dnevnik. Ljubljana.

33Toš, N. (1991). Slovensko javno mnenje 1991/1. Ljubljana, FSPN, CJMMK.

34Toš, N. (1990). Slovensko javno mnenje 1990/2 [Slovene public opinion]. Ljubljana, FSPN, CJMMK.

35Toš, N. (1990). Slovensko javno mnenje 1990/2 [Slovene public opinion]. Ljubljana, FSPN, CJMMK.

36Toš, N. (1991). Slovensko javno mnenje 1991/1. Ljubljana, FSPN, CJMMK.

37Toš, N. (1992). Slovensko javno mnenje 1992/2. Ljubljana, FSPN, CJMMK.

38Frye, T. and A. Shleifer (1997). “The invisible hand and the grabbing hand.” American Economic Review 87 (2): 354‒358.

39Golob, M. (2013). Ko enkrat prodaš [Once you sell]. Večer. Maribor: 9.

40Schulmerich, M. (2010). Real Options Valuation: The Importance of Interest Rate Modelling in Theory and Practice, Springer.