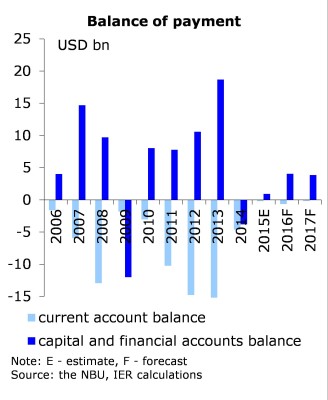

The beginning of 2016 is associated with downward trend for prices on commodities, which puts additional pressure on Ukraine’s exports. Decline in prices for imported crude oil and gas does not compensate for lower nominal exports, which results in higher than previously expected exchange rate vulnerability. Demand for foreign currency also increased due to high fiscal spending in the end of 2015 as well as increased depreciation expectations associated with crash in global stock markets and stalled IMF program. However, the IMF is most likely to provide next tranche of the loan within the next few months and liquidity of foreign exchange market is expected to increase in spring. This should help calm down volatility of the exchange rate. The fiscal position of the Government remains comparatively strong. The Government is expected to continue reforms implementation, which would also result in additional support by official international donors. Overall, real GDP is expected to grow by 1.7% in 2016.

The beginning of 2016 is associated with downward trend for prices on commodities, which puts additional pressure on Ukraine’s exports. Decline in prices for imported crude oil and gas does not compensate for lower nominal exports, which results in higher than previously expected exchange rate vulnerability. Demand for foreign currency also increased due to high fiscal spending in the end of 2015 as well as increased depreciation expectations associated with crash in global stock markets and stalled IMF program. However, the IMF is most likely to provide next tranche of the loan within the next few months and liquidity of foreign exchange market is expected to increase in spring. This should help calm down volatility of the exchange rate. The fiscal position of the Government remains comparatively strong. The Government is expected to continue reforms implementation, which would also result in additional support by official international donors. Overall, real GDP is expected to grow by 1.7% in 2016.

Still, political uncertainty makes downward risk for the forecast more severe as prolonged political crisis will damage both medium-term growth prospects and short-term macroeconomic stability. If the political crisis is not resolved in the nearest future, it would result in the further delays if the next tranche of the IMF loan and may lead to delays in other funding. This will reduce further the flexibility of the NBU in dealing with hryvnia volatility. In particular, depreciation expectations increased more than previously expected due to domestic instability, falling global financial market, and collapse in commodity prices.

Key Forecast Figures for Baseline Scenario

Forecast calculations were completed on February 3, 2016.

Forecast calculations were completed on February 3, 2016.

GDP: Bounce in 2016

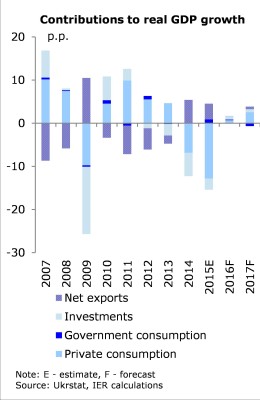

Real GDP in 2016 is expected to increase by 1.7% in 2016 (decline in real GDP is estimated at 10.8% in 2015). We assume that the Government will continue reforms required for provision of assistance of official donors, including the IMF. In particular, the Government will continue anti-corruption measures, reduce tax avoidance (levelling playing field for business), increase efficiency and transparency of fiscal spending. The deregulation is likely to be continued, which would help to moderately improve investment climate. Moreover, the Government will be able to restart privatisation process.

Real exports is projected to remain stable as Ukrainian producers are expected to reallocate sales from Russian market to the EU and other countries.

Domestic demand will also bounce back slightly as wages will recover some of the purchasing power lost in 2015 and companies will finance overdue investment projects. Labour market is expected to remain weak as unemployment rate is estimated to increase primarily due to decline of employees in public sectors. Stabilisation of the banking sector will not be able to drag demand.

We expect that real gross value added will increase in all sectors, except for agriculture.

GDP: Real Growth in 2017

We forecast real GDP growth in 2017 at 3.2% due to higher external and domestic demand. Real exports will increase more than real imports. Ukraine will not increase energy imports. Some increase in world commodity prices will stimulate higher nominal exports. Still, hryvnia will somewhat depreciate as the NBU policy focus will be shifted to inflation targeting.

Better financial situation of companies will stimulate growth of consumption and investment demand. In particular, we expect that investments will continue to grow in 2017 due to recovery of economic activity, improved financial situation of companies and higher bank lending. However, wage growth will be limited by attempts of companies to increase financing primarily for investments. The Government is not likely to increase substantially gross wage bill in public sectors.

The Government will continue reforms, which would mean further support of international donors. Some of the assistance will be allocated to financing of infrastructural projects.

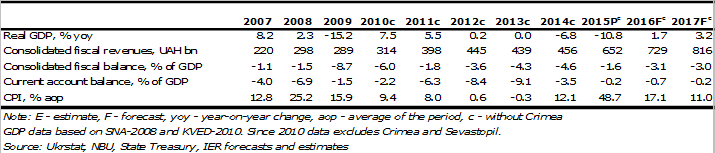

Fiscal Indicators: Decline in Government Sector

2016. The year has started with changed tax and fiscal legislation. The largest change is the reduction of the single social contribution (SSC) rate from effective rate of 41% to the flat rate of 22%. Besides, employees’ part of SSC at 3.6% of wage was abolished. This is projected to result in (limited) wage de-shadowing. In addition, the Government stepped up efforts to fight with so-called ‘converting centers’ (that cash funds from bank accounts illegally).

2016. The year has started with changed tax and fiscal legislation. The largest change is the reduction of the single social contribution (SSC) rate from effective rate of 41% to the flat rate of 22%. Besides, employees’ part of SSC at 3.6% of wage was abolished. This is projected to result in (limited) wage de-shadowing. In addition, the Government stepped up efforts to fight with so-called ‘converting centers’ (that cash funds from bank accounts illegally).

The reduction of the SSC resulted in sharp increase of the planned central fiscal transfer to the Pension Fund. Limited increase in gross wage bill in public sectors and more efficient public procurement spending would result in decline in fiscal expenditures in relation to GDP for wage payments and purchases of goods and services. Interest on debt will also fall in relation to GDP. Overall, consolidated fiscal expenditures are expected to remain close to the level of 2015. Consolidated fiscal revenues will decline by 1.1 p.p. in relation to GDP due to lower non-tax revenues. Decline in fiscal revenues will be counterweighted by increase in consolidated fiscal deficit to 3.1% of GDP.

2017. Fiscal situation is not likely to change substantially in 2017. Changes in tax laws are expected to focus on easing of tax administration. At the same time, we assume no major changes in key tax rates as high social commitments make tax rates decreases unlikely.

We expect further increase in efficiency of fiscal spending in part due to improvements in public procurement as well as conducted reforms in healthcare and education. The Government will continue reducing number of civil servants and employees in public sectors, but this will have to be offset by increasing wages to preserve quality of public services. Consolidated fiscal deficit is forecasted to decline to 3.0% of GDP.

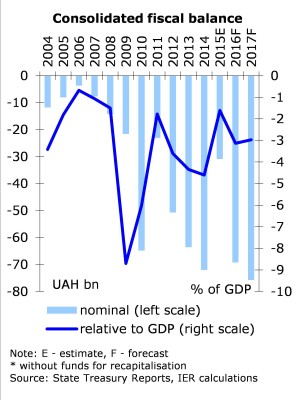

Balance of Payment: Current Account Remains in Deficit

2016. The current account deficit is expected at USD 0.6 bn in 2016. External demand for Ukrainian goods will remain weak, while downward price trend at the commodity markets is likely to prevail for entire year. The crop harvest is likely to be lower than in 2015 hampering exports potential. Imports will be influenced by continuing reduction of gas consumption in Ukraine. We forecast merchandise trade deficit at USD 2.9 bn as flat real exports growth will be worsened by lower prices. Nominal exports of goods is expected to decrease by 5.1%, while imports is projected to decrease by 5.5%.

2016. The current account deficit is expected at USD 0.6 bn in 2016. External demand for Ukrainian goods will remain weak, while downward price trend at the commodity markets is likely to prevail for entire year. The crop harvest is likely to be lower than in 2015 hampering exports potential. Imports will be influenced by continuing reduction of gas consumption in Ukraine. We forecast merchandise trade deficit at USD 2.9 bn as flat real exports growth will be worsened by lower prices. Nominal exports of goods is expected to decrease by 5.1%, while imports is projected to decrease by 5.5%.

Financial and capital account surplus in 2016 is expected at USD 4.1 bn, or 4.6% GDP. FDI will increase to USD 3.0 bn due to continuing recapitalization of banks. Some investments will be allocated to the real sector. Besides, the Government is expected to receive financial support of international official donors under assumption of continued implementation of reforms.

2017. We expect that current account deficit will narrow to USD 0.2 bn or 0.2% GDP due to rebound of both real exports and increase in export prices. Real import increase will be limited because of lower purchases of imported natural gas.

We expect that financial and capital account balance in 2017 will widen to USD 3.9 bn, or 3.8% GDP. Net FDI inflow is projected to increase slightly to USD 3.2 bn and will be mainly directed to the real sector. The situation with external borrowing will remain unchanged. The Government will attract external financing, whereas real sector and banks, despite some improvement, will remain in shortage of external debt financing.

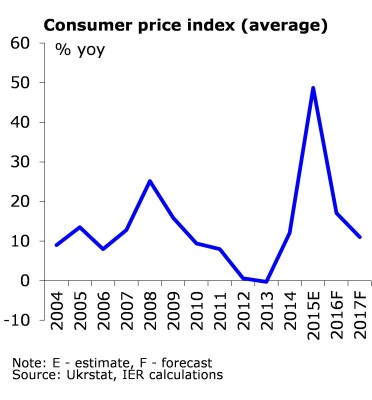

Inflation and Exchange Rate: Difficult Road to Single Digits of Inflation

2016. Recent increase in inflation expectations as well as direct increase in import costs increased pressure on prices. However, we assume that oil prices would remain in USD 30-50 range in 2016 and global food prices will not recover significantly from multiyear lows observed in January 2016 (FAO cereals and vegetable oil price indices in January 2016 dropped to 2006/2007 MY levels). This will help to contain prices for tradable goods. Moreover, we expect exchange rate volatility to reduce in the second quarter of 2016. Overall, we expect CPI to increase by 13.9% yoy in December 2016.

2016. Recent increase in inflation expectations as well as direct increase in import costs increased pressure on prices. However, we assume that oil prices would remain in USD 30-50 range in 2016 and global food prices will not recover significantly from multiyear lows observed in January 2016 (FAO cereals and vegetable oil price indices in January 2016 dropped to 2006/2007 MY levels). This will help to contain prices for tradable goods. Moreover, we expect exchange rate volatility to reduce in the second quarter of 2016. Overall, we expect CPI to increase by 13.9% yoy in December 2016.

2017. Next year we expect global commodity prices to bounce back moderately. Domestic demand will continue to grow at considerable pace in response to lower taxation of wages and higher consumer confidence. Inflation expectations are unlikely to drop to single digits and depreciation expectations will likely remain substantial.

Still, we project that low volatility of exchange rate will help anchor inflation expectations. Weak labour market and significant unused production capacity will limit demand pressure on inflation. This means that consumer inflation will slow down to 10.3% yoy in December 2017.

High Political Risks: The Economic Growth Might Be Delayed

Political uncertainty delayed the next tranche of the IMF loan (which was scheduled for the end of 2015) and may lead to delays in other funding. Domestic instability, falling global financial market, and collapse in commodity prices led to higher than expected depreciation expectations and lower exports receipts. Uncertainty over external funding reduced the flexibility of the NBU in dealing with hryvnia volatility. This resulted in hryvnia depreciation during the month from UAH 25.44 per USD to UAH 27.09 per USD in the last day of the month (at the interbank currency exchange market). Interestingly, spread between cash rate and interbank rate reduced sharply. Therefore, our expectations for exchange rate and inflation in 2016 will likely turn out too optimistic. Impact of extra hryvnia depreciation on inflation will be moderated by impact of lower than expected commodity prices.

If the political crisis is not resolved in the nearest future it would result in further termination of reforms, which would then indicate postponement of assistance from official donors and, thus, larger hryvnia depreciation and higher inflation. As a result, real GDP will continue falling in 2016 under pessimistic scenario.

The article was published on March 3, 2016 as Issue #2 (101) of Macroeconomic Forecast Ukraine (http://www.ier.com.ua/en/publications/regular_products/forecast?pid=5194)