Greek run continues – sPain or sPanic? Fiscal rules will be strict. Right after exemptions for Spain, Italy…Will Spiderman save the banks? Can somebody who doesn’t pay taxes criticize others for not paying taxes? Who works the hardest in the EU? Will Greeks unveil the European bluff?

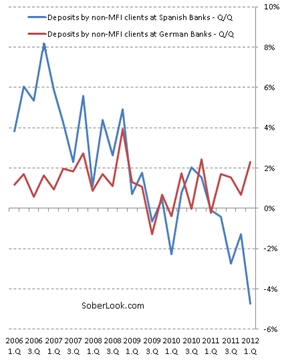

Jogging on banks in peripheries continues. EUR 31 billion (1.9%) were withdrawn from Spain in April. Portuguese central bank also warns against possible withdrawal of the deposits from the country. In Greece prompts of the police (out of whom over a half voted for the neonazi Golden Dawn party) not to withdraw money from bank accounts didn’t help. It seems that before Greece leaves euro, euro will leave Greece (Tyler Cowen).

Situation was supposed to get calmer after suggestions that the EU should become a „banking union“,that means everyone should share the bill for saving the banks, regardless of the bank’s home country and distribution of the profits of these private institutions. These suggestions remain only suggestions since the treasurer of the eurozone Angela Merkel says clear „Nein!“.

Situation was supposed to get calmer after suggestions that the EU should become a „banking union“,that means everyone should share the bill for saving the banks, regardless of the bank’s home country and distribution of the profits of these private institutions. These suggestions remain only suggestions since the treasurer of the eurozone Angela Merkel says clear „Nein!“.

Oh, Spain. This week was rich in news mainly from this country. Almost all were entirely bad. sPain? sPanic? sQuit? Whatever you call it, Spain is going downTthe future of the eurozone will be probably decided in this country.

The volume of retail sales which indicates well-being of a society continues its free fall in Spain.It decreased by significant number of 9.8% in April. Sales have already fallen to the level of 1999. If we take population growth into account, then sales per capita reached the level of 17 years ago. Do you see space for „European solidarity“ there? Then you should probably beg, not donate, since Slovakia also observed significant fall in sales volume (-16%) since the introduction of euro.

It won’t come as a surprise that the new rules concerning responsible fiscal management, which were supposed to be imposed by impotent Stability Pact, won’t apply to such a troubled countrylike Spain. Strict rules would probably be too strict. The European Commission suggests that the target of decreasing deficit of public finances to 3% GDP should be postponed by a year. But there won’t be any exceptions in the future! Really! Taking into account the recent earthquake, Italy also wants to ask for exemption from meeting the fiscal pact’s requirements.

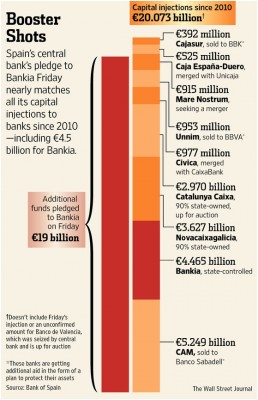

Spain is saving its third biggest bank Bankia. Real estate prices have just started to fall significantly to the level, where supply meets demand. The EUR 4 billion needed for recapitalization turned into 19 billion in just a few days. Bankia’s executives were paid EUR 22 million in 2011. Together with EUR 20 billion, which the state has already spent to save Spanish banks since 2010, the bill for socializing the bank losses reached EUR 39 billion for the taxpayers. Financial alchemy was supposed to be used as well in the process of saving Bankia -the bank would be recapitalized with Spanish state bonds, which would be used as collateral in ECB by Bankia in the next step and ECB would lend further fresh euros. But ECB ruined the whole operation, since it was against it. Apparently it was resembling a direct support for financing country’s central bank too obviously. Who knows, what purchases of sovereign bonds by ECB or commercial banks purchasing sovereign bonds thanks to LTRO, are similar to. Meanwhile, Bankia decided to solve the problem of scared clients withdrawing money in a very original way. For a deposit of EUR 300 you could get a towel with Spiderman! The bank withdrew this attractive offer when it was publicized by Zero Hedge blog.

The richest Spanish region of Catalonia asked the government for help.

ECB President Mario Draghi called for politicians to come up with a vision of the European Union’s future. At the same time it turned out that he wrote in his thesis how the eurozone would not function. Article in which you can read about it is entitled „Draghi admits he erred as a student“. Really? Given the raging eurozone crisis it seems to me that rather than the Draghi-student it is the Draghi-ECB president who is wrong. „It probably is about time to judge the euro zone as a failed idea.“ writes the economist Tyler Cown. „There is also talk of forming a true fiscal union, but that seems to be doubling down on a bad idea. If the euro zone cannot summon enough cooperation now, how is any union requiring tighter cooperation supposed to work?“

International Monetary Fund’s head lost her nerve. “I think they should also help themselves collectively … by all paying their tax,” she told the Greeks. She feels more pity towards African children than students in Greece. Annual tax evasion in Greece is estimated at EUR 40-45 billion. Other representatives of IMF cooled her down a bit and she reportedly regreted her way of addressing Greece. By the way, Lagarde doesn’t pay any taxes from her annual income of $551 700.

Photo from the Ministry of Finance from an interesting document „The Greek Lie“ about Greece by German ZDF.

Greeks are losing revenues from taxes; they decreased by 10% on monthly basis. To cover the expenses of the state, they will use 3 billion which remained from the first aid package. Foreign money will be spent around the time the elections will be over (17/06). The results of the elections will determine if Europe will send more money. Meanwhile, the uncertainty about the future is destroying the Greek economy. Companies don’t want to do business with Greece, the largest credit insurance company in the world Eurler Hermes doesn’t want to insure exports to this country. And foreign investors are reluctant to buy interestingly priced Greek assets (Greek assets market has already decreased by 90% from its peak) because of the uncertainty. New York Times had a glimpse under the skirt of European solidarity with Greek nation and came to the conclusion that only one third of money which is supposed to „save Greece“ actually reaches Greek hands. Two thirds travel back outside Greek borders to the foreign creditors (financial institutions).

According to the recent survey by German state TV ZDF majority of Germans think that membership in the eurozone causes more disadvantages than advantages. This is not good news for euro. The future of the eurozone to a big extent depends on the German willingness to allow the Southerners a free access to their wallet.

And what do the Greeks think? Whichnation according to them works the hardest in Europe?…. Greeks. It is interesting that the rest of Europe thinks that about Germans.

Some German professors would rather see Greece outside eurozone as soon as possible. As the former banker of Bundesbank and professor of economy Wilhelm Noelling says: „Better an end with horror than a horror without end.“ Michael Saunders, economist of Citigroup bets that Grexit will happen until Jnuary 1, 2013. Given that during the expulsion Greece it will also break away from the euro-breast feeding in a form of the program Emergency Liquidity Assistence (within which Greece today creates new euros covered by dubious collateral, not meeting the requirements of ECB), such decision will have political character and it won’t be made by central bankers in ECB.

Greeks don’t believe that anyone will expulse them from the eurozone: “No one  can force us to leave the euro. Now that they have us, they’re stuck with us,” says Makis Deligiannis, a baker from Athens. “They’re just barking to scare us but actually they’re the ones who are scared,” he added.

can force us to leave the euro. Now that they have us, they’re stuck with us,” says Makis Deligiannis, a baker from Athens. “They’re just barking to scare us but actually they’re the ones who are scared,” he added.

Austrian Der Standard thinks that in the case of uncontrolled and chaotic Greek exit, European Union might close the state borders in Europe. Since Thursday Greeks can’t travel with cash exceeding EUR 7 000.

Have a weekend of travelling with bags full of money

Juraj Karpiš

P.S.:Rather avoid Everest, it’s crowded there:

http://www.outsideonline.com/featured-videos/adventure-videos/climbing/Summit-Day-on-Everest.html