In late August 2025, the Institute for Economic Research and Policy Consulting (IER) released the results of its 40th monthly Business Tendency Survey, covering 474 industrial enterprises across Ukraine. The findings paint a picture of cautious optimism in the short term, but deep uncertainty over the longer horizon.

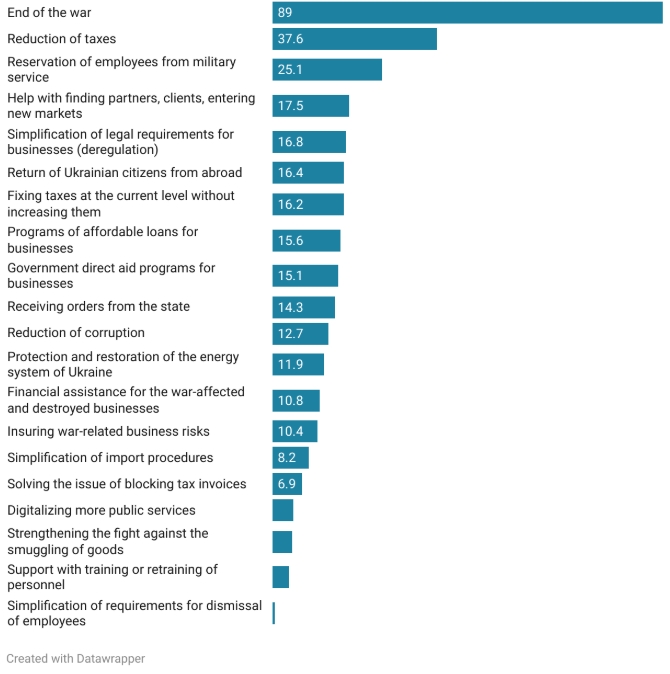

Most strikingly, 89% of entrepreneurs named “ending the war” as the single most important condition for business development. Despite improvements in production expectations and some stabilization of orders, the persistence of war-related risks, labor shortages, and inflationary pressures continues to dominate the business environment.

Recovery Index Shows Fragile Momentum

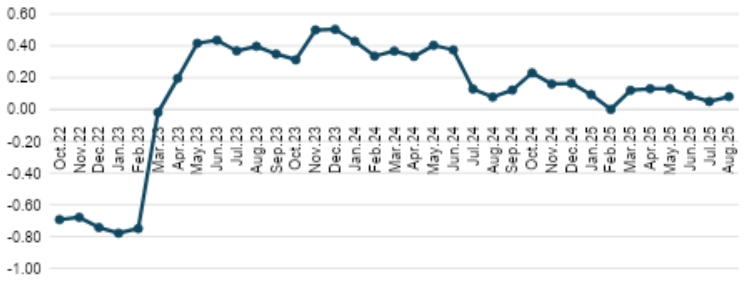

After two months of decline, the Business Recovery Index (BRI) rose modestly from 0.05 in July to 0.08 in August. A positive value close to zero indicates that, compared to last year, businesses no longer see significant deterioration, but neither do they perceive strong improvements.

Figure 1 BARI

The divergence across company size remains sharp: microbusinesses report a negative index (-0.33), while large enterprises lead with +0.29. Overall, 63% of enterprises operated at full or nearly full capacity, the same share as in July but a dramatic increase compared to just 41% in August 2024. This stabilization reflects a gradual adjustment to wartime conditions.

The aggregate industry outlook indicator, which measures short-term expectations, rose to 0.14 — the highest level since April 2024. Production expectations surged most significantly, from 0.38 in July to 0.49 in August, driven by an increase in the share of optimists from 39% to 46.8%, while the share of pessimists remained steady at just over 4%. Export expectations followed a similar trend, reaching a value of 0.48.

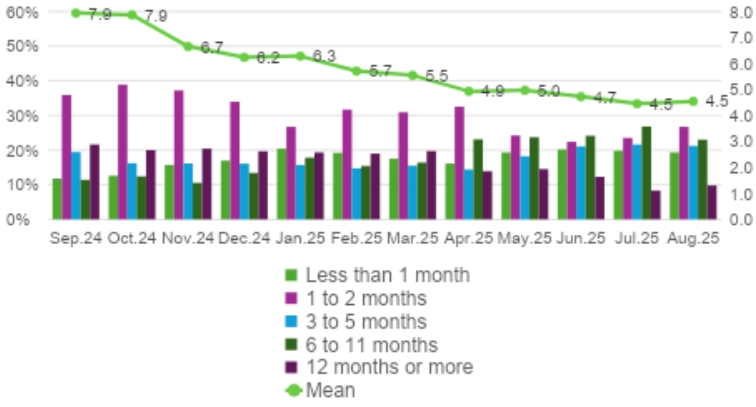

At the same time, the average duration of order portfolios stabilized at 4.5 months, with 10% of firms now holding contracts lasting one year or more. The wood-processing industry leads with the longest order books (5.3 months), while construction materials firms have the shortest (2.2 months).

Figure 2. New Orders

Short-Term Stability, Long-Term Uncertainty

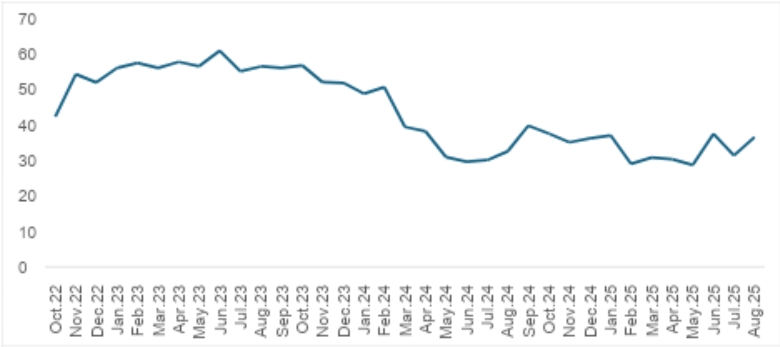

Expectations differ sharply across time horizons. Uncertainty in the three-month perspective has remained essentially unchanged. At the same time, in the six-month horizon, it has increased for enterprise-level financial conditions (21.9%) and remained stable for the broader economic environment (23.6%).

Figure 3: “It is hard to predict what will happen with the activities of our enterprise in 2 years,” % of answers.

Most worrying, however, is the surge in long-term uncertainty. In August, 36.5% of businesses reported having no clear vision of their activities over the next two years, up from 31.4% in July. The share of entrepreneurs who expect no significant changes in production over that period declined from 82.8% to 77.8%. This shift was driven by both an increase in firms planning to expand production (from 15.2% to 17.5%) and those expecting contraction (from 2% to 4.7%).

War Shapes Business Priorities

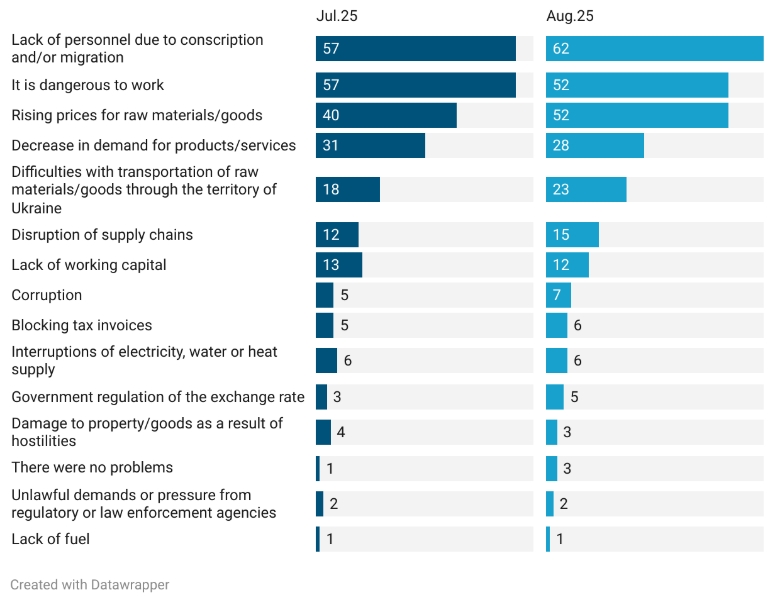

The survey confirms that, beyond cyclical indicators, structural constraints remain firmly tied to the ongoing war. The top three obstacles to business, cited by 62%, 52%, and 52% of respondents, respectively, are labor shortages, security risks, and rising prices.

Figure 4. Impediments to business development, % of respondents

Labor shortages have worsened: the share of firms reporting difficulties in finding qualified workers rose from 44.8% in July to 50.1% in August. By contrast, problems with unqualified labor remained stable at around 36%. The primary cause remains mobilization and outmigration. Shortages of workers have grown by 5 percentage points to 62%, making it the most significant barrier to business.

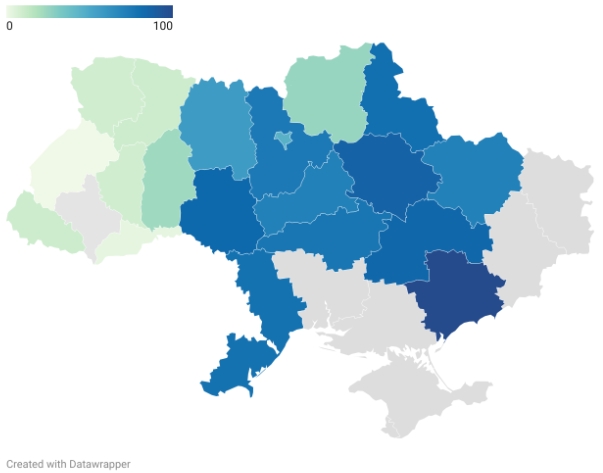

Regional differences are also significant. Large enterprises (64%) are far more likely than microbusinesses (43%) to cite “dangerous working conditions.” Predictably, firms closer to the front line and in central Ukraine are more likely to report security risks than those in the west.

Figure 5. “It is dangerous to work” by oblast, % of respondents

Other barriers include reduced demand (28%), transportation difficulties (23%), and supply chain disruptions (15%). Just 12% of businesses report insufficient working capital as a primary problem, while fewer than 10% cite issues such as utility outages. Indeed, electricity cuts resulted in minimal losses in July—just 2% of working time on average—with only 10% of firms temporarily suspending operations.

Inflationary Pressures Mount

Inflation expectations are rising again. The share of firms observing price increases for raw materials jumped from 26.4% in July to 35.8% in August. At the same time, 40.6% expect further price growth, up from 38.9%. For finished goods, 36.7% of businesses reported higher prices (versus 29.6% in July), while 40% anticipate continued growth. This inflationary environment compounds uncertainty, particularly in industries that are heavily reliant on imported inputs or energy-intensive processes.

What Businesses Want from Policy

When asked which policy measures would most improve the business environment, ending the war ranked first for an overwhelming 89% of respondents. Tax reduction was the second most popular option (37.6%), although it had decreased by almost 10% since January. Third came labor reservation policies (25.1%), reflecting ongoing concerns about workforce availability.

Figure 6. Key events or measures that would most improve business conditions, % of respondents

Other priorities include support for entering new markets, partner and client search, deregulation, return of Ukrainians from abroad, tax freezes, affordable loans, and direct budgetary support programs.

Interestingly, the share of positive evaluations of government economic policy rose from 2% to 8% in August, marking the highest level in over a year. This may be linked to improved short- and medium-term expectations, though neutrality remains the dominant sentiment (55%), while negative assessments still account for 25%.

Between Hope and Hesitation

The August survey illustrates the paradox facing Ukrainian businesses. On the one hand, production expectations are improving, capacity utilization has stabilized, and firms are cautiously investing in longer-term contracts. On the other hand, labor shortages, security threats, and inflationary pressures continue to elevate uncertainty—particularly over the two-year horizon.

Most of all, businesses are sending a clear message: without a sustainable end to the war, neither optimism nor policy incentives can provide the certainty required for long-term investment and growth.

As Ukraine continues to fight for its sovereignty and economic survival, the voice of its entrepreneurs underscores a fundamental truth: peace is not only a political or humanitarian imperative, but also the single most decisive condition for economic recovery.

The IER’s New Monthly Enterprises Survey (#NRES) involves 474 Ukrainian industrial enterprises located in 21 of Ukraine’s 27 regions. The survey has been conducted on a monthly basis since May 2022.

The reports are here: http://www.ier.com.ua/en/proekt_dilova_dumka/NRES_Presentations

Written by Oksana Kuziakiv, Yevhen Angel, Anastasia Gulik

Continue exploring:

EU Road Requirements: Time and Cost for TEN-T Standards Adaptation in Ukraine

Ukraine’s Economy Shows Resilience with 8% Growth Despite Ongoing War Challenges