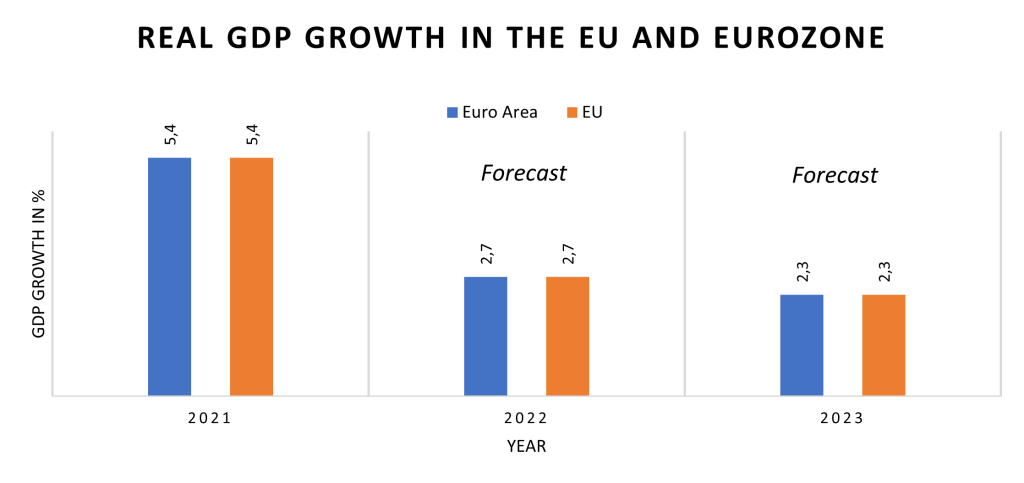

The EU Commission’s (EC) spring forecast, demonstrating the expected real growth for 2022 and 2023, was published exactly a day before the preliminary data for growth in the first quarter of 2022. According to this forecast the real GDP growth in both the EU and the Eurozone will be 2.7% and 2.3% for 2022 and 2023 respectively – a stable increase when accounting for disrupted supply routes, rising prices of natural gas and oil as well as the political uncertainty surrounding the war in Ukraine. But will the supposition of the EC become reality?

Source: The EU Commission’s spring economic forecast 2022

Source: The EU Commission’s spring economic forecast 2022

The preliminary data for Q1 points to growth in the EU of just 0.4% (and 0.3% in the Eurozone). If this rate is maintained then 2.7% is a practically unattainable aim for the EU. Afterall, it is not expected that during the second quarter there will be drastically significant economic activity while the sanctions against Russia and their reciprocal ones limit the scope for real growth.

The lack of certainty around gas deliveries and the rising prices of raw materials and oil additionally contribute to the already high average price level in the EU and Eurozone – where the average increase in prices of energy was 38% for April alone.

Even in the forecast it is clearly highlighted that in the post-pandemic situation a slow normalization and a significant growth of 5.4% ensued in 2021 but the war in Ukraine once again created macroeconomic uncertainty and a signified a new wave of supply-chain disruptions. Agriculture goods and the price of products like sunflower oil are expected to continue their price increase given that Russia and Ukraine are the top world exporters.

The report mentions the higher market volatility and the fall in investment caused by uncertainty and de-globalization. The EC predicts that this will negatively impact eastern European economies more due to their close proximity to the war.

In the last few months, the EU’s trade deficit continued to rise. It reached 27.7 billion euro in the EU in March 2022 (16.4 billion in the Eurozone). This deficit is expected to enlarge throughout the year due to rising prices of gas and oil, which the EU is a net importer of, and after the renewal of imported goods from China.

This will limit (even if only slightly) the increase in GDP of the EU regardless of the relatively positive data for industrial production and export. In the forecast the EC is certain that this factor will not have a significant influence on the GDP in 2022 and 2023.

Given all of these obstacles a rise in GDP of 2.7% for 2022 appears difficult to attain. In the report, however, a few factors are mentioned which could cause significant growth in the three quarters remaining compensating the poor results in the first quarter. The domestic trade in the EU and the recovery of tourism after COVID-19 most likely will compensate the negative of de-globalization. It is also expected that households will begin spending funds saved during the pandemic regardless of the uncertainty and war.

The forecast works with the supposition that COVID-19 will not cause any further strain on the economy. EC forecasts a drop in unemployment by 1.2% in 2022 with an assumption being that effective employment of the nearly 6 million Ukrainian refugees can stimulate economic activity. The expectation is that these new consumers will contribute to an overall rise in the consumption of goods and services and that approximately 8% of them will find jobs in 2022 (and around 20% will be part of the labor market by 2023).

There are many unknowns regarding these assumptions. In the chapter “Risks” the EC highlights that due to the ever-evolving situation the forecast is uncertain in many aspects. If prices of imported raw materials continue to rise after mid-2022 then there could be even more negative impacts on the economy that could stunt future growth.

And even though COVID-19 may not be a serious concern to the EU, the partial lockdowns like the one in Shanghai could interrupt the functioning of key industries and infrastructure – leading to damages of the European economy.

What Does This All Mean for Bulgaria?

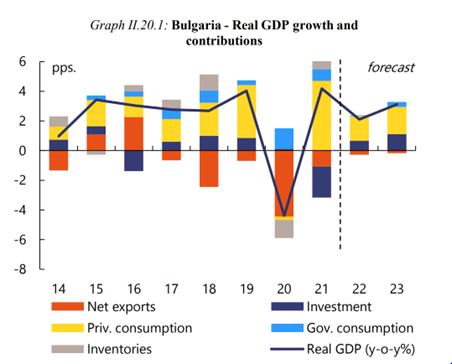

According to the report, the Bulgarian economy expanded by 1.0% in Q1 of 2022 – 2.5 times over the average EU growth – however, the EC nonetheless predicts only 2.1% annual growth; lower than the EU mean.

Source: The EU Commission’s spring economic forecast 2022

Source: The EU Commission’s spring economic forecast 2022

The EC claims that the high oil prices, disrupted supply of gas by Gazprom will lead to a one-off rise of natural gas prices and hence higher energy prices. According to the analysis this will undoubtedly lead to higher costs of production and stimulate producers and investors to maintain prices high, freeze salaries, reduce the number of new employees, and postpone the planned investments for 2022 until 2023 when the EC expect the inflation rate to fall to 5%.

The rise in private consumption is also expected to shrink to 2.8% in 2022 (it was 8% in 2021) because the increase in prices will lead to a fall in real income and thus in purchasing power.

Regardless of this forecast, the preliminary assessment of the National Statistical Institute (NSI) for Q1 2022 reports real growth of consumption of 1.7% and an over 14% real increase in wages in the private sector from the same quarter in the previous year (NSI – average gross salary). If these tends are maintained the Bulgaria will have better indicators than those forecast by the EC.

Moreover, according to the spring forecast of the Bulgarian Ministry of Finance, 55,000 Ukrainian refugees will find employment in 2022, resulting in a 1.7% increase in employment. This number could be too optimistic when accounting for the fact that the officially employed refugees are no more than 3,000 until the present moment, though an increase in employment is nonetheless expected.

In any case, the war and its consequences on inflation and trade will likely slow the recovery rate after the pandemic in the other quarters of 2022. Parallel to a fall in inflation the EC predicts an increase in investment (especially due to the postponements from 2022) which could stimulate annual growth of up to 3.1% in 2023.

As with the main forecast for the EU, the one for Bulgaria is also full of uncertainties and dependent on many claims. The risks and assumptions for the EU as a whole apply to Bulgaria with the same seriousness.

Written by Alexandar Krastev – an intern in the Institute for Market Economics (IME)

Continue exploring:

Signals Sent by EU Convergence Reports

How Much Fuel Could Be Bought with Average Monthly Income in EU?