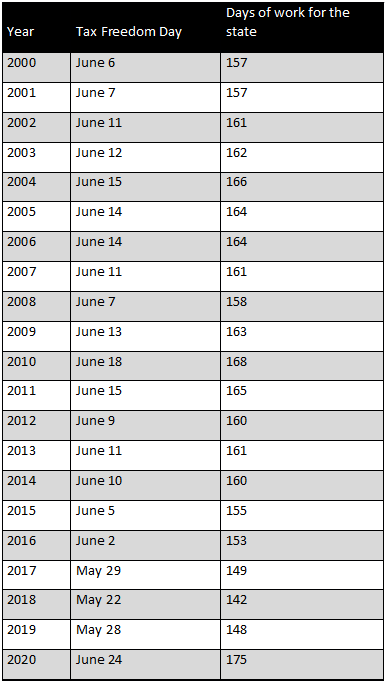

In the year of the COVID-19 crisis, Czechs must endure one more month of work for the state. After June 24, 2020, they will start earning money for themselves. Until then, for 175 days, they only work for the state. This is the least free year since 2000.

A comparison with 2010 comes to mind. That year, the Czech economy was hit the hardest by the previous economic recession. Although the situation has worsened by almost a whole month compared to last year (still, only a one week worse than during the the 2010 crisis).

Tax Freedom Day represents an imaginary boundary that divides a calendar year into two parts. Until the Tax Freedom Day, it is necessary to earn to cover the expenses of the state and public institutions.

This virtual period of 100% taxation ends with the Tax Freedom Day, from which people earn for themselves and decide on the money earned at their own discretion. For every CZK 20,000 that will remain for Czechs’ own consumption this year, the state will redistribute another CZK 18,270.

“Two years ago, the government of Andrej Babiš experienced the freest year in terms of tax, while it did nothing to achieve it. This year, it will experience the least free year, again by doing nothing. The COVID-19 pandemic cannot be blamed on the government. The Liberal Institute would – in any other circumstances – want for the Tax Freedom Day to move closer to the beginning of the year.

This year, our position is different. It is the year when the state should legitimately raise spending, which in our metrics moves Tax Freedom Day closer to the end of the year,” says Martin Pánek, the director of the Liberal Institute.

The Liberal Institute uses a methodology focused on the expenditure side of public finances to calculate Tax Freedom Day. It is the expenditures that need to be financed by tax revenues and which, in the case of deficit budgets, also determine the need to repay in the future.

Figure 1: Tax Freedom Day in the Czech Republic (2010–2020)

Source: dendanovesvobody.cz

Source: dendanovesvobody.cz

“We are experiencing one of the longest periods of economic growth we can remember,” we commented on last year’s Tax Freedom Day.

“Unfortunately, the government did not use this period of prosperity to prepare for the recession that necessarily had to come one day – although, of course, no one could have predicted how serious and unique the crisis would be.

We have not seen any public finance reform in recent years. The financial reserve, which the government could have created thanks to years of economic growth if it actively sought surplus budgets, would now be very useful for us to support the unprecedentedly halted economy,” comments Jiří Nohejl, Chief Economist at the Liberal Institute.

“With another slowdown or recession, Tax Freedom Day could easily get back to mid-June, where it was during the last financial crisis,” we also commented on last year’s Tax Freedom Day.

“We would not criticize the government this year, even if Tax Freedom Day was at the end of July. This year, it is necessary to finance additional expenditures in healthcare and help individuals and companies from public budgets.

However, the government deserves criticism for its anti-economic and harmful ideas, such as price caps for facemasks and tests, which lead to their acute shortage, rescuing government’s friends’ businesses or pointless bureaucracy, where parents must receive confirmation from the school that the government did actually close the school.

The poorly thought-through, unnecessarily harsh and long-lasting closure of some services significantly dampened economic activity, which moved Tax Freedom Day a few weeks further,” explains Pánek.

Table 1: Tax Freedom Days in the Czech Republic since 2000

Continue exploring: