The European Commission (EC) is conducting an open consultation on A Fair & Competitive Digital Economy – Digital Levy. The consultation document acknowledges that digitalization has brought many benefits to the global economy, but questions are raised about revenue collection from digital businesses.

It is argued that digital businesses are not paying their fair share of tax and are weakening the sustainability of public finance. It is also noted that the issue of market concentration of digital companies and accumulation of market power should be addressed as it potentially increases market inefficiencies. The consultation document accentuates the need to ensure a level playing field between the digital economy and other sectors of the economy by proposing a digital levy.

DOWNLOAD FULL POSITION NOTE [IN PDF]

When addressing these concerns, it should be taken into account that a major problem underlying this EC initiative is a lack of a clear definition of what a digital business is. It follows that the aims or objectives advanced through this policy proposal may be based on imprecise data and inaccurate assumptions about the digital sector and the direction in which the global economy and markets are moving.

Therefore, additional tax measures or regulations may not bring the desired outcomes in terms of addressing the concerns laid down in the consultation document, while implying a range of unintended negative consequences for the digital sector and the economy at large.

The Object of Digital Levy

Digital companies or digital businesses is a relatively new phenomenon, as is digital economy. People are much more familiar with traditional industries or businesses. Therefore, defining what is a digital business is a key to this discussion.

If the object is not clearly defined, the intent and the design of the initiative is questionable and the proposed policy measures are likely to be misguided and not appropriate in terms of producing the desired results.

A Lack of a Clear Definition of a Digital Business

Although the absence of a definition does not automatically mean that there would be a substantial amount of companies affected by the proposed taxation measures, it is clear that in this case no definite list of those that will likely be affected can be deciphered. The propositions made in the initiative are too vague for any taxation measures to be formulated but they will undoubtedly affect many EU businesses.

Assumptions underlying the initiative and proposed measures do not justify new taxation nor do they delineate possible consequences. Notably, other sources like Eurostat do not provide a definition of digital businesses either.

There are several overlapping definitions of a digital business from market participants. For instance, a data management company Komprise suggests that “a digital business is one that uses technology as an advantage in its internal and external operations”.

According to the consulting company McKinsey & Company, “digital should be seen less as a thing and more a way of doing things”.

Furthermore, the research and advisory company Gartner defines digital business as “the creation of new business designs by blurring the digital and physical worlds”.

If we use the market definition of a digital business, then a vast majority of businesses have a potential to be or already are digital businesses. Using digital technologies and methods can essentially change the business model of a company, the value they create, how they create it, and how they interact with customers.

Moreover, it affects various sectors and even the economy at large. Therefore, the proposed initiative could affect a vast majority of currently existing companies and many more to come.

The Organization for Economic Co-operation and Development (OECD) notes that there is a “lack of commonly agreed definition of the digital Economy”.

When it comes to taxing digital companies, OECD acknowledges, “the difficulty if not, the impossibility to “ring-fence” the digital economy from the rest of economy for tax purposes because of the increasingly pervasive nature of digitalization”. The same argument can be advanced towards not taxing digital businesses separately from other economic actors.

A Mismatch Between Reform Options and Objectives

The EC identifies the following taxation options:

A corporate income tax top-up to be applied to all companies conducting certain digital activities in the EU

A corporate income top-up tax for digital companies would complicate a tax environment even more. The different tax rates, exemptions, incentives, deductions, etc. of EU member states imply that there would be different tax effects based on all of the criteria for a particular digital business varying from country to country.

This is in opposition to the EU’s initiative to create a simple and clear tax environment with the view of reducing the unnecessary burden for businesses and fostering competitiveness and economic growth as stipulated in the Tax Action Plan.

A tax on revenues created by certain digital activities conducted in the EU

Taxing revenues of digital companies means backsliding to the old counterproductive approaches. If a company generates revenues, it does not mean it is profitable, and in the case of zero profit, a tax on revenue becomes regressive, burdening business and jeopardizing the future of the company.

Lower profitability companies would be penalized much harder by such a tax than more profitable digital businesses. It is especially problematic for young fast growing digital businesses that may not be profitable for several years and may require additional investments to support business operations.

A tax on digital transactions conducted business-to-business in the EU

A digital transaction tax is a tax on operations between different business entities (B2B). Such transactions may not generate profit at all, as they are usually used to help facilitate business transactions. For example, these activities can include ordering online advertising or web services.

However, this indicates an increased cost of operations. Every activity has to be accounted for when calculating the costs and prices of a service. Subsequently, prices could increase for consumers or there would be fewer incentives for investment.

Additionally, this could imply less impetus for businesses to digitalize fully or partially.

Effectiveness Concerns for Tax Collection

The effectiveness of the proposed measures in terms of tax collection as declared by the EC is uncertain. Not only the geographical localization of value creation and consumption of digital services is impossible and will have to be set arbitrarily, but the enforceability also remains an open question (hypothetically, in a situation when Chinese digital giants might refuse to cooperate).

There are different tax environments in all of EU member states that will affect the proposed policy outcomes. Additionally, digital levy runs counter to other EC initiatives such as the Tax Action Plan, which seeks to simplify the taxation environment and reduce unnecessary burdens for business.

Digital Levy would also make it harder to achieve policy objectives relating to EU competitiveness and productivity growth laid down in Europe 2020 Strategy.

Digital Companies Pay Their Fair Share of Tax

One of the EC’s concerns is that digital businesses are not paying their fair share of tax. It is argued that digital companies are operating under certain jurisdictions while generating revenue elsewhere. However, data suggest that digital companies are in fact paying their fair share even while operating under different regulatory environments in the EU.

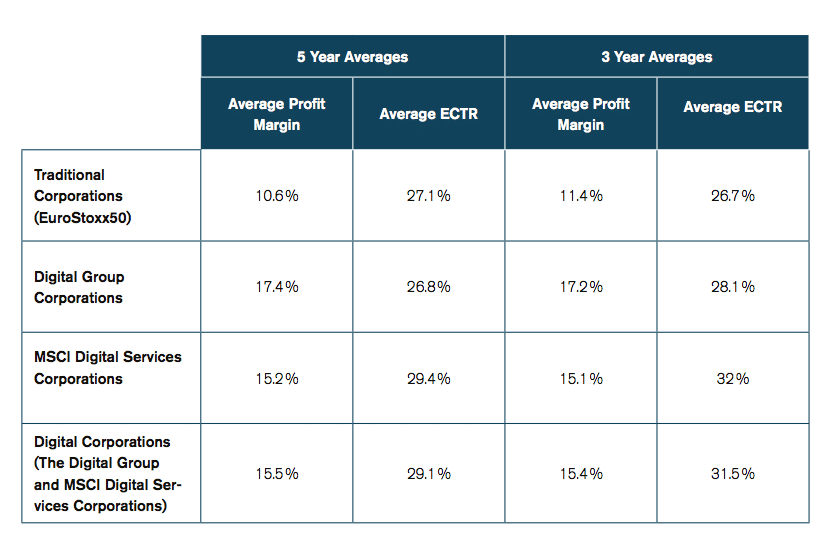

Digital businesses are subject to an effective corporate tax rate ranging from 27% to 32% for 5- and 3-year averages.9 Compared to traditional industries, this does not suggest that digital companies should in any way be singled out as the target group for different taxation measures.

It is important to note that EU member states apply diverse tax exemptions for R&D which consequently may affect tax revenues from digital companies. Additionally, EU member states offer supplementary government support in the form of tax grants for startups, accelerated depreciation on R&D assets or incentives for FDI.

In a way, this further complicates the tax system and may create a partially misleading picture of digital companies paying less tax. It is likely that without all the current allowances in place, the effective tax rate for digital businesses could be even higher than it is now, potentially suggesting over-taxation. In order to know the exact effect of tax exemptions, data about all digital companies need to be collected and examined.

Table. Average effective corporate tax rates (ECTR) and average profit margins

Taxation of Digital Companies Would Not Have a Significant Impact on EU Public Finance

Taxation of digital companies will not have a significant impact on EU public finance for several reasons. Firstly, bigger digital business players can effectively use existing tax exemptions applicable in EU member states such as for patent boxes or R&D. As many as 14 out of 27 EU member states have provided incentives for companies to establish their operations in the form of patent boxes.

Secondly, new or already existing companies would have a harder time growing and generating revenues. Consequently, this would put them under certain tax brackets or businesses may even choose to pursue different business venues to minimize taxation.

Digital Taxation Would Complicate the Tax and Legal Environment

Any of the proposed policy options would mean a higher burden for business activities as more hours and money would be needed to comply with taxes and regulations. Additionally, more government resources would be required to implement and administer such taxes.

Moreover, if the EC introduces taxes earmarked for digital companies, it would imply their different treatment as an economic sector and consequently discrimination vis-a-vis other industries. Another issue arises regarding eligibility of who is to be taxed and what and how many exemptions are to be introduced, thus jeopardizing the simplicity of the proposal. By and large, this is inconsistent with the EU’s Tax Action Plan.

Unintended Consequences for Market Dynamics, Economic Competitiveness, and Growth

Any one of the proposed taxation options would have severe unintended consequences for market dynamics, economic competitiveness and growth. They would have detrimental effects not only for the development of digital businesses but the economy at large.

The EC notes its concern about an unequal or unfair distribution of market power, higher market concentration and additional market inefficiencies resulting from these processes. Nevertheless, it is not indicated which company or companies have such market power and how exactly market concentration is measured or what market inefficiencies exist.

Under Digital Levy businesses may choose not only to transfer such increased taxes to consumers via increased prices but may also choose to slow down the wage growth or reduce employment levels. Moreover, this could imply fewer incentives for investments, particularly digital investments.

Measures for Taxing Digital Companies Will Undermine Competition and Incentivize Market Concentration

One of the problems is that taxing digital companies could distort competition and create a potential for market concentration. It should be considered that bigger market players have the means and resources to use accountants, financial advisers, lawyers and consultants to better understand and navigate through new tax and regulatory rules.

Ways to mitigate the effects of new taxes and regulations by implementing new structural changes to the business would be sought. For example, operations may be outsourced to other companies within the EU or even abroad.

Additionally, companies may be split in order to reduce the tax burden. However, smaller companies with fewer resources would be placed at a disadvantage and would suffer in terms of competitiveness.

Digital Levy Would Undermine the Digital Economy and Slow Down Economic Recovery

It is assumed that the proposed tax policy would lead to a more level playing field between digital businesses, given its speedy growth, and other sectors of the economy. However, if implemented, these measures would reduce opportunities for digital economic activity, both for existing businesses and potential newcomers.

Importantly, the EC views digitalization as one of the main drivers for recovery from the COVID-19 pandemic and increasing the EU’s overall competitiveness. The proposed initiative would not facilitate recovery. Increasing the level of taxation, if compared to the rest of the economy, would automatically create disincentives for business expansion and unnecessary barriers to market entry. An entrepreneur who starts a company has no guarantee of success and additional regulation and taxes make their endeavors even more challenging.

Additionally, they would create additional compliance expenses that otherwise businesses would not face.

Digital Levy Would Lead to Higher Prices

Revenue taxes are more likely to be passed on to consumers, they deter investments and can lead to high effective tax rates when considered as a percentage of profits. Therefore, a new digital levy will result in higher prices for digital services for EU consumers, consequently reducing EU consumers’ welfare.

For example, in France, Amazon passed along the costs of a new French digital tax to its third-party sellers and increased its commission rate on businesses selling on Amazon’s French marketplace by 3 percent in October 2019, as it was not willing to absorb the tax expense if it were to continue making investments in infrastructure.

The same happened in the U.K. in September 2020 whereby Amazon increased the fees for U.K sellers by 2 percent, followed by Apple and Google. Besides the U.K., Google increased the price of serving an advertisement on the Google platform, or purchased through Google Ads, by 2 percent in Austria, and in Turkey by 5 percent, to meet the “significant increases in the complexity and cost of complying with regulations.

In March 2021, Google issued a guidance regarding the additional 2 percent online advertising fee levied on its customers in France and Spain. Social media providers will apparently also transfer the tax cost onto the price of the service (advertisement) so that ultimately it will be the consumer as the end user who will bear the cost of the tax.

Also, services and application used by large number of users (e.g. Spotify and UBER) will be more expensive because of the DST.

Digital Companies Do Not Hold Strong or Weak Market Positions for Long

The digital economy is rapidly increasing the pace of innovation and competition. For instance, Microsoft had a dominant position in terms of search engines with Internet Explorer. However, the market itself introduced new players in the form of Google Chrome, Mozilla Fire Fox and Apple’s Safari that led to a significant loss of market share for Microsoft.

The music streaming platform Spotify did not exist until 2006 and today is a business giant with the likes of iTunes. It has completely changed the way of music consumption. Altavista, Netscape, Xerox, Kodak, Polaroid, Iomega, Compaq, Minolta, and many other companies can serve as example of large information technology multinational businesses which quickly became small or even diminished.

It would be enormously challenging to identify who has weak or strong market positions given the fast-changing landscape of digital business.

Digital Levy Is an Attempt to Regulate a Very Dynamic Sector

Digital economy is a relatively new phenomenon. Consequently, digital companies as such are also recent. The pace of innovation means that new digital businesses and new digital sectors of the economy are created every day bringing innovative products and services to the market. Thus, regulation and additional taxation pose a risk of slowing down the digital economy. Regulations would significantly reduce the speed of change and adaptation.

Therefore, European businesses would find themselves at a competitive disadvantage as the EU companies are competing globally and not just within the EU. Consequently, new start-ups will be disincentivized to start business in the EU.

Digital Levy May Lead to Undesired Global Trade Wars

Judging from the EC proposal, the suggested revenue thresholds (global combined with national) most likely seem to be targeted at US-based companies than EU Member States business entities. Therefore, the digital tax would de facto represent a tariff in breach of international trade rules.

According to the Office of the United States Trade Representative (USTR) investigations, digital taxes adopted by Austria, Britain, France, India, Italy, Spain and Turkey discriminate against U.S. technology companies and are inconsistent with international tax norms. USTR is maintaining the threat of U.S. tariffs on goods from these countries in retaliation for their digital services taxes.

The digital levy proposal is likely to cascade retaliatory initiatives around the globe in the form of tariffs on other goods and eventual trade wars between the EU and other countries where digital companies within the scope of the digital levy are based.

Digital Levy Will Hamper Investment and Innovation

The key factors to focus on in terms of digitally driven economic growth in the EU are investment, innovation, and productivity. Today EU companies lack investment, especially in the non-traditional industries. However, the digital levy is not designed to improve the landscape when it comes to the aforementioned key factors of EU growth.

The focus should be shifted towards the potential of the digital economy and digital businesses. According to the European Investment Bank (EIB), “the share of fast-growing companies is more than 25% lower in EU than in US” and “an additional EUR 130bn a year needs to be invested in R&D to meet the EU target of 3% of GDP”. EU and US approaches to investing are different. In the US, investments are made “in case your company succeeds whereas in EU they invest because your company succeeded”.20

A Lack of Investments and Innovation Will Damage the EU’s Productivity and Economic Growth

GDP in the EU has been growing at an average rate of 1.6 % a year since 2010. It is very likely that it will grow at a similar rate in the future as well. This slow growth rate is partially due to the EU’s competitiveness issues. The key component in wealth creation is competitiveness. Without investing into innovation, it is unlikely for the EU to increase productivity, become more competitive worldwide and, consequently, create more prosperity.

Digital Levy does not promote more investment into innovation that could lead towards productivity gains and, eventually, GDP growth. While the EC is focusing on new taxation and regulation, it disregards the issue of low levels of capital expenditure22 in the EU if compared to United States. Therefore, it has a direct impact on innovation that extends to future economic growth.

It could be argued that digital levy would make this kind of business activities less desirable to undertake. Actions that digital business are performing within the EU based on the idea of clear and simple market rules (taxation, regulation, etc.) would be discriminated against all other market participants. Such rules require businesses to invest, innovate and test new ideas in the form of products or services.

Nevertheless, they should not be penalized as it is a very dynamic sector requiring skillful labor and high levels of capital. According to EIB, “productivity growth in the EU has trailed the US since the mid-1990s and was hit harder during the crisis than in other regions.”

A Digital Levy Would Negatively Affect the Free Flow of Capital and Labor in the European Union

The proposed policies would complicate the playing field for new digital economy and discard its potential. As traditional industries are being automated, their employment capacity may be falling. The digital economy offers a solution for the inevitable loss of employment by millions of Europeans. It creates new industries, new occupations and possibilities for EU citizens.

According to the EC, “between 37% to 69% of jobs in the EU can be partly automated and 14% of jobs face a very high risk of automation”.23 Hence, focus should be placed on retraining as well as improving skills of the EU workforce and improving access to capital instead of creating obstacles for businesses. Digital companies, especially those with high focus on R&D and under high competition levels, require large amounts of capital.

Therefore, this initiative indirectly would affect the free flow of capital towards European digital business opportunities by making them less desirable for investments.

Conclusions

When considering new tax or regulatory initiatives, it is necessary to clearly define their object. Unfortunately, a lack of clear definition makes it difficult to conduct a proper discussion about policy options, their impact assessment and alternative solutions. In this case, when we talk about digital businesses, we should bear it in mind that potentially many EU businesses can be regarded as digital or having a component of digital business based on the provided definition by market participants.

It is highly likely that the number of such businesses will continue to increase even while these discussions proceed. Consequently, the number of potentially affected businesses will be even larger.

Digital businesses are subject to an effective corporate tax rate ranging from 27% to 32%, which is more than the tax rate applicable to other business sectors in some cases.

However, the current tax environment, tax incentives, and regulations can be regarded as distortionary and discriminatory and this may be creating assumptions that digital businesses are undertaxed and consequently undermining public finances.

Any of the proposed taxation measures would negatively affect the development of the digital economy and digital businesses. It would reduce market opportunities for entrepreneurs and other businesses by putting many unnecessary barriers for market entry such as increased administrative and compliance costs. They would also disincentivize investments and innovations, resulting in negative effects on employment, productivity and income growth.

Digital taxation will undermine EU competitiveness and recovery from the pandemic-induced crisis will be slowed down. Taking into consideration the potential effects of digital levy implementation, the digital levy initiative should be halted.

This position paper was authored by the Lithuanian Free Market Institute, with a contribution from the Institute for Economic and Social Studies. Both organizations are private non-profit non-partisan think-tanks and member of 4liberty.eu.

Continue exploring:

Estonian Corporate Tax Model Should Return Home, to Lithuania