The issue of excise duties is a broadly discussed topic in every developed economy. The Czech Republic makes no exception due to the involvement of two key players in the process of public choice – politicians and voters.

Considering excise duties, the role that politicians play is clear: they impose taxes on consumption of goods that create negative externalities, so from the perspective of politicians this policy should be positively (neutrally) perceived by voters, it should be politically feasible and, for politicians who would like to use their influence for a more intensive relationship with interest groups, it should also enable a dialogue with regulated sectors about political support (rent-seekers).

The role of voters is directly related to the role of politicians – excise taxes influence retail prices of goods and affect disposable income of households and their consumption expenditures. Voters’ opinion can influence the tax system through participation on public choice. They decide whether they prefer lower taxation, i.e. more personal responsibility for their behavior, or higher taxation, i.e. more involvement of the state in preventing types of behavior that cause negative externalities. Tax rates are a political decision with fiscal impacts. And despite the fact that all voters are influenced by taxes, at least voters who have a strong opinion on the issue of excise duties (e.g. alcohol, tobacco, etc.) affect the election outcome.

The relationship between politicians and voters creates an area for political debates, government proposals, coalition negotiations, opposition complaints, new laws and legislative amendments, and also for a significant role of unelected officials. For these reasons, I consider it as extremely important to use any platform for a broader discussion about the issue of excise duties, more specifically about the rates of the taxes, their fiscal impacts, market distortions and unexpected effects.

Excise taxes in general

Excise taxes are charged by all developed economies in the world. The concept of excise duties is referred to the so-called Ramsey taxation1. A difficult option to substitute taxable goods means that excise taxes create a stable source of revenue for the state budget. Therefore, we can say that excise duties are used to achieve two goals: as a fiscal-policy instrument to generate tax revenues to the state budget on the one hand and as a regulatory tool to regulate the consumption of goods whose consumption create negative externalities to the society on the other hand.

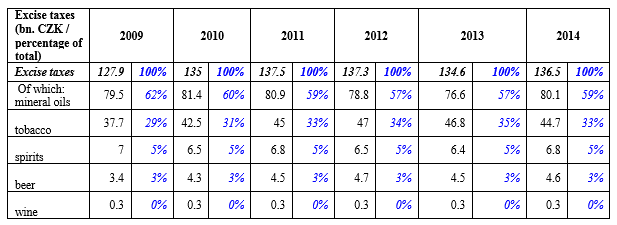

In the Czech Republic, excise duties are imposed on five types of goods, including mineral oils (including fuels), tobacco, alcohol (spirits), beer and wine. The Ministry of Finance and its subordinate Customs Administration is in charge of the administration of excise duties in the Czech Republic. The table below shows the aggregate revenues of excise duties from 2009 to 2014 and their decomposition by individual groups of taxed goods. Except for 2009, the revenues for all the years exceeded the value of 130 billion CZK (4.8 bln euros). From a fiscal point of view, the attention is mainly focused on mineral oils (especially fuels) and tobacco (tobacco products). These two groups together accounted for over 90% of the collected revenues.

Table 1: Excise tax revenues in the Czech Republic (2009-2013)

Note: For each year the columns to the left represent the absolute value of the collected revenues, and the columns to the right indicate a relative share in the collected revenues (in %). Source: Customs Administration.

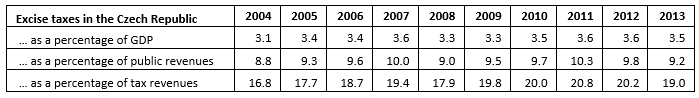

Generally, revenues from excise taxes are considered to be a stable income pillar of public finances. Is this true or not? The answer is shown in Table 2. In the Czech Republic excise taxes represent about 20% of the total annual tax revenues and around 10% of the total public income. The stability of excise tax returns could also be demonstrated as a percentage of gross domestic products, which stands at an average of 3.4% of GDP. As an illustration, revenues from excise taxes cover all compensation of employees in the Czech public sector (wages plus social contributions of government employees consumed an annual average of 3.4% of GDP in the past three years).

Table 2: Excise taxes in the Czech Republic in relation to GDP, tax revenues and total government income (2004-2013)

Source: Ministry of Finance

The importance of excise taxes in the Czech public finances is obvious, especially of those imposed on mineral oils and tobacco. I will analyze these two groups of in the following chapters. Finally, several policy recommendations are formulated.

Mineral oils

From a fiscal perspective, mineral oils are the most important element of the excise tax system in the Czech Republic (see table 1). In 2014, excise taxes on mineral oils generated 81.1 billion CZK, which is 4.6% above the 2013 level and 1.5% below the 2010.

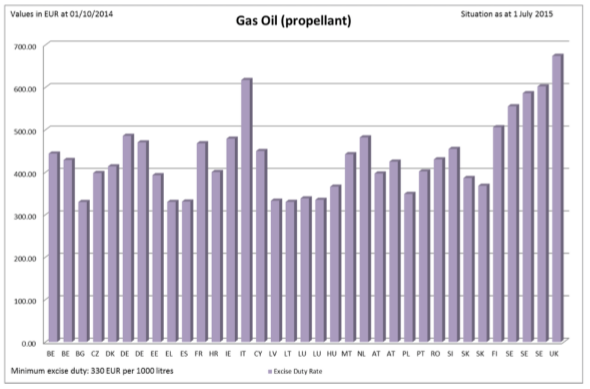

Apart from the value added tax (21%), the Czech government has regulated the consumption of mineral oils through differentiated excise taxes. The rates, which have been effective from January 2010, vary. A rate of 10.95 CZK per liter (0.40 eur/liter) is levied on diesel oil, and a rate of 12.84 CZK per liter (0.48 eur/liter) is charged on gasoline. Both rates are above the minimum level set by the European Union. Despite serious political debate, the rates of excise duties on fuels have not changed in the Czech Republic in the last five years.

Figure 1: International comparison of excise duties (diesel oil)

Source: European Commission

A composition of revenues is an important factor too. The tax return from mineral oils consists mainly of revenues from fuels (98 % of total). Approximately two-thirds (67%) of the revenues from fuels relate to diesel oil, and the remaining third is generated by the excise tax on gasoline. In 2013 the tax obligation prescribed on consumption of diesel and gasoline reached 79.4 billion CZK (2.94 bln euros), which represented a decrease of 1.20% in comparison with 2012, a decrease by 3.15% compared to year 2010, and minus 4.94% compared to 2008. Similar results2 are anticipated for 2014.

The reason behind this trend is twofold. Firstly, a role of road freight transport has to be taken into account. The Czech economy is export-oriented and, moreover, due to the location of the Czech Republic domestic roads are heavily used as international transit corridors. So competition relating to taxation of diesel oil among European states provides incentives to buy/not to buy fuels in the Czech Republic.

Between 2009 and 2012, the Czech Republic belonged to the group of states with the highest excise taxes on diesel oil in the European Union, i.e. with the highest prices of diesel oil. This negatively influenced the willingness of domestic and foreign carriers to refuel their tanks in our tax domicile, because tax rates in the EU countries differed significantly (tax competition). Road freight carriers have an easy access to diesel oil international markets and can choose cheaper markets or even specific gas stations (thanks to the Internet, GPS navigations, etc.). Due to the monetary intervention made by the Czech National Bank (depreciation of the CZK/EUR), the real excise tax rate in EUR dropped to 395.65 eur/1000 liters. Therefore, the Czech Republic has moved in the ranking of countries with the highest excise taxes (diesel oil) from the 5th place in July 2010 to the 18th position just due to the change in the exchange rate.

However, the second aspect is the matter of technological progress. This spontaneous effort to cut costs is reflected in downsizing (less consumption of engines) or in new alternative fuels, often subsidized from public finances (biofuels, electricity, LPG, CNG, etc.). Consumers cannot avoid taxes illegally3, so they do it legally, through indirect economic transactions and substitutions.

These issues have changed the “classic” environment. Neither diesel oil nor gasoline in one country are goods with sharply inelastic price demand curves. Substitutions are available and automatic boom of excise tax revenues is over. The Czech government should respect this and adapt policies given that market players are able to replace traditional fuels with new commodities and downsize the consumption. Policy recommendations are outlined in the conclusions chapter.

Tobacco

The tobacco product market is strictly regulated in the Czech Republic, with indirect taxation (excise duties plus value added tax) being just part of the regulation. Excise duties levied on tobacco products alone bring annually more than 40 billion CZK (1.5 bn. eur) to the state budget.

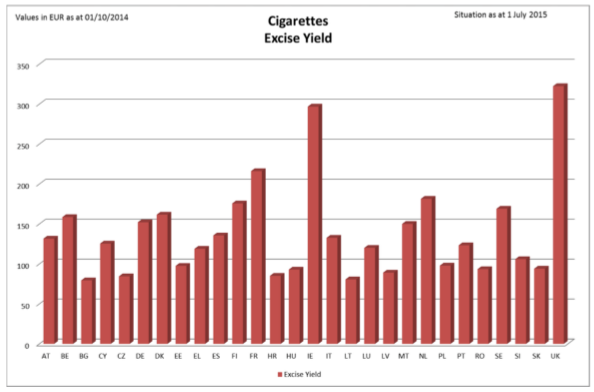

The system of excise taxes in the Czech Republic levied on cigarettes uses a combined concept, with a specific component of excise duty and an ad valorem component of excise duty. Effective from December 1st, 2014, the specific component in the Czech Republic amounts to 1.29 CZK for per cigarette (0.94 eur per pack with 20 cigarettes) and the ad valorem component accounts for 27%. However, the minimum level of excise duty is set at 2.37 CZK per cigarette (1.75 eur per pack with 20 cigarettes).

Figure 2: International comparison of excise duties

Source: European Commission

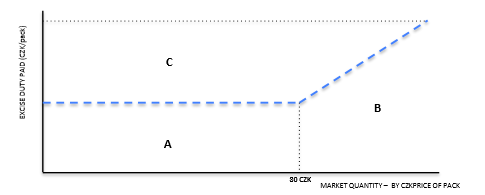

In practice, for all packs priced below the 80 CZK level, the excise duty is rounded up to the minimum level 47.40 CZK per pack (1.75 eur per pack). For all packs with price tags over 80 CZK, the excise duty is a sum of both specific and ad valorem parts. The Czech market with cigarettes is quite specific, because for two thirds of all packs sold, the excise duty has to be rounded up to the minimum level. According to the fiscal effects, the market is illustrated in figure 3.

Figure 3: Cigarette market – real tax revenues and potential tax revenues

Source: Own calculations

Area A represents the sum of excise tax paid by the producers that appraise a pack of cigarettes below the 80 CZK level. Area B represents the tax revenues paid by producers selling more expensive cigarettes (a pack price above the level 80 CZK). Area C is de facto a potential tax return which could be collected if the minimum excise duty per pack reflected the effective rate paid by producers of “more expensive” cigarettes. Apart from the excise duty on cigarettes, other tobacco products are also subject to taxation. The government has imposed a duty of 1,896 CZK/kg per fine-cut smoking tobacco (70.1 eur/kg) and 1.42 CZK/pc. on cigars and cigarillos (0.05 eur/pc.). Due to a rapid increase in frauds relating to the tax exemption for raw tobacco, the government imposed the same excise duty (1896 CZK/kg) on raw tobacco as of July 1st, 2015.

Recommendations

For the Czech government, tax revenues from mineral oils and tobacco products represent a crucial fiscal factor. Politicians, voters, media, interest groups and their lobbyists pay a significant attention to both these areas. Economists are also included, of course. Therefore, the following recommendations can be formulated:

1) Mineral oils: The taxation should follow the best practice of countries that have applied the so called floating rate of excise tax. The system works very efficiently. Excise duty consists of a law component (passed through a standard law process by the parliament, e.g. regarding the minimum EU level) and a decree component (passed by a ministerial decree). This enables adjustments for the optimal level of taxation with respect to various factors such as the economic cycle, macroeconomic indicators, excise duties in neighboring countries, etc.

2) Mineral oils: The government should abolish the continuously discriminatory pricing through a higher excise duty on gasoline. The consumers have found a way to respond (preference of diesel engines, LGP, CNG, electricity…). And this has created a huge challenge for European refineries and also caused continuously declining revenues from excise taxes and VAT.

3) Mineral oils: A high proportion of the tax burden on the final price of fuels creates incentives for frauds and tax evasion. Shadow transactions negatively influence fiscal measures and – due to a lower control and product quality – harm consumers. Regulators should prevent adulteration of fuels, i.e. eliminate tax exemptions for heavy oils or lubricant oils for machines, etc., and also implement a reverse charge on the value added tax. The government should use more information and experiences of subjects from the official economy who possess substantial information about both legal and illegal market structures.

4) Tobacco: The minimum excise duty should be eliminated. App. 66% of the Czech cigarettes market operates below the level of minimum taxation (i.e. on the edge). The tax system should follow “one box of cigarettes = same harm = same excise tax” logic, so the ad valorem tax should be abolished and only one excise tax rate should be charged. The solution is to lower the ad valorem component of excise duty on the level of the regular excise tax rate4.

5) Tobacco: A volatility of tax and other regulatory measures imposed on the industry decreases both stability and transparency of the business environment. Predictable regulation of the tobacco market is a prerequisite for the efficient taxation. More transparent regulation will cultivate the official business environment and also reduce the illegal market for tobacco products.

1 Frank P. Ramsey, A Contribution to the Theory of Taxation (1927): The government should consider imposing tax on the consumption of products with inelastic demand, i.e. those whose consumption cannot be replaced by the consumption of other goods (food, alcohol, tobacco, cigarettes, fuel…).

2Some cases from 2014 (frauds, arrears) are still under investigation, however, statistics should not have to change dramatically.

3Final consumers have very little opportunity to buy shadow fuels. Shadow transactions in the Czech Republic are common during the custom clearance process, and mainly on VAT (not excise taxes). Adulteration (excise taxes) generates just a minority of the Czech shadow market. Fuels are legalized in the supply chain via a simple formula: 1) Import fuels; 2) Sell fuels to the gas station; 3) Bankrupt before VAT payday. Tax arrears are related to a bankrupted company, often registered on intermediaries or foreigners, i.e. arrears are hardly enforceable

4Of course, this is not an easy political decision. Czech minors have access to ones of the cheapest cigarette markets in the European Union, so the political representatives often argue they must meet the objectives of public health measures and reduce the availability of tobacco products for children.