The provisional application of the EU-Ukraine Association Agreement (AA) started in 2014. Since then, Ukraine has done a lot to use the agreement’s opportunities and improve its access to the EU market. The fifth annual survey of Ukrainian exporters and importers1 marks growing optimism among companies regarding the already achieved AA impact, while their future assessments are marred by uncertainty.

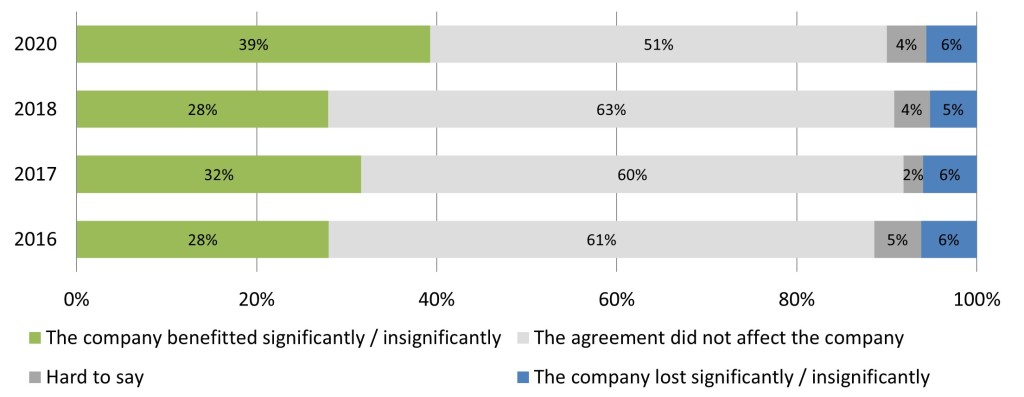

In 2020, compared to the previous waves of the survey2, the highest share of enterprises positively assessed the AA impact. In 2020, 39% of respondents claimed their companies to benefit from the AA compared to 30% in 2016-2018 (see Figure 1).

Such a high increase of positive assessments might testify about the success of trade efforts in Ukraine. After the first uneasy years, more companies could discover new trade opportunities in the EU and used them. Nevertheless, every second company is neutral about any AA impact.

Figure 1: Assessment of the AA impact, by years (% of respondents)

As for sectoral dimension, circa 40% of companies from industry and trade sectors admit positive impact, more than a half higher than in 2016. Those sectors are the main contributors to the growth of overall optimism.

The level of positive assessments of agricultural and service enterprises has hardly changed compared to 2016. Only every fifth agriculture company has reported benefits from the AA, probably due to trade barriers to agri-food products.

Survey results also demonstrate that big companies have more positive assessments than the SME sector. Trade reorientation and finding new markets could have been easier for big businesses.

However, micro and small companies doubled the share of positive assessments between 2016 and 2020. It seems that small-scale businesses have started benefitting from trade facilitation measures by government and support of international export promotion projects.

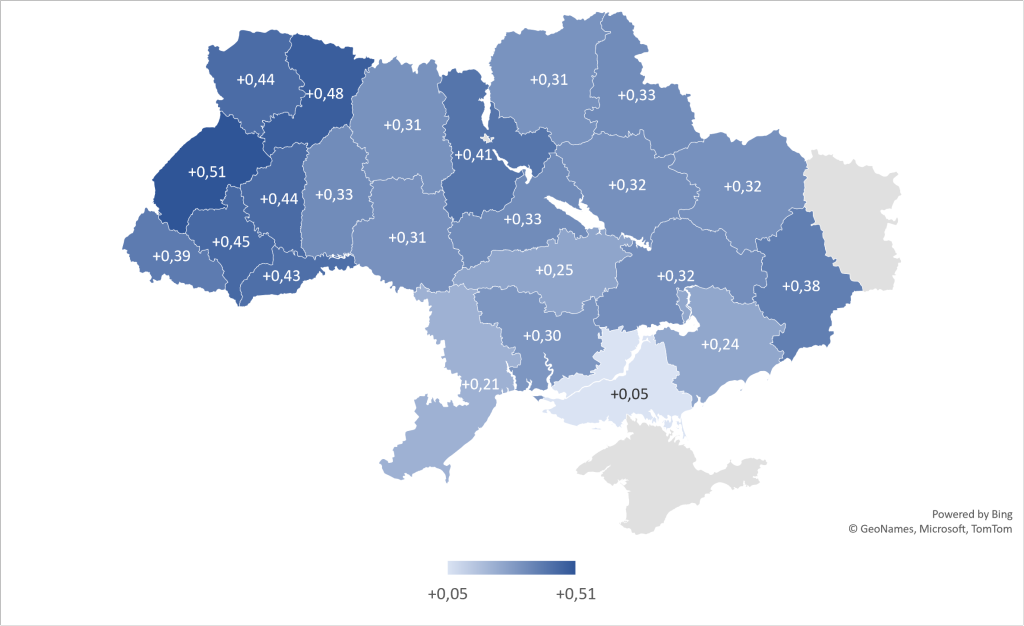

Figure 2: Balance index of AA impact, by regions3

Note: The balance index for the city of Kyiv is +0.33

Distribution of positive and negative responses marks regional disparities. The balance index (the difference between positive and negative answers) clearly shows high values, mainly in the western and selected central regions. The best results are in the Lviv, Rivne, and Ivano-Frankivsk regions. At the same time, the lowest marks are in the south.

For example, in the Kherson region, the balance index is only +0,05. It seems it was a smart step by the government to open the first Regional European Integration Office in Kherson in October 2020. The share of positive assessments is relatively high in the Donetsk region, probably due to several international assistance projects active in the region.

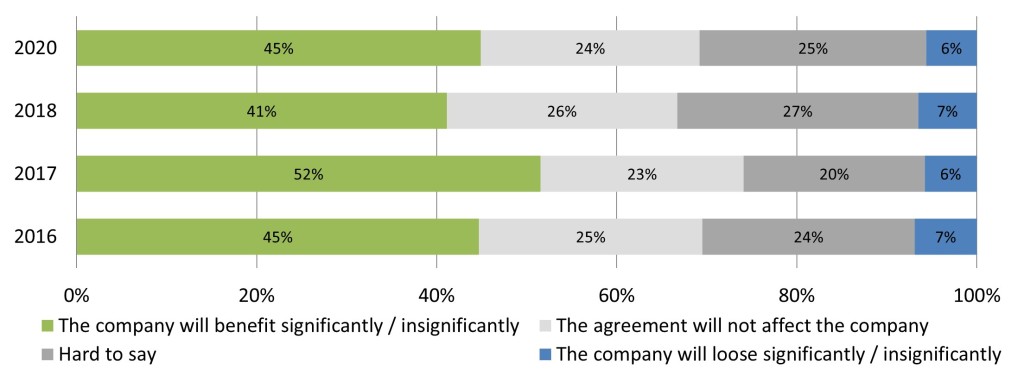

The survey also demonstrates the high level of uncertainty among businesses regarding expected AA impact. A quarter of respondents state that the AA will not affect their companies over the next five years, and a quarter more chose “hard to say” response. In 2020, the share of positive assessments increased compared to 2018 only by a few percentage points (from 41 % to 45%).

However, enterprises remain less optimistic compared to the results of 2016 and 2017. As the survey covered enterprises trading not only with the EU but with any other countries, we might have reached the level of saturation in orientation towards the EU market.

Also, all the survey waves contained a similar share of ‘hard to say’ answers indicating high uncertainty about the future in Ukraine, likely not related to the AA, but the general business and investment environment in Ukraine.

Figure 3: Assessment of the AA expected impact, by years (% of respondents)

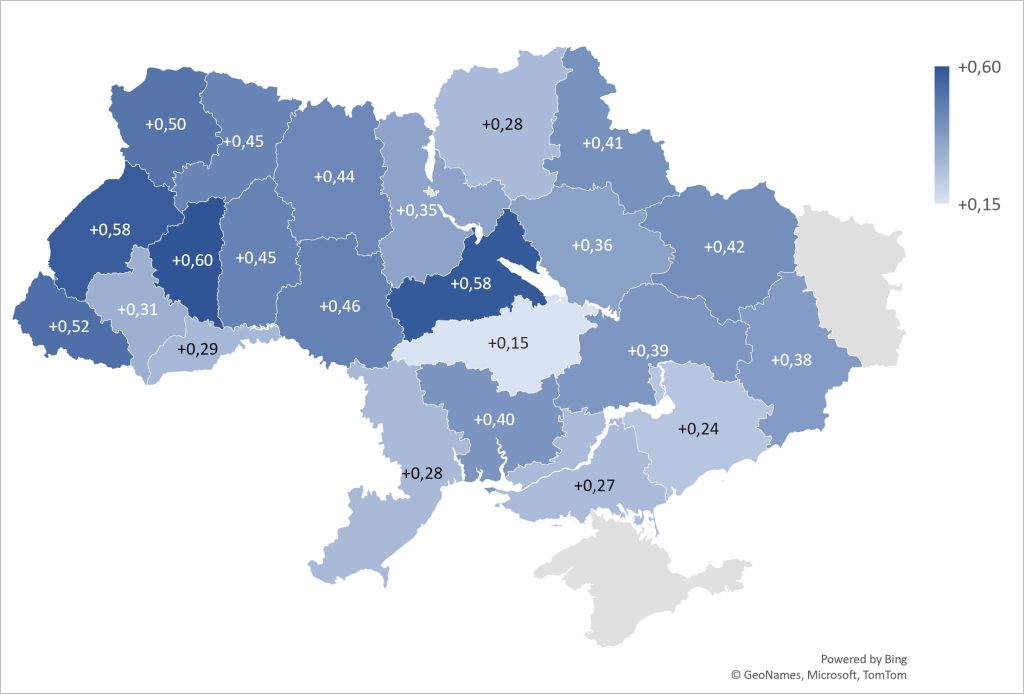

Assessments of future impact repeat the survey results regarding the current effect. About 56% of big businesses admit positive evaluations than 43-45% in the SME sector. Representatives of industry and trade see better opportunities due to the AA. Regional disparities also demonstrate a higher level of optimism in the western and selected central regions.

Figure 4: Balance index of AA expected impact, by regions4

Note: The balance index for the city of Kyiv is +0.34

To sum up, the level of optimism regarding the AA impact has increased among Ukrainian exporters and importers.

However, the share of positive assessments is different for various types of enterprises and regions. The same disparities are admitted regarding future impact. This result highlights weak points where the government should put more efforts to facilitate trade.

The publication was prepared within the framework of the project Support of the Civil Society Initiative “For Fair and Transparent Customs”, conducted by the Institute for Economic Research and Policy Consulting, funded by the European Union, the International Renaissance Foundation and the Atlas Network. Views expressed in this publication are attributable only to the authors, and may not be attributed to the European Union, the International Renaissance Foundation and the Atlas Network

1 The fifth survey was conducted by the Institute for Economic Research and Policy Consulting as a part of the implementation of the project “Support of the Civil Society Initiative “For Fair and Transparent Customs””, funded by the European Union, the International Renaissance Foundation and the Atlas Network. The previous rounds of the survey were done in the framework of the Trade Facilitation Dialogue project supported by the European Union and the International Renaissance Foundation

2 Questions on AA (DCFTA) impact were included into the survey in the second wave (2016).

3 It is impossible to calculate the balance indicator for Luhansk region due to insufficient filling of the subsample.

4 It is impossible to calculate the balance indicator for Luhansk region due to insufficient filling of the subsample.

Continue exploring:

Local Election Results in Ukraine: New Political Landscape on Ground?