A full-scale war became an existential challenge for the Ukrainian industry. Manufacturing enterprises have been forced to actively cut expenditures for innovation, shifting the focus from development to survival. At the same time, businesses see opportunities to restore innovative activity with the help of industry support programs, fiscal incentives, and other measures at the state level. These are the main results of the twelfth New Monthly Enterprises Survey conducted by the Institute for Economic Research and Policy Consulting (IER).cxd

The economic front sets high expectations for the modernization of the country. However, for some industries, innovation is currently an unrealistic development direction. On the one hand, part of the business, mainly export-oriented, continues to work on the introduction of innovations. On the other hand, many enterprises experienced a significant drop in production, sales, and exports, which forced them to focus on issues of business survival. Nevertheless, at the macro level, it is obvious that the Ukrainian recovery cannot be planned without the activation of innovation activities.

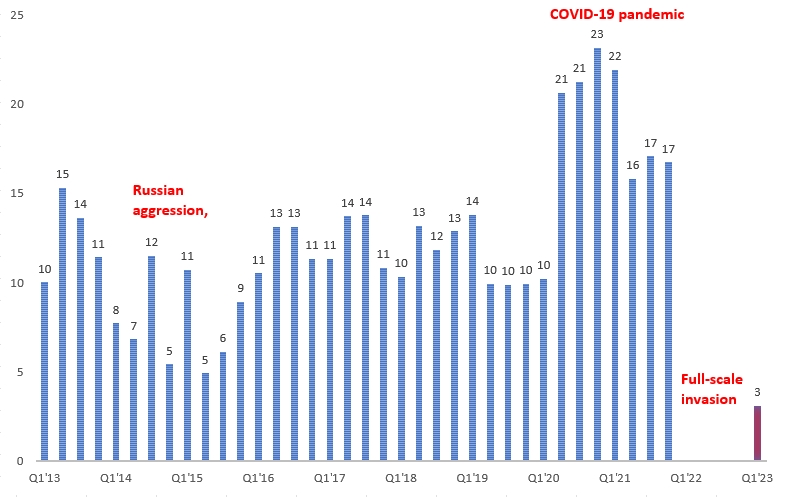

Survey results confirm a change in business priorities. In April 2023, only 3% of enterprises indicated outdated technologies among the obstacles to production growth (compared to 17% in the fourth quarter of 2021). This is the lowest indicator in all waves of the IER survey over the past two decades (the quarterly enterprise survey has been conducted since 1998). Currently, problems such as an unfavorable political situation (including the impact of the war) and low demand dominate the concerns of businesses.

Fig.1. Outdated technologies as an impediment to production growth in 2013-2023 (% of respondents)

Source: IER – Business Opinion 1998 – 2023, New Monthly Enterprises Survey “Ukrainian business in wartime.” Institute for Economic Research and Policy Consulting, 2023

It is worth noting that the issue of outdated technologies has always remained in the shadow of other “priority” challenges. In the past, during crisis phenomena in the economy, the attention of Ukrainian businesses to technology was usually further reduced. For example, businesses hardly mentioned outdated technologies in 2008-2009 due to the global economic crisis, and similarly, in 2014-2015, after the beginning of Russian aggression and the economic crisis in Ukraine. The only exception was during the crisis phenomena associated with the COVID-2019 pandemic, which significantly increased entrepreneurs’ attention to technology in the last decade.

Business Cautiously Believes in the Importance of Innovation

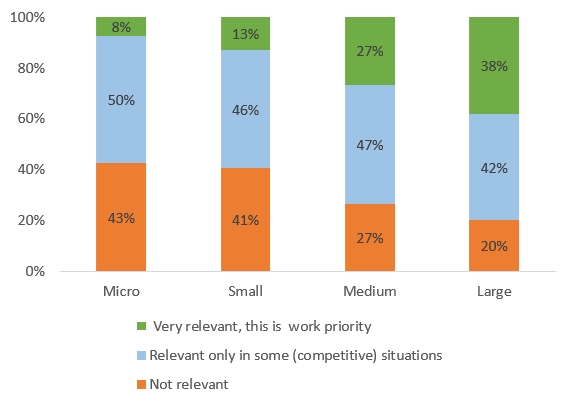

Despite the war, innovation remains important for a large part of the manufacturing sector (at least declaratively). For example, 23% of enterprises indicate that the introduction of innovations (introduction of technologically new and/or technologically improved products, production processes) is a priority in their work.

Additionally, for 46% of enterprises, innovations are relevant in the case of individual (competitive) situations. However, for almost a third (31%) of respondents, innovations are not relevant at all. At the same time, a significant part of them had no innovation activity even before the war.

As in peacetime, the relevance of innovation depends on the business size. As the size of the enterprise increases, the probability that the introduction of innovations is a priority or is relevant in competitive situations increases. For example, innovation is a priority for 38% of large enterprises but only 8% of micro and 13% of small ones. At the same time, the war increases the gap in businesses’ ability to innovate. Micro-business suffers the most from the war and shows the slowest recovery rates. It is an important wake-up call about a business’s ability to modernize.

Fig.2. Relevance of innovations by enterprise size, % of respondents

Source: New Monthly Enterprises Survey “Ukrainian business in wartime” Institute for Economic Research and Policy Consulting, 2023

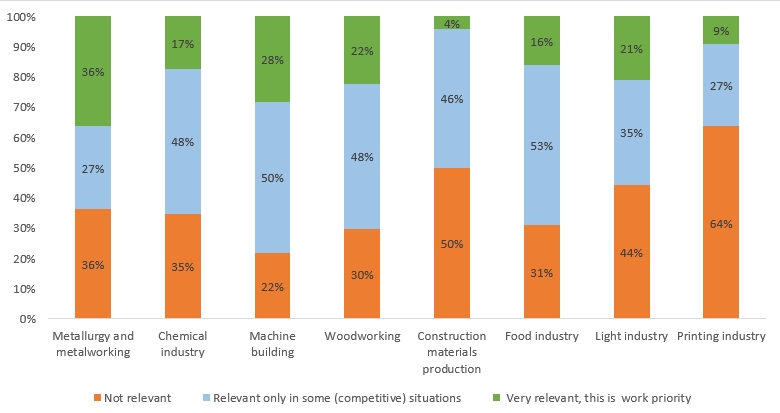

Results by sector bring deep manufacturing problems to the surface. For example, innovations are irrelevant for 50% of construction materials manufacturers, an industry that has long struggled with some of the worst recovery results due to the construction crisis. On the other hand, innovations are also irrelevant for 22% of machine-building enterprises, representing the most technologically advanced productions.

Fig.3. Relevance of innovations by the manufacturing sector, % of respondents

Source: New Monthly Enterprises Survey “Ukrainian business in wartime.” Institute for Economic Research and Policy Consulting, 2023

Costs on Innovation Activities Are Not Priority

The full-scale war forced manufacturing enterprises to reduce expenditures for innovation activities significantly. Thus, 42% of enterprises reported they had cut expenditures during the war. Another 39% of enterprises left the expenditures on innovation activities at the pre-war level.

However, 19% of enterprises increased expenditures on innovation activities. At the same time, the situation today may even look somewhat more optimistic than, for example, last summer. After a year of war, part of the business managed to restore production and export volumes.

Among enterprises that continue to export during the war, innovation is more often a priority. Additionally, it was active exporters who often increased expenses on innovation activities. At the same time, most companies that stopped exporting during the war also decrease innovation expenditures. These businesses felt the most about the lack of demand, labor force, and safety of the business environment.

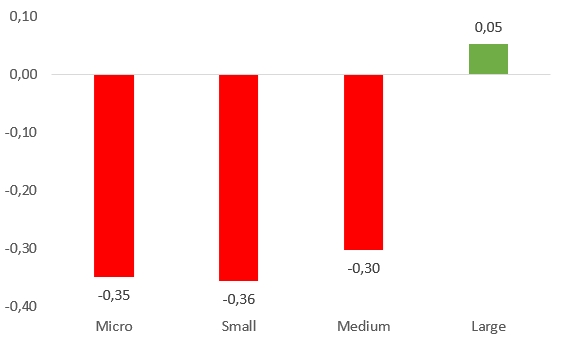

Fig.4. Index of innovation expenditures by enterprise size

Source: New Monthly Enterprises Survey “Ukrainian business in wartime.” Institute for Economic Research and Policy Consulting, 2023

The war impact on innovation expenditures also differs significantly for businesses of different sizes and sectors. Only large companies slightly more often increased expenses on innovation activities than reduced them (35% versus 29% of respondents).

However, 36% of large enterprises kept expenses at the pre-war level. As a result, the innovation expenditures index is +0.05 for large businesses. Among enterprises of other sizes, the reduction of innovation expenditures prevails.

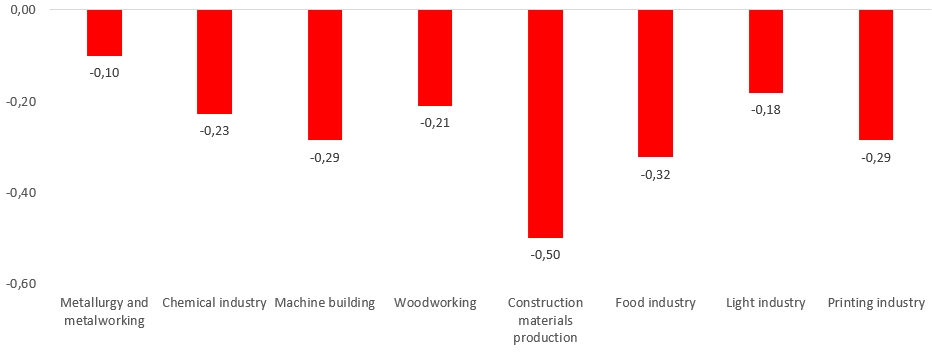

Cutting innovation expenditures has affected all manufacturing industries. However, the situation is particularly difficult for manufacturing construction materials, where the index is -0.50. Additionally, the reduction of innovation expenditures in the food industry (index -0.32), which was the recovery leader throughout the war, is also cause for concern.

Fig.5. Index of innovation expenditures by sector

Source: New Monthly Enterprises Survey “Ukrainian business in wartime.” Institute for Economic Research and Policy Consulting, 2023

Is Modernization Possible Without State Support?

Currently, society has high expectations for the modernization of Ukraine’s economy, but there are still no obvious practical solutions to launch this process. Manufacturing enterprises admit their need for state support for innovation activities. Almost three-quarters (73%) of manufacturing enterprises indicate that special long-term sectoral programs are needed.

Considering the uncertain environment, we are witnessing stagnation, degradation, and the destruction of entire industries. Avoiding these challenges through our efforts will be difficult. Perhaps businesses are awaiting sectoral programs, drawing inspiration from the reconstruction experiences of other post-war countries.

Fig.6. What can most stimulate the innovative activity of your company in the current conditions? (% of respondents)

Source: New Monthly Enterprises Survey “Ukrainian business in wartime.” Institute for Economic Research and Policy Consulting, 2023

Also, many enterprises need fiscal incentives (41%). Most often this incentive is emphasized by microbusiness, which actualizes the issue of supporting SMEs in the context of reconstruction. The business also needs to establish communication with relevant innovators (32%) and support for training specialists (32%). Such needs reflect the traditional problems of weak interaction between businesses and innovators and the lack of skilled specialists, which only deepened during the war.

Finally, a quarter of businesses need assistance in developing an innovative enterprise strategy. At the micro level, the business often does not understand why and how to modernize and expects consultations. Unfortunately, it is accompanied by the problematic nature of strategic planning at the state level. Innovation policy was inconspicuous even before the full-scale invasion, but rebuilding and modernizing the country will require a more proactive government stance.

The Institute for Economic Research and Policy Consulting conducts the New Monthly Enterprises Survey using the Business Tendency Survey approach to quickly collect information on the current economic state at the enterprise level. The methodology is designed to assess the situation from the “base level”: the judgments and expectations of key economic agents such as entrepreneurs and business managers. Data on innovations were collected for the 12th monthly survey (from April 17 to April 30, 2023). The article was prepared as part of the project “For Fair and Transparent Customs” financed by the European Union and co-financed by the Renaissance Foundation and the ATLAS Network.