After the general government deficit in Poland reached 7.8% GDP in 2010, at the beginning of 2011 Polish government presented a plan to reduce it to 3% GDP by 2012, a goal which is in line with Maastricht criteria. By the end of 2011 the European Commission assessed the actions taken by Poland as insufficient and forecasted that the deficit in 2012 will be 4% GDP, asking simultaneously for additional measures. The measures have been presented in Prime Minister’s expose and in a letter from Minister of Finance to Brussels. Taking them into account EC currently forecasts the general government deficit in Poland in 2012 to be 3.3% GDP.

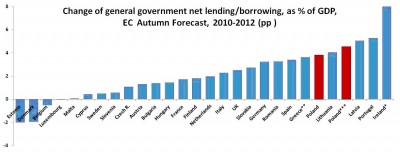

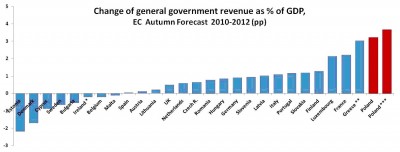

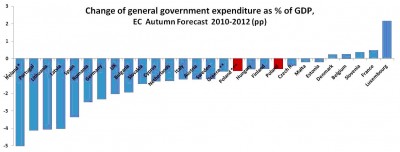

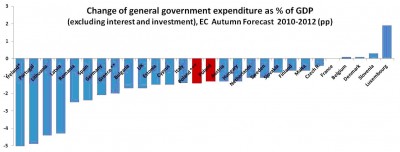

The size of the planned fiscal adjustment in Poland seems proper, but the structure of it is much more questionable, as it is apparently revenue-based. During the 2010-2012 period general government revenue (as % of GDP) is forecasted to increase by about 3.8 pp, while the expenditure will fall by merely 0.7 pp, together resulting in fiscal consolidation of about 4.5 pp, which is among the biggest within EU-27. Compared to other EU-27 countries, the planned increase of revenue in Poland is the biggest, while the planned expenditure cut is far below the EU’s average of 2 pp. The comparison is more favorable, when the growing public investment in Poland is taken into account: expenditure other than investment and interest are forecasted to fall in Poland by 1.4 pp, which is still below EU average of 1.7 pp.

The expenditure based fiscal consolidations tend to have higher chances of success and to be more durable than revenue based consolidations. For example Alesina and Perotti (1996) studying experience of OECD countries find that “(…)fiscal adjustments which rely primarily on spending cuts on transfers and the government wage bill have a better chance of being successful and are expansionary. (…) On the contrary fiscal adjustments which rely primarily on tax increases and cuts in public investment tend not to last (…)“. The results of studies on the CEE countries are similar – for example Alfonso et. al (2005) report that “(…) since the early 1990’s expenditure based consolidations have indeed tended to be more successful in Central and Eastern Europe. The reverse is also true, namely that revenue based consolidations have tended to reduce the likelihood of success. (…)”.

The impact of the fiscal consolidation on GDP growth and the incidence of non-Keynsian effects is still subject to debate, as can be seen in a resent discussion between professor Alesina and IMF staff. However both sides seem to agree, that expenditure based adjustments have better (Alesina) or less harmful (IMF) impact on growth. While Alesina and Perotti (1996) find expenditure based adjustments expansionary, IMF (2010) states that “(…) Consolidation is more painful when it relies primarily on tax hikes (…)”. Both Alesina and IMF focus mainly on OECD countries/advanced economies. But studies focused on the CEE region, like the one by Borys, Cizkowicz and Rzonca (2010) are also worth mentioning. The authors show that “(…) composition of the fiscal impulse is crucial for non-Keynesian effects to occur. We find that fiscal contractions that rely on expenditure reductions are accompanied by GDP and exports growth acceleration even in the short term (…)”.

One of the most important policy changes in 2011 was a significant increase of social contribution paid to the pay-as-you-go pillar of pension system, at the expanse of the contribution going to the capital pillar. The reduction of contribution going to private funds from 7.3% to 2.3%[1] of gross wage resulted in an increase of public revenue by about 1% GDP annually. Although this change in the short term reduces general government deficit, it might affect long term sustainability of public finance and has negative impact on national savings and GDP growth. The rest of the increase of government revenue was mainly due to changes in tax rates (VAT, excise), freeze of PIT thresholds, increase of capital transfers received and other minor policy changes. Public finances also benefited from previously implemented reforms, limiting early retirement and thus raising population’s economic activity.

The economic agenda of reelected Polish government presented in November 2011 has two economically significant items: the increase of retirement age and the increase of social contributions. Given worsening demographic situation of Poland the gradual increase of retirement age up to 67 is a necessity. The direction of the reform is right, but the speed of the implementation is too slow, particularly in the case of woman. According to the Prime Minister expose, the increase of retirement age of woman from 60 to 67 will take about 30 years (for man it will be less than 10 years, as the increase is only from 65 to 67). So slow a pace of the reform will allow woman born during the baby boom to leave the labor market before the retirement age is significantly increased, limiting the gains from reform. The second important policy change is the increase of social contribution. As a result, the tax wedge will grow, discouraging employers from creating jobs, which given low employment rate, is an unwelcomed development.

Overall picture of fiscal adjustment in Poland planned for the years 2010 – 2012 is mixed. The size of the consolidation, among the biggest in EU-27 is right. The structure however could be better, with more expenditure cuts and less revenue increases. Reduction of contributions going to the capital pillar of pension system and an increase of tax wedge stand out as particularly myopic policies. On the other hand, the growing activity rate, the effect of previous reforms, is a welcomed development.

Fiscal adjustment in Poland planned for the period 2010-2012 is among the biggest in EU-27.

Planned reduction of general government net borrowing is mainly due to the growth of general government revenue, which will be the biggest among EU-27 countries.

Planned reduction of public expenditure is rather limited.

It should be noticed however, that Poland will be one of the few countries with public investment (as % GDP) higher in 2010 than in 2012. But still, even excluding interest and investment, the planned reduction of other public expenditure is rather limited.

Source: EC Autumn Forecast

*out of scale; public expenditure as % of GDP in Ireland will fall by 23.1 pp between 2010 and 2012. The size of this fall is due to one off cost of banking crisis.

**The forecasts were finalized before the European Union Summit of 26 October 2011. Thus, they have not been updated to reflect the decisions taken at this summit which will have a direct impact on the debt, the interest and the deficit projections as of 2012.

*** additional measures announced after the publication of the EC forecast have been taken into account. This include: higher social contribution (5 bn PLN), new tax on copper and silver (1.5 bn PLN), changes in taxation of interest on bank savings (0.4 bn PLN), healthcare contribution paid by farmers (0.2 bn PLN), stricter deficit limits for local government (expenditure reduction by 2 bn PLN), higher wages for police officers (expenditure increase by 0.2 bn PLN).

[1] Over time the part of contribution going to capital pillar will be gradually lifted to 3.5% of Gross wage.