One of the most frequently repeated electoral promises of the Civic Coalition and the Third Way in the parliamentary elections was the “depoliticization of state-owned enterprises.” This pledge was reflected in point 13 of the coalition agreement from November 10, 2023, which states, “One of the coalition’s priorities will be the depoliticization of state-owned companies by introducing clear recruitment criteria for managerial positions.“[1]

Szymon Hołownia, leader of Poland 2050, announced on Twitter a commitment to “detach politics from the finances of state-owned companies,” stating, “We did not come to precipitate in old policies. We came to change them.”[2] By the end of February, deputies from his party submitted a legislative proposal to amend certain acts aimed at repairing corporate governance in state-shareholding companies. [3]

Transparent and fair selection rules for board members of state-controlled companies are an important step towards depoliticizing these entities, yet they are insufficient alone. The only true change that would allow for a real and complete depoliticization of state-owned enterprises is their privatization. [4] Controversies related to partisan appointments will not cease as long as politicians have any influence over such appointments—such influence as exercised by the Ministry of State Assets and other departments and agencies through ownership of shares.

Unfortunately, recent statements by ministry representatives suggest that true and lasting depoliticization is unlikely to occur. Deputy Minister of State Assets Marcin Kulasek, when asked about privatization plans, stated that “there are no such plans at all. We believe that the state treasury should maintain these companies.”[5]This message disturbingly echoes the claims of Marzena Małek, Minister of State Assets in the so-called two-week government of Mateusz Morawiecki: “The sale of Polish national assets, also known as the privatization of state-owned enterprises, is not a mistake, it is a crime.”[6]

The KO-TD-NL coalition government does not plan to return to the path of privatization, which was maintained by all governments—except those of Law and Justice—after 1989. The transformation and its most crucial element, privatization, enabled unprecedented economic development and catching up with the West. After 2015, instead of decreasing the share of state ownership, the Law and Justice government nationalized private companies, calling it “repolonization.” Notable examples include Pekao Bank, Polskie Koleje Linowe, Polska Press, and power plants. They also created and developed state-owned holdings reminiscent of the shamed communist-era conglomerates (zjednoczenia), such as Polski Holding Hotelowy, Polska Grupa Lotnicza, or Krajowa Grupa Spożywcza.

State Ownership in Economy

The share of state ownership in the economy is very high in Poland. Regardless of the used methodology and source, Poland ranks among the countries with the highest share of state ownership in the European Union, often leading to this shameful ranking. A certain difficulty in comparing data on the share of state-owned enterprises (SOEs) in the economy is the definition itself. Generally, state-controlled companies are economic entities over which the state exercises corporate control, either directly or indirectly.

However, in different countries, such enterprises may operate according to different models, such as state enterprises, companies created by acts of law, or commercial law companies. In the latter case—especially in the case of companies listed on the stock exchange—the state may not even hold a majority share in the capital to exercise control over such company, as the remaining shares are dispersed among many smaller private owners. [7]

What is more, the state’s involvement in the economy can be measured in various ways, such as by analyzing the turnover or the added value of state-owned enterprises relative to other entities in the economy, or by examining the share of employment in these firms as a proportion of total employment.

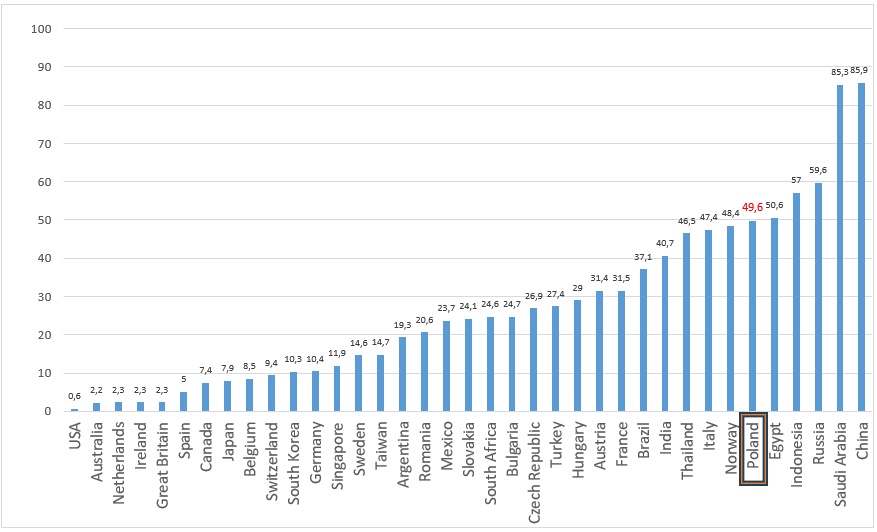

According to an index developed by Maciej Bałtowski and Grzegorz Kwiatkowski, the share of state-controlled entities among the 100 largest companies in Poland, measured by turnover and assets, is nearly 50%.[8] This is the highest result among the European Union countries studied. Poland “competes” with countries such as Egypt and Russia in this respect.

Chart 1: SS-100 Index, i.e., the share of state-owned enterprises among the 100 largest corporations in a given country, measured by turnover and assets.

Source: Own elaboration based on M. Bałtowski, G. Kwiatkowski, State-Owned Enterprises in the Global Economy, 2022, Routledge, p. 299-300.

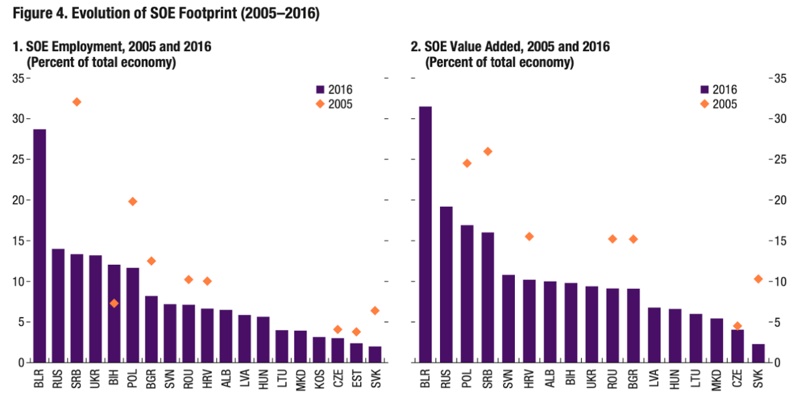

The International Monetary Fund assessed that in 2016, state-controlled enterprises in Poland accounted for approximately 17% of the added value and employed about 13% of workers. [9]This is the highest among the post-socialist countries of the European Union. Only Bosnia and Herzegovina, Ukraine, Serbia, Russia, and Belarus have a higher state presence in the economy in terms of employment, while only Russia and Belarus surpass Poland in terms of added value contributed by state enterprises.

Source: IMF, Reassessing the Role of State-Owned Enterprises in Central, Eastern and Southeastern Europe, 2019, Figure 4.

Source: IMF, Reassessing the Role of State-Owned Enterprises in Central, Eastern and Southeastern Europe, 2019, Figure 4.

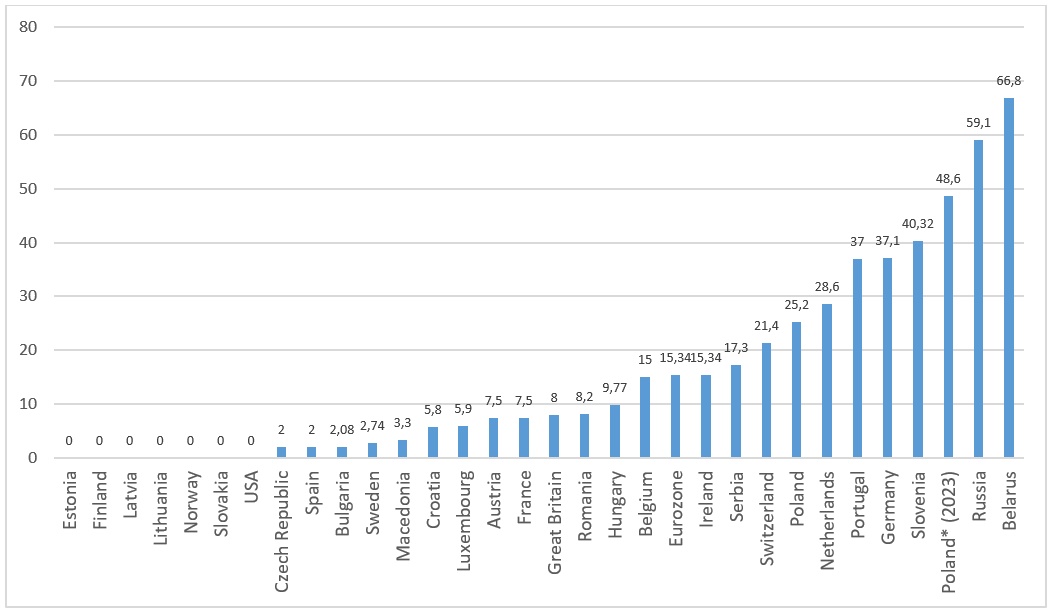

The Situation in the Banking Sector is even worse. According to the Financial Supervision Authority, by the end of 2023, the state, measured by assets, controlled nearly half of the banking sector. In 2016, according to the World Bank, the state’s share in Poland was over 25%.[10]Following the nationalizations of banks by the Law and Justice (PiS) government, this share, according to the Financial Supervision Authority, increased to 48.6% in 2023[11], which is the highest percentage in the European Union.

Chart 2: Percentage Share of State-Controlled Banks in the Entire State Sector in 2016

*Share of state capital in the banking sector in Poland according to monthly data from the Financial Supervision Authority (KNF) at the end of 2023. The rest of the countries according to the World Bank for the year 2016. Source: Own elaboration based on Bank Regulation And Supervision Survey (2023), World Bank, and Financial Supervision Authority. Monthly banking sector data – December 2023.

The abovementioned data clearly shows that the share of state ownership, i.e., the influence of politicians on the economy in Poland compared to other countries, is very high. Discussions about depoliticizing the economy without privatization remain futile. Open competitions for open positions in firms controlled by the state, or even the proposed law regulating the staffing rules cannot address the core problem, which is the ownership structure of the Polish economy.

References

[1] Coalition Agreement of 10 November 2023 https://platforma.org/upload/document/203/attachments/433/UmowaKoalicyjna.pdf

[2] https://twitter.com/szymon_holownia/status/1757052686124376385

[3] A parliamentary act amending certain acts to improve corporate governance in companies with State Treasury shareholding. https://orka.sejm.gov.pl/Druki10ka.nsf/Projekty/10-020-75-2024/$file/10-020-75-2024.pdf.

[4]Zieliński M., Odpolitycznienie przedsiębiorstw kontrolowanych przez państwo. https://for.org.pl/pl/a/9454,odpolitycznienie-przedsiebiorstw-kontrolowanych-przez-panstwo

[5] PAP after Radio Zet, MoSA does not plan to privatize state-owned companies – deputy minister, https://biznes.pap.pl/pl/news/pap/info/3547105,map-nie-planuje-prywatyzacji-spolek-skarbu-panstwa—wiceminister

[6] Minister of State Assets: Privatization? It’s not a mistake, it’s a crime https://www.bankier.pl/wiadomosc/Minister-Aktywow-Panstwowych-Prywatyzacja-To-nie-blad-to-zbrodnia-8657243.html

[7]Bałtowski M., Więcej władzy niż własności – Skarb Państwa jako szczególny inwestor na GPW w Warszawie., Studia Ekonomiczne, (2017). https://inepan.pl/wp-content/uploads/2017/07/SE_2017-1_Baltowski.pdf

[8] M. Bałtowski, G. Kwiatkowski, State-Owned Enterprises in the Global Economy, 2022, Routledge, s. 299-300.

[9] IMF, Reassessing the Role of State-Owned Enterprises in Central, Eastern and Southeastern Europe, 2019, Figure 4.

[10] World Bank, Bank Regulation and Supervision Ten Years after the Global Financial Crisis (2019)

[11] Polish Financial Supervision Authority. Monthly data for the banking sector – December 2023.