Gold and silver are still in the correction phase. Switzerland is going to introduce a gold coin as official currency. Swiss army is prepared. Mario Draghi will kiss with everybody.

Gold and silver were traded around $1737 and $32.7 per ounce at the beginning of the week. The story for this week is very similar as was for the previous one – correction. Both metals were smashed down on Monday but we could witness some returns during following days to the level of $1750 on gold and $33 on silver. But the same story from the beginning of the week was repeated on Friday. Both prices were almost identically smash down within 30 minutes; gold was down for $20 and silver for $0.40.

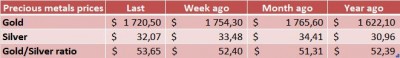

Gold finally closed the week on $1720.5 per ounce what was $33.8 less than the previous week. Silver closed on $32.07 per ounce what was $ 1.41 USD less compare to the previous week. The gold/silver ratio is 1 to 53.65 (i.e. you could buy 53.65 gram of silver for 1 gram of gold, it was 52.40 week before). It indicates that silver was again not so successful compare to gold this week. But it is in accordance to our opinion that silver price will be injured much more by correction compare to gold.

Once again nothing important happened on the market during first days of this week. The ride on the precious metals on Tuesday was probably connected with the dollar index decline. We were waiting for some important announcements from the EU summit but as usual all details will be dealt in the future.

There were not any huge moves in the short position holdings on the COMEX however they once again slightly declined and I think that the trend will continue after the price action within this week. But there is still a probability of the further price correction and especially on silver. But who knows? We have to be aware also some other facts or probably chatting because there don´t belong to any official announcements. As one London trader confided to KWN “the competition to buy physical (gold) is extremely fierce right now.” And he described similar situation in silver market. He stated that “when they (commercials shorts) see a large physical order enter the market, that’s the point where the commercials start covering.” If it is really true, it doesn´t mean nothing else just the fact that we will not witness any huge correction because any price drop will be used by physical buyers to buy and make them more furious for getting as much physical stuff as possible to get rid of their US dollars. The next question will be how difficult is to get some physical. I think that we will see the future price of precious metals in the context of answers to these questions. Once traders find out that it is too difficult to deliver physical the price will rise north as a polar explorer.

We are still bullish on the precious metals prices in the long run. We have the same reasons for that: printing money, poor economic data, debts of governments and no reasonable solution offered by politicians.

Overview of the prices of gold and silver for the remaining periods:

Source: upner.com, kitco.com

News from the world of silver and gold

Central bank of Vietnam tries to acquire gold which is hold by private individuals but it is not so successful. Vietnamese are very gold positive nation because of vast inflation periods in the country. The Central Bank officials presuppose that public hold approximately 400 ton of gold. The Central bank banned commercial banks to accept gold deposits. They try to acquire gold by changing it for gold certificates which could be possible to trade subsequently on the secondary market. But Vietnamese are probably aware of the fact that this action has nothing to do with their wellbeing and as a consequence of these prohibitive attempts against private ownership of gold the price of gold is actually $152 over the global spot market price because of demand for yellow metal.

The Perth Mint of Australia has announced that it sales of silver rose up to 1,251,580 ounces (269% growth from prior month) and gold rose to 81,095 ounces (118% growth from prior month) and very similar situation is in the US Mint as well. China is still busy to hoarding their physical gold and silver bullion. The export of gold from Australia to China has soared a 900% in the first 8 month 2012 worth $4.1 billion.

Central Bank of Mexico is probably very first central bank which has revealed how much gold it possess in other countries. It has approximately 126 ton of gold which 95 % of it is in England, 4 % in Mexico and 1 % in the US. It is very probable that the gold is in England but it is not absolutely sure if England custodians do not use it for other purposes like lending of swaps.

The crisis in the European Union makes the Asia much attractive for European gold investors according to Deutsche Bank. Best destination for European gold is Singapore. The basic purpose to moving gold out of the EU is concerns about their banking sector and its possible collapse. The same story is happened in China where wealthy individuals also diversify their storing opportunities and move their bullion outside the country.

According to Egon von Greyerz who speaks to KWN Switzerland is going to introduce gold coin as a parallel currency. The initiative is based on the idea that Switzerland has a quite positive attitude towards gold and is very likely that the proposition will pass. According to Greyerz there are also other initiatives in Switzerland. One of them tries to back up the Switzerland frank by gold on the level of 20%. It seems that this country could be a suitable one if you want to diversify the risk of nationalization of your gold. The reason is simple – quite positive attitude to yellow metal.

Influential news

The most important topic of the week was the 20th crisis-fighting EU summit. As usually leaders decided that they will decide about the most important questions and details next time. It shows us that there is no unanimity among them; for example Mr. Rumpoy said that “the banking supervisor can probably be effectively operational, allowing the euro bailout fund to lend directly to banks as soon as 2013,” but German chancellor said that “there are complicated questions to clarify and we’ll see in December if we complete it or not.” Anyway Germans have problems with the direct recapitalization efforts of banks from the firewall fund. And it is very logical. It is better for them (and here I agree with them it is better for us as Slovak shareholders of the ESM as well) if the entity which owes money to the ESM is the sovereign state and not a private bank. But it seems that there will be some kind of compromise and they will probably agree on the possibility of the direct recapitalization of banks but with no retroactivity. It means that the direct recapitalization of banks will be possible for future problems not for debts of banks which already exist.

What other was important on the summit? Greeks were praised that they did a lot of work with their primary budget which is planned in surplus. It seems to me that there are no plans for Greece to exit the Eurozone and the money they are awaiting for are already packed whatever Troika said. This was also indirectly confirmed by the German finance minister in Singapore conference last weekend where he said that Greece will not bankrupt (as if it does not already happened) and is not forced out of the Eurozone.

Spanish Prime Minister Rajoy was not facing any pressure to ask for any aid and he wouldn’t take any such pressure into account in any case. I would say this is true. I think it will not be necessary to take any pressure into account because Spain is already falling on the knees and he will be more than happy for financial help. According to some sources Spain will ask for the aid most likely in November. There are some reasons behind this. First, they have enough cash at least till the end of October and second, the decision about the help must be discussed in the German, Finnish and Dutch parliament. And the plan is to discuss the new package for Greece, Cyprus and Spain at once.

German Finance Minister Wolfgang Schäuble wants to solve the European crisis once and for all. He wants to suggest to introduce the position of the commissioner for economic and currency affairs (I would say that he wants to be the first one) who will control all Eurozone countries budget proposals and if there are some problems he will resend the budget for adjustments. The commissioner would become equally powerful as the commissioner for competition who rules very independently. Do you see? More concentration of powers, more centralization, new bureaucracy, new public office, new public servants and more problems; sorry but I do not see any real solutions. Human race is incorrigible for 5,000 years so I am not very surprised for this.

The France starts to remind us old socialists’ regimes times. And it is not the question of 75% income stupid tax but other suggestions; this time it is a law which aims to reduce the electricity consumption in the country as the Hollande election promise. And they try to fulfill it with huge enthusiasm. They suggested that homes should pay bills based on wages, age and climate and would like to set the reward and the penalty incentives for less and more electricity consumptions. It is clear that what is less and what is more will be stated in the law. The bill did not pass yet paradoxically because of French communists. I think no comments are necessary.

First swallows of the real problems of Italian banking sector are more and more visible. Moody´s downgraded the world’s oldest bank Monte dei Paschi di Siena by two notches to Ba2 from Baa3 as a consequence not to increase its capital base to the required level and hence elicited government’s assistance. I think that we will hear about Italy more often in the very near future.

In the meantime the Swiss army is preparing itself for potential riots, civil unrest and refugees from the EU. Swiss defense minister told that there may be some escalation of violence in Europe as a consequence of the financial crisis and he cannot exclude that in the coming years Switzerland may need the army.

China announced its 7.4% YoY GDP growth which was exactly the same as the forecast and officials believe that the stated target 7.5% growth for 2012 will be reached. The industrial production was up 9.2% and growth in retail sale rose unbelievably to 14.2%. But all these data are questionable. Why? It is because of electricity consumption which has dropped by 2.9% at the same time. This could indicate that the official 7% GDP growth rate is very likely lower.

Ok. So “the most important” news at the end. Mario Draghi has hired Christine Claire Graeff (39) as communication director. She will help him to communicate his vision and policies and probably some interpersonal communication as well because she is some sort of a kissing manner specialist. But it is not very likely that she will help him to improve relationships with German Bundesbank Jens Weidmann who opposes everything from Draghi. According to Graeff’s memo, the German level of corporate kissing is “mostly none.”