Ukrainian industrial enterprises entered 2015 with a negative perspective on the business climate in the country. The ongoing conflict and economic downturn have taken a toll on Ukrainian businesses across the sectors and sizes. For them, the current political and market uncertainty would make a zero-growth scenario look like a positive development, which, however, is not yet in sight: as shown in the survey by the Kyiv-based Institute for Economic Research and Policy Consulting (IER), business climate keeps deteriorating.

In early 2015, very few Ukrainian industrial enterprises polled by the IER assessed the economic situation in the country positively. Their share was 1.7% out of 312 industrial firms of different sectors and regions of Ukraine that made up the sample of the February 2015 survey. This is even less than 6.5% of the enterprises that were positively-minded in October 2014 when the previous survey was held. In February 2015, 42.7% of industrial firms called business climate in Ukraine negative, and 55.6% considered it neutral. To compare, in October 2014, firms with neutral assessments comprised 53.6% of the polled, and 39.9% of the firms called business climate negative.

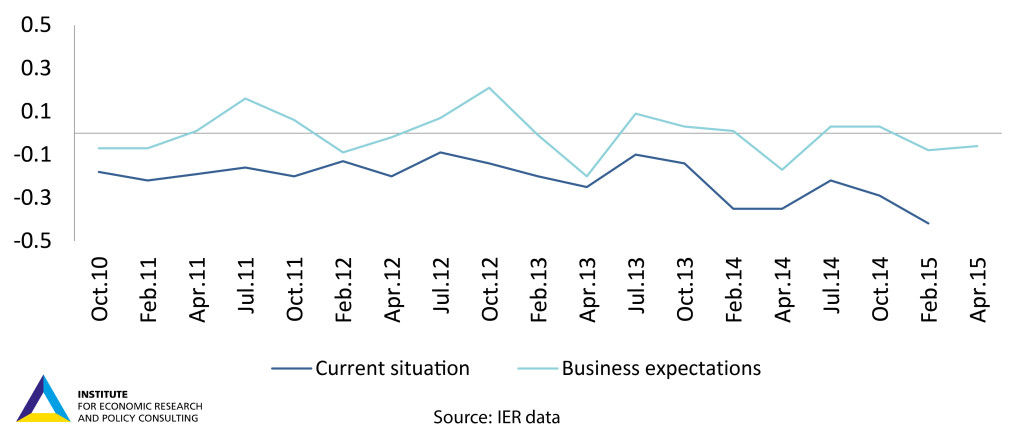

As a result, there was an evident decline of the business climate indicator that measures the difference between the positive and negative opinions of the enterprises. The indicator fell down to -0.42 in February 2015 from its previous mark of -0.29 in October 2014. In the history of the IER polls, this has proved to be the lowest value of the business climate indicator since the 2009 recession in Ukraine.

Bigger and smaller firms alike find the business climate unfavorable. 45.4% of small industrial enterprises (employing up to 50 persons) as well as 40.9% of medium-sized firms (with 50-250 employees) and 41.8% of big ones (with 250 employees and more) consider the economic situation in the country to be negative. 53.7% of small enterprises, 56.5% of the middle ones, and 57% of big enterprises made neutral assessments of the current business climate in Ukraine.

In their prospects for the next few months Ukrainian enterprises seemed to be uncertain and in hope for a basic stabilization. Most of them did not have positive or negative expectations. In February 2015, 68.4% of the polled enterprises believed that the business climate in Ukraine would not change in the following six months. One out of five respondents (18%) was pessimistic about future changes saying that business climate would deteriorate. The optimists made up 13.6% of the polled firms. They anticipated improvement of the business climate in the next half a year.

In their prospects for the next few months Ukrainian enterprises seemed to be uncertain and in hope for a basic stabilization. Most of them did not have positive or negative expectations. In February 2015, 68.4% of the polled enterprises believed that the business climate in Ukraine would not change in the following six months. One out of five respondents (18%) was pessimistic about future changes saying that business climate would deteriorate. The optimists made up 13.6% of the polled firms. They anticipated improvement of the business climate in the next half a year.

Businesses’ expectations about the economic situation in Ukraine were practically the same in the previous quarter. In the October 2014 poll, 20% of the industrial enterprises expected business climate to worsen, 12.8% believed it would improve, and 67.2% thought it would not change. Thus, the index of business climate expectations had stayed at the same near-zero level for two quarters. In October 2014, its value was -0.09, and in February 2015, it was -0.06.

Small and medium-sized firms had similar expectations about the future developments in the economic situation of Ukraine. 14.7% of small enterprises and 15.8% of medium ones assumed business climate would improve. 20.6% of small enterprises thought that business climate would get worse, as did 18.4% of medium firms. The remaining 64% of small entities and 65.85% of medium-sized enterprises did not expect business climate to change over the next six months.

Big industrial enterprises mostly did not expect the economic situation in Ukraine to turn for the better or for worse over the following half a year. Specifically, 75% of them believed the business climate would not change during these months. Considering the current economic decline in Ukraine this appears to be quite an optimistic outlook.

An article by Iryna Fedets