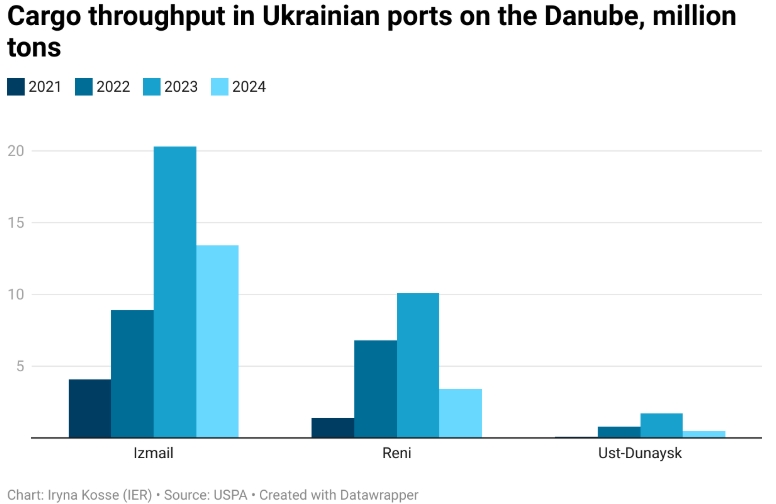

In 2022–2023, when Russian aggression blocked most of Ukraine’s Black Sea ports, the small river ports of Izmail, Reni, and Ust-Dunaisk quietly became lifelines. Grain, metals, oil products — all rerouted through the Danube. Cargo volumes multiplied sixfold. But in 2024, things changed.

With the reopening of the Black Sea corridor, cargo naturally shifted back. Danube traffic dropped by nearly 46%, falling to 17.3 million tons. Grain exports via the Romanian port of Constanța also fell sixfold in early 2025. Nibulon, one of Ukraine’s largest exporters, has stated it sees little opportunity to scale grain exports via the Danube under current conditions.

But does that mean the Danube ports have served their purpose? Absolutely not.

While bulk cargo, such as grain, is heading back to deep-sea ports, the Danube continues to serve as a strategic hub for cargoes requiring specialized handling, including fertilizers, oil products, and metals. Izmail remains a vital link for Ukrainian iron ore exports to European Union (EU) steel plants. Oil product throughput is growing. The infrastructure built in crisis should not now be left to wither.

Why This Matters

The Danube corridor is not just a short-term workaround. It is part of the Solidarity Lanes initiative — the EU’s flagship effort to physically integrate Ukraine into its transport and trade system. It is also a pathway into the TEN-T network, which provides access to long-term EU funding and planning.

Ukraine cannot afford to treat this as a fallback. It is the opposite: it provides resilience — logistical redundancy in the best sense of the word. A functioning, EU-aligned Danube cluster means:

- Less reliance on a single corridor (Odesa/Pivdennyi).

- Increased flexibility for mid-size cargoes and niche trade.

- Cross-border integration with Romania, Moldova, and beyond.

- Opportunity for localized industrial development near port zones.

What Needs to Happen Next

To preserve and scale this resilience, several priorities are clear:

- Dredging and depth maintenance must be consistent. Low water levels in summer and autumn severely constrain throughput.

- EU-backed co-investment must expand. Through the RELINC program alone, $34.5 million in equipment and fleet renewal is already planned.

- Integration into TEN-T is essential — for funding, status, and interoperability.

- Support for niche cargoes, such as fertilizers, oil products, and minerals, is key. Not everything moves in Panamax bulk.

- Encouraging industrial activity in port zones will turn throughput into added value.

Final Thought

The Danube ports do not need a rescue plan. What they need is strategic integration. With vision, coordination, and modest public investment, they can shift from being Ukraine’s crisis infrastructure to becoming a foundational part of its European economic future.

Because in logistics — just like in geopolitics — flexibility is strength.

Continue exploring:

AI Regulation: Comparative Analysis of EU, USA, and Ukraine’s Approaches