The special connection between a federal or non-centralised state structure on the one hand and economic development on the other has become increasingly important in recent years, not least because of the Eurozone debt crisis.

Politically, the debate on this issue goes back a long way. It already played a central role when the U.S. Constitution was ratified in 1787/88. It gave rise to one of the liveliest intellectual discussions on the foundations of political, social and economic orders. That also made it a conflict about various economic concepts.

Some of the leading representatives of the Federalists, as the proponents of the Constitution called themselves, pursued not only the design of a more centralised federal structure of the state, but also a neo-mercantilist policy of protectionism and state subsidies for the economy. This was true particularly of Alexander Hamilton.[1]

Many of the ratification opponents, the Anti-Federalists, opposed not only political centralisation, but also an excessively politicised economy. James Winthrop, a librarian at Harvard who used the pseudonym Agrippa, illustrated this approach in his polemics of 1788, where he emphasised a market-oriented credo: “There cannot be a doubt, while the trade of this continent remains free, the activity of our countrymen will secure their full share.”[2]

At the same time, he emphasised that, when states had the authority to make decisions, this brought their comparative advantages into relief, and that a federal government should, therefore, at most act as an arbitrator. He asked whether there weren’t better alternatives to a strong federal power: “Fortunately there is one. This is commerce. All the states have local advantages, and in a considerable degree separate interests. They are, therefore, in a situation to supply each other’s want. … A diversity of produce, wants and interests, produces commerce, and commerce, where there is a common, equal and moderate authority to preside, produces friendship.”[3]

This early and robust debate in the U.S. established a tradition and indirectly helped to define a theme of more recent political economics. Public choice economists, who deal with economic incentives in political processes and institutions in the spirit of James Buchanan and Gordon Tullock, noted early on that federalism and non-centralisation led to increased economic competition between geographic locations and could, therefore, bring about more liberal economic policy.[4] In the words of one exponent of this theory, Viktor Vanberg, “competition between governments… may be compared to ordinary market competition between firms”[5] – competition which needs regulatory or constitutional rules to work, though.

The New Economic History school further pursued this approach. For example, one prominent argument sought to explain the early occurrence of the Industrial Revolution in Europe by pointing to the relative cultural and economic coherence despite the political fragmentation This enabled political competition and avoided fateful decisions that affected wide areas, as occurred in politically centralised cultural areas – like the decree of the Chinese Ming emperor in 1480 to abandon overseas travel and exploration by ship, which held back its economic development for a long time. Eric Lionel Jones, one of the early representatives of the school, speaks of the decisive benefit of non-centralisation, namely that it offers fewer opportunities for “incontrovertible system-wide decisions”[6]. According to this logic, federalism continually opens up new fields for experimentation.

But even outside of the U.S. context, the federal structures have been recognized time and again as an essential condition for a free market order. This is especially true of the tradition of German ordoliberalism. Wilhelm Röpke pointed out that state centralisation was the logical political complement of a centrally planned economy: “A collectivist administrative economy that is rooted in national centralisation must prove incompatible with federalism and regional or communal self-administration. It robs true administrative decentralisation of the air it needs to breathe by coercively coordinating the economy by means of a central plan.”[7]

It would seem that the positive relationship between federalism and non-centralisation on the one hand, and successful political implementation of economic freedom on the other hand, has been solidly established at a theoretical level. But theories are only valid if they can be empirically tested. This is the topic of this essay, which explores the question using statistics. Is it even possible to measure non-centralisation (defined here as federalism) and economic freedom (and its results), as well as their interdependence? Notwithstanding, several tools of varying quality are available for this purpose.

I. Measuring economic freedom

Comparative measurements of economic freedom are relatively easy to do. There are two global comparative indices that have existed for a long time and which are updated annually. The Economic Freedom of the World index, published by an international consortium of free market think tanks (including the Liberal Institute of the Friedrich Naumann Stiftung for Freedom), is the most widely recognised and cited in the academic literature.

The Economic Freedom of the World report, which has been published annually since 1996, measures economic freedom for143 countries in five areas, which are subdivided into 42 components and sub-components:

| Area | Component/Sub-Component[8] | |

| 1 | Size of Government: Expenditures, Taxes, and Enterprises | General government consumption spending as a percentage of total consumption |

| Transfers and subsidies as a percentage of GDP | ||

| Government enterprises and investment | ||

| Top marginal tax rate– Top marginal income tax rate

– Top marginal income and payroll taxes |

||

| 2 | Legal Structure and Security of Property Rights | Judicial independence |

| Impartial courts | ||

| Protection of property rights | ||

| Military interference in rule of law and the political process | ||

| Integrity of the legal system | ||

| Legal enforcement of contracts | ||

| Regulatory restrictions on the sale of real property | ||

| 3 | Access to Sound Money | Money growth |

| Standard deviation of inflation | ||

| Inflation: Most recent year | ||

| Freedom to own foreign currency bank accounts | ||

| 4 | Freedom to Trade Internationally | Taxes on international trade– Revenues from trade taxes (% of trade sector)

– Mean tariff rate – Standard deviation of tariff rates |

| Regulatory trade barriers– Non-tariff trade barriers

– Compliance costs of importing & exporting |

||

| Size of trade sector relative to expected | ||

| Black-market exchange rate | ||

| International capital market controls– Foreign ownership/investment restrictions

– Capital controls |

||

| 5 | Regulation of Credit, Labour, and Business | A. Credit market regulations– Ownership of banks

– Foreign bank competition – Private sector credit – Interest rate controls/negative real interest rates B. Labour market regulations – Minimum wage – Hiring and firing regulations – Centralised collective bargaining – Mandated costs of worker dismissal – Conscription C. Business Regulation – Price controls – Administrative requirements – Bureaucracy costs – Starting a business – Extra payments/bribes – Licensing restrictions – Cost of tax compliance |

The data on which the index is based is taken from international sources (World Bank, WEF, etc.) as far as possible to enable comparisons to be made across countries.

The data is shown on a scale ranging from 0 (= economically unfree) to 10 (= free) for statistical processing.

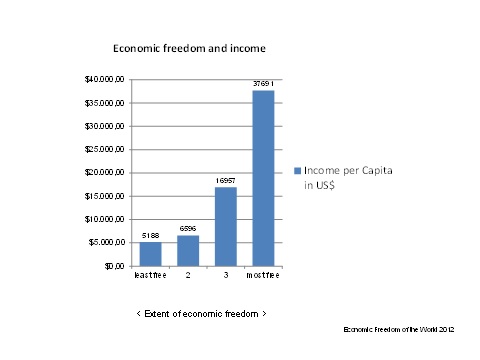

The results can easily be summarised: regarding the main parameters of prosperity (growth, average income, education etc.), economically freer countries perform better throughout – and often substantively better – than the ones that are not free. The diagram shows just one example. Countries are grouped together to mitigate the latent effects of country-specific special conditions or events on factors of prosperity without showing a correlation with economic freedom. Therefore, the following diagram shows countries grouped into quartiles, that is, one group containing the freest countries, another containing the second-ranked countries in terms of freedom, and so on. Only by aggregating countries in this way can general statements be derived about relationships. Afterwards, the findings of Economic Freedom of the World are correlated with corresponding data. In this case, it is average per capita income:

Average incomes in the quartile with the economically freest countries are almost seven times higher than those of the least free countries. So, if it were to turn out that a federal structure of the state indeed benefits economic freedom, this would make a not inconsiderable contribution to prosperity.

For the purpose of identifying correlations with possible indices of federalism or regionalism, areas such as size of government, taxes and international trade [9] were emphasised. These are areas where the impact of inter-state competition is most likely to influence size. It remains to be seen whether the set of criteria of the Economic Freedom of the World report is sufficiently differentiated for this task.

II. Measuring federalism

Measuring the degree of federal non-centralisation turns out to be much more difficult than measuring economic freedom. Federalism is a vague term. It can mean more than just the political autonomy of certain regions in a country. Even the degree of autonomy itself may vary – from the constitution of the German Reich of 1871, which still contained many confederal elements, to the “unitary federal state”[10] of today’s Federal Republic of Germany. With regard to economic competition between geographic locations, there is also the fundamental distinction between competitive federalism, where the focus is on the competencies of the sub-units, and the model of “cooperative federalism”[11], which focuses on co-determination by regions when it comes to economic and distributive decisions at the federal level. As the example of the Federal Republic of Germany shows, the latter excludes competition between political approaches or, at the very least, reduces it. This makes it necessary to precisely differentiate between the various types of federalism and the associated degrees of autonomy in order to describe their relationship with economic freedom properly.

Most attempts to set up an international comparative classification of federalism have been less thorough than measurements of economic freedom. A true, regularly updated index remains an unfulfilled wish. But in recent years, there have been some serious attempts to achieve a classification that can be verified quantitatively.[12] Here, two main sources are used: first, the 2008 essays on measuring regional autonomy by Gary Marks, Liesbeth Hooghe and Arian H. Schakel [13], and second, the OECD studies by Hansjörg Blöchliger and Oliver Petzold on the subject of fiscal federalism.[14] The first measures the extent of competencies of regional authorities in 42 countries, based on 16 criteria (further subdivided into 44 sub-criteria) between 1950 and 2006. The criteria encompass the institutional level (e.g. existence of a separate parliamentary representation), the range of competencies, and fiscal economy. The criteria are scored using a system of points and then aggregated to form an overall result. The dataset is very substantial and covers all sub-entities down to the local level. In this paper only the second level (e.g. the German Länder) is analysed.

III. Federalism and economic freedom

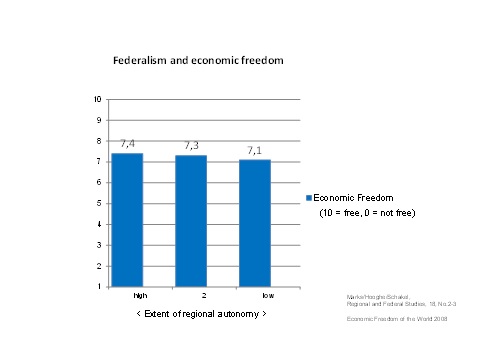

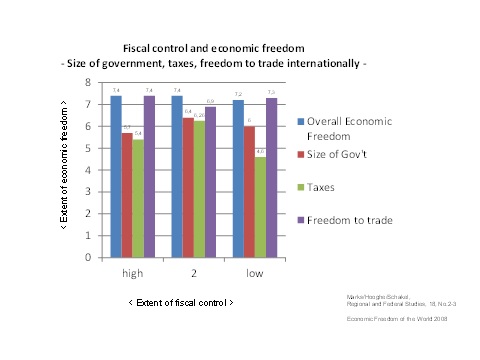

What connection is there between the classifications by Marks/Hooghe/Schakel and economic freedom? In the following diagram, the countries assessed by Marks/Hooghe/Schakel were simply divided into three groups: those with the highest, second-highest and lowest degree of regional competency allocations. These were then assigned the respective average value of economic freedom according to the Economic Freedom of the World index. The results are shown in this diagram, which displays data from 2006 (the latest year included by Marks/Hooghe/Schakel.)

This rather rough representation does not show any obvious link between federalism and economic freedom. On the 10-point scale of economic freedom, the differences are visible only in the last decimal places.

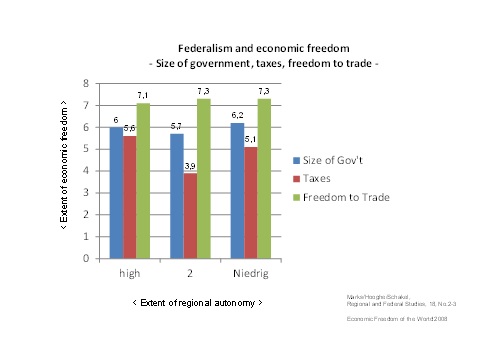

Though the result may be surprising at first glance, some of the criteria used by Marks/Hooghe/Schakel are neutral per se towards economic competition – for instance, the question of how far parliamentary representation reaches – whereas others are directly affected. Moreover, not all criteria of economic freedom are taken into account equally in competition between geographical locations. As mentioned above, it also seems advisable to break down the components and criteria of Economic Freedom of the World and to establish a statistical relationship between size of government, taxes and international trade on the one hand and the degree of federalism on the other. The following picture emerges:

Here, some differences are clearly visible. Whereas the differences are relatively small for size of government and free trade, they are more pronounced in the area of taxes as a factor of economic freedom. At least less centralised countries perform better here, although the trend does not continue linearly for the most centralised countries.

IV. Competitive federalism: fiscal autonomy and economic freedom

The model requires more refinement. The component of federalism that matters for economic competition has to be isolated first and can then be correlated with the corresponding criteria of Economic Freedom of the World.

The element that probably affects competition most directly is tax jurisdiction. Here we use “fiscal autonomy” as described by Marks/Hooghe/Schakel as a criterion subdivided into five sub-criteria:

| Fiscal Autonomy | Score | Extent to which a regional government can independently tax its population |

| Based on Marks, Hooghe, Schakel, 2008 | 0 | The central government sets the base and rate of all regional taxes |

| 1 | the regional government sets the rate of minor taxes | |

| 2 | the regional government sets the base and rate of minor taxes | |

| 3 | the regional government sets the rate of at least one major tax: personal income, corporate, value added or sales tax | |

| 4 | the regional government sets base and rate of at least one major tax: personal income, corporate, value added or sales tax |

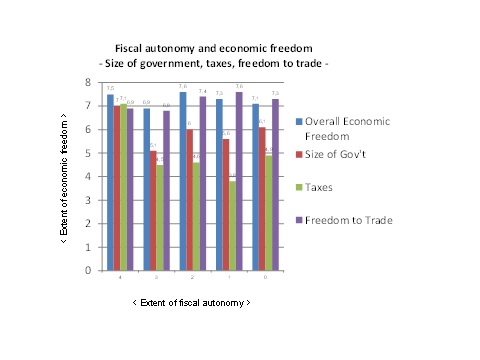

In the following diagram, the countries are classified according to these scores (0-4) and every group is assessed by applying the average value of the three criteria from the Economic Freedom of the World used above:

The trend that just started to appear in the previous diagram is now much more obvious. While the differences are almost insignificant for economic freedom (in general) and free trade, they are clearly visible for size of government and indeed remarkable for taxes. This allows the preliminary conclusion to be drawn that there is a tendency to have a smaller state and, above all, a lower tax burden in places where there is a high degree of fiscal autonomy.

Where fiscal autonomy is understood to mean the independent and self-determined right of regional authorities to raise taxes, it is one of the essential characteristics of competitive federalism. Cooperative federalism, on the other hand, is characterised by strong participatory rights when it comes to redistributing tax revenues – for instance, by means of a horizontal or vertical revenue sharing approach. Contrasting the two models could provide useful insights in the context of the ongoing discussions about the reform of federalism in Germany.

V. Cooperative federalism: Fiscal control and economic freedom

In addition to fiscal autonomy, the analysis by Marks/Hooghe/Schakel also includes fiscal control as a component. This describes participation and veto rights when it comes to national tax policy. The rights are scored on a scale that goes from 0 to 2.

| Fiscal Control | Score | Extent to which regional representatives co-determine the distribution of national tax revenues |

| 0 | regional governments or their representatives in the legislature are not consulted over the distribution of tax revenues | |

| 1 | regional governments or their representatives in the legislature negotiate over the distribution of tax revenues, but do not have a veto | |

| 2 | regional governments or their representatives in the legislature have a veto over the distribution of tax revenues |

The following diagram again relates the individual point groups from 0 to 2 to the corresponding average value of the components.

The link between fiscal control and the various categories of economic freedom is not very pronounced here. At most, the diagram indicates that countries where sub-regions have strong vetoing rights tend to perform worse on the “size of government” criterion. When it comes to taxes, even real centralism appears to reduce the tax burden in this respect. That also makes sense from a theoretical perspective, because actors at the regional level – as has often happened in Germany – like to use their blocking powers to “blackmail” others into conceding redistributive benefits. This mechanism almost inevitably leads to a higher public expenditure quota and tax quota.

VI. Reality check: fiscal autonomy and economic freedom

Of course, the degree of economic freedom cannot be linked solely to the competencies formally assigned to regional authorities. After all, Economic Freedom of the World is an index based on quantitative data. A system of federalism indicators would have to accommodate this. The classification used by Marks/Hooghe/Schakel does not do this, but nor does it claim to be a comparative economic index. Yet, the question of how economic freedom relates to the quantitatively measurable reality of fiscal autonomy remains unanswered.

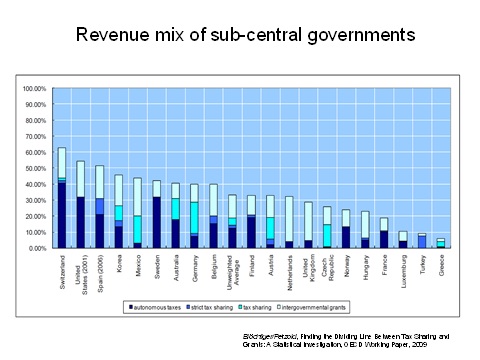

Blöchliger/Petzold, in their 2009 working paper, analysed the share of various revenue sources as a proportion of regional total tax income for 21 OECD countries, using the following categories:

– autonomous taxes

– strict tax sharing

– redistributive tax sharing

– intergovernmental grants

The diagram shows that Swiss cantons, for example, primarily fund themselves through autonomously raised taxes, whereas in Germany tax income comes from mixed sources. In Great Britain, grants “from above” make up the largest share of revenues.

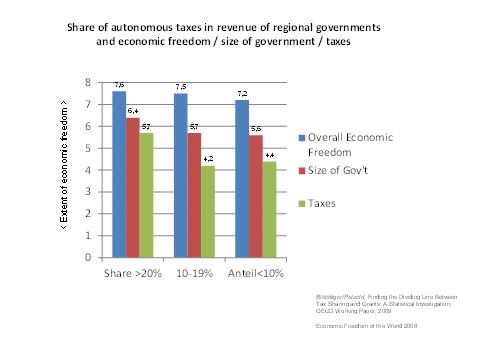

We will limit our analysis to the share of taxes raised autonomously by regions, as this serves as an indicator of fiscal autonomy, and thereby of competitive federalism. With this aim in mind, the countries assessed by Blöchliger/Petzold were classified by share of autonomously raised taxes. Three classification categories were created, namely those where the share is greater than 20% of total income, followed by the group with a share of 10-19% and finally the group of those where the share is less than 10%. In the following diagram, this information is linked with the fiscally relevant components (size of government/taxes) of the Economic Freedom of the World index:

This seems to approximately confirm the previous results. Here, too, the countries with a high degree of practised fiscal autonomy perform better when it comes to the size of government, but most prominently when looking at taxes, attaining a higher score on the 0-10 Economic Freedom of the World scale. It appears that the previous assumptions regarding the impact of federal fiscal autonomy have been confirmed.

VII. Provisional findings

The findings presented here should be interpreted with care. They are the first attempt to address the question. Although some findings are highly plausible and are supported by the data to an extent, this approach can by no means claim to deliver a final result, much less a complete index of the economic effects of federalism.

The main problem is the availability of data provided by existing indices. The data, both for measuring economic freedom and for federalism research, is not as complete as would be desirable.

Let us first take a look at the Economic Freedom of the World index. It is true that this is a coherent and scientifically recognised long data series. But it is not specifically designed to reflect federal structures. For an international, overall comparison of economic freedom, it may be sufficient to measure the “Taxes” component solely by means of income and payroll tax, but other taxes could be more important in federal competition – for instance, corporate tax, which is the subject of considerable competitive pressure in the European Union.[15]

The pioneering studies on non-centralisation or regional autonomy are even more problematic. Marks/Hooghe/Schakel have provided an excellent basis for a systematic analysis with their international comparative classification for the period 1950-2006. It would be desirable for the analysis to be continued beyond 2006. Moreover, they only cover 42 countries in their analysis. Important examples of federal states – for example, emerging markets with large populations such as India and Brazil – are not included. This means that the number of samples for individual categories of federalism often becomes so small that the statistical explanatory power is low. For instance, Marks/Hooghe/Schakel include only four (!) countries that are considered fully autonomous fiscally (i.e. which are able to determine the assessment base and rates for important taxes). In addition, the classifications of the 42 most highly developed OECD countries are not sufficient for a conclusive analysis. If one extends the coverage to include constitutionally less developed countries, even more refined instruments would probably have to be developed. How does one deal with China, which is formally a Communist unitary state, but de facto has provinces that are more autonomous than the German Länder, which form part of what is formally a federal republic?

The problem of capturing fiscal reality rather than just the formal side of it is not brought up by Blöchliger/Petzold, because the empirical measurement of state revenue is already the subject of the study. But the problem of sample size is even more pronounced, with just 21 countries included in the analysis.

In addition, neither study takes economies of scale into account. Economic freedom and non-centralisation may be closely linked to the area and population of a country. For example, Luxembourg displays a low degree of federalism. Presumably, further decentralisation would not bring the freedom gains which one could reasonably expect in the case of a state with a large territory. The fact that the Economic Freedom of the World index is headed by the city states of Hong Kong and Singapore indicates that attempts to correlate economic freedom and non-centralisation would benefit from weighting small states differently from large ones.

In brief: the findings shown here should be considered provisional, but seem to point in a clear direction. A comprehensive “federalism index” that can be correlated with other economic factors and quality of life remains a vision of the future. Its implementation would advance research in this field tremendously.

VIII. Conclusion

Economic freedom is an important pre-condition for prosperity and growth. Modern economic theory assumes that a non-centralistic or federal order will generally work in favour of economic freedom. But can this theoretical assumption also be verified empirically? This paper tries to take some first steps to answer this question. At present, the data sources do not allow sufficiently solid conclusions. Nevertheless, there is substantial evidence that properly constructed federalism could boost essential elements of economic freedom and, therefore, contribute to positive economic development. While the frequently held view that federalism promotes international trade liberalisation cannot be confirmed statistically, the positive influence of non-centralisation is clearly visible in other areas of economic policy. The present state of research quite clearly indicates that a high degree of regional fiscal autonomy does help to lift the burden of taxation and big government. This makes it a helpful instrument to curb excessive state intervention.

IX. Sources:

Charles B. Blankart, Öffentliche Finanzen in der Demokratie, 7th ed., 2008

Hansjörg Blöchliger/Oliver Petzold, Finding the Dividing Line Between Tax Sharing and Grants: A Statistical Investigation, OECD Working Paper, 2009

Daniel J. Elazar, American Federalism. A View From the States, 3rd ed., 1984

James Gwartney/Robert Lawson, Economic Freedom of the World 2008

Konrad Hesse: Der unitarische Bundesstaat, 1962

Eric L. Jones, The European Miracle. Environments, Economies and Geopolitics in the History of Europe and Asia, 2nd ed., 1987

Junghun Kim/Jorgen Lotz/Hansjörg Blöchliger (ed.), Measuring Fiscal Decentralisation. Concepts and Policies, OECD Fiscal Federalism Studies, 2013

Gary Marks/Liesbet Hooghe/Arjan H. Schakel, Regional and Federal Studies 18, No.2-3, 2008, 11-121/ 123-142

.Jean-Luc Migué, Federalism and Free Trade, 1993

Wilhelm Röpke, Fronten der Freiheit. Wirtschaft, internationale Ordnung, Politik, 1965

Herbert J. Storing (Hg.), The Anti-Federalist. Writings of the Opponents of the Constitution, 1985

Gordon Tullock, The New Federalist, 1994

Viktor Vanberg, Wettbewerb in Markt und Politik – Anregungen für die Verfassung Europas, 1994

[1] Alexander Hamilton, one of the authors of the Federalist Papers, explained his party’s protectionist stance in his “Position Report on the Subject of Manufactures” in 1791. This would later go on to inspire Henry Carey and Friedrich List, among others.

[2] Herbert J. Storing (ed.), The Anti-Federalist. Writings of the Opponents of the Constitution, 1985, 240

[3] ibid., 243

[4] To quote Gordon Tullock: “I argue for it on grounds of efficiency, on the grounds of making popular control effective, on the grounds that it permits people to some extent to choose their own government on an individual basis, and last but not least, that it seems to work well enough so that it promotes domestic prosperity…”

Gordon Tullock, The New Federalist, Vancouver 1994, 133

[5] Viktor Vanberg, Wettbewerb in Markt und Politik – Anregungen für die Verfassung Europas, St. Augustin 1994, p. 23

[6] Eric L. Jones, The European Miracle. Environments, Economies and Geopolitics in the History of Europe and Asia, 2nd ed., 1987, p. 109

[7] Wilhelm Röpke, Fronten der Freiheit. Wirtschaft, internationale Ordnung, Politik, 1965, 53

[8] James Gwartney/Robert Lawson, Economic Freedom of the World 2008

[9] Particularly when it comes to free trade, this correlation is often assumed in the literature. See: Jean-Luc Migué, Federalism and Free Trade, 1993

[10] This term was first introduced in Konrad Hesse: Der unitarische Bundesstaat, Heidelberg 1962

[11] The term “cooperative federalism” was introduced into the academic debate by Daniel J. Elazar, American Federalism. A View From the States, 3. ed., 1984, p. IXf, under the impression of the welfare state reforms of the administration in the USA in the sixties.

[12] An overview of the state of art is provided by: Junghun Kim/Jorgen Lotz/Hansjörg Blöchliger (ed.), Measuring Fiscal Decentralisation. Concepts and Policies, OECD Fiscal Federalism Studies, 2013

[13] Gary Marks, Liesbet Hooghe, Arjan H. Schakel, Regional and Federal Studies 18, No. 2-3, 2008, 11-121, dies, idem., 123-142

[14] Hansjörg Blöchliger/Oliver Petzold, Finding the Dividing Line Between Tax Sharing and Grants: A Statistical Investigation, OECD Working Paper, 2009

[15]“In recent years, the governments of the EU states in particular have been forced to deviate from their previous redistributive goals and to lower rates, for instance on corporate taxes, in order to keep production factors inside the country in the face of increased mobility”, Charles B. Blankart, Öffentliche Finanzen in der Demokratie, 7. ed., 2008, 82