Introduction

List of countries implementing flat tax reforms has been gradually getting longer over time. Although Hong Kong introduced its flat tax back in 1947, we could not see any similar reforms until 1994, when several transition economies of former Eastern bloc followed. By 2011 there were already 27 countries with flat proportional income taxes.

This encouraging trend is, however, under a permanent fire. In addition to a strong opposition to the idea from leftist politicians worldwide there is an urgent threat represented by a current financial crisis, exploding deficits, and government debts going through the roof. The flat tax countries are under a growing pressure to revert their flat tax reforms and necessary fiscal consolidation is used as an excuse for such requests.

Hall-Rabushka proposal

The idea of a flat tax was introduced by economists Robert E. Hall and Alvin Rabushka of the Hoover Institution in the editorial page of the Wall Street Journal in the article “A Proposal to Simplify Our Tax System” on December 10, 1981 (Rabushka, 2007). In 1985, their book „The Flat Tax“ followed. Although flat tax wasn’t a new idea, as it had been working in practice in Hong Kong for over 30 years by that time, this was one of the first and one of the most exhaustive analyses on the topic. The following year, Republican presidential candidate Steve Forbes based his campaign on the same idea – a single income tax rate for all Americans. (Grecu, 2004) The Hall-Rabushka work – describing the purest form of the flat tax – provides a benchmark for any proposal and actual flat tax reform in the world. Nevertheless, not a single country has gone this far yet.

It is important to comprehend that a flat tax is a more complex system than solely a single-rate income tax. There are several essential characteristics that define the system proposed by Hall and Rabushka. Firstly, it taxes every income only once and as close to its source as possible. Secondly, it taxes all types of income, which is classified as either wages or business income, but at an equal rate.

The Business Income Tax is designed to tax any income other than wages, salaries, and pensions. There are no deductions for interest payments, dividends, or any other type of payment to the owners of the business since every income that people receive from business activies had already been taxed. Therefore the tax system does not need to worry about what happens to interest, dividends, or capital gains after these types of income leave the firm. (Heath, 2006)

It is crucial that savings and investments are not taxed. This effectively turns the Hall-Rabushka proposal into a consumption tax collected via taxing income. In addition, despite the fact that tax rate remains the same regardless of the type or amount of income, this system sustains a certain degree of progressivity at two levels. First of all, it is always important to point out that the nominal sum paid increases with the amount of taxable income, as this happens to be quite a common public misconception. The Hall-Rabushka proposal also incorporates a relatively generous tax-exempt allowances for low-income individuals and families, which means that a significant number of them pay a very low income tax or none at all. As explained by the authors:

“We want to tax consumption. The public does one thing with its income – spends it or invests it. We can measure consumption as income minus investment. A really simple tax would just have each firm pay tax on the total amount of income generated by the firm less that firm’s investment in plant and equipment. The value added tax works just that way. But a value added tax is unfair because it is not progressive. That’s why we break the tax in two. The firm pays tax on all the income generated at the firm except the income paid to its workers. The workers pay tax on what they earn, and the tax they pay is progressive [thanks to the personal allowance].” (Hall-Rabushka, 2007)

Benefits of flat tax

Simplicity and fairness are considered key traits of the flat tax system. Simplifying the tax system by flattening tax rates and broadening the tax base by eliminating exemptions saves taxpayers’ time, money and other resources needed for complying with tax code and associated regulations. Fiscal authorities can benefit from it as well since enforcing rules is significantly easier in a simple and transparent system. Relieving the administrative burden of managing taxes by both the public and the private sectors releases resources that could be used for productive activities.

In combination with a reasonable tax rate it also lowers the opportunity cost of avoiding taxes so people are generally more willing to pay the correct tax burden and less willing to cheat and risk being sanctioned by fiscal authorities. For example, “In Russia, income tax revenues increased by 25.2% in real terms for the fiscal year after introducing its flat rate in 2001, by 24.6% in 2002, by 15.2% in 2003 and by 14.4% in 2004. The IMF estimates that there was a 16% increase in the proportion of income declared, partly due to improved enforcement.” (Heath, 2006)

A simple tax system is also far more predictable and transparent both for taxpayers and investors and allows them to shift their attention from avoiding high taxes to more productive activities. As a Goldman Sachs economist Eric Nielsen points out, the “announcement effect” of tax simplifications sends important messages about the government’s overall reform agenda to businesses, and may thus encourage additional investment by global and local firms. (Nielsen, 2005)

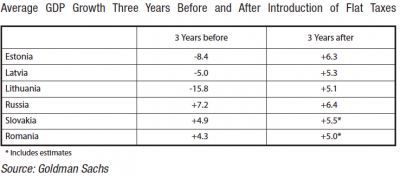

As a result, flat tax has a positive impact not only on tax revenues, but it also encourages economic growth. In practice, flat tax reforms are associated with lowering the overall tax burden in contrast to various reforms of existing progressive tax systems, which usually result in higher taxation overall or at least of the high-income, high-productive economic agents. There is plenty of empirical and theoretical evidence that low taxes boost economic growth. Nevertheless, there are two specifics in terms of evaluating flat tax reforms in countries of the former Eastern Bloc. Firstly, these reforms are still relatively recent, which means comprehensive evaluations are often lacking. Secondly, none of these countries introduced a pure flat tax as proposed by Hall and Rabushka. As a result, any assessment of these reforms can be performed either on the actual reform or as opposed to the theoretical Hall-Rabushka model.

Calculations by the economist John Chown based on figures of the European Bank for Reconstruction and Development reveal that Estonia enjoyed a nearly 73% growth over the 10-year period since 1994, against an average of 35% for all transitional economies. Russia has under-performed during this 10-year period. However, its growth since 1998 has been one of the best of the group, partly because of its tax code reforms. (Heath, 2006) A separate research by Eric Nielsen also illustrates that flat tax countries have been economically very successful.

Average GDP growth three years before and after introduction of flat taxes

Source: Goldman Sachs

Fairness of the flat tax is a much more complicated issue as the very definition of “fairness” varies significantly across ideological and political spectrum. However, flat tax is certainly less intrusive, restricts individual freedom less and distorts economic behaviour less. By sustaining a certain degree of progressivity in actual taxes paid and by implementing personal allowances for low-income individuals and families, the idea of flat tax could be acceptable also from a more leftist point of view.

Flat tax reforms

The term „flat tax“ covers various approaches to reforming tax systems. Ways of introducing exemptions, personal allowances and types of taxes differ from country to country. The minimum common denominator is simplifying of tax systems by flattening rate structure and broadening tax base by eliminating exemptions. This chapter will cover mostly EU-member states flat tax reforms, but in the beginning, long-term positive experience of the very first flat tax country, Hong Kong, should be noted.

Hong Kong

According to the Index of Economic Freedom 2013 by The Heritage Foundation, Hong Kong was ranked the freest economy in the world for the 19th consecutive year. This publication uses ten economic indices to measure the degree of economic freedom in countries around the world. These excellent ratings compliment Hong Kong’s tradition as non-interventionist economic policy that has supported the fastest growing economy of the last half a century.

Since 1947, Hong Kong has maintained a dual income tax system, which allows taxpayers to choose between progressive taxation that ranges between 2%-20% of income adjusted for allowances and deductions and a flat tax rate of 16% on gross income. Long-term experience shows that taxpayers prefer mostly flat tax due to low tax rate, zero preparation costs and significantly lower probability of tax audit by fiscal authorities. Hong Kong also does not have any payroll tax, VAT and does not tax dividends, capital gains, wealth, or gifts. Combination of a low tax burden and a simple tax system reduces negative effects of taxation on work effort, saving and entrepreneurial activity. This system has laid down the foundations of Hong Kong’s remarkable economic growth and development whilst government revenue between 1950 and 1981 has still been sufficient enough to produce fiscal surpluses. (Grecu, 2004)

Reforms of post-communist EU member states

In the period between 1994 and 2011 eight out of twelve countries of former Eastern Bloc that became EU members in 2004 and 2007 introduced the flat tax. As noted above, these reforms differed significantly as they consisted of substantial tax system reform or just tax rates unification. In our sample countries, the flat tax rate itself spreads between 10% and 33%.

|

|

Tax rates before reform |

Tax rates after reform |

|||

| Country |

Reform |

CIT |

PIT |

CIT |

PIT |

| Estonia |

1.1.1994 |

35% |

16% – 33% |

26% |

26% |

| Lithuania |

1.1.1995 |

29% |

18% – 33% |

29% |

33% |

| Latvia |

1.1.1997 |

25% |

10% and 25% |

25% |

25% |

| Slovakia |

1.1.2004 |

25% |

10% – 38% |

19% |

19% |

| Romania |

1.1.2005 |

25% |

18% – 40% |

16% |

16% |

CIT … corporate income tax

PIT … personal income tax

Source: Author

Estonia

This small ex-Soviet country managed to transform relatively quickly into the 6th freest country in the world according to the Heritage Foundation’s 2004 Index of Economic Freedom as a result of a series of reforms started by the Prime Minister Mart Laar in the early 1990s. After the dissolution of the Soviet Union and reclaiming independence in 1991, Estonia has implemented tight budgetary policies, trade liberalization and extensive privatization. In 1994, despite the IMF advice to increase tax rates, the government implemented a flat income tax of 26 percent as the first of the current crop of flat tax countries. (Grecu, 2004) This rate has been persistently lowered and is now at 21%.

The corporate income tax rate, previously 35 percent, was set to 26 percent, and has remained the same as personal income tax. One of the key traits of Estonian the CIT is that investment spending is tax-free and there is no double taxation of dividends either. The VAT and the excise tax were not changed at the time of adopting the flat tax. (IMF, 2006)

Foreign direct investment has more than quadrupled in Estonia since introducing the flat tax, from an inflow of $202m in 1995 to $926m in 2004, according to the United Nations Conference on Trade and Development’s Foreign Direct Investment Database. (Heath, 2006)

Lithuania

Lithuania introduced its flat tax in 1994 with the PIT rate of 33%, which was the highest of the marginal rates imposed prior to the reform, and remained unchanged since. The CIT rate was set to 29%, but later reduced to 15%. The previous general excise tax was transformed into a full VAT at the time of the flat tax adoption, with the rate of 18%. The revenue from the PIT rose with the shift to the flat tax, but according to IMF there is no obvious explanation for the fall in CIT revenue. (IMF, 2006)

Latvia

The flat tax in Latvia was introduced in 1997 at the rate of 25% both for PIT and CIT. The specific of Latvian reform is that due to a previously regressive rate structure with a starting marginal rate of 25% followed by 10% and 8% rate, adoption of the flat tax resulted in an actual increase of tax liability at the very highest incomes. Corporate tax rate was, however, later decreased and is now set to 15%. Both PIT and CIT revenue rose following the reform. (IMF, 2006) Dividends received by residents from Latvian companies and interest paid by Latvian banks both to residents and non-residents are not taxed.

Romania

In January 2005, a 16% flat tax rate replaced a previous PIT with five marginal rates ranging between 18% to 40%. The profit tax rate was also reduced from previous 25% to 16%. On the contrary, dividends paid to individuals, interest income and capital gains became subject to the 16% rate only after the reform. The two rates of the VAT at 9% and 19% were left unchanged, only some exempts were eliminated and excise taxes were slightly raised. (IMF, 2006)

The corporate tax revenue rose by 21.1% in the first six months of 2005, refuting fears that the introduction of the flat tax would lead to a collapse in revenues. Tax receipts increased by 17.3% and VAT returns rose by 27%. Introducing the flat tax also helped reduce the shadow economy as the number of employees rose by 153,000 in the first quarter, helping to cut the unemployement rate to a 13-year low of 5.5%. (Heath, 2006)

Slovakia

A major and innovative tax reform was implemented in 2004 when a single common rate of 19% was set for PIT, CIT and also VAT. This replaced a complicated PIT consisting of five marginal rates ranging between 10% to 38% with five other rates applying to specific types of income. The personal allowance was more than doubled, from SK 38,760 to SK 80,832 to around 60 percent of the average wage. Income-related tax allowances for children were replaced by fixed allowances and a refundable tax credit for those with sufficient labor market participation. (IMF, 2006)

The CIT rate was reduced from previous 25%, whilst the dividend tax of 15% was abolished along with inheritance and gift taxes. The reform also included significant elimination of exemptions under PIT, CIT and VAT and also a slight increase of the excise tax.

It is very important to note, that the tax reform was accompanied by a substantial reform of the social benefits system and the labor code in order to enhance incentives to work and increase the overall flexibility of the labour market.

Alvin Rabushka, who counts Slovakia’s flat tax to one of his favourites, says: “It greatly simplified the previous system which included 90 exceptions, 19 sources of income that were not taxed, 66 items that were tax exempt and 27 items with their own specific tax rates, such as bank interest and honoraria. Once the corporate tax is paid, dividends received by individuals are tax free.” (Heath, 2006)

According to a paper published by Reform, a free market think-tank, after introducing the flat tax in 2004, tax revenues fell by 0.2% of GDP, from 25.5% in 2003 to 25.3% in 2004, though this was partly a result of raising indirect taxes. As a result, Slovakia had been enjoying a significantly higher economic growth, rising from an average of 3.4% in the six years preceding the reform, to 5.5% in 2004 and 4.8% in 2005 accompanied by a major increase of FDI. (Heath, 2006)Recent trends in tax policies

Fiscal consolidation has already its „casualty“ among flat tax countries as Slovakia became the very first to revert its flat tax reform and thus established a new, disquieting precedent. By January 2013, a second marginal rate of PIT was set to 25% and CIT increased to 23%. Slovakia has now a higher corporate tax rate than Sweden, since the Swedish government decided to lower the rate from 26,3% to 22%. As Slovakia is struggling with cutting the deficit below 3% of GDP, tax revenues declined already in the first months of the new fiscal year, despite (or more likely because of) imposed consolidation measures. Therefore, Slovakia could become an example of how abolishing a successful tax reform is not a helpful approach to cutting the deficit; especially in times of a general economic slowdown.

Despite the reversal of flat tax reforms might be welcomed by the leftist electorate, such a decision sends an explicit signal that the government is openly deviating from a pro-investment and pro-business economic policy. In case of Slovakia this is further demonstrated by quite a significant reversal in labour code reform. As a result, potential political gains could be diminished by worsening the overall economic condition over the election period.

As Drahokoupil demonstrates in his 2009 book on Globalization and the State in Central and Eastern Europe, all new member states with the exception of Slovenia gradually converged to the model of a “competition state” with an extremely high share of foreign direct investment in key sectors of the economy (Drahokoupil, 2009). The importance of external signalling in such an environment should not be underestimated. In addition, for the organised leftist interest groups (as for example trade unions), abolition of the flat tax is welcomed, but not essential as they focus mostly on strengthening their influence on labour market legislation and social benefits.

From a fiscal point of view, reversal of the flat tax reform would not have significant fiscal benefits, but as in case of Slovakia, raising taxes would lead to a decline in tax revenue. Despite a tight timetable for deficit reduction set by the EU, such an urgency does not call for changing methods that work to methods that do not work.

References

Drahokoupil, J. (2009), Globalization and the State in Central and Eastern Europe: The

Politics of Foreign Direct Investment, Journal of Contemporary Central and Eastern Europe, Vol. 17, No. 2.

Grecu, A. (2004), Flat Tax – The British Case, Adam Smith Institute, London

Hall, E. and Rabushka, A. (2007), The Flat Tax (Second Edition), California: Hoover Institution Press

Heath, A. (2006), Flat Tax: Towards a British Model, Stockholm Network and The TaxPayers’ Alliance

Keen, M., Y. Kim and R. Varsano (2006), The “Flat Tax(es)”: Principles and Evidence, IMF Working Paper WP/06/218, International Monetary Fund, Washington, D.C.

Nielsen, E. (2005), Europe: Getting Ready for Lower, Flatter and Simpler Taxes, European Weekly Analyst, Issue No: 05/34, Goldman Sachs