Imagine someone takes from one’s pocket some money from time to time, what should we call such a person? Certainly ‘a thief’ as such an action is clearly an example of theft. But what we should call the same action if some organization does the same with millions of people? Well, then we call it monetary policy.

Every individual earns money for living somehow. The society agreed that the government is needed and this means we should pay money for their service, and we call it taxes. We may not like paying taxes, but we understand the need for the government to exist and so we agree to pay them in a transparent and clearly defined way.

However, what we did not agree to was to pay hidden taxes. Yes, inflation tax is a robbery. Let us, therefore, examine the contemporary problem of inflation from a rather different point of view.

At first, let us try to understand, what money is? By definition, it is:

- An intermediary of exchange.

- A tool for measuring value.

- A medium for value accumulation.

What is important is that money should have some qualities for it to be used effectively, like durability, divisibility, and so on.

Let us remember what is said above and check what we really now call money. The world’s main currency in the modern world is the US dollar, so this overview is mainly about it. In the period of existing of the US dollar, a very important point was the year 1913. That year, the FED (same FRS, Federal Reserve System) was established as the central bank of the United States.

So, let us take this year as the initial point of our examination and measure the dollar’s value in different years by value of this year. Let us mark it as the USD in 1913. So, the value of the 1914 USD equals 0.99 USD in 1913, the value of the 1915 USD equals 0.9802 USD in 1913, and so on.

Now, let us go one century back and check what was happening there, measuring the value of the USD by the USD in 1913 [See: Table 1].

Table 1: The USD value in 1913 comparing to the USD in the period of 1803–1913.

|

year |

USD in 1913 / current value |

| 1803 | 1.52 |

| 1813 | 1.96 |

| 1823 | 1.21 |

| 1833 | 0.98 |

| 1843 | 0.94 |

| 1853 | 0.84 |

| 1863 | 1.24 |

| 1873 | 1.21 |

| 1883 | 0.94 |

| 1893 | 0.91 |

| 1903 | 0.91 |

| 1913 | 1 |

Source: https://westegg.com/inflation/

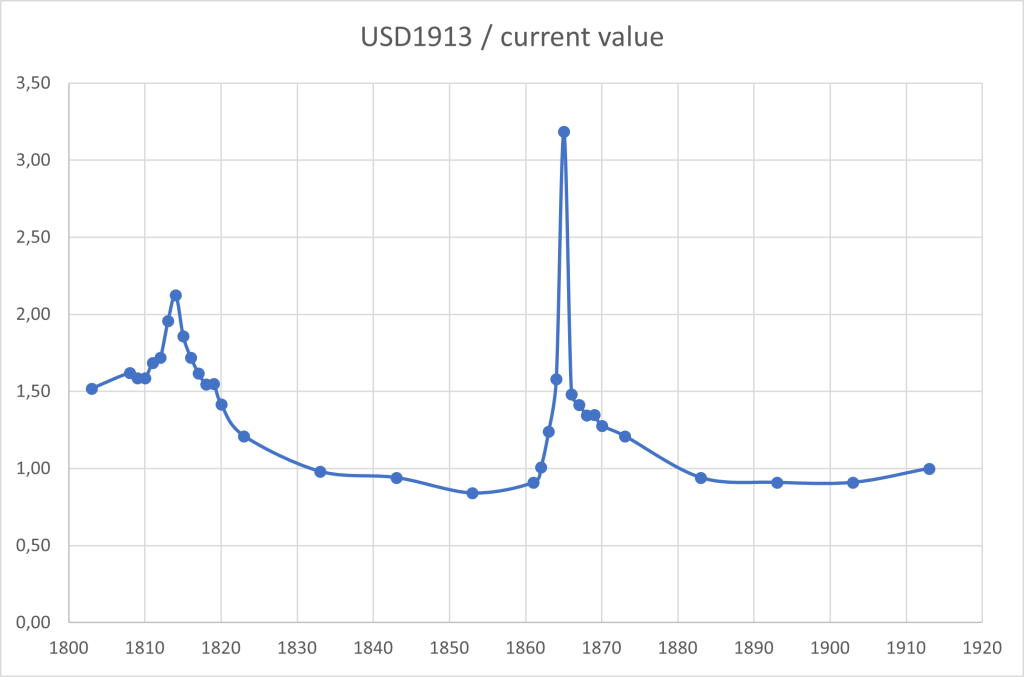

In the interval of these 10 years, it is visible that the maximum point wass 1.96 in 1813. If we take more data from the same site, we will find that there are two maximums’ points and they are in the periods of years 1812-1815 and 1863-1865. The first one is in 1812-13-14-15 years, the time of war between USA and Britain.

So, during the war, the currency with golden back devaluated, and after the war the currency value returned to its initial position and continued strengthening.

The second maximum is the period of the 1860s, the civil war in the United States. Here too, during the war the currency devaluated, and its value returned to its initial position after the war[See: Figure 1]

Figure 1: The USD value of 1913 comparing to the USD in the period of 1803–1913.

Data from: https://westegg.com/inflation

Data from: https://westegg.com/inflation

Looking at this chart, it needs to be mentioned that during the war period currency value devaluates, and it is clear (less needs to gold during the war), it should be so, but the value of dollar returns to its initial position soon after the war. (Here is not mentioned the same kind of changing of currency value can be expected during any political non-stability).

Shortly put, devaluation of the money two or three times comparing to the initial value (as it is shown in the Figure 1) should be quite painful eceonomically for the individual, but as the reason is clear and as the circumstances are temporary, each person can find ways to cope with this problem and knows that they should count their wealth not with the currency value of the war period.

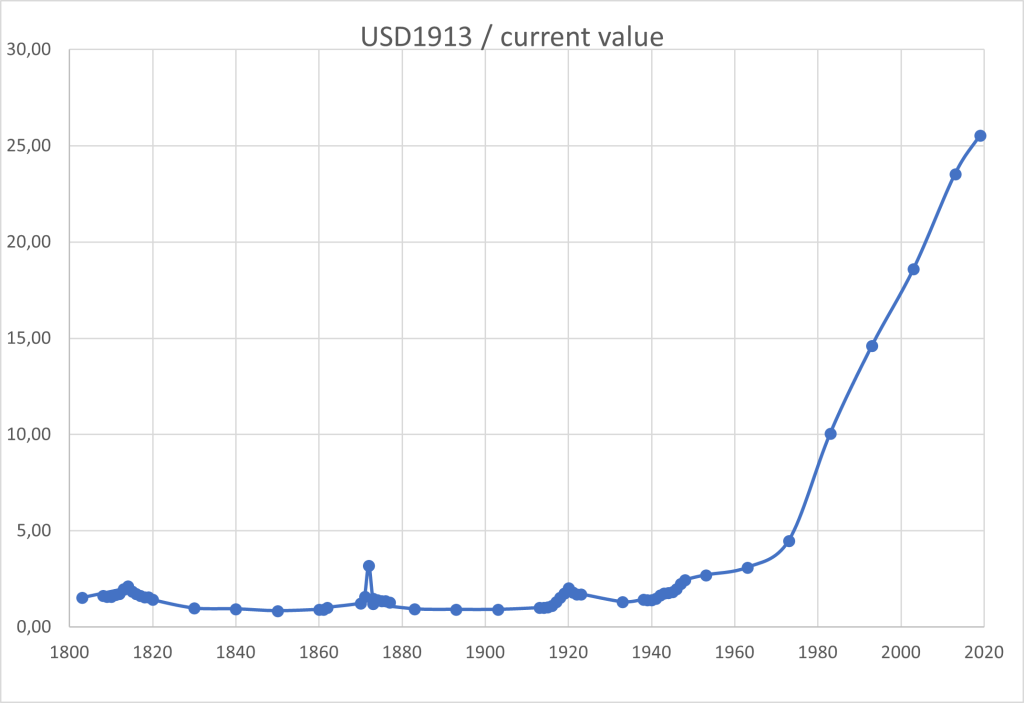

Now, let us create a similar chart for the current times [See: Figure 2].

Figure 2: The USD value of 1913 comparing to the USD in the period of 1803–2019.

Data from: https://westegg.com/inflation and https://www.usinflationcalculator.com/

Data from: https://westegg.com/inflation and https://www.usinflationcalculator.com/

In this chart, the 19th centuries maximums look like a small fluctuation. Even the world-wars periods are a small fluctuation comparing with the events after the 1970s.

Everyone knows what a guaranty of stability of the US dollar in 19th century was and what happened in the 20th century. And the year 1971 was the last turning point, when the last thread connecting the US dollar to the gold was severed. And so the former devalued, without any return. In the period of 1913-2019, it lost 96.08% of it’s value. This means, if your ancestor saved 100 USD in 1913 for you, its value now is less then 4 USD in 1913.

Now, let us take a look at a shorter period, for example 1995-2019. This part of the graph goes up and only up. To look carefully, if you had 100 USD in 1995, now it is worth only 61.72 of USD1995, so saving 100 USD in 1995 means you have lost 38.28% of its value. It is not 100 years, but it is time of person’s savings, saving any amount now means you will lose more than one third in 24 years. (Here should be mention also that the interest rate to deposit in the banks in many countries goes to negative!).

All this concerns the US dollar, one of the mostly trustable currencies in the world. If you take currencies from developing countries, the circumstance is much worse. For the same period 1995-2019, Georgian Lari devaluated nearly four times. If I had saved 100 GEL in 1995, now I wouldd have 100 GEL worth only 25 GEL in 1995.

So, what is money? It was invented by people for serving them to save their earnings. Is it okay for anyone to lose 75% of their earning in less than 25 years? Where is the durability of the currency? Maybe it is time that free people choose the best money freely?

And what is the best money, what can it be, will it return to gold or any other commodity? Maybe crypto currency? Or maybe crypto-gold connection or crypto-commodity money? – this remains uncertain. Only one thing is clear: each of us needs real money.

References:

https://www.usinflationcalculator.com/

https://westegg.com/inflation/

https://www.nbg.gov.ge/index.php?m=2