“Keep your chin up” is the headline of the June issue of the New Monthly Enterprise Survey, a #NRES conducted by the Institute for Economic Research and Policy Consulting since May 2022.

From June 15 to June 30, 2023, the heads of 530 enterprises located in 21 out of 27 regions of Ukraine answered questions about the current state of affairs at enterprises and their expectations for further business development.

Optimistic Uncertainty

In the short to medium term, business remains optimistic, although it refrains from precise forecasts for the long-term perspective. We have recorded increased uncertainty in the long and short term, which indicates further business decision-making complications and a certain “stagnation” of optimism.

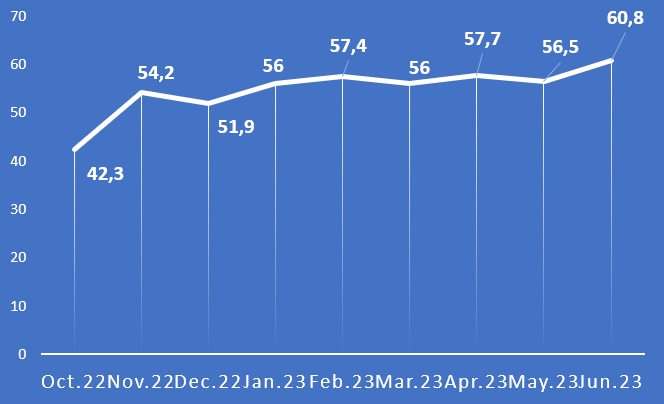

Percent of enterprises that have had no idea about their plans for two years has increased from 56.5 to 60.8% The share of respondents who could not forecast changes in the country’s general economic environment in the whole in the next six months increased from 19.6% to 21.2%.

The same trends are observed from the short-term perspective. After several months of gradual decline, there is a slight increase in the level of uncertainty for all enterprise results over a three-month perspective. Thus, in June compared to May 2023, The share of respondents who could not answer the question about the change in production in the next three months increased from 7% to 8%, the corresponding employment indicators increased from 10% to 12%, for receivables —13% to 14.5%).

Figure 1. “It is hard to predict what will be with activities of our enterprise in 2 years“, % of answers

At the same time among those enterprises that provide us with expectations for all types of perspectives the share of optimists is quite high and exceeds the pessimist. For example, 23,1% of surveyed enterprises that were provided with answers to questions regarding two years’ expectations plan to grow in 2 years, and only 2.9% expected a decrease. Moreover, the share of enterprises planning to reduce activity in 2 years is decreasing in June compared to May, and the share of those planning growth remains unchanged.

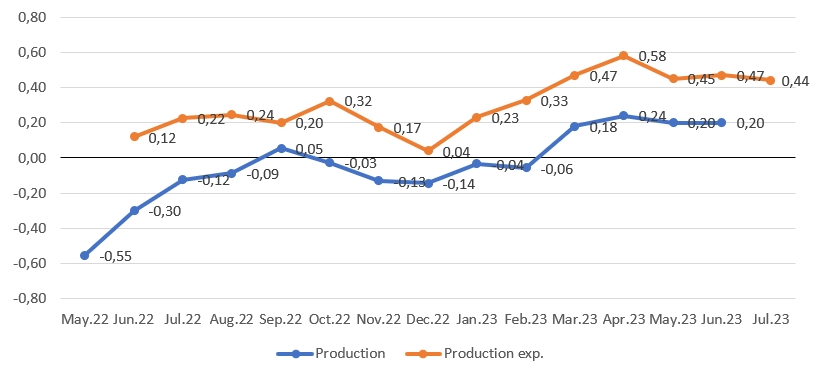

Three months’ expectations are optimistic. Thus 44.8% of enterprises expect to increase production in the next 3-4 months, 3.2% of which will decrease. But as it was mentioned at the beginning, the optimism “stagnations” are observed for three months in a row. In June, compared to May, the share of enterprises that plan to have no change in production volumes during the next three months increased from 47.0% to 52%, and respectively the share of enterprises that planned production growth in the next 3-4 months decreased from 48.9% to 44.8%. The positive signal in this background is that the share of enterprises that planned to reduce production decrease is almost unchanged (4.0% in May and 3.2% in June)

Figure 2. Production and production expectations, balance indicator

Economic Recovery Is on Site

Despite the high level of uncertainty, the survey results show that business activity is recovering. In particular, 53.3% of respondents believe that the situation at the enterprise is better compared to “as it was a year ago”, 36.9% believe that “nothing has changed, and only 9.8% report that the situation is worse

Another signal of recovery is the growing share of enterprises operating at full and almost full capacity. In general, almost two-thirds of respondents have almost fully recovered, and this is, in principle, the result that indicates the stability and resilience of the Ukrainian economy and the Ukrainian real sector.

Impediments to Doing Business

Among the impediments to doing business, the 1st place is occupied by rising prices for raw materials and goods, the 2nd place is for transporting raw materials or finished goods in Ukraine, and the 3rd is low demand for products and services. It is important to note that while the top three remained unchanged, the importance of these obstacles has increased in June compared to May 2023.

One of the factors affecting the business environment is business security. Although the list of obstacles to doing business has moved from 4th to 6th place, more than a third of businesses continue to indicate that operating is dangerous.

Also, despite the expectations of past periods, the share of respondents who choose interruptions in electricity, water, and/or heat supply as an obstacle has increased.

Regulatory problems occupy the bottom of the list – 6% of respondents indicated the blocking of tax invoices as an obstacle to business, 4% of respondents consider corruption an obstacle to doing business, and 1% consider pressure from regulatory or law enforcement agencies to be such an obstacle.

Employment

Employment expectations have deteriorated, % of businesses planning employment growth has risen, and % of businesses intending to reduce the number of employees has risen. The share of enterprises planning employment growth is 4.9% (in May it was 5.2%). The share of enterprises intending to reduce the number of employees slightly increased from 3.6% in May to 5.6% in June. And as a result, the number of enterprises at which no changes in employment are expected to decrease from 91.2% to 89.5%

Other important characteristics of the employment situation are estimates of staff shortages compared to other obstacles to doing business in the country. And here we draw attention to the growing importance of obstacles: labor shortages due to recruitment and/or departure of employees increased from 29 to 37% compared to the previous month.

The analysis of problems in the search for skilled and unskilled workers also shows the first signals of a shortage of workers with the necessary qualifications even in conditions of moderate economic growth.

In June, the problems with finding skilled and unskilled workers increased slightly. From 24.0% to 25.4%, enterprises reported complications in finding qualified workers. At the same time % of those to whom it is easier to search for skilled workers slightly decreased (from 3.1% in May to 2.8% in June). Saying for unskilled staff, 19.6% of enterprises report increased problems (the respective data for May was 14.3%).

Conclusions

Against a background of high levels of long-term uncertainty and, at the same time, high levels of near-term optimism about production, the analysis of employment trends proves that business is still risk-averse and growing and plans to grow further. Against this background, Ukrainian enterprises are beginning to face the problem of a lack of qualified workers.

All the above means that Ukrainian businesses despite all their thoughts and challenges, are adapted very well to the uncertain environment, but they need to get more positive news from the battlefield.

The Institute for Economic Research and Policy Consulting conducts the New Monthly Enterprises Survey using the Business Tendency Survey approach to quickly collect information on the current economic state at the enterprise level. The methodology is designed to assess the situation from the “base level”: the judgments and expectations of key economic agents such as entrepreneurs and business managers. Data on innovations were collected for the 14th monthly survey (from June 15 to July 30, 2023). The article was prepared as part of the “For Fair and Transparent Customs” project financed by the European Union and co-financed by the Renaissance Foundation and the ATLAS Network.