In the run-up to Lithuania’s 2020 national elections LFMI published a handbook for policy makers Election 2020. Towards Liberty and Prosperity (in Lithuanian). The handbook delivered a long-term policy vision and immediate recommendations for the new parliament to preserve and create new opportunities for people in Lithuania to pursue well-being for themselves, their families and communities.

LFMI called on policy makers to restore the culture of law-making and government trust in the creative power of human potential.

Together with the handbook, LFMI also presented to major political parties a 10-step mandate for leadership that delineated recommendations for improving the law-making quality, implementing a systematic deregulation reform and revising taxation, pension insurance, education and competition policies.

Our proposal to restore a zero-tax rate on reinvested profits has already been adopted by four political parties. Two of them, the Liberal Movement and the Freedom Party, have joined the election winner, the conservative Homeland Union, in the new coalition government.

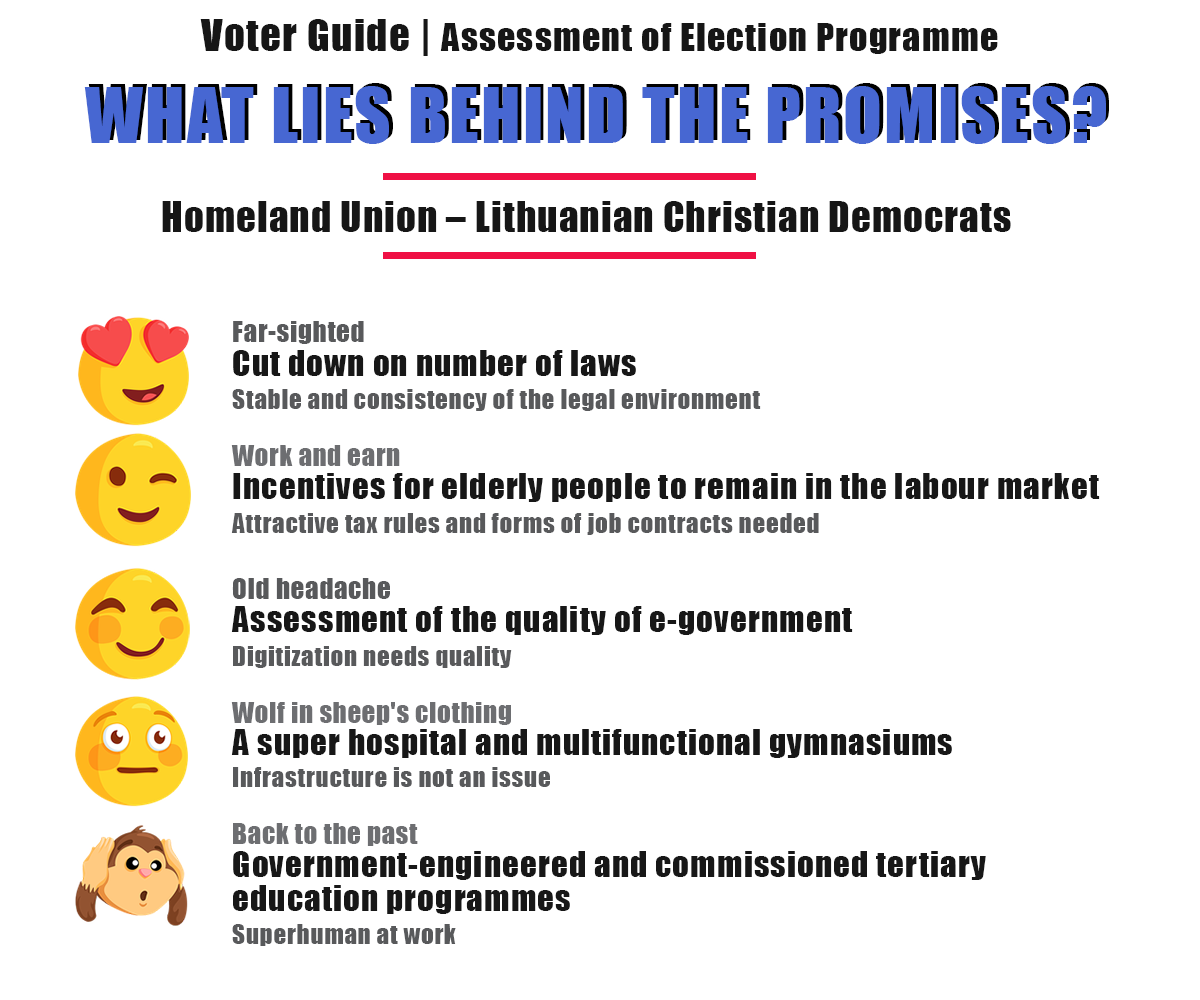

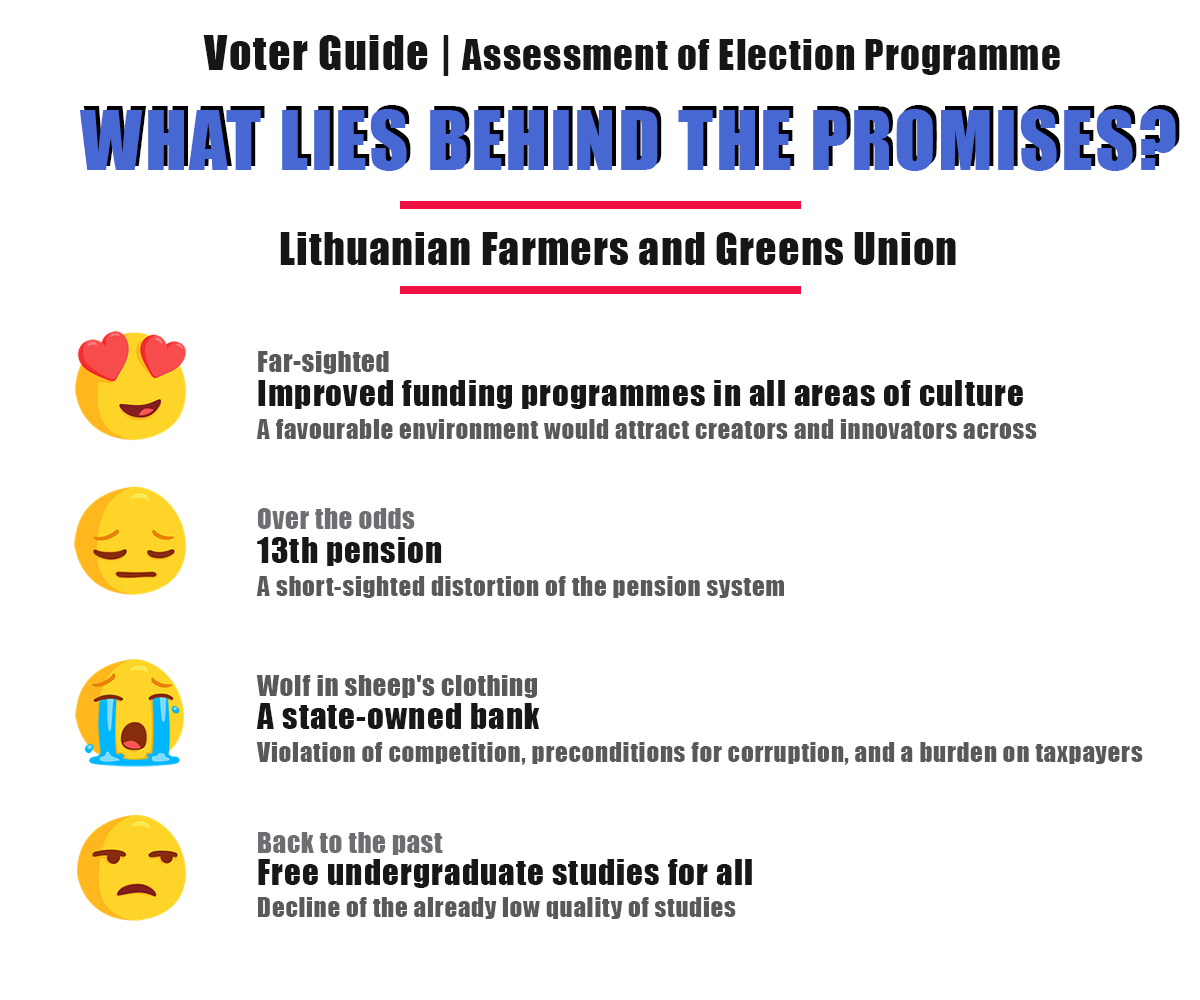

In partnership with the largest news portal delfi.lt (Lith.) LFMI ran an awareness-raising campaign to educate the Lithuanian public about the economic and social implications of the election programmes advanced by the major political parties.

We have analyzed election programs of six major political parties – Homeland Union, Farmers and Greens Party, Freedom Party, Liberal Movement, Social Democrat Party and Labor Party.

We assessed the most relevant provisions that would affect people’s income, taxes, freedom of choice, and economic life, specifically provisions on labor regulation for elderly generation, accounting and tax payment platform for small and medium businesses, improving quality of legislative process and governmental electronic services, increasing transparency of pension system, changing the procedure for parental benefits, preparing and implementing personal motivation and retraining programs and etc.

LFMI paired its commentaries with an ingenious infographic series in social media.

Elections 2020: A Ten-Step Mandate for Leadership

Prosperity is the word that most accurately sums up the expectations of voters. For the 2020 national election vote, the Lithuanian Free Market Institute formulated 10 key steps towards prosperity and freedom.

Ideas that enable us to live a free, meaningful and value-creating life have the power to unite all those who endorse them.

- Restore trust and respect for those who create prosperity, regardless of their place of work or enterprise. Enable individuals to take responsibility for their actions and responses to their needs in a community-based, subsidiary manner.

- Revive the primacy of private ownership and free exchange, enshrined in the Constitution as the basis for the creation of a prosperous state. Just as Lithuania did 30 years ago, find the courage to leave behind a cumbersome framework of bureaucracy and nationalisation. Nurture harmony through words and actions, and foster public respect for those who work and create in the private sector.

- Avoid promoting state intervention as a means to raise wages while simultaneously lowering prices. What is income for some is the price paid by others – and vice versa. Refraining from such interference will help to avoid damaging confrontations within society and move away from futile, contradictory political discourse.

- Restore the culture of legislation, prevent the devaluing of laws, and adhere consistently to the principle of people’s equality before the Constitution. Conduct a quality assessment of the impact of legislation and amend statutory provisions that exert a harmful effect on the creation of prosperity. Ensure that legislators are held responsible for the initiatives they propose, for failure to comply with legislative principles, processes and regulatory impact assessment requirements, and for the inefficient use of resources.

- Establish a system-wide policy for reducing the regulatory burden. To conduct a continuous assessment of the burdens that directly affect economic activity, and remove those regulations that no longer serve their initial purpose, in the spirit of the Regulatory Performance and Fitness programme (REFIT) endorsed by the European Commission. When a new regulation is proposed, realistically assess its potential impact and apply the principle of “one in, one out.”

- Make Lithuania a country with a system of low and transparent taxes that do not incentivize people to transfer their activities to other jurisdictions or participate in the shadow economy. Consistently lower income tax. Reinstate the 18% rate of VAT. Establish a provision that prevents changes being made to tax laws during the approval of the budget (when the six-month adjustment period is not complied with in practice). Recognising the power of the state, establish the principle that citizens and economic entities must be regarded as the weaker party in tax disputes.

- To address the issue of shortfalls in credit and investment and the outflow of capital, reintroduce a zero tax rate on reinvested profits, a regime that played a major role in accelerating the country’s economic growth. This would help to restore Lithuania’s competitiveness, both regionally and worldwide, and create a tax system similar to those of neighboring Estonia and Latvia.

- Refrain from expanding the economic activities of the state. Establish strict criteria governing the justification of government ownership in business, and apply these not only to new activities, but also to the existing operations of state- and municipality-owned enterprises. This will help ensure fair competition and benefits for all consumers. Render it impossible for municipal enterprises to conclude internal transactions among related entities without applying competitive bidding processed in accordance with the Law on Public Procurement. This will help reduce corruption, increase transparency and efficiency in the use of state funds, and bring about lower prices for citizens.

- De-politicise increases in pensions. Ensure transparency in the obligations of the state and adhere to automatic indexation. Prohibit any politicised disbursements by law. Legalize a wider range of retirement savings instruments and avoid obstructing such investments (e.g. real estate or cumulative life insurance) with taxes and regulations. To enhance people’s trust and the long-term sustainability of the pensions system, establish a principle that ensures the rules on long-term accumulation remain unchanged, without worsening the conditions that apply to people’s retirement savings. Pursue a targeted social support policy and provide integrated allowances to disadvantaged individuals (according to income and property, disability or other specific criteria), rather than to particular social groups.

- Reinstate the system of universal school vouchers and create conditions for the development of educational institutions with various profiles and types of ownership, offering different learning programmes and methods, thus increasing opportunities for families to satisfy their children’s educational needs. Cultivate a socially conscious young generation that embraces freedom and morality and is ready to take responsibility for creating prosperity and unity.