The 10% flat income tax was introduced in Bulgaria in 2008, and the Institute for Market Economics (IME) was one of the major proponents of its implementation. In our opinion, the introduction of the flat tax has been one of the most successful policies in the last decade, but now it is threatened by the plans of the current Bulgarian government, which is a coalition of socialist, nationalist and ethnically-dominated parties. In an attempt to win public approval and support, which at the moment are extremely low and could only be compared to the ones during the 1990s, the new government has put forward a series of populist policies. One of them is the introduction of a minimum non-taxable income, which is equal to the minimum wage in the country – 340 BGN (175 euro) per month. The idea is that people receiving the minimum wage will pay their income tax during the year, but at the beginning of the following year, they will submit a tax return and the income tax they have paid during the year will be refunded to them. However, this rule will apply only to those who are paid this minimum wage, so if you earn even 1 lev above the minimum wage, you will have to pay 10% in taxes on the whole amount earned. This creates huge incentives for tax evasion and avoidance of income declaration for people who are paid wages close to, but above, the country’s declared minimum.

What historical data shows

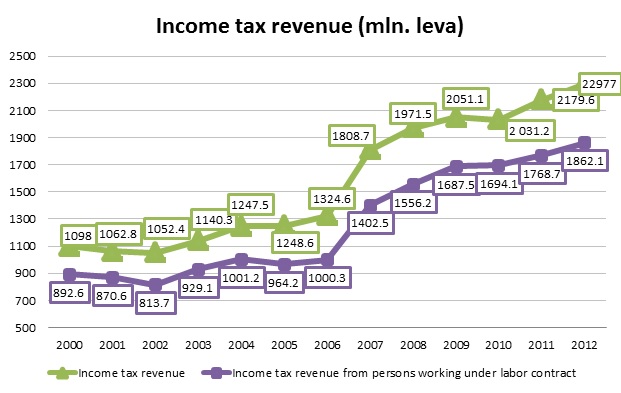

Almost six years have passed since the introduction of the 10% flat income tax, which makes it possible to assess its effects on the budget and on the informal economy. This period is suitable for such assessments, since it encompasses a period of economic growth (in 2008), a period of recession (2009) and a subsequent stagnation (2010-2013). Graph 1 shows the amount of budget revenues from income taxes in the period between 2000 and 2012.

Tax revenues have been growing steadily over the past six years despite the crisis and stagnation. Even the slight drop in tax revenue from income taxes in 2010 was entirely due to other categories of income taxes, different from those paid by people working under employment contracts. We can see from the data that, among other things, the introduction of the 10% flat tax appears to have been an appropriate anti-crisis measure for the budget. Given the large decline in employment (over 400,000 people lost their jobs between 2009 and 2011) and the consequent loss of taxable income, resulting from the unemployment in the period 2009-2011, it could easily be argued that the flat tax rate has contributed to the increase in the share of people who declare their income.

Graph 1: Income tax revenue (2000-2012)

Source: Ministry of Finance

In line with Laffer’s curve[1], the low flat income tax has led to a steady growth in revenues from income tax, because people responded to the reduced incentives for concealing income. Given the traditional strengthening of such incentives in times of crisis, these results are a very strong argument for the positive effects of the flat tax rate on the budget.

What will be the effect of the amendment proposed by the current government?

A big problem with this amendment is a large incentive for not declaring income. A marginal tax rate (which here represents the tax one should pay for every extra BGN earned) for people who earn 341 BGN (or 1 BGN above the country’s minimum wage) becomes the mind-blowing 2,970% (calculated as the % ratio between the yearly tax of 356.41 BGN that has to be paid by someone who earns 341 BGN per month and the 12 additional BGN in annual income that this person gets from having a monthly salary that is 1 BGN higher than the minimum wage). People who receive a monthly remuneration between 341 and 377 BGN will actually be poorer, if we consider their net salary, than people who receive the minimum wage of 340 BGN. The loss that the budget will face is much greater than the one estimated by the government, since their calculations only take into account the loss of tax revenue from people who now declare minimum wage (around 400,000 people), but they do not consider all the people who earn between 341 and 377 lev and who will have a strong incentive to report earning a minimum wage rather than their actual wage. In addition to these problems, this new amendment to the tax legislation will impose an additional administrative burden on both individuals who receive minimum wages (since they will have to file a tax return at the end of the year to get back the money they have paid in taxes) and on tax authorities (since they will be the ones checking those declarations).

Conclusion

Our belief is that the proposed amendment to the 10% flat tax rate is not economically justified; it is rushed and not carefully considered. It is mainly an attempt to win public approval without consideration of the negative effect it will have on the country’s budget already overstretched in terms of expenses. If the aim is to help financially the poorest people in the country, then a better way to do that is through direct social benefits – which has already proved to be quite efficient – rather than changes in the income tax legislation.

Desislava Nikolova PhD is chief economist at the IME.

Evgeni Ivanov is an intern at the IME.

[1] According to the theory of Arthur Laffer (American economist, lecturer and advisor to R. Reagan) increases in the tax burden initially achieve revenue growth. After reaching the optimal point of revenue, further tax increases would actually lead to a fall in the collected tax revenue (due to the increase in the shadow economy).