This week, the venerable Financial Times website juxtaposed three pieces of seemingly unrelated economic news all within a few hours of each other. Taken individually, these three stories tell the tale of a complex economy, driven by forces we cannot hope to understand and only hope to constrain. However, when taken as a whole (as the media and many economists do not), they tell a familiar tale of economic mismanagement backed by an archaic premise. Indeed, as Europe and the US continue to descend into an economic madness that they may never recover from, the justification for the madness becomes ever more crucial, and is lurking behind the economic news emanating from Brussels this past week.

The first offering seemed to trumpet the end of crisis and a growing recovery, as stock markets this week reached a cyclical high with the FTSE All-World equity index hitting a height not seen since pre-crash (June 2008). The second, and perhaps more important, somewhat contradicted this rosy outlook, however, as the unemployment rate in the entire Eurozone had increased to 12.1% on a seasonally adjusted basis – apparently the “recovery” that has been slowly growing (we’re told) over the past four years apparently still has not been acting as a job creation machine. Finally, the last bit of information was somehow a corollary to the unemployment saga, in that inflation (as understood by the media) was still contained in the Eurozone, and thus the ECB was likely to lower interest rates from historic lows of 0.5% even closer to the “zero bound.”

The thread linking these three bits of news together is of course the Phillips curve, the 1960s Keynesian mainstay that posits a direct relationship between unemployment and inflation. At its most base level, the Phillips Curve says there is a direct trade-off between levels of inflation and unemployment, and thus one must sacrifice employment to keep inflation low, or sacrifice price stability in order to achieve “full employment.” The policy implications of the curve follow directly from this supposed relationship, in that bursts of inflation can help to reduce unemployment, directed by Central Bankers who are trying to keep the markets guessing (indeed, most of the early literature on Central Bank independence and monetary rules focused on the role of expectations and how “surprise” inflation was the only kind to move along the curve).

Although I hint in the title of this piece that the Phillips curve was once not fashionable (mainly in the 1970s, during the era of “stagflation”), in the halls of power it never really left; however, it is now back in vogue with a vengeance and trumpeted from Central Bank to Central Bank, from media outlet to media outlet. In fact, the belief that one can “fine-tune” an economy through bursts of inflation is Holy Writ for bankers from Bernanke to Draghi and everyone in-between, being their true raison d’être. And this approach has been the theoretical underpinning of the response of Central Banks to the global financial crisis, predicated on some form of monetary stimulus (in addition to massive fiscal stimulus). As the Federal Reserve moves to “QE Infinity” and explicitly says that it is now targeting unemployment rates, the link could not be clearer that monetary policy is being used to somehow influence unemployment.

Of course, the result of this policy is understandable from an Austrian or even a neoclassical perspective (not to mention a public choice or institutional one!), and explains the three main news stories from the past week. Indeed, it’s only for a Keynesian that these three stories would be utterly perplexing: we’re printing money as fast as we can and yet unemployment is steeply downward! The natural response for the Keynesian is thus that the inflation is far too low, and so we must keep at it lest we fall prey to the demon of deflation (the scariest creature ever to walk the earth). This is the consistent response of Krugman, Stiglitz, and others who seek to tame the animal spirits.

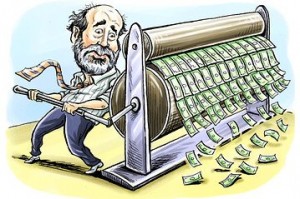

Back here in reality, however, the ramifications of adhering to a Phillips curve mentality continue to wreck the creation of wealth around the world. Keeping the printing presses running and debasing the currency does not equate with creation of real value, but with playing with prices. And while this may work its way through the economy and fool some into thinking that happy days are here again, in a world of rational expectations (if not actions), businesspeople are not fooled by bursts of money from helicopters. Without underlying changes to the structure of the economy, and the guarantee of better conditions, there is no incentive to invest… nor is there to hire. Inflation may prove an evanescent gain, but it won’t create the conditions for sustained employment (in fact, it does just the opposite). This time around as well, the massive liquidity that has built up in the system has remained on the balance sheets of banks, which, for the most part, have not been lending this flood of liquidity.

So, Central Banks are printing and creating money as fast as they can, with the result of liquidity sloshing around the system, but it’s not going into job creation, nor is it going into investment. Well, where would it go? Interest rates are too low to make a gain anywhere in the world, government bonds are for suckers, and the real economy is (as noted) stunted by uncertainty. The end result is, of course, the equity markets, given that equities are merely pieces of ownership and do not, in and out of themselves, create value.

And this is exactly what we see in the world economy: low interest rates, high liquidity, no investment leading to job creation, and, oh yes, new high in stock markets around the world. The logic is easy to trace, as there is no reason to invest long-term if “austerity” measures are going to ramp up taxes (do not get me started on that one). There is also no reason to continue to hold money if the value of currency is going to be inflated away and Central Bankers are looking for still more ways to take it away from you (as with Cyprus, in charging negative interest rates and charging “vault storage fees” – you don’t earn money by parking it with a bank, you actually lose it). Thus, equities look pretty good right now, and with everyone else piling in, well, prices are being driven higher and higher. This should last forever, right?

Of course not. We are once again living in bubble land, where all economic bad news can be rectified by recourse to the printing press and the inflation of some asset or another. Unfortunately, back in reality, unemployment and inflation are not substitutes but two sides of the same debased coin, symptomatic of economic mismanagement. And the effect of continuing this economic lunacy based on the Phillips curve in the world’s “developed” economies will be to create the uncertainty that will kill investment for a generation.

Don’t worry, though – when that happens, I’m sure we will all be told that it was the fault of markets.