The first steps of the long-awaited customs reform in Ukraine started in 2017 only to be cancelled at the beginning of 2018. Meanwhile, customs clearance in the country remains lengthy and complicated, which is reflected in Ukraine’s low positions in comparative international rankings. And the newest annual survey of exporters and importers in Ukraine conducted by the IER shows that without a customs reform that would bring more transparency and reduce bureaucracy, the deep-seated problems will remain.

In an official strategic document that set its policy agenda in 2015, Ukrainian government chose the World Bank’s international “Doing Business” ranking as the indicator of success of the deregulation reform that intended to remove barriers for private entrepreneurship in the country.

Despite a notable progress that Ukraine demonstrated in this ranking over the recent years moving up from the 96th place in 2015 to the 76th one in 2018 worldwide, its international trade performance still brings the overall result down.

Due to the long hours needed to import and export and the high related compliance costs, Ukraine has been placed at the 119th position in the “trading across borders” category in 2018, which continues to be one of the country’s weakest indicators in this ranking year after year.

Last year, Ministry of Finance of Ukraine initiated a reorganization of customs, which is closely linked to the tax system of the country. But in 2018, Ukrainian government canceled the decrees that were meant to guide this process and currently has not suggested a new plan for reforming the customs.

In the meantime, Ukrainian businesses which are involved in international trade report recurrent problems that are rooted in complicated legislation as well as in the lack of transparency at Ukrainian customs.

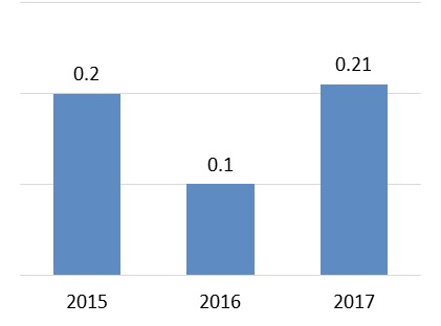

The Institute for Economic Research and Policy Consulting (IER) conducted the third wave of the survey of Ukrainian exporters and importers in late 2017 and early 2018. The survey shows that the assessment of the customs performance by businesses virtually has not changed since 2015 when the first wave of this survey took place. In 2017, the Customs Performance Index calculated by the IER using the data of the survey was +0.21 on the scale from -1 to +1. The index shows the assessment of customs efficiency by the surveyed enterprises. The value of the Customs Performance Index was +0.2 in 2015 and +0.1 in 2016. This suggests that while positive assessments prevail over the negative ones, there is no visible change in the businesses’ opinion about customs performance.

Figure 1: Customs Performance Index. Source: IER

Figure 1: Customs Performance Index. Source: IER

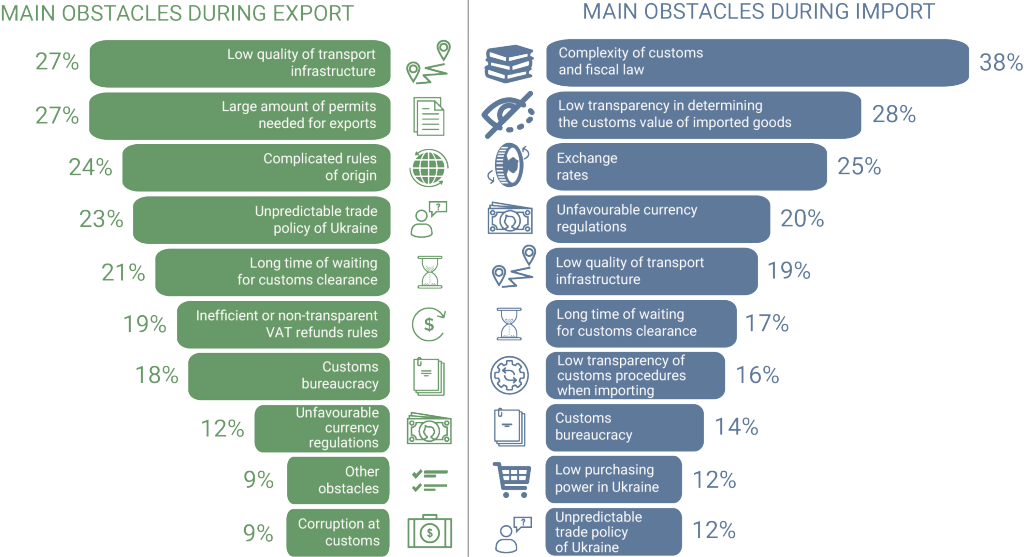

Speaking about barriers that hinder foreign trade, exporters and importers point out bureaucracy and lack of access to information at customs, as well as difficulties associated with infrastructure and currency rate in Ukraine. For importers, complicated customs and fiscal legislation is the main obstacle (38% of them reported this problem).

Other frequently mentioned trade barriers for exporters are non-transparent determination of goods’ custom value, disadvantageous foreign currency exchange rates, and unfavourable currency regulations.

However, the impact of some of these barriers is smaller now than it was a year before. The share of the importers that report lack of transparency at determining customs value of goods and the share of those that face unfavourable currency regulations decreased in 2017 compared to 2016. This may be attributed to foreign currency liberalization in Ukraine and successful court appeals by businesses that resulted in lowering custom values of goods.

The most frequently reported trade barriers for exports are low quality of transport infrastructure and large number of permits needed to export. 27% of the surveyed exporters reported these problems. Slightly smaller shares of exporters name complicated rules of origin and unpredictable trade policy of Ukraine as obstacles.

While the share of the enterprises reporting lack of unpredictability in Ukraine’s trade policy reduced in 2017 compared to 2016, the percentage of those facing large number of permits for export, on the contrary, increased. The Export Strategy approved by Ukrainian government in 2017 can explain the improvement in policy predictability assessments, but the fact that the problem of many permits required for exports became more pressing signals the need of deregulation in foreign trade.

With the recent dismissal of Ukrainian Minister of Finance and the momentum of reforms threatened by upcoming elections in 2019, the government of Ukraine is unlikely to undertake a comprehensive customs reform very soon. This is, however, what Ukrainian business expects from the government.

Making customs procedures more transparent, reducing the bureaucracy, and making trade policy more clear and predictable will not only boost Ukraine’s international business rankings, but will encourage entrepreneurship and trade.

Figure 2: Main obstacles during export and import. Source: IER

Figure 2: Main obstacles during export and import. Source: IER