Against the background of the forthcoming crisis and problems in the leading economies in the Euro area such as Germany and Italy, we find an unexpected example of a booming economy in the Iberian Peninsula – Portugal.

This example is even more impressive given the poor performance of the Portuguese economy before 2008, the logical recession afterwards and the debt crisis that led to EUR 78 bn in aid from the European Union’s international creditors and the International Monetary Fund in 2011 and the related stabilization and reform program.

What are the factors that played a key role in the recovery process of the Portuguese economy and what are the new challenges it faces?

Balancing the Budget

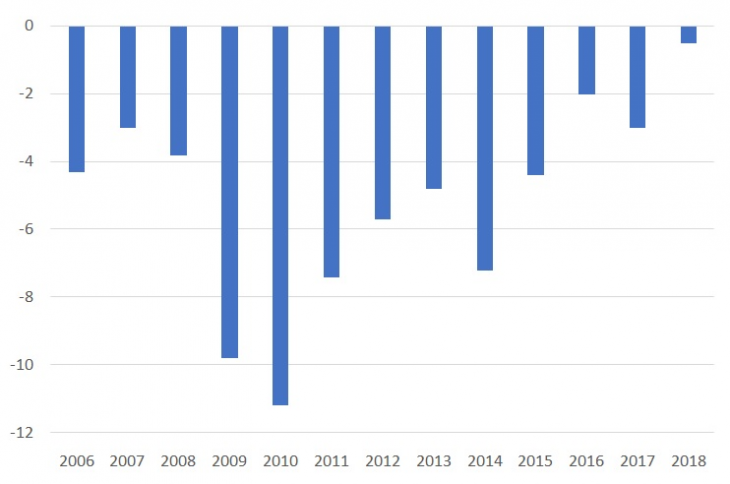

As it can be seen from the graph below, Portugal maintained high levels of budget deficits even before the 2008 global financial and economic crisis.

The peak of the deficit was observed in 2010, when it reached 11.2% of GDP.

However, after receiving financial support, Portugal was committed to implementing austerity measures implemented by the centre-right government of Pedro Coelho. These strict fiscal policies are also followed by the current government, with the country repeatedly reducing its budget deficit.

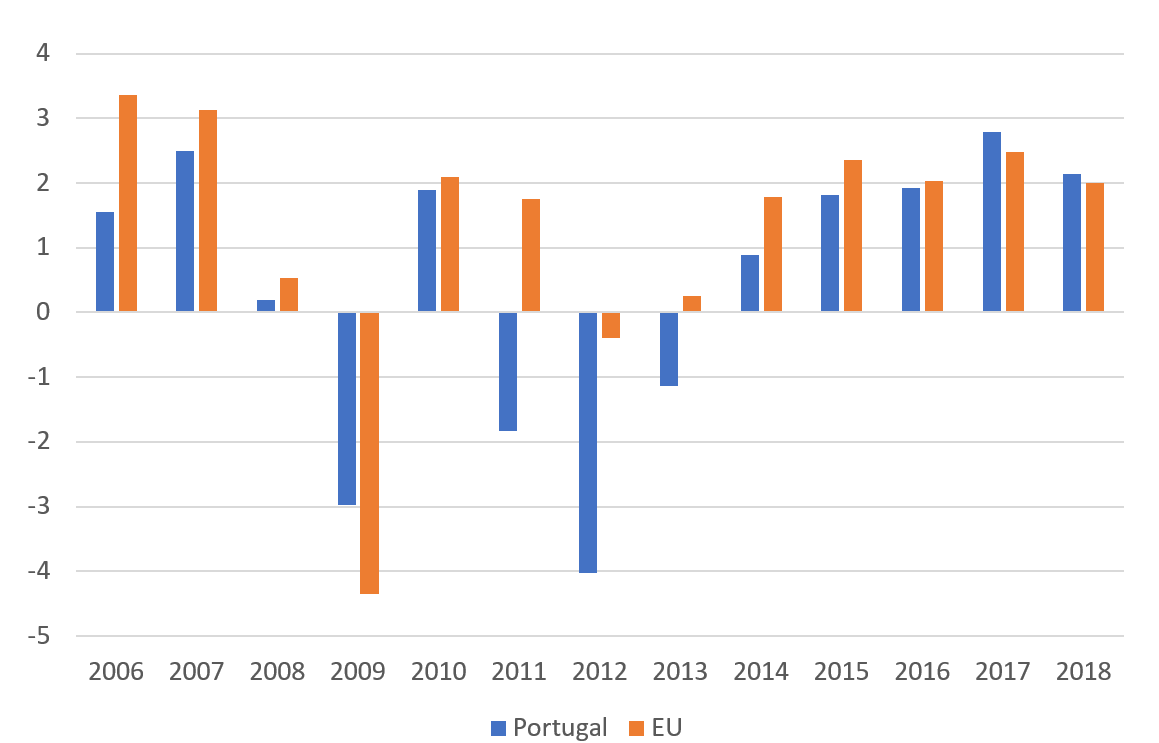

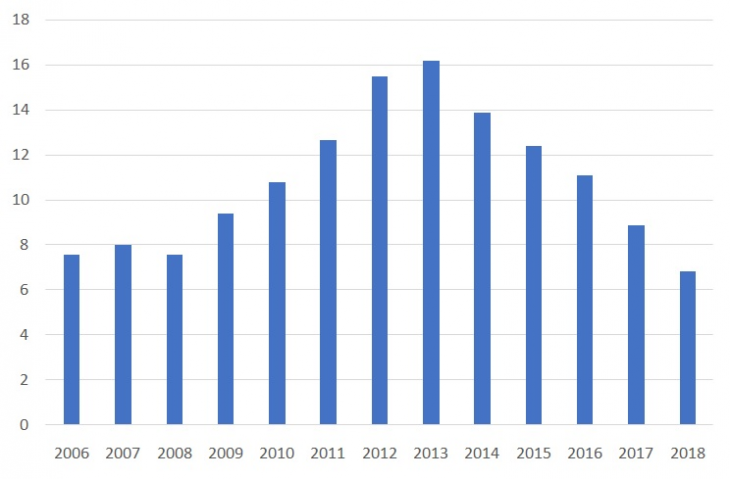

In 2018, it was only 0.5% of GDP – the lowest level since the country de facto became a democracy in 1974. Among the other reasons that made such an improvement in the budget balance possible are the economic growth, which in the last two years is higher than the EU average (Graph 2), and the record low unemployment, which in 2018 was narrowed to 2002 levels (Graph 3).

By balancing the budget, the Lisbon authorities have also succeeded in regaining the confidence and interest of international investors.

Graph 1: Portugal’s budget deficit as share of GDP (%), 2006-2018

Graph 2: Real annual GDP growth (%) in Portugal and the European Union, 2006-2018

Graph 3: Unemployment in Portugal (%), 2006-2018

Export Growth

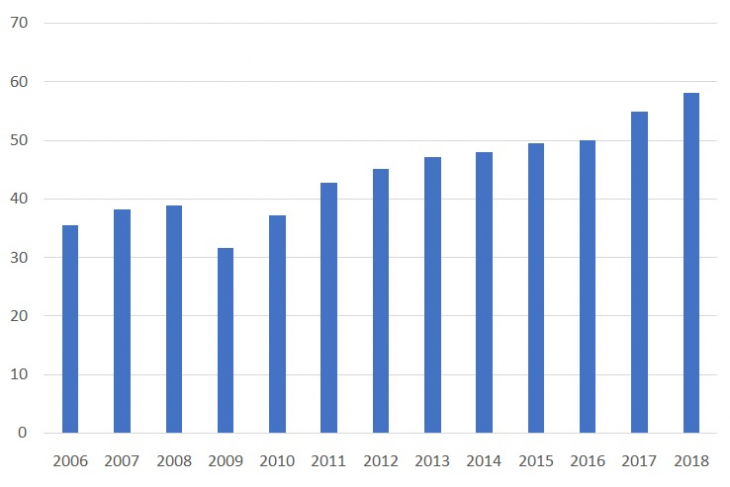

Since 2010, Portuguese exports have grown every year, reaching over 43% of GDP in 2018, according to World Bank figures.

In recent years, there has also been some diversification: in addition to the largest economies in the euro area, like Germany and France, sales to Eastern European countries such as Romania and Poland have continued to grow, who continue to have strong economic growth in the process of catching up with Western Europe.

Moreover, according to data from the International Trade Centre, exports to non-European markets have increased their share, reaching over 20% in 2018. The US remains Portugal’s largest trading partner outside the EU, with exports to them increasing by more than 50% since 2010 (Graph 5).

Portugal’s significant increase in exports in recent years can be explained by its greater involvement in the global production chains. Deeper integration into the global economy, which is of paramount importance for a small economy such as Portugal, reinforces the role of exported goods for intermediate consumption.

These components are, in turn, invested in the production of end products that target markets in third countries. The major factor contributing to the competitiveness of Portuguese goods on the world market is the large investments in export-oriented sectors of the economy, which are combined with various tax benefits.

Graph 4: Portugal’s exports in billion euros, 2006-2018

Source: International Trade Centre

Source: International Trade Centre

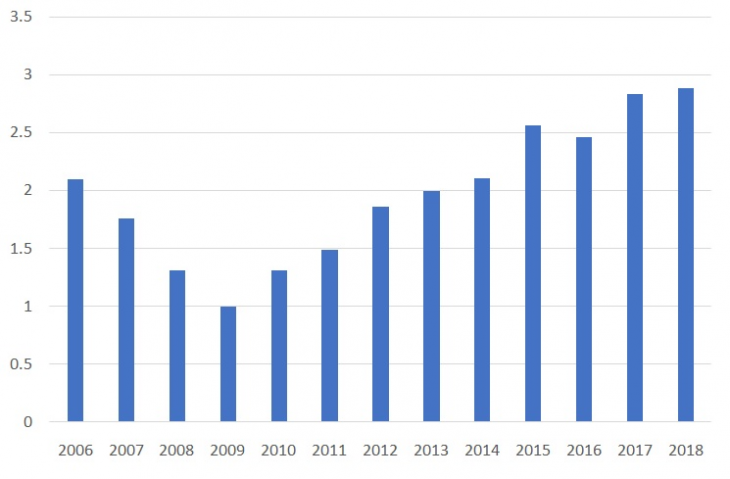

Chart 5: Portugal’s exports to the US in billion euros, 2006-2018

Source: International Trade Centre

Source: International Trade Centre

Powerful Tourism Sector

Portugal’s tourism boom has made the sector one of the most important drivers behind the growth of the national economy, as well as the largest employer with almost 1 million direct and indirect jobs.

Despite the slowdown earlier this year, the number of foreign tourists visiting Portugal has continued to grow since 2010, reaching over 12 million tourists in 2017, according to data published by the Portuguese Statistical Institute.

Challenges to Portugal

The biggest question facing Portugal is whether it can attract enough investment from abroad to boost its economic growth potential in the long run. The upcoming October parliamentary elections and the fiscal policy of the newly formed government will play a key role. The public debt of the country is also important for future foreign investments.

According to Eurostat, despite its decline over the past two years, the country’s debt remains 121.5% of GDP, lower only than Greece’s and Italy’s in the euro area.

Brexit could also have a negative impact on the Portuguese economy – according to data from the Portuguese Institute of Statistics, there is already a 5.3% decline in 2018 compared to the previous year in the number of British tourists.

Although the crisis in Portugal was a “mixture” between the events in Italy and Greece, the country currently has better performance than both. With tight fiscal policies, high export and tourism growth, Portugal has been able to revive its economy at a time when many experts are predicting a crisis.

However, the challenges facing the Portuguese authorities remain – high levels of public debt and a possible future recession in the euro area could create big trouble for the small southern economy.