Over the recent weeks, Ukraine’s macroeconomic outlook discussions were on the top of the agenda taking into account aggravating external and domestic risks. The FX payments on state debt are high for next several years, while the National Bank of Ukraine (NBU) was unable to increase international reserves to the safer level.

The government liquidity was also low with UAH 13 bn on government accounts at the NBU in the end of July down from peak of UAH 105 bn in November 2017. Even though the fiscal revenues improved in recent months, lower than planned deficit financing resulted in the under-execution of expenditures. This raised concerns on the possibility of the Government to finance key liabilities timely and in full.

However, the hottest debates were about the future relations the International Monetary Fund (IMF) and the needed revision in gas pricing for households to continue cooperation.

According to the initial plan on external borrowings in 2018, the Government expected to receive another tranche of loan from the IMF in March or April 2018, which would help the planned placement of Eurobonds. However, the late approval of the law on the establishment of the Anticorruption Court pushed back the timeline for negotiations. As a result, the IMF mission came to discuss the terms of the next loan installment only in September.

Meanwhile, the Ministry of Finance postponed the issue of regular Eurobonds but it has secured USD 0.7 bn through private placement of six month Eurobonds at a relatively high yield estimated at 9.1% p.a. Short-term Eurobond was likely meant as bridge financing until more long-term financing is secured after conclusion of IMF talks.

Recently, the media announced the leaked information that the current Enhanced Fund Facility (EFF) program might be substituted by new USD 4-5 bn IMF Stand-by program with revised conditionalities. In any case, to receive a loan under either old or new programme, the government will definitely have to increase gas prices for population according to its commitments taken in 2016.

At that time, the government approved the import parity approach in setting gas tariffs for population, but it repeatedly delayed its application. Over time, the difference between import parity rate and applied rate increased substantially.

If received, the IMF loan will supplement the NBU international reserves but it will not contribute directly to fiscal deficit financing. However, the IMF deal will unlock significant donor funds and ease access to private financing for the government.

For example, continued cooperation with the IMF is among key conditions for the latest loan from the EU (MFA-IV), recently signed by the Ukrainian government and the European Commission. The first tranche of the MFA at EUR 0.5 bn is expected in autumn 2018.

The second and the last tranche under this program set at EUR 0.5 bn is scheduled for spring 2019 if the government approves the reforms of the State Fiscal Services (SFS) including customs; ensures progress in tax evasion fighting; and introduces automatic verification of e-declarations.

The World Bank is preparing USD 650 m in policy-based guarantees to Ukraine, for which the cooperation with the IMF is again a key condition for support. Guarantees are expected to support USD 0.8 bn in external borrowing. The government can also place the Eurobonds under better conditions than in August after the IMF deal is secured.

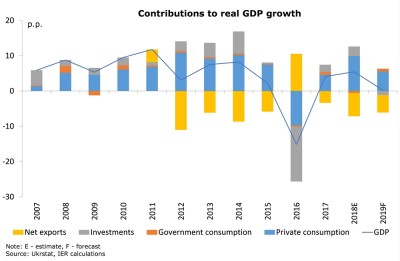

If the IMF deal is in place, the Institute for Economic Research and Policy Consulting (IER) expects real GDP to grow by 3.3% in 2018 and by 3.2% in 2019. Consumer price inflation will decelerate to 9.3% yoy in the end of this year and 8.1% in the end of 2019.

Domestic demand will drive the growth by boosting both consumption and investment imports. As a result, real net exports will continue to make a negative contribution to real GDP growth at 1.7 p.p. in 2018 and 0.7 p.p. in 2019.

Domestic demand will drive the growth by boosting both consumption and investment imports. As a result, real net exports will continue to make a negative contribution to real GDP growth at 1.7 p.p. in 2018 and 0.7 p.p. in 2019.

The IER estimates are close to the official forecast used as a baseline for the Draft State Budget Law for 2019. The government submitted the Draft Budget on September 15, which complies with the Budget Code.

The fiscal indicators are mostly based on the effective legislation (accounting for usual increase in excise rates, rent payments and ecology tax and few other changes in taxation) and, thus, do not account for increase in gas tariffs, which will result in higher revenue from the Naftogaz but also will increase spending for housing and utility subsidies.

The Draft also does not envisage the introduction of exit capital tax. Overall, according to the official forecast, consolidated fiscal revenues are expected to reduce by 1.1 p.p. to 32.8% of GDP. Fiscal deficit is planned at about 2% of GDP, which complies with current IMF program.

However, if Ukraine loses the chance to receive assistance from the IMF and other international donors in 2018, the government will be hard-pressed to execute planned fiscal expenditures in 2018. The fiscal indicators will be also revised for 2019 to lower real GDP growth and higher inflation.