We can safely mark this week as Greek. No, it’s not about action week in McDonalds but the majority of messages that stirred euro came right from that country.

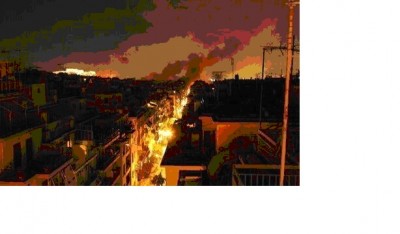

On Sunday Greek Parliament passed new austerity package (199 MPs for, 77 against), so-called Memorandum of Understanding, based on which Greece will receive further bailout of 130 bln. euro (or more if we count also 15 bln. euro which has been discussed since the end of January and 35 bln. for swapping ECB Greek bonds). According to Greek police 48 buildings were set on fire and 150 shops were robbed. After voting 43 MPs were thrown away from the ruling parties for voting against or abstaining. That a new form of democracy is being born in this country is also proved by the voices calling for setting up a new committee in Greece representing creditors, which would control the government and have a right to veto its decisions.

Problem solved? Not really. Even after writing off part of it, Greek debt will remain at the level of 140% of GDP (debt should decrease to 120% of GDP by the year 2020). And Greeks can default really anytime. There are elections in April and according to the latest surveys 48,1% of Greeks are for hard default.

Problem solved? Not really. Even after writing off part of it, Greek debt will remain at the level of 140% of GDP (debt should decrease to 120% of GDP by the year 2020). And Greeks can default really anytime. There are elections in April and according to the latest surveys 48,1% of Greeks are for hard default.

Taking into account latest estimations how many bonds would be offered in exchange for voluntary participation of the private sector (plan assumes 100 bln. euro) hard and not „voluntary“ default seems more probable. Greek president asks in media „Who is Mr Schaeuble to insult Greece?“. Mr Schaeuble is German Minister of Finance, who compared aiding Greece to throwing money into bottomless pit. It came along with further suggestions how to transform Greek democracy. For example postponing Greek elections and until then setting up a government without political parties. The second aid package has to be approved by the German, Dutch and Finnish parliaments and then agreed on at the EU summit on 1st of March. There are even voices that March’s installment of Greek bonds (14,5 bln. euro), because of which negotiations are hectic, should be solved by bridging loan from the euro countries and the rescue package should be tapped by the Greece only after Greek elections in April when it is already clear who will be holding real power in Greece. Regarding Greek bailout there are still numerous open questions. There will be more information on this drama after Monday’s meeting of eurozone’s Ministers of Finance. Finns got from Greeks guarantees in exchange for the participation in the second aid package (Greek banks will provide Finland with 880 millions euro in cash and bonds). What does Slovak Minister of Finance think about it?

Much is said about what role in Greek restructuring will be played by the ECB. It is clear for the President of the Deutsche Bundesbank Jens Widmann. „Euro must be saved by the governments, not by central banks“. The whole interview is worth reading. At least a bit of conservative approach towards the role of central bank in today’s inflationary times.

Some of the comments from Germany, Finland or Netherlands indicate that these countries are prepared for a tough stand towards Greece, even for the price of its leaving the monetary union. Here a reflection on the geopolitical consequences if Greece is forced out of the monetary union can be found. That Greek withdrawal from the monetary union does not necessarily mean idyll is indicated by the amount of loans granted by ECB to those banks (around 100 bln. euro), but it is a fact that a country going bankrupt exiting the eurozone may help itself with freshly printed euros. It can issue a lot of bonds, put them into eurosystem (system of the eurozone’s central banks) and send money to cooperating institutions abroad. At the time of setting up the eurosystem it was simply not foreseen that there can be a case of unfriendly exit. Let’s hope we won’t test this opportunity.

When the concessions are handed out, usually there are many interested. Ireland already talks about its review of obligations to creditors and earlier mentioned Mr. Schaeuble started in a charming manner informal negotiations for concessions for Portugal.

This week for a change Moody’s agency caused rating massacre. Apart from 9 countries and also for example British Central Bank Bank of England it downgraded rating for Slovakia as well.

When two years ago I said that saving actions of the International Montery Fund and the EU in Greece will end badly, opponents referred to the example of Argentina, where IMF supposedly did a good job. Bank holidays, hyperinflation and chaotic bankruptcy after dozens billions of dollars‘ aid in Argentine don’t strike me as success. This week I was proved right by IMF itself. „Sorry, we made mistakes“ concerning rescue actions resulting in chaotic bankruptcy in 2011, International Monetary Fund referred to Argentina. What will IMF say in 2021 about Greece?

When two years ago I said that saving actions of the International Montery Fund and the EU in Greece will end badly, opponents referred to the example of Argentina, where IMF supposedly did a good job. Bank holidays, hyperinflation and chaotic bankruptcy after dozens billions of dollars‘ aid in Argentine don’t strike me as success. This week I was proved right by IMF itself. „Sorry, we made mistakes“ concerning rescue actions resulting in chaotic bankruptcy in 2011, International Monetary Fund referred to Argentina. What will IMF say in 2021 about Greece?

In order not to end up pessimistically before weekend, here comes something positive (apart from a picture of a cute animal). Not everything in Greece is black. Despite last year’s collapse of Greek economy the first positive signs can be already seen (competitiveness improved by decreasing the labor costs, deficit of the current account is reduced, primary deficit falls). It is therefore possible that Greek economy is already somewhere close to the bottom, which would explain the growth on Greek stock market since the beginning of this year. If a disaster happens in Athens, situation can in theory start improving.

Have a nice weekend!